Unrealized Gains On Investment Securities Fdic

The stability of the U.S. banking system, long considered a bedrock of economic security, has been shaken in recent times by a silent threat lurking within the balance sheets of many institutions: unrealized losses on investment securities. These paper losses, often masked by accounting practices, represent a significant vulnerability, especially in a rising interest rate environment, and have drawn increased scrutiny from regulators like the Federal Deposit Insurance Corporation (FDIC).

At the heart of this issue lies the disconnect between accounting values and market values of assets held by banks. When interest rates climb, the value of fixed-income securities, such as bonds, tends to decline. These losses, though not yet realized through the actual sale of the securities, can erode a bank's capital base, creating potential solvency concerns, and raising alarms at the FDIC, tasked with protecting depositors and maintaining financial stability.

The FDIC's Concerns and Observations

The FDIC has been vocal about the risks posed by unrealized losses. Their supervisory guidance and public statements highlight the potential for these losses to destabilize individual institutions and, more broadly, the banking sector. The agency is actively monitoring banks' investment portfolios and assessing their ability to withstand further interest rate shocks.

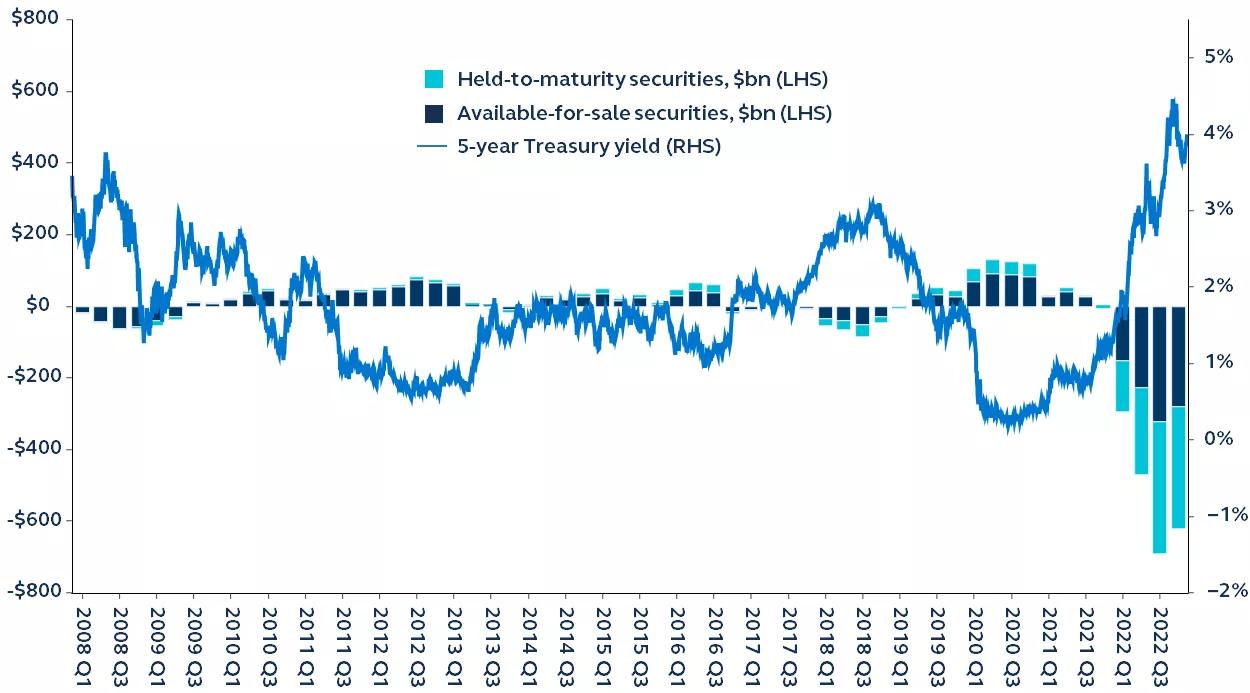

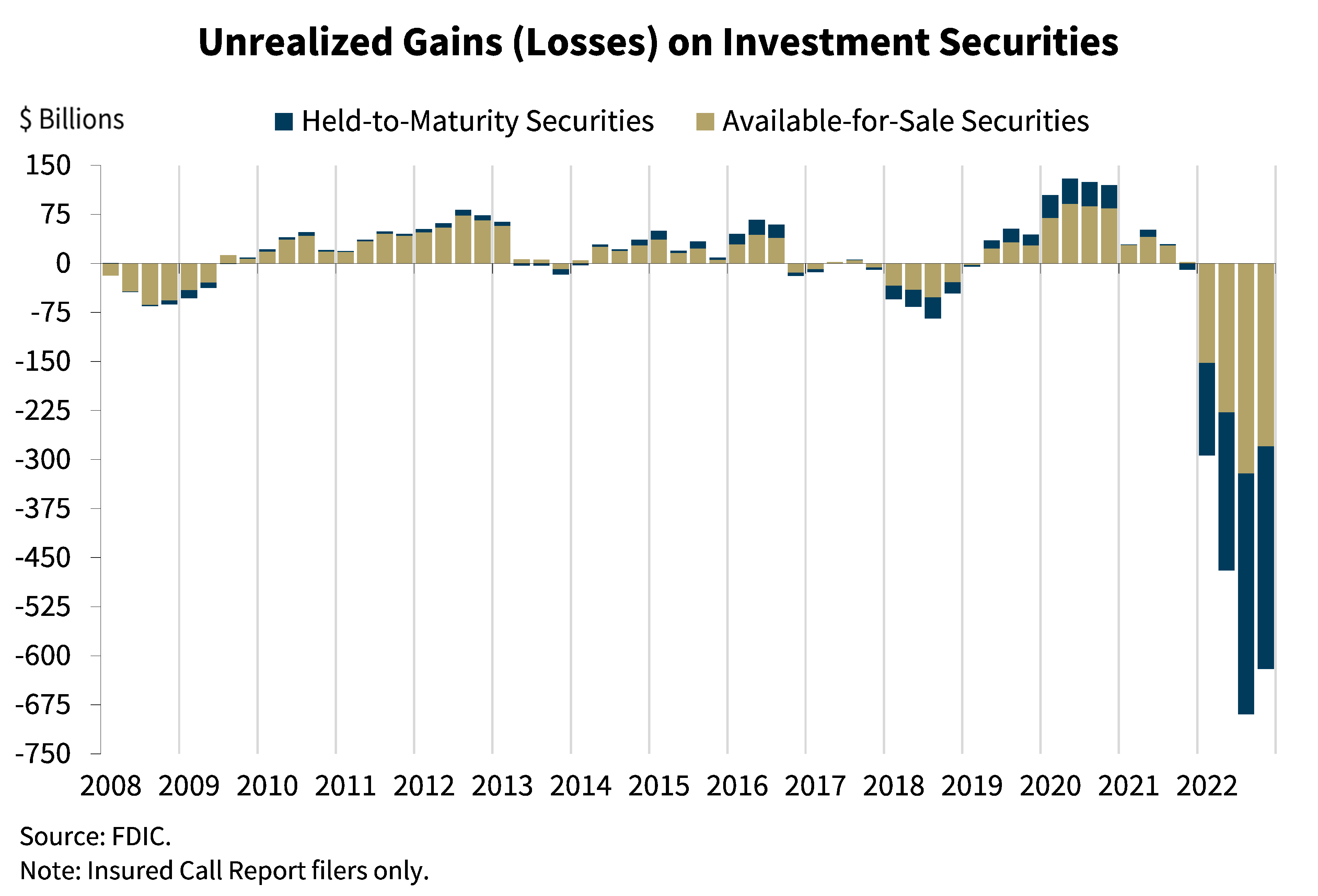

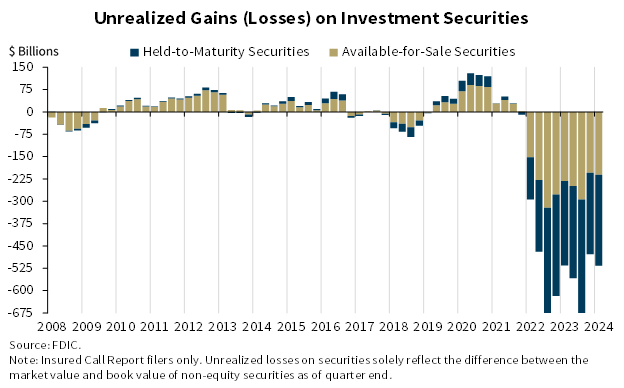

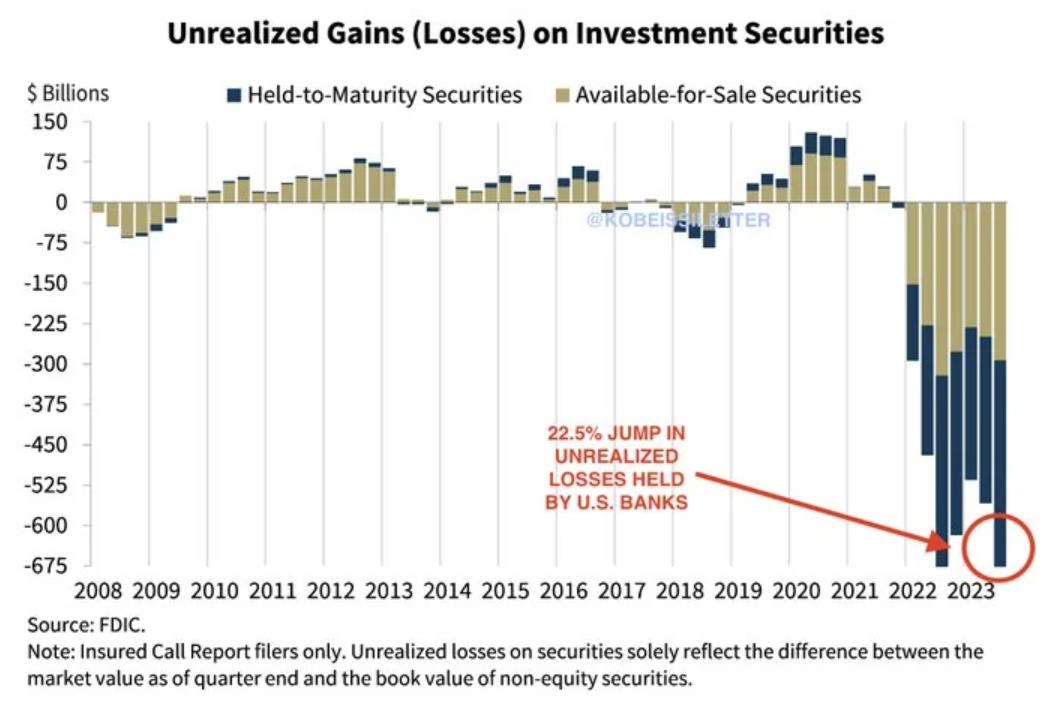

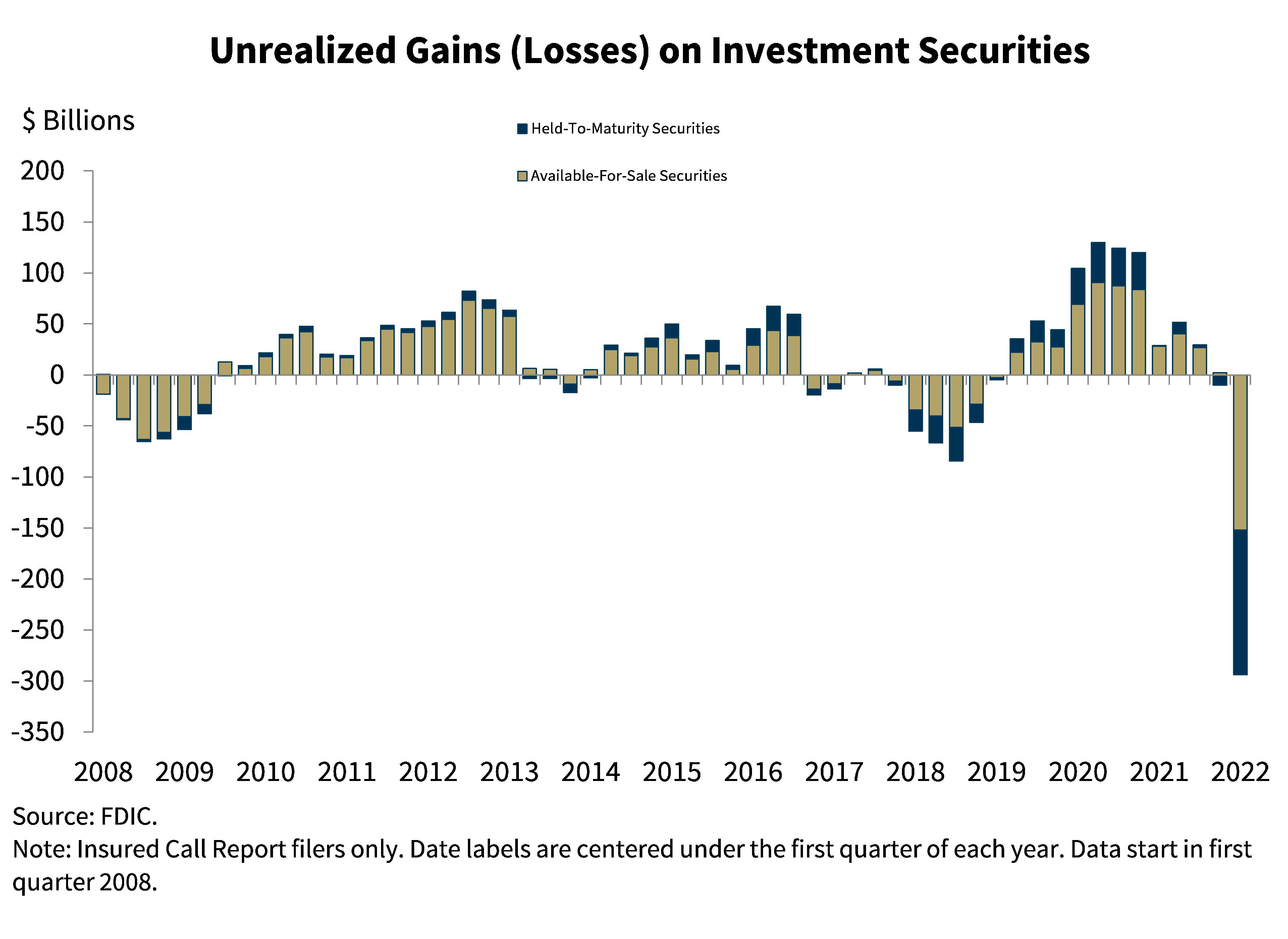

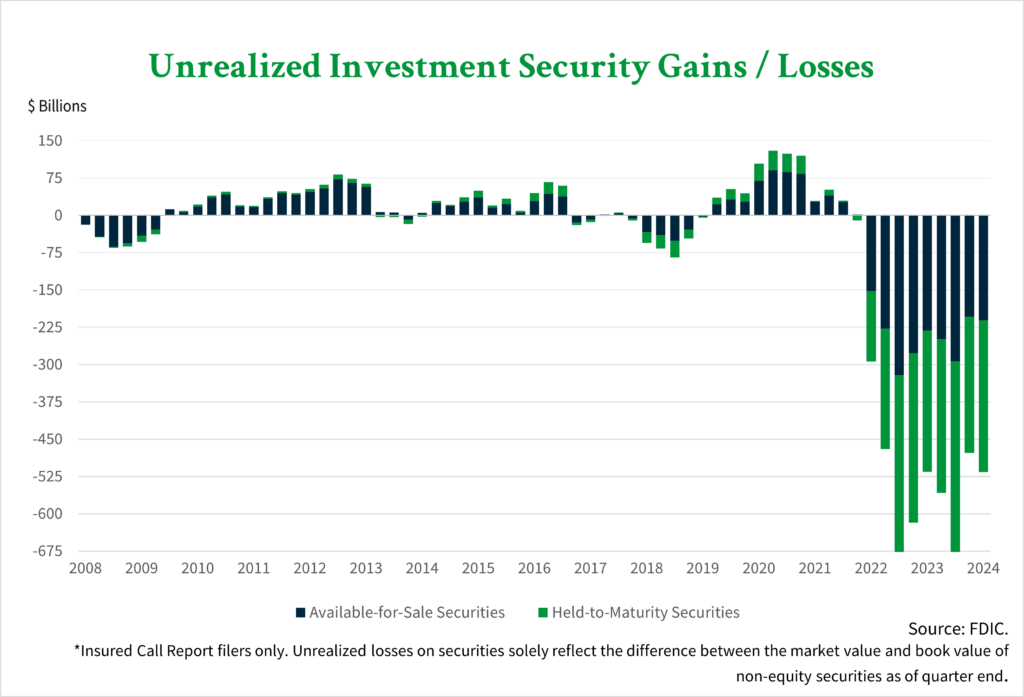

Specifically, the FDIC points to the accumulation of long-duration assets, particularly mortgage-backed securities (MBS) and U.S. Treasury bonds, held by banks during the low-interest-rate environment of the past decade. As the Federal Reserve aggressively hiked interest rates to combat inflation, the market value of these securities plummeted, creating substantial unrealized losses.

These losses are especially concerning for institutions with a high proportion of uninsured deposits, making them vulnerable to deposit runs.

"The rapid increase in interest rates in 2022 and 2023 exposed asset-liability management vulnerabilities at some banks,"warned an FDIC report, signaling the seriousness of the situation.

Accounting Standards and Regulatory Capital

A key factor contributing to the issue is the accounting treatment of these securities. Banks typically classify investment securities into one of three categories: held-to-maturity (HTM), available-for-sale (AFS), or trading securities. The accounting treatment differs for each category.

Securities classified as HTM are carried at amortized cost, meaning that unrealized gains or losses are not reflected on the income statement or in regulatory capital. AFS securities, on the other hand, are marked-to-market, and unrealized gains or losses are reported in accumulated other comprehensive income (AOCI), a component of equity. Trading securities are marked-to-market with changes in value flowing through net income.

Many banks opted to classify a significant portion of their investment securities as HTM, shielding their regulatory capital from the impact of unrealized losses. This strategy, while permissible under current accounting rules, masked the true economic condition of these institutions, creating a delayed recognition of the problem.

The Impact on Bank Stability

The presence of substantial unrealized losses can significantly weaken a bank's financial position. While these losses do not immediately impact cash flow, they erode the bank's capital base, reducing its ability to absorb future losses and potentially triggering regulatory intervention.

A decline in capital ratios can lead to restrictions on lending and other activities, hindering economic growth. In extreme cases, it can trigger a loss of confidence in the institution, leading to a deposit run, as was seen with the failure of Silicon Valley Bank (SVB) in March 2023.

The FDIC’s insurance fund is ultimately responsible for covering insured deposits in the event of a bank failure. Therefore, it has a vested interest in proactively addressing the risks posed by unrealized losses and ensuring the stability of the banking system.

Lessons from Recent Bank Failures

The failures of SVB and other regional banks in early 2023 served as a stark reminder of the dangers associated with large unrealized losses and poor asset-liability management. These institutions held a significant amount of long-duration assets, and when interest rates rose rapidly, the value of those assets plummeted.

These banks also had a large concentration of uninsured deposits, making them particularly vulnerable to deposit runs when concerns about their solvency arose. The FDIC was forced to step in to protect depositors and prevent a broader contagion effect.

The events highlighted the need for increased regulatory scrutiny and a more proactive approach to identifying and addressing risks in the banking sector. They also underscored the importance of sound risk management practices at individual institutions.

Potential Solutions and Future Outlook

Addressing the issue of unrealized losses requires a multifaceted approach. One potential solution is to require banks to more accurately reflect the market value of their investment securities in their regulatory capital calculations.

Another option is to strengthen supervisory oversight and require banks to enhance their asset-liability management practices. This includes stress-testing their portfolios under various interest rate scenarios and developing contingency plans for managing potential deposit outflows.

The FDIC is actively working on these issues, in collaboration with other regulatory agencies. The agency has signaled its intent to enhance its supervisory framework and to promote more robust risk management practices at banks of all sizes.

The future of the banking sector will depend on the ability of regulators and banks to effectively manage the risks associated with unrealized losses. A proactive and comprehensive approach is essential to maintaining financial stability and protecting depositors. Failure to address this issue could have serious consequences for the U.S. economy.

.jpg)

![Unrealized Gains On Investment Securities Fdic Unrealized gains (losses) on investment securities.[10] | Download](https://www.researchgate.net/publication/376131429/figure/fig2/AS:11431281209086216@1701633286787/Unrealized-gains-losses-on-investment-securities10_Q640.jpg)