Can You Make An Offer Without Pre Approval

The competitive landscape of the housing market often pushes prospective buyers to explore every possible advantage. A crucial question that arises for many is whether it's possible to make an offer on a property without first securing pre-approval for a mortgage.

Understanding the implications of making an offer without pre-approval is critical for anyone looking to purchase a home. This article explores the process, risks, and potential benefits associated with this approach, providing a comprehensive overview for prospective homebuyers. We examine the perspectives of real estate agents, mortgage lenders, and recent homebuyers to provide a balanced understanding.

Pre-Approval vs. Pre-Qualification: Understanding the Difference

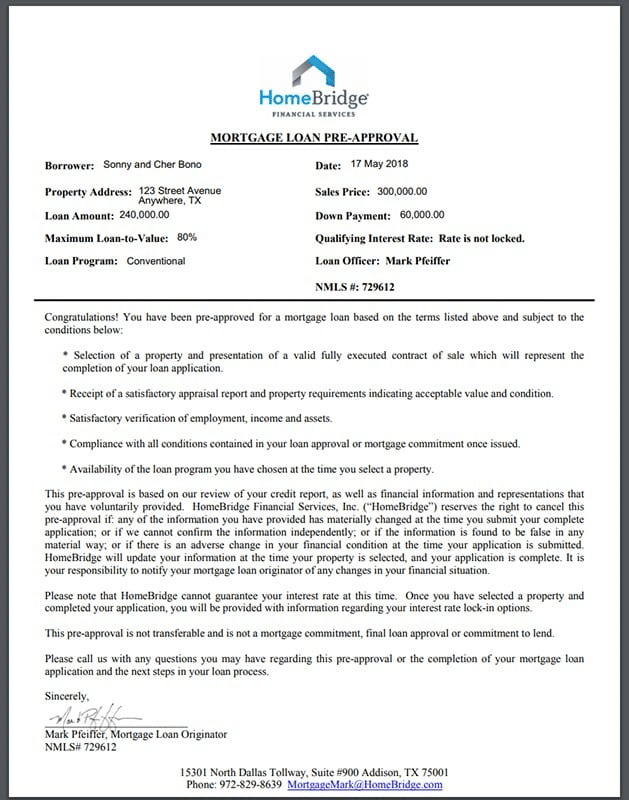

It's important to distinguish between pre-qualification and pre-approval. Pre-qualification is an initial assessment based on self-reported financial information, providing a rough estimate of what a buyer might be able to borrow. Pre-approval, on the other hand, involves a more thorough review of your financial documents by a lender, including credit reports, income verification, and asset statements.

A pre-approval letter from a lender signifies a stronger commitment, indicating the lender is likely to provide a mortgage up to a specified amount. This gives sellers greater confidence in the buyer's ability to secure financing.

The Risks of Offering Without Pre-Approval

Making an offer without pre-approval carries significant risks. Sellers are more likely to favor offers from pre-approved buyers, as they represent a lower risk of the deal falling through due to financing issues. An offer without pre-approval may be viewed as less serious or even dismissed outright in a competitive market.

Furthermore, if your offer is accepted and you're subsequently denied a mortgage, you may lose your earnest money deposit. This can be a substantial financial loss.

According to a 2023 survey by the National Association of Realtors (NAR), properties with pre-approved buyers spent significantly less time on the market. This data underscores the importance of pre-approval in a fast-paced market.

When It Might Be Acceptable (or Necessary)

There are certain situations where making an offer without pre-approval might be considered. In a buyer's market, where there are more homes available than buyers, sellers may be more willing to consider offers from those who haven't yet obtained pre-approval. This is often because there is less competition.

Another scenario is when a buyer has a substantial cash down payment or is planning to purchase the property with cash. In this case, a pre-approval isn't necessary, as financing isn't a contingency.

However, even in these situations, obtaining at least a pre-qualification can provide a sense of your borrowing power. This can guide your offer and prevent you from overbidding.

The Real Estate Agent's Perspective

Real estate agents generally advise buyers to obtain pre-approval before making offers. "A pre-approval letter strengthens your offer and shows the seller you're a serious buyer," says Sarah Miller, a real estate agent with XYZ Realty.

They often act as a point of contact between buyer and lender, facilitating the pre-approval process. This helps streamline the purchasing process.

The Lender's Viewpoint

Mortgage lenders emphasize the importance of pre-approval for managing risk. A thorough review of the buyer's finances allows them to accurately assess the borrower's ability to repay the loan.

"Pre-approval allows us to identify any potential issues early on and work with the borrower to address them before they make an offer," explains John Davis, a loan officer at ABC Mortgage. This proactive approach reduces the likelihood of financing falling through.

Alternatives and Considerations

If you're unable to get pre-approved immediately, consider including a financing contingency in your offer. This clause allows you to withdraw from the deal without penalty if you're unable to secure financing within a specified timeframe.

However, keep in mind that a financing contingency can weaken your offer, particularly in a competitive market. Sellers may prefer offers without such contingencies.

Conclusion

While it's possible to make an offer on a house without pre-approval, it's generally not advisable, especially in a seller's market. The risks of having an offer rejected or losing your earnest money outweigh the potential benefits. Securing pre-approval strengthens your offer, provides you with a clear understanding of your borrowing power, and ultimately increases your chances of successfully purchasing a home.