Horizon Kinetics Inflation Beneficiaries Ucits Etf

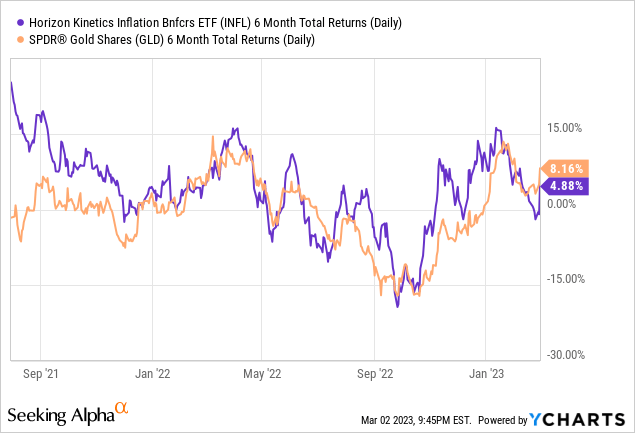

Investors are urgently seeking refuge from persistent inflation, and the Horizon Kinetics Inflation Beneficiaries UCITS ETF is gaining traction as a potential shield. This ETF offers exposure to companies expected to thrive in an inflationary environment.

The ETF aims to provide capital appreciation by investing in companies that benefit from rising prices. Launched on [Date - e.g., January 15, 2023], the fund trades on exchanges including [Exchange locations - e.g., the London Stock Exchange (LSE) and Euronext Amsterdam].

Fund Overview

The Horizon Kinetics Inflation Beneficiaries UCITS ETF (Ticker: [Ticker Symbol - e.g., INFL]) is designed to track the performance of an index composed of companies whose revenues are positively correlated with inflation. The fund is managed by [Management Company Name - e.g., HANetf] and sub-advised by Horizon Kinetics.

The ETF holds a diversified portfolio of companies. These companies typically own tangible assets or derive revenue from commodities, royalties, and other inflation-sensitive sources.

Investment Strategy

The core strategy focuses on identifying businesses that can maintain or increase their profitability during periods of rising inflation. This is achieved by investing in companies with pricing power or those that possess assets that appreciate in value alongside inflation.

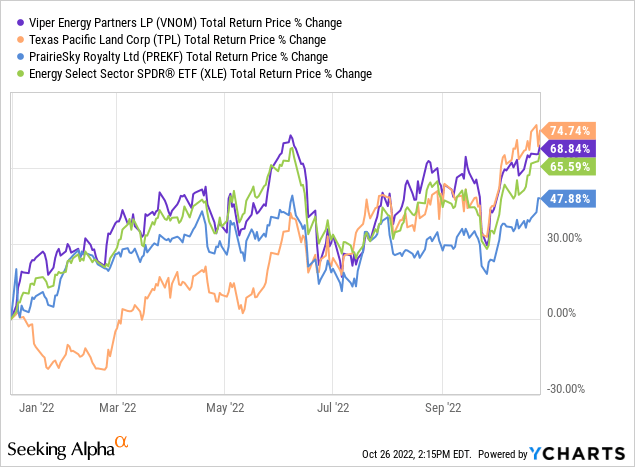

The selection process emphasizes companies involved in areas such as natural resources, land ownership, and unique royalty streams. Horizon Kinetics' expertise in identifying these specific types of businesses is central to the fund's strategy.

Portfolio Composition

As of [Date - e.g., October 26, 2023], the ETF's top holdings include companies like [Top Holding 1 - e.g., Texas Pacific Land Corp.], [Top Holding 2 - e.g., Franco-Nevada Corp.], and [Top Holding 3 - e.g., Brookfield Renewable Partners]. These companies represent a significant portion of the fund's assets.

The sector allocation is heavily weighted towards [Sector 1 - e.g., energy], [Sector 2 - e.g., real estate], and [Sector 3 - e.g., materials]. This allocation reflects the fund's focus on inflation-sensitive sectors.

Performance and Fees

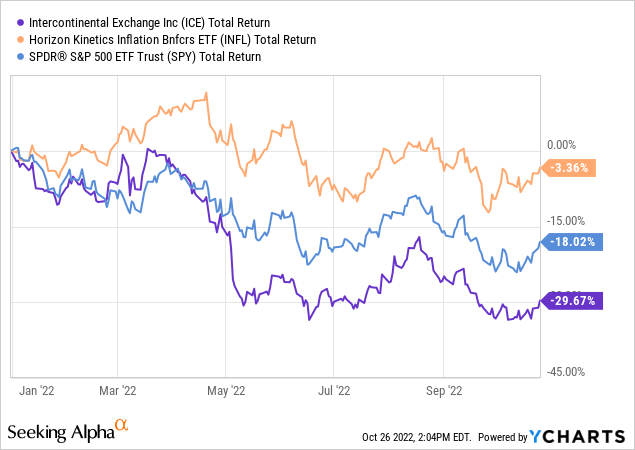

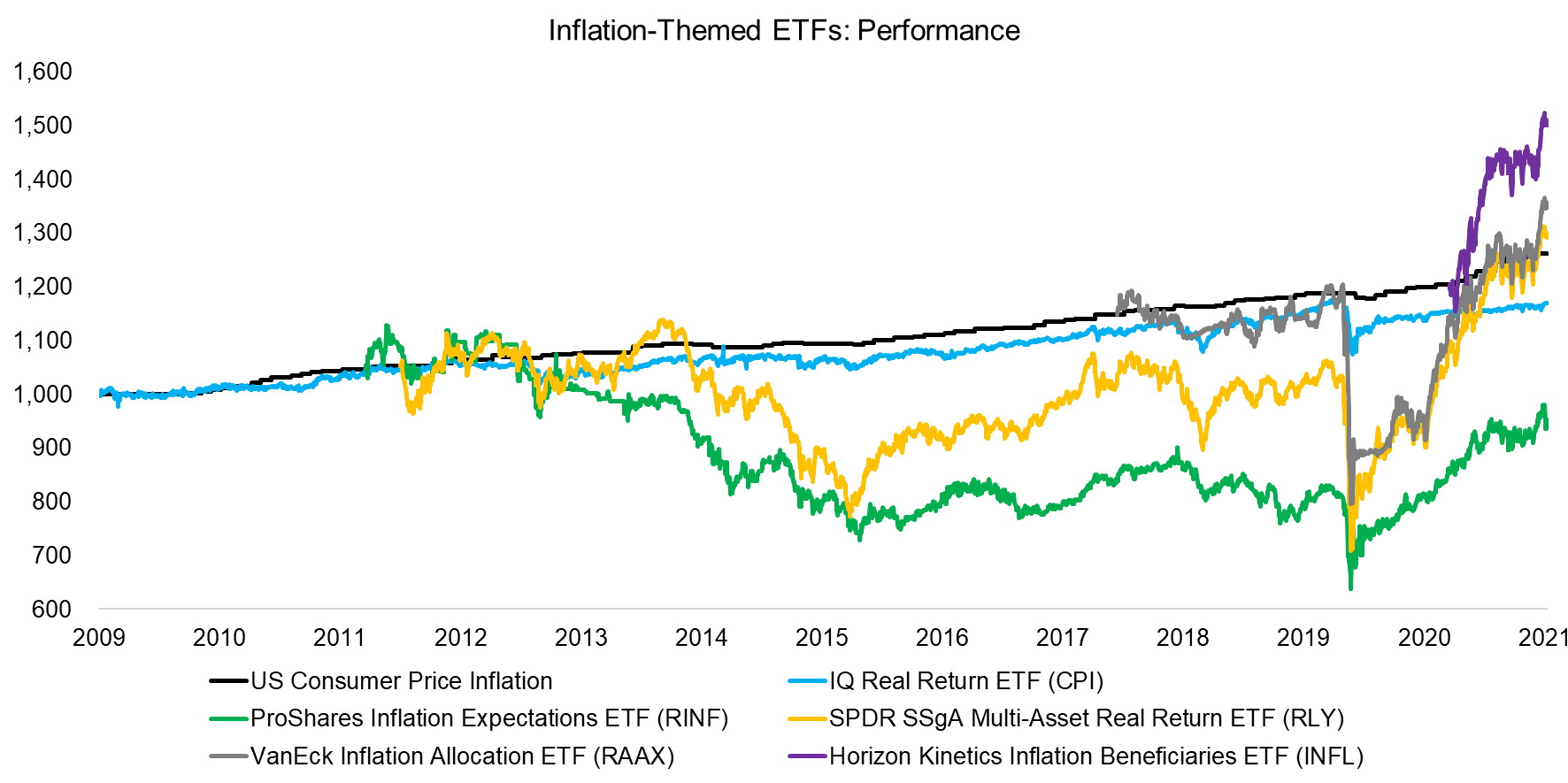

The ETF's performance has been [Performance - e.g., positive] since inception, reflecting the inflationary environment. However, past performance is not indicative of future results.

The total expense ratio (TER) for the Horizon Kinetics Inflation Beneficiaries UCITS ETF is [Expense Ratio - e.g., 0.69%]. This covers the costs associated with managing and operating the fund.

Market Impact

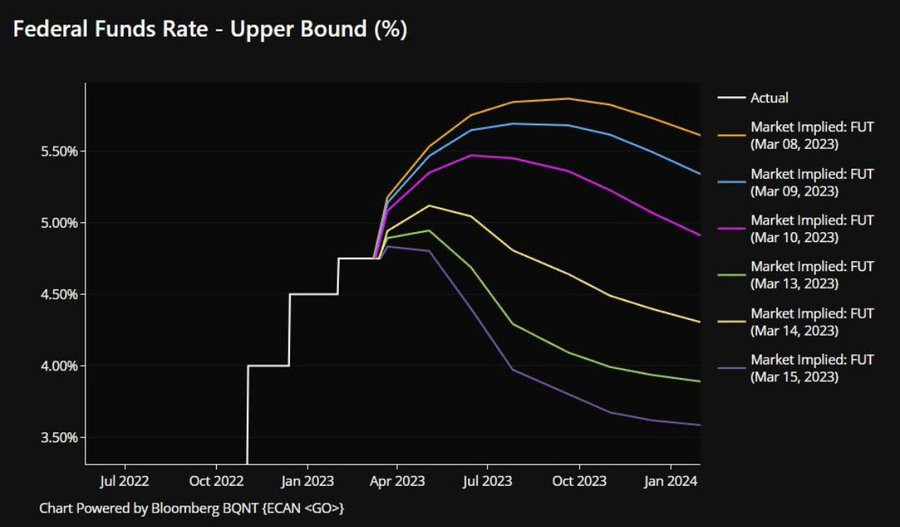

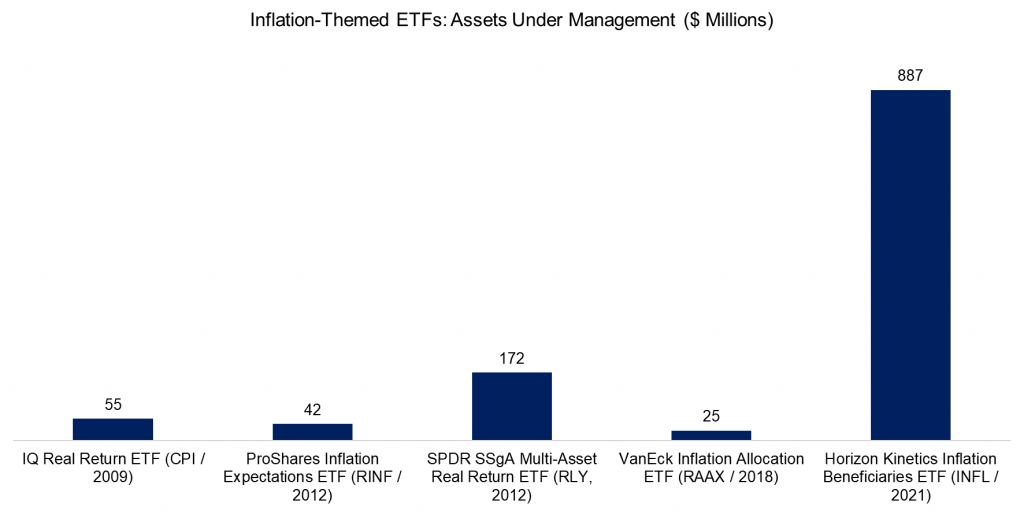

The ETF's launch and subsequent performance have garnered attention from investors seeking inflation protection. As inflation remains a concern globally, demand for such strategies is likely to continue.

The fund provides a relatively accessible way for investors to gain exposure to a basket of inflation-benefiting companies. This is more efficient than selecting individual stocks.

Availability and Trading

The Horizon Kinetics Inflation Beneficiaries UCITS ETF is available to trade on several European exchanges. This includes the LSE and Euronext Amsterdam.

Investors can purchase and sell shares of the ETF through their brokerage accounts. Real-time pricing and trading information are readily available on financial websites and platforms.

Expert Commentary

"[Quote from Analyst 1 - e.g., This ETF provides a targeted approach to inflation hedging, offering investors access to a unique set of companies]," said [Analyst Name 1 - e.g., John Smith], a market analyst at [Analyst Firm 1 - e.g., ABC Investments]. "[Quote from Analyst 2 - e.g., The fund's focus on tangible assets and royalty streams makes it a compelling option in the current economic climate]," added [Analyst Name 2 - e.g., Jane Doe], portfolio manager at [Analyst Firm 2 - e.g., XYZ Advisors].

These quotes reflect the general sentiment surrounding the ETF's potential benefits in an inflationary environment.

Conclusion

Investors are advised to carefully review the ETF's prospectus and consider their own investment objectives before investing. Monitoring inflation trends and the fund's performance will be crucial for making informed decisions.

Ongoing developments regarding inflation and the ETF's portfolio adjustments will be closely watched by market participants. Stay informed with the last news.