How To Get Money To Start Up A Business

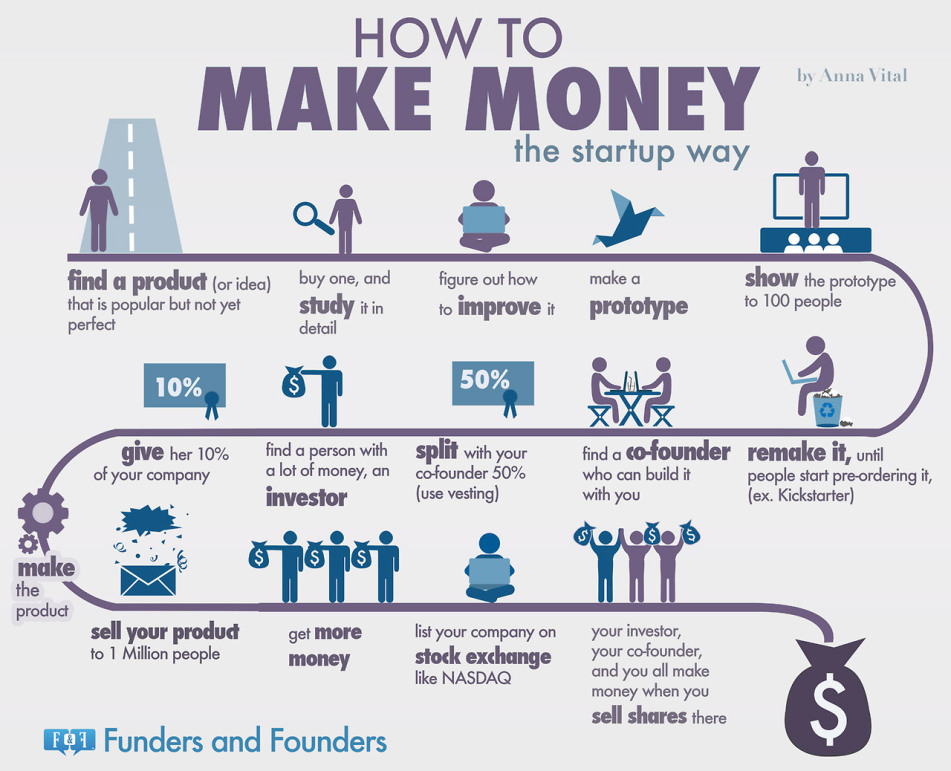

The dream of launching a successful business often crashes against the harsh reality of funding. Securing capital is a monumental hurdle for aspiring entrepreneurs, a challenge exacerbated by economic uncertainties and increasingly competitive markets. Access to the right financial resources can be the difference between a brilliant idea flourishing and withering on the vine.

This article provides a comprehensive guide to navigating the complex landscape of startup funding. It details various avenues, from traditional loans and venture capital to crowdfunding and government grants. It explores the pros and cons of each option. The aim is to equip future business owners with the knowledge to make informed decisions about their funding strategies.

Understanding Your Funding Needs

Before diving into funding options, meticulously assess your financial requirements. Create a detailed business plan, including projected revenue, expenses, and a cash flow forecast. Honest self-assessment is crucial.

Distinguish between seed funding, for initial development, and growth capital, for expansion. Accurately estimating your needs will prevent underfunding, which can cripple a startup early on.

Traditional Funding Options

Bank Loans

Small business loans from banks are a common funding source. They typically require a solid credit history, collateral, and a comprehensive business plan. Prepare to navigate a rigorous application process.

Interest rates and repayment terms vary, so shop around for the best deal. Government-backed loan programs, like those offered by the Small Business Administration (SBA), can provide more favorable terms.

Venture Capital

Venture capitalists (VCs) invest in startups with high growth potential in exchange for equity. This is a suitable option for businesses poised for rapid scaling.

Securing VC funding involves pitching your idea to investors. Be prepared for intense scrutiny and due diligence.

Alternative Funding Sources

Angel Investors

Angel investors are wealthy individuals who invest their own money in startups. They often provide mentorship and guidance in addition to capital.

Networking and building relationships are key to finding angel investors. Attend industry events and connect with angel investor networks.

Crowdfunding

Crowdfunding platforms allow you to raise funds from a large number of people, typically in exchange for rewards or equity. Sites like Kickstarter and Indiegogo are popular choices.

A compelling story and strong marketing are essential for a successful crowdfunding campaign. Clearly communicate your vision and offer attractive incentives.

Government Grants

Government grants offer non-repayable funding for specific types of businesses. These are highly competitive, and require detailed applications.

Research grants offered by federal, state, and local government agencies. Focus on programs that align with your business's mission and goals. The Grants.gov website is a good starting point.

Bootstrapping and Personal Savings

Bootstrapping, funding your business with personal savings and revenue, is a viable option. It allows you to retain full control and avoid debt early on.

This approach requires frugality and resourcefulness. Prioritize essential expenses and focus on generating revenue quickly.

The Importance of a Strong Business Plan

Regardless of the funding source you pursue, a strong business plan is essential. It serves as a roadmap for your business and demonstrates your understanding of the market.

Include a detailed market analysis, competitive assessment, and financial projections. A well-crafted plan increases your chances of securing funding.

"A business plan is not just a document; it's a reflection of your commitment and vision,"says Jane Doe, a startup consultant.

Navigating the Legal and Financial Landscape

Seek legal and financial advice before making any funding decisions. Understand the terms and conditions of any agreements you enter into.

Consult with an attorney and accountant specializing in startups. They can help you navigate the complexities of business law and finance.

Looking Ahead

The funding landscape is constantly evolving. Staying informed about new trends and opportunities is crucial for long-term success. Explore innovative funding models and build relationships with investors and mentors.

With careful planning, perseverance, and a compelling vision, entrepreneurs can overcome the funding hurdle and turn their business dreams into reality. Adaptability is the key.

![How To Get Money To Start Up A Business Beginner's Guide For How To Start A Startup [Infographic] | Bit Rebels](http://www.bitrebels.com/wp-content/uploads/2013/07/how-start-a-startup-infographic.png)