Home Loan Eligibility Calculator Axis

Axis Bank has enhanced its online toolkit for prospective homebuyers by refining its Home Loan Eligibility Calculator. The updated calculator aims to provide a more accurate and user-friendly assessment of loan eligibility, assisting potential borrowers in making informed decisions before beginning the formal application process.

This tool is intended to streamline the home-buying journey for individuals across India, offering a preliminary estimate of the loan amount they may qualify for based on various financial parameters. This article explores the key features of the updated calculator, its potential impact on borrowers, and how it fits into the broader landscape of digital tools offered by financial institutions.

Key Features and Functionality

The Axis Bank Home Loan Eligibility Calculator is an online tool designed to provide an instant estimate of a potential borrower's eligibility for a home loan. Users input key financial details, including their monthly income, existing EMIs, and other obligations.

The calculator then processes this information against Axis Bank's internal lending criteria to generate an estimated loan amount. Factors like age, employment type (salaried or self-employed), and credit score can also be considered, enhancing the accuracy of the estimate.

How the Calculator Works

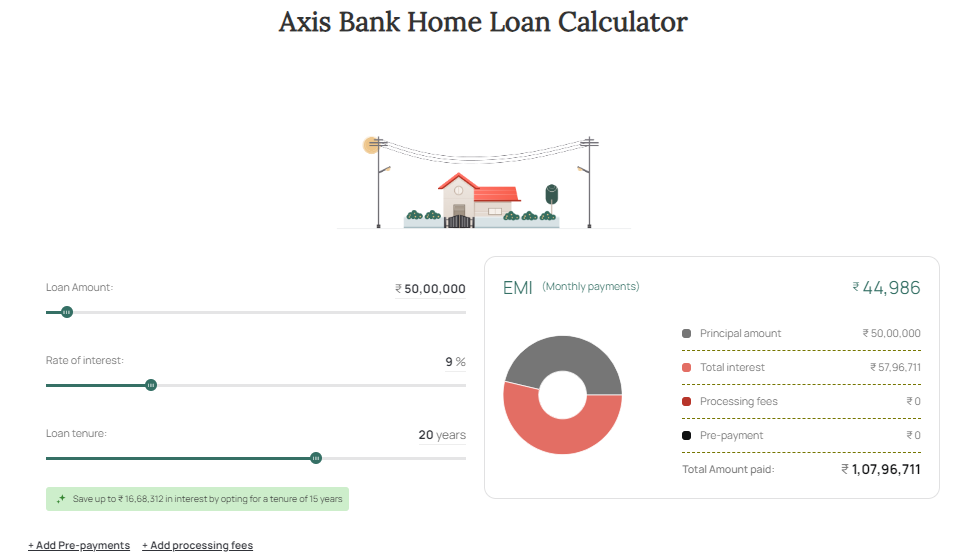

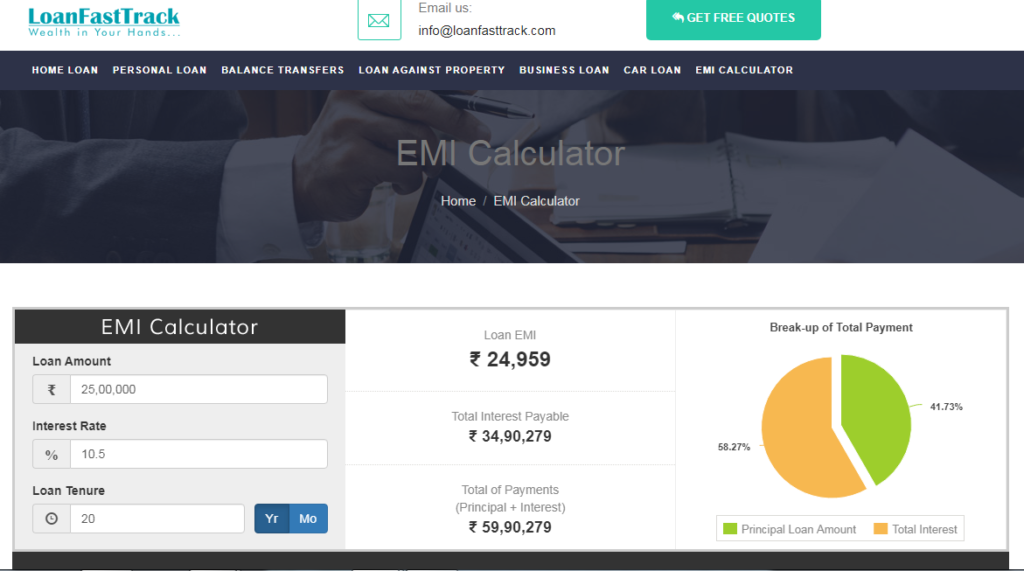

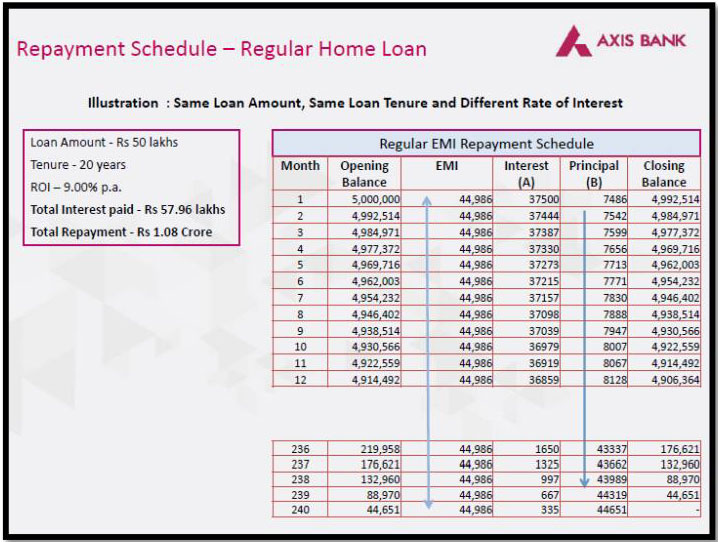

The calculator operates by applying a set of algorithms based on standard lending practices. These algorithms consider the debt-to-income ratio (DTI), which compares a borrower's total debt payments to their gross monthly income.

A lower DTI typically indicates a higher likelihood of loan approval. Furthermore, the calculator considers the loan tenure selected by the user and prevailing interest rates to project the estimated EMI and total loan amount.

Axis Bank clarifies that the result provided by the calculator is only indicative and not a guarantee of loan approval. The final loan amount and terms are subject to a thorough assessment by the bank's credit underwriting team.

Significance and Impact

The enhancement of the Home Loan Eligibility Calculator reflects Axis Bank's commitment to leveraging technology to improve customer experience. By offering an easily accessible and relatively accurate pre-assessment tool, the bank hopes to reduce the time and effort involved in the initial stages of the home loan application process.

For prospective homebuyers, the calculator provides a valuable starting point for financial planning. Individuals can use the tool to assess their affordability and adjust their expectations regarding the type and value of property they can realistically afford.

Furthermore, the transparency offered by the calculator can empower borrowers to make more informed decisions and avoid overextending themselves financially.

Expert Opinion and Industry Trends

Financial analysts suggest that tools like Axis Bank's Home Loan Eligibility Calculator are becoming increasingly important in the digital age. "Consumers expect instant gratification and readily available information," says Mr. Sanjay Sharma, a financial advisor with Credible Finance Solutions.

"Banks that offer convenient and accurate online tools are better positioned to attract and retain customers." This trend aligns with the broader movement toward digital banking and the increasing use of technology to simplify complex financial processes.

Other banks and financial institutions are also investing heavily in similar tools, creating a competitive landscape focused on providing seamless and user-friendly digital experiences.

Looking Ahead

The enhanced Home Loan Eligibility Calculator from Axis Bank represents a positive step towards empowering potential homebuyers with valuable financial information. While the calculator should be used as a preliminary tool and not a substitute for professional financial advice, it can significantly aid in the initial stages of the home buying process.

As technology continues to evolve, it is likely that these types of online calculators will become even more sophisticated, incorporating more data points and providing even more precise estimations.

Ultimately, the goal is to provide consumers with the knowledge and tools they need to make sound financial decisions when pursuing the dream of homeownership.

![Home Loan Eligibility Calculator Axis How to Calculate Home Loan EMI [FREE CALCULATOR] - FinCalC Blog](https://i.ytimg.com/vi/m0bZMZaWrvs/maxresdefault.jpg)