Selling The Bonds At A Premium Has The Effect Of

Imagine a bustling town square, filled with the cheerful chatter of neighbors. Today, however, there's a different kind of buzz in the air. The local municipality is announcing the sale of its bonds, promising investment in new community projects. But something’s different: these bonds are being sold at a premium, sparking curiosity and a flurry of questions among the residents.

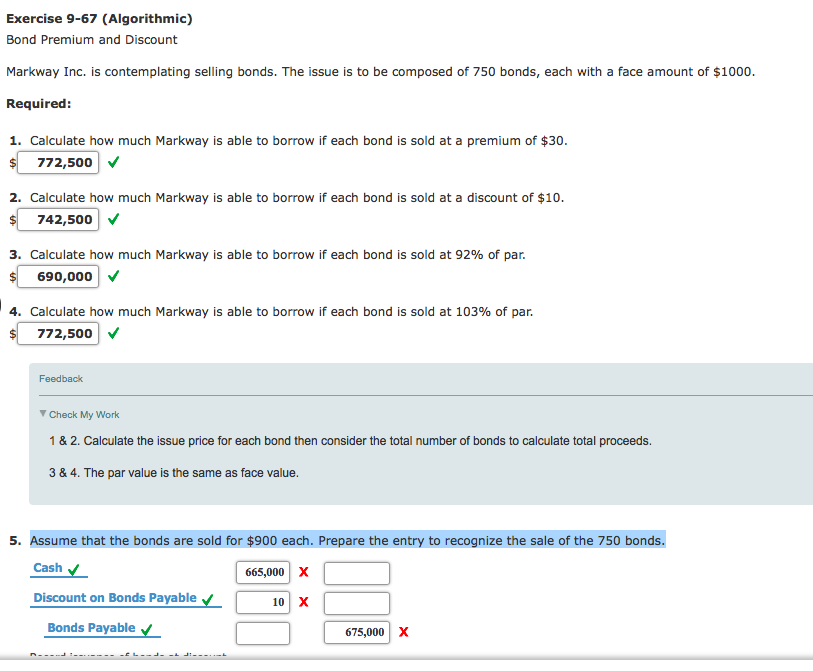

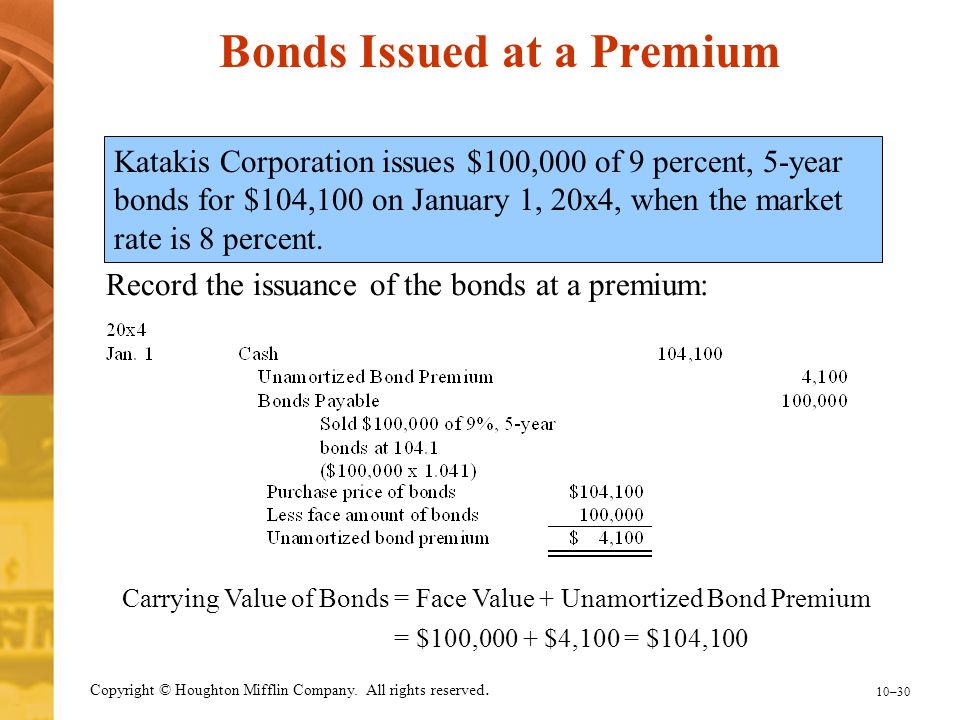

The sale of bonds at a premium, simply put, means they are being offered for more than their face value. This can have various effects, especially on the issuer and the investor. We will explore the implications of this financial strategy. It allows us to understand how governments and corporations manage their debt and funding obligations.

Understanding Bonds: A Quick Refresher

Before we dive into the specifics of selling bonds at a premium, let's revisit the basics of bonds. Bonds are essentially IOUs issued by governments or corporations to raise capital. When you buy a bond, you're lending money to the issuer, and they promise to repay you the face value (also known as par value) at a specific maturity date, plus periodic interest payments known as coupons.

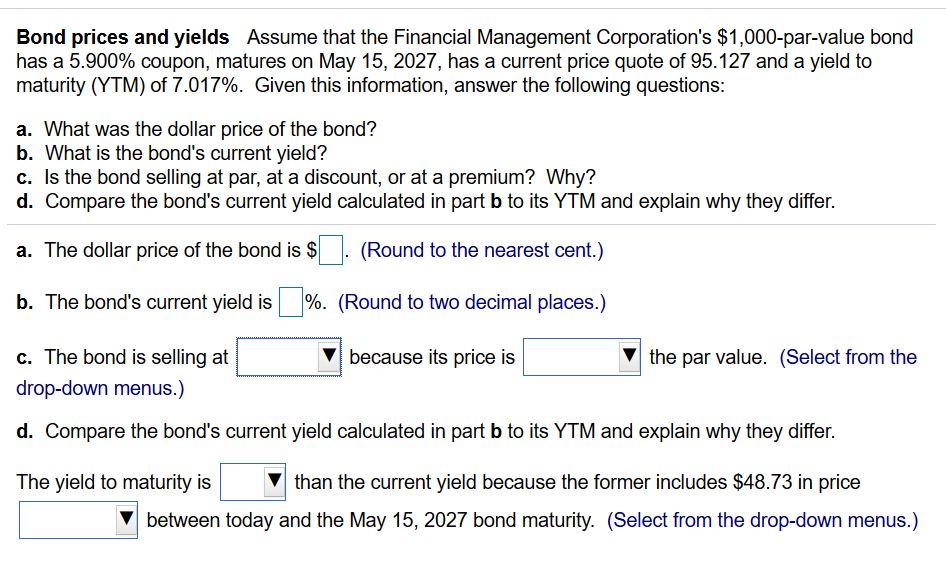

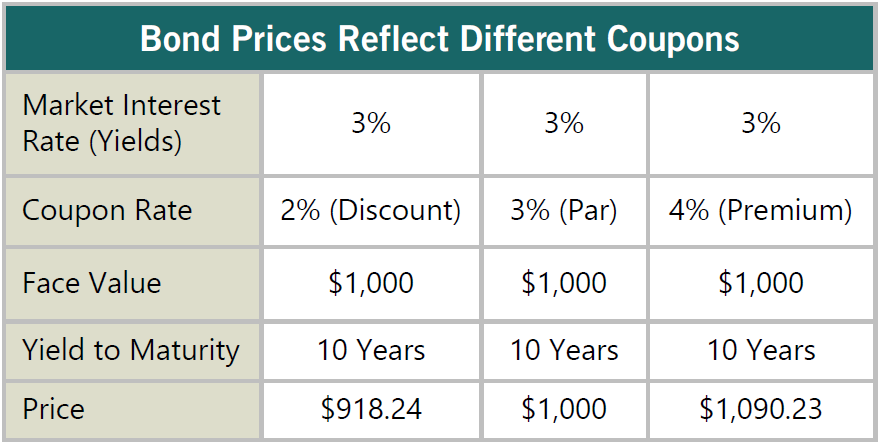

For instance, a bond with a face value of $1,000 might pay a 5% coupon annually, meaning you'd receive $50 each year until the bond matures, at which point you'd get your $1,000 back. Bonds trade in the market, so they don't always trade at their $1,000 face value. The current market interest rates and the bond's creditworthiness drive this.

The Premium Proposition

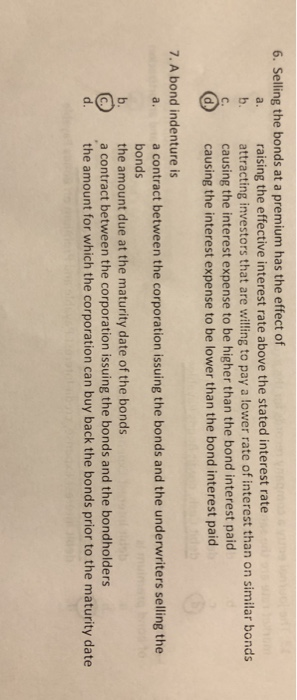

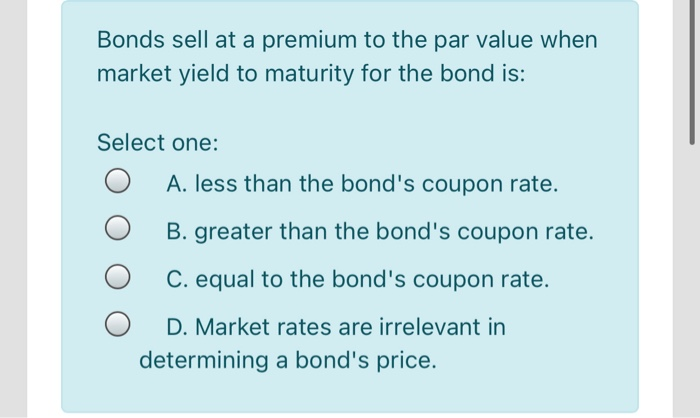

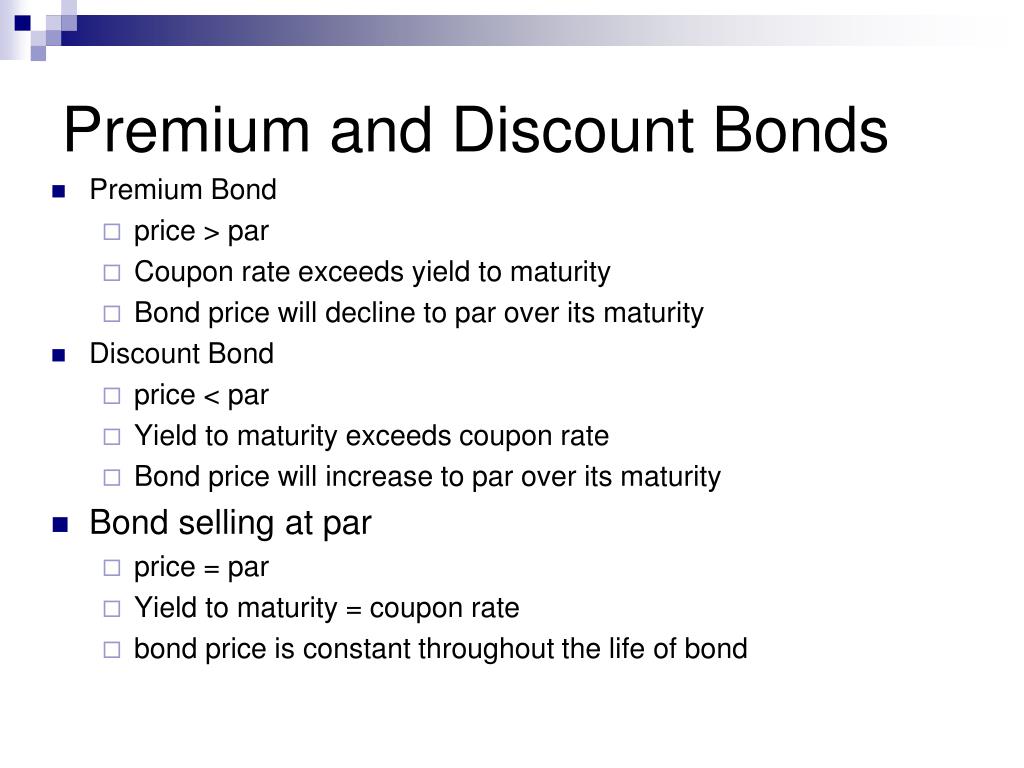

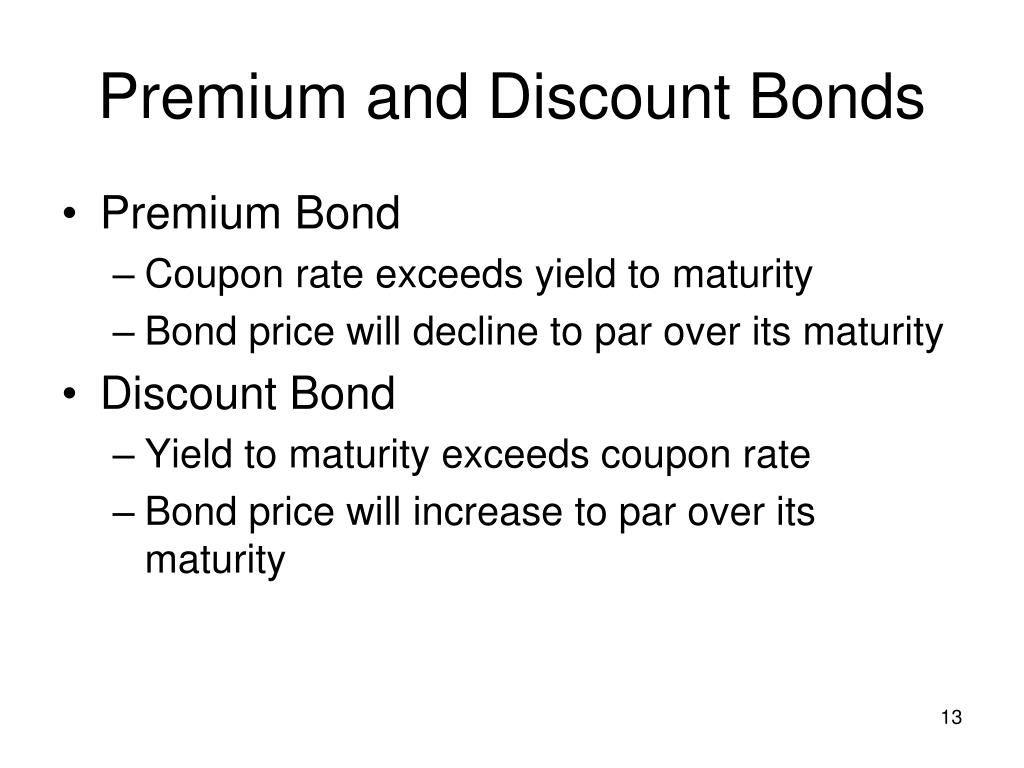

Now, let's consider why a bond might be sold at a premium. This typically happens when the bond's coupon rate is higher than the prevailing market interest rates for similar bonds. Investors are willing to pay more than the face value to secure that higher yield.

Think of it like this: if current market rates are 4%, but a particular bond is offering 6%, investors will bid up the price. They are willing to pay a premium to get that extra 2% return. This makes it very attractive from an investment point of view.

Effects on the Issuer (e.g., the Municipality)

Selling bonds at a premium has several notable effects on the issuer, in our example, the municipality. Firstly, it provides the issuer with more upfront capital than they would receive if selling at par. This extra cash can be used to fund projects or pay down existing debt.

Secondly, while the municipality receives a premium upfront, they still have to pay the full coupon rate until the bond matures. This means that their total interest expense over the life of the bond will be higher compared to issuing at par. Effective management of these funds is crucial.

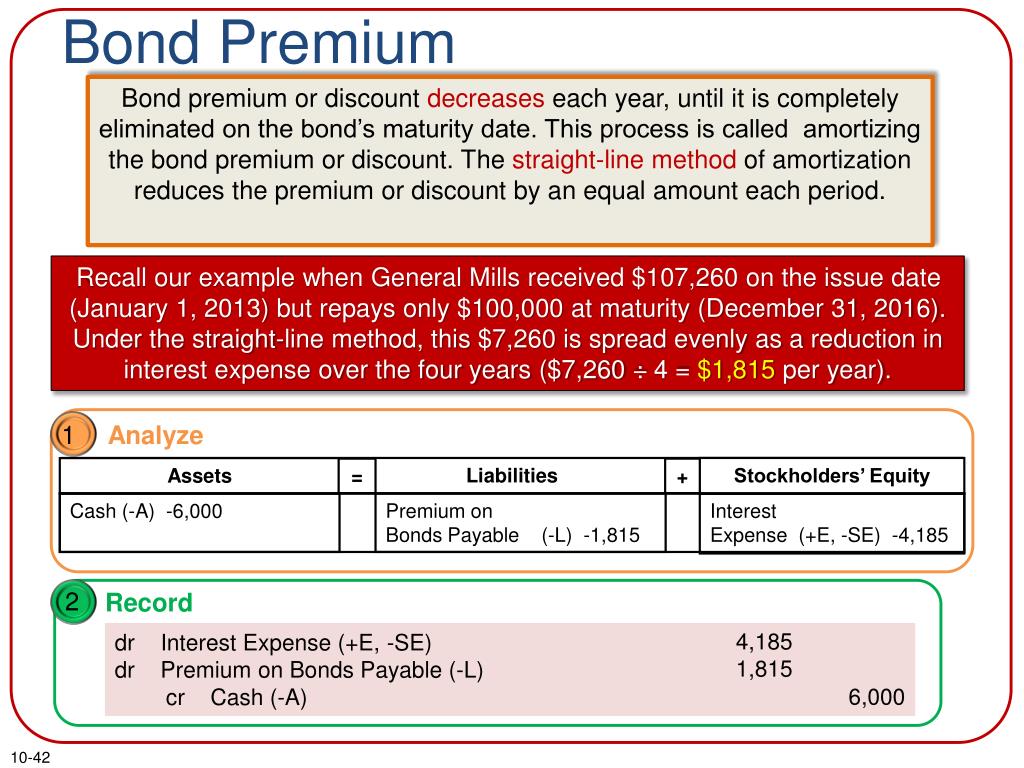

However, issuers account for the premium received as income over the life of the bond, essentially offsetting some of the higher interest expense. This is often done through amortization, a process that gradually reduces the premium on the balance sheet.

Effects on the Investor

For the investor, buying a bond at a premium means paying more than the face value. They will receive the full coupon payments until maturity, but at maturity, they will only receive the face value back, effectively losing the premium they initially paid.

Despite this apparent loss, investors are still drawn to premium bonds because the coupon rate is attractive. The higher immediate income stream from the coupon payments is enough to compensate for the eventual loss of the premium at maturity. This is true if the investor holds the bond until it matures.

However, investors must consider the *yield to maturity* (YTM) which is a more accurate measure of the bond's return. YTM takes into account the premium paid, the coupon payments, and the face value received at maturity. It gives a more realistic picture of the overall return on investment. This gives a fuller picture of financial considerations.

Accounting and Tax Implications

The accounting treatment for bonds sold at a premium is slightly different for issuers and investors. Issuers amortize the premium over the bond's life, reducing the recorded debt and recognizing income. Investors amortize the premium as well, but they treat it as a reduction in interest income.

Tax implications also vary. The premium received by the issuer is generally treated as taxable income. The investor's amortized premium reduces their taxable interest income each year. Consulting with a tax professional is essential.

Real-World Examples

To illustrate, consider a real-world example. The State of California might issue bonds to fund infrastructure projects. If these bonds offer a higher coupon rate than prevailing market rates, they will likely be sold at a premium.

The state receives more upfront capital. However, it also commits to higher coupon payments throughout the bond's term. Investors are attracted by the high coupon rate.

Corporate bonds follow a similar pattern. A company like Apple, with a strong credit rating, might issue bonds at a premium if its older bonds have a higher coupon rate than current market offerings. The interplay between perceived risk and prevailing market conditions is complex. This has implications for both issuer and investor.

Factors Influencing Premium Bond Sales

Several factors influence the likelihood of bonds being sold at a premium. The most significant is the prevailing interest rate environment. When interest rates are low, bonds with higher coupon rates become more attractive and command a premium.

Creditworthiness also plays a crucial role. Issuers with strong credit ratings are more likely to sell bonds at a premium. Because investors perceive them as less risky. Investor sentiment and market demand also affect bond prices.

Economic conditions and expectations also play a part. During periods of economic uncertainty, investors often flock to safer investments like high-quality bonds. This can drive up demand and lead to premium pricing. It is also worth noting that bonds are not the only securities that trade at premium.

The Bond Market Ecosystem

The bond market is a complex ecosystem involving a multitude of players. These can range from institutional investors like pension funds and insurance companies to individual retail investors. Each participant has different objectives and risk tolerances. They interact to determine bond prices and yields.

Investment banks act as intermediaries, underwriting new bond issues and facilitating trading in the secondary market. Rating agencies like Moody's and Standard & Poor's assess the creditworthiness of bond issuers, providing investors with valuable information to guide their decisions.

Central banks also influence the bond market. Central banks do this through monetary policy decisions such as setting interest rates and conducting open market operations. Regulatory bodies like the Securities and Exchange Commission (SEC) oversee the market. They help ensure fairness and transparency.

A Balanced Perspective

Selling bonds at a premium is a strategic financial decision. This decision involves careful consideration of various factors. While it offers immediate benefits like increased upfront capital, it also comes with longer-term obligations like higher interest expenses.

Investors must carefully analyze the yield to maturity. Investors should also consider their individual risk tolerance and investment goals. Understanding the nuances of the bond market helps ensure informed decisions and optimal financial outcomes. Both issuers and investors must be diligent.

As the sun sets over our hypothetical town square, the initial buzz has evolved into a deeper understanding. The sale of bonds at a premium isn't just a financial transaction. It's a reflection of the delicate balance between risk, reward, and the promise of a brighter future. It embodies a sense of collective investment in the community's well-being.