How Much Capital Is Needed To Put Up The Business

Launching a new business is an exciting endeavor, but one crucial question often looms large: How much capital is needed to get off the ground? The answer, unsurprisingly, varies widely depending on the industry, business model, and growth ambitions.

Understanding the true cost of starting a business is essential for securing funding, managing cash flow, and ultimately, achieving long-term success. This article explores the key factors influencing startup costs, drawing on data from industry reports and expert insights to provide a comprehensive overview.

Startup Costs: A Multifaceted Equation

The amount of capital needed to launch a business is not a one-size-fits-all figure. It is influenced by several factors. These include industry sector, business model (e.g., brick-and-mortar vs. online), location, and the desired scale of operations.

For example, a tech startup developing a software application might have relatively low initial capital requirements. Its requirements will be mostly focused on software development and marketing. Contrastingly, opening a restaurant can demand significant upfront investment in real estate, equipment, and inventory.

According to the Small Business Administration (SBA), many microbusinesses can be started for under $3,000, but the average startup cost is closer to $30,000. This figure can easily climb into the hundreds of thousands, or even millions, for capital-intensive industries like manufacturing or energy.

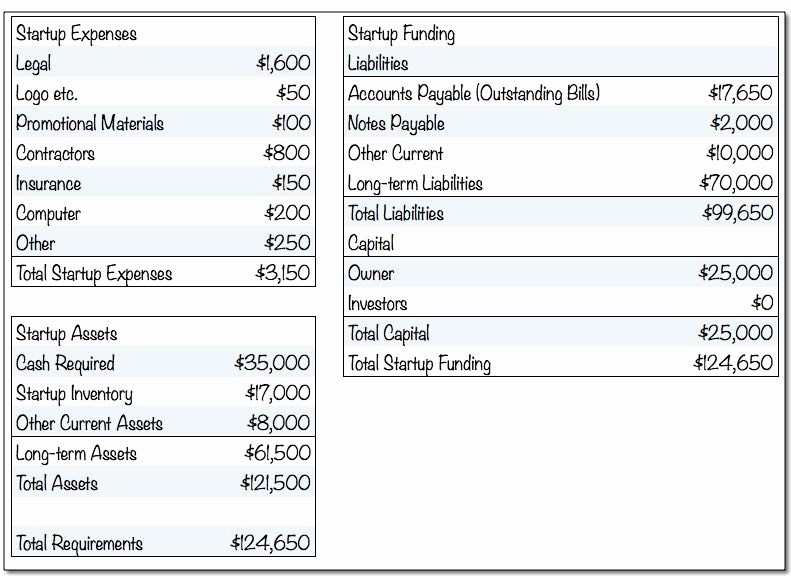

Key Components of Startup Capital

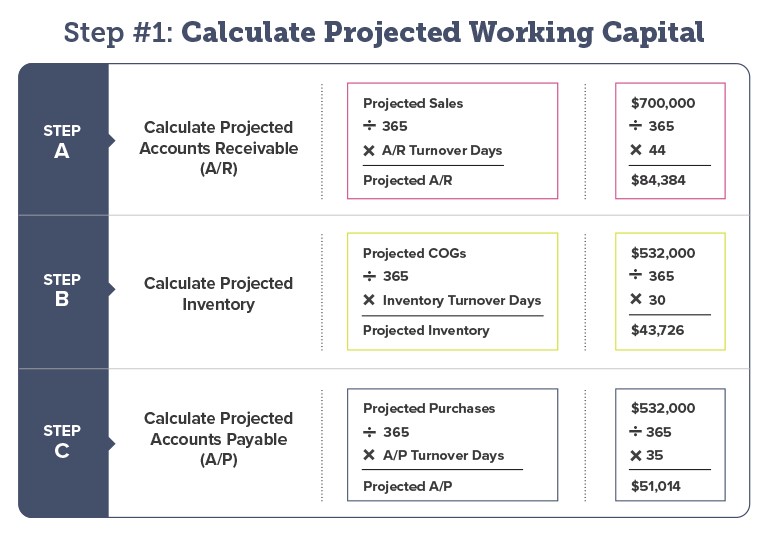

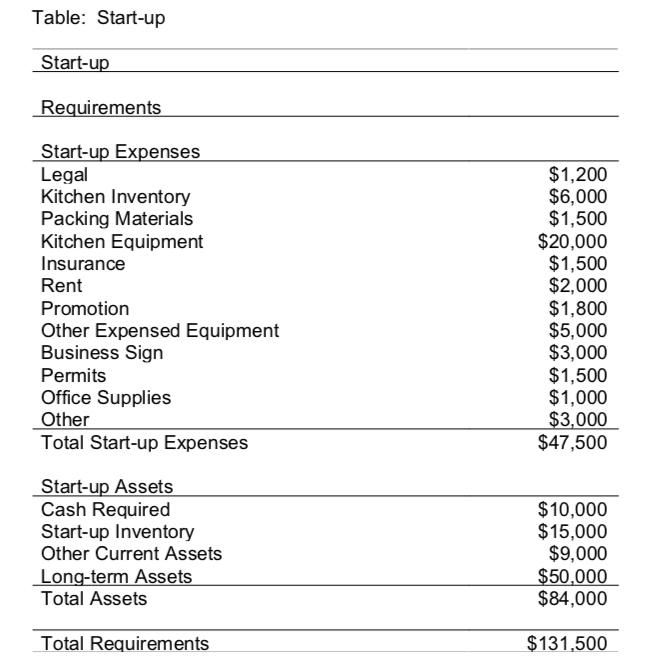

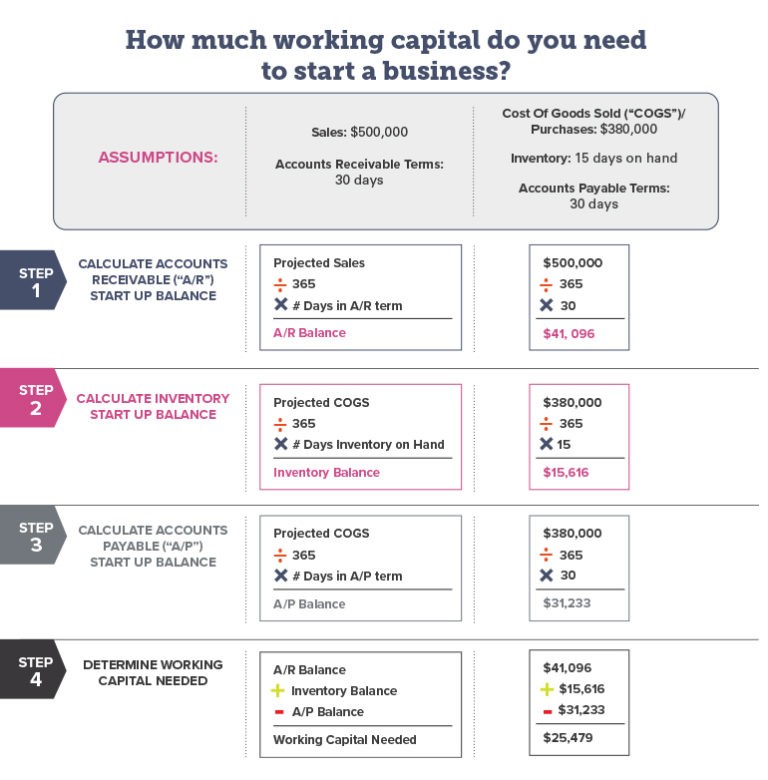

Several core elements typically comprise the initial capital requirements. These include: Business plan preparation (including research and consulting fees). Legal and administrative costs (incorporation, permits, licenses).

Marketing and branding expenses (logo design, website development, initial advertising campaigns). Operational costs (rent, utilities, salaries, insurance). Inventory and raw materials (if applicable). Equipment and technology (computers, software, machinery).

A recent report by Fundera highlights the importance of accurately estimating these costs. Underestimating can lead to cash flow problems and potentially jeopardize the business's viability.

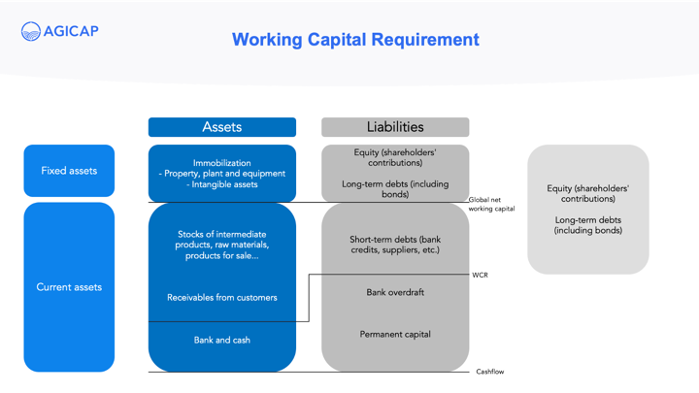

Funding Sources: Navigating the Landscape

Once the required capital is determined, entrepreneurs need to explore funding options. These options include: Personal savings and loans from family and friends. Small business loans from banks and credit unions.

Venture capital and angel investors (primarily for high-growth potential startups). Crowdfunding platforms (Kickstarter, Indiegogo). Government grants and programs (often sector-specific).

"Securing funding requires a well-crafted business plan that demonstrates a clear understanding of the market, a viable business model, and a realistic financial projection," stated Jane Doe, a business consultant at ABC Consulting.

"Investors look for entrepreneurs who are passionate, knowledgeable, and prepared to navigate the challenges of starting and growing a business."

The Human Element: Bootstrapping and Resourcefulness

While substantial capital can provide a significant advantage, resourcefulness and "bootstrapping" are equally important. Many successful businesses started with minimal investment, relying on the founders' ingenuity and hard work.

For example, John Smith, founder of XYZ Software, initially funded his startup with his savings and by working part-time jobs. He built the initial product himself and leveraged free marketing channels to attract early customers.

His story highlights that passion, dedication, and a willingness to embrace constraints can compensate for a lack of initial capital.

Conclusion: Planning for Success

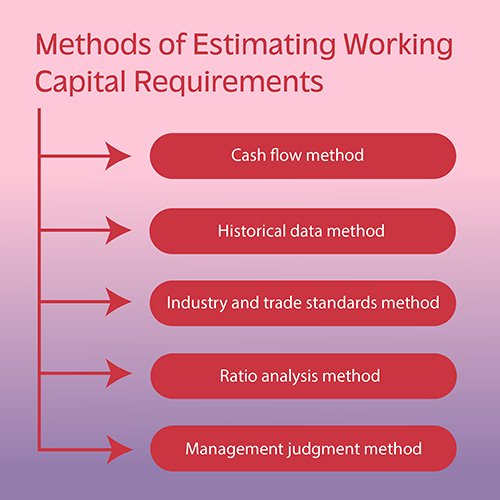

Determining the necessary capital to launch a business is a crucial step in the entrepreneurial journey. By thoroughly researching industry benchmarks, carefully estimating expenses, and exploring various funding options, aspiring entrepreneurs can increase their chances of success.

Ultimately, a well-funded business with a solid plan and a dedicated team is best positioned to navigate the challenges of the startup world and achieve sustainable growth.

Careful planning, resourcefulness, and a clear understanding of the market are key to transforming a business idea into a thriving reality.