How To Add New Folio In Uti Mutual Fund

In the ever-evolving landscape of personal finance, navigating the intricacies of mutual fund investments can often feel overwhelming. For investors seeking to diversify their holdings within UTI Mutual Fund, understanding the process of adding a new folio is crucial. This guide provides a comprehensive breakdown of the steps involved, ensuring a smooth and informed experience.

Adding a new folio in UTI Mutual Fund allows investors to segregate their investments based on different financial goals, risk profiles, or investment strategies. This article will serve as a practical roadmap, detailing the various methods and requirements involved in establishing a new folio with UTI Mutual Fund.

Understanding Folios in UTI Mutual Fund

A folio number acts as a unique identification for your investment account with a mutual fund. Think of it as your account number within the fund house. Each folio can hold multiple schemes under the same investor name and holding pattern.

Creating a new folio allows you to manage your investments more effectively. It is especially useful for segregating investments for different purposes, such as retirement planning, children's education, or short-term goals.

Methods to Add a New Folio

Online Method

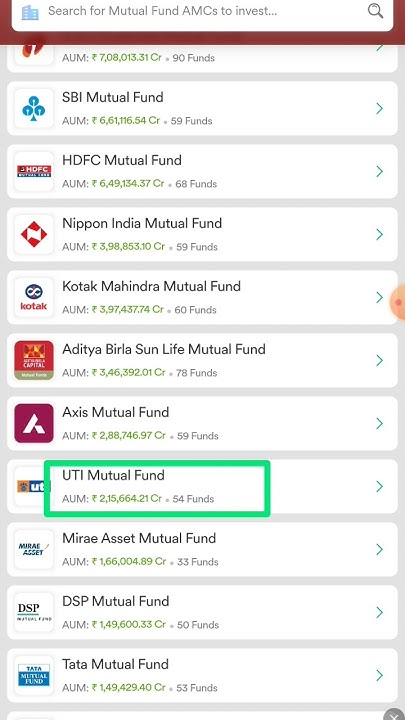

UTI Mutual Fund offers a convenient online platform for creating new folios. Investors can access this feature through the official UTI Mutual Fund website or mobile app.

First, you will need to register or log in to your existing account. Then navigate to the section dedicated to "New Folio Creation" or similar wording.

You'll be required to provide essential details such as your PAN, KYC information, and bank account details. Ensure all information is accurate and matches the records associated with your KYC.

Once you submit the required information, the system will verify your details. Upon successful verification, your new folio will be created.

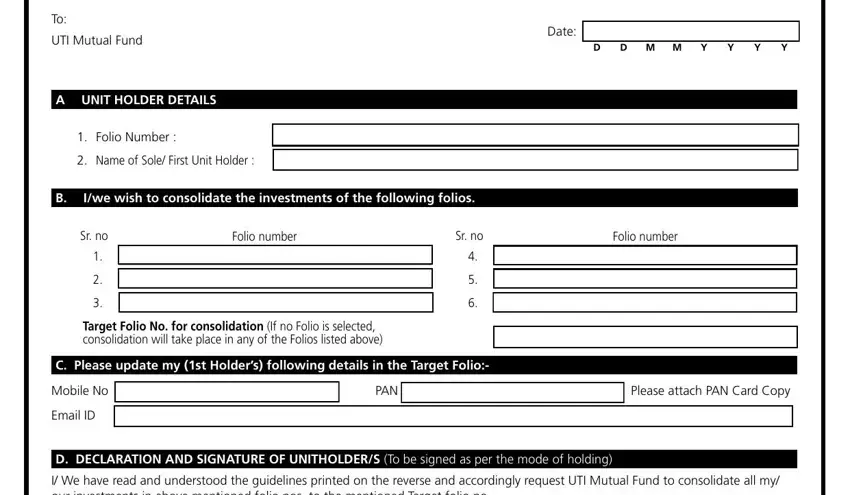

Offline Method

For investors who prefer a more traditional approach, adding a new folio offline is also an option. This involves submitting a physical application form.

Obtain the "New Folio Creation" form from the UTI Mutual Fund branch or download it from their website. Complete the form accurately, providing all necessary information.

Submit the filled-out form along with the required documents to the nearest UTI Mutual Fund branch or designated collection center. The required documents typically include a copy of your PAN card, address proof, and KYC documents.

Essential Documents and Information

Regardless of the method you choose, having the following documents and information readily available is crucial. This will streamline the folio creation process.

PAN Card: A copy of your PAN card is mandatory for all investments in mutual funds in India.

Address Proof: You will need to provide a valid address proof, such as an Aadhar card, passport, or utility bill.

KYC Documents: Ensure your KYC (Know Your Customer) is up-to-date. If not, you may need to complete the KYC process before creating a new folio. You can check your KYC status on the websites of KYC Registration Agencies (KRAs).

Bank Account Details: Provide accurate bank account details, including the account number, IFSC code, and bank name.

Important Considerations

Before creating a new folio, consider the implications for your investment strategy and tax planning. Each folio will be treated as a separate investment account.

Understand the charges associated with managing multiple folios. While creating a folio is generally free, managing multiple accounts can sometimes incur additional costs depending on the fund house’s policies.

Review the terms and conditions associated with the new folio. This includes understanding the redemption process, expense ratios, and other relevant details.

Future Trends in Folio Management

The future of folio management is likely to be heavily influenced by technology. Expect increased automation and personalized investment recommendations.

Blockchain technology could potentially streamline the KYC process and enhance the security of folio management systems. This would simplify the process for investors.

The integration of Artificial Intelligence (AI) may provide investors with customized folio management solutions. These solutions would cater to their specific financial goals and risk tolerance.

By understanding the process of adding a new folio and staying informed about future trends, investors can effectively manage their UTI Mutual Fund investments to achieve their financial aspirations. Staying updated on regulatory changes is also vital for smooth and compliant investment management.