How Long Does It Take A Loan To Be Approved

Imagine this: you've finally found the perfect little cottage, or perhaps you're ready to launch that dream business. Excitement bubbles, but a looming question dampens the enthusiasm: how long will it take for my loan to be approved? This waiting game, familiar to many, can feel like an eternity.

The approval timeline for a loan varies significantly depending on the loan type, lender, and individual applicant. Understanding the factors influencing this process can alleviate stress and help you plan effectively.

The Labyrinth of Loan Approval

Loan approval isn't a simple yes or no; it's a multifaceted process. Each stage, from application to underwriting, adds to the overall timeline.

Mortgages: A Marathon, Not a Sprint

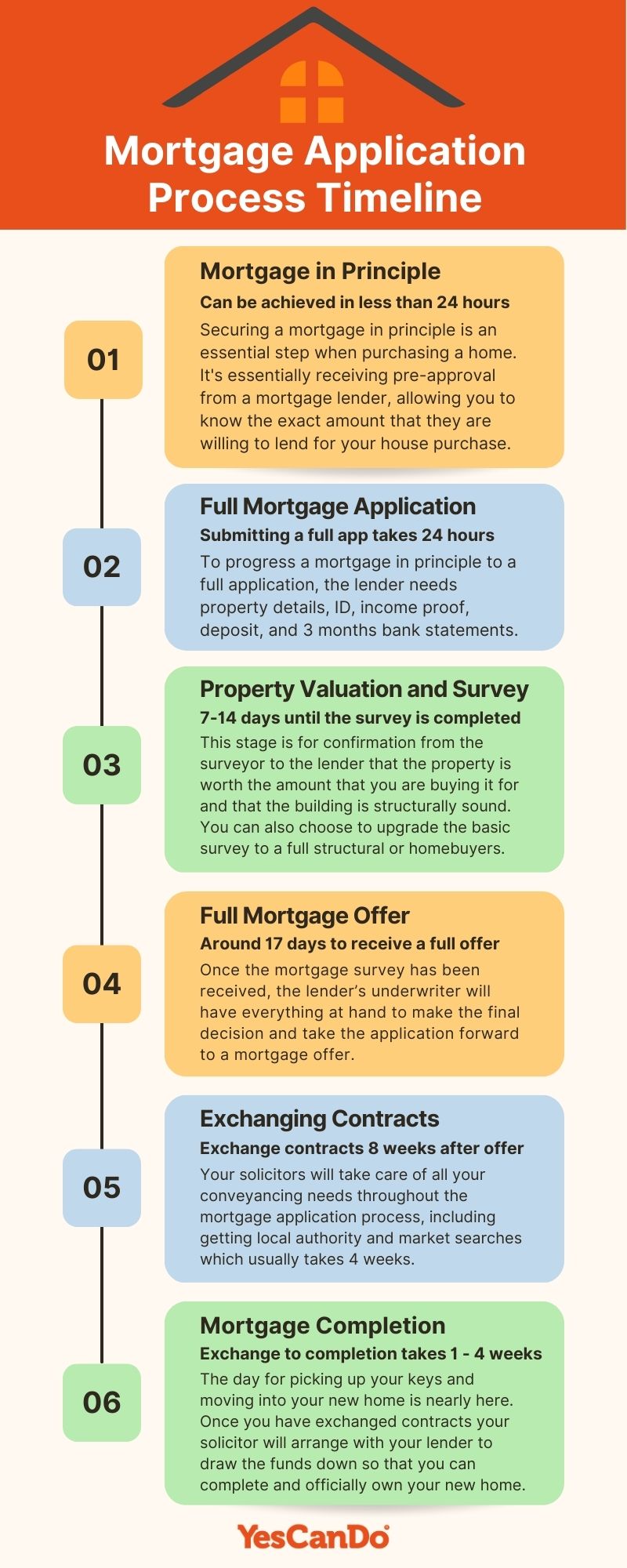

Mortgages, due to their size and complexity, typically have the longest approval times. According to data from Ellie Mae, a leading mortgage technology provider, the average time to close a mortgage loan in recent months has hovered around 45-50 days.

This timeframe involves several crucial steps: pre-approval, property appraisal, underwriting, and closing. Any hiccups, such as appraisal issues or income verification delays, can extend the process.

Lenders meticulously assess your credit history, debt-to-income ratio, and employment stability. Documentation requirements are extensive, ensuring the lender's security in the investment.

Personal Loans: Quicker, But Still Calculated

Personal loans generally offer a faster approval process compared to mortgages. Many online lenders boast approval times ranging from 24 hours to a few business days. However, this speed comes with caveats.

While the application process might be streamlined, lenders still need to verify your information. Credit score and income remain key factors in determining approval and interest rates.

Traditional banks may take a bit longer, perhaps a week or two, due to more stringent internal procedures. The tradeoff might be more favorable terms for borrowers with excellent credit.

Small Business Loans: A Balancing Act

Small business loans present a unique set of considerations. Lenders not only evaluate your personal credit but also scrutinize your business plan and financial projections.

The Small Business Administration (SBA) offers loan programs that can be attractive, but these often involve a more extensive application process. Expect weeks, even months, for approval.

Alternative lenders, like online platforms, may offer quicker funding but potentially at higher interest rates. Carefully weigh the pros and cons before committing.

Factors Influencing Approval Time

Several factors can either expedite or delay your loan approval. Creditworthiness is paramount; a strong credit score signals lower risk to lenders.

Complete and accurate documentation is crucial. Any missing information or discrepancies can trigger delays.

The lender's workload and internal processes also play a role. During peak seasons, approval times may be longer due to increased application volume.

Tips for Speeding Up the Process

Being proactive can significantly shorten your waiting time. Gather all necessary documents beforehand: bank statements, tax returns, and pay stubs.

Maintain open communication with your lender. Promptly respond to requests for information and address any concerns.

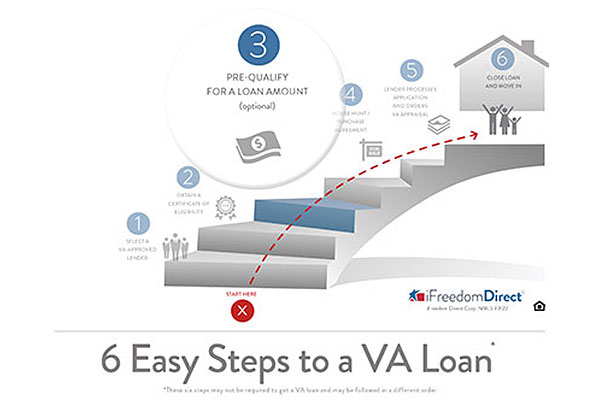

Consider getting pre-approved. This provides a preliminary assessment of your eligibility and can streamline the final approval process.

The journey to loan approval can be a test of patience, but with understanding and preparation, you can navigate the process with greater confidence. Remember to carefully evaluate your options and choose a loan that aligns with your financial goals. The dream, whether it's a new home or a thriving business, is worth the wait.