Host Hotels Hst Q1 2025 Earnings

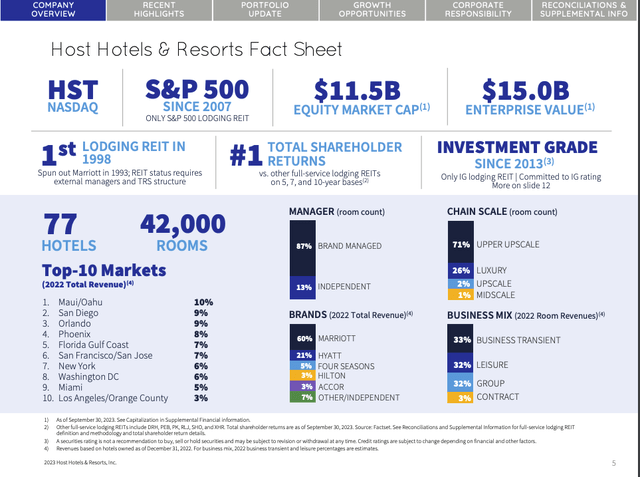

Host Hotels & Resorts, the largest lodging real estate investment trust (REIT), released its first-quarter earnings for 2025, revealing a mixed bag of results amidst a dynamic economic landscape. The report, issued after market close on Tuesday, outlined key performance indicators and offered insights into the company's strategic outlook for the remainder of the year.

These results are significant because Host Hotels' performance is often seen as a bellwether for the broader hospitality industry, providing clues about travel demand, pricing power, and overall economic health. Investors, analysts, and industry stakeholders closely scrutinize these earnings to gauge the sector's current state and anticipate future trends.

First Quarter Financial Highlights

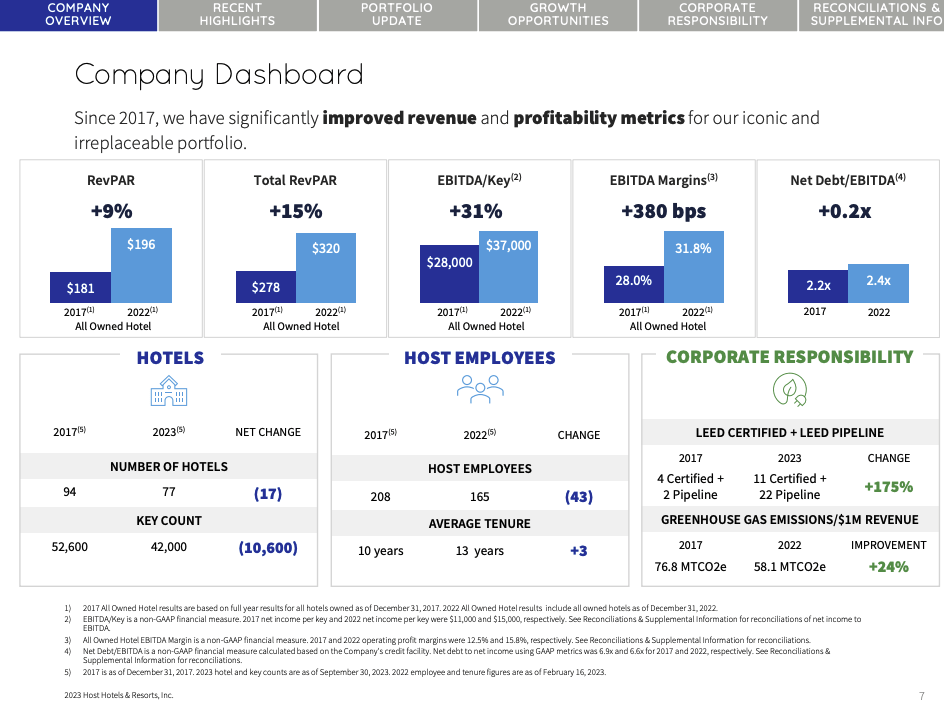

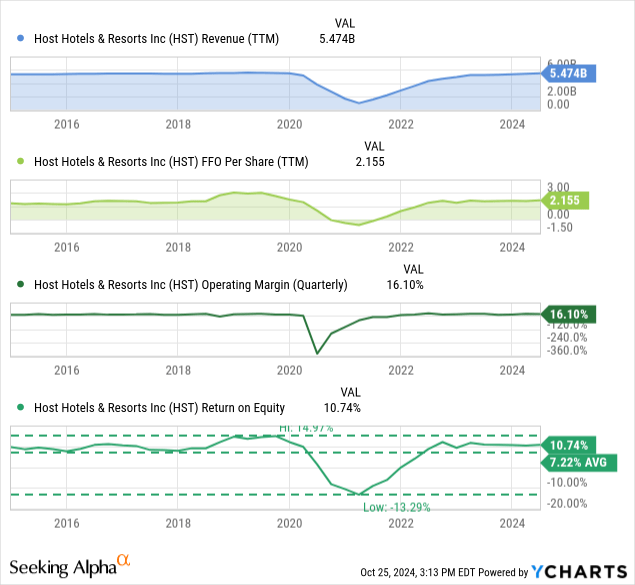

For the first quarter ending March 31, 2025, Host Hotels reported an adjusted earnings per share (EPS) of $0.48, slightly surpassing analysts' expectations of $0.45. Revenue per available room (RevPAR), a key metric for hotel performance, increased by 3.5% compared to the same period last year.

Total revenues for the quarter reached $1.3 billion, a 4% increase year-over-year. This growth was primarily driven by strong demand in urban and resort markets, offsetting some softness in convention-oriented properties.

However, the company noted that operating expenses also rose, impacting overall profitability. Increased labor costs and inflationary pressures on other operational expenses contributed to this rise.

Key Performance Metrics

The 3.5% RevPAR growth was a crucial indicator of the company's ability to maintain occupancy and pricing power. Occupancy rates averaged 75% across the portfolio, a slight improvement from the 73% recorded in the first quarter of 2024.

Average daily rate (ADR) also saw a modest increase of 2.5%, reflecting the company's strategies to maximize revenue through dynamic pricing. Resort properties experienced the most robust RevPAR growth, exceeding 5%.

Urban hotels also performed well, benefiting from a resurgence in business travel and leisure activities.

Strategic Initiatives and Capital Allocation

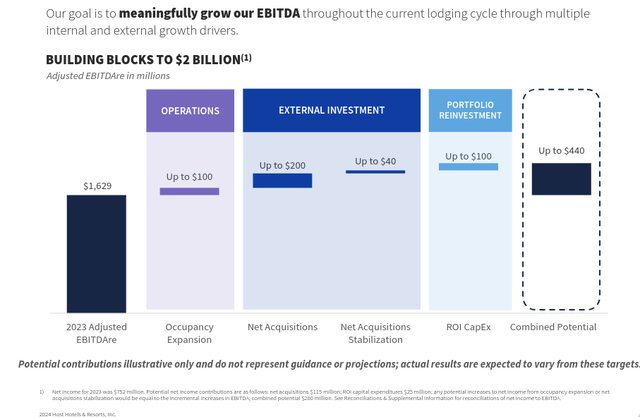

During the earnings call, James Risoleo, President and CEO of Host Hotels, emphasized the company's focus on strategic capital allocation and portfolio optimization. The company invested $150 million in capital improvements across its properties during the quarter.

These investments are aimed at enhancing guest experiences and driving long-term value creation. Risoleo stated that they are committed to modernizing their properties and maintaining their competitive edge.

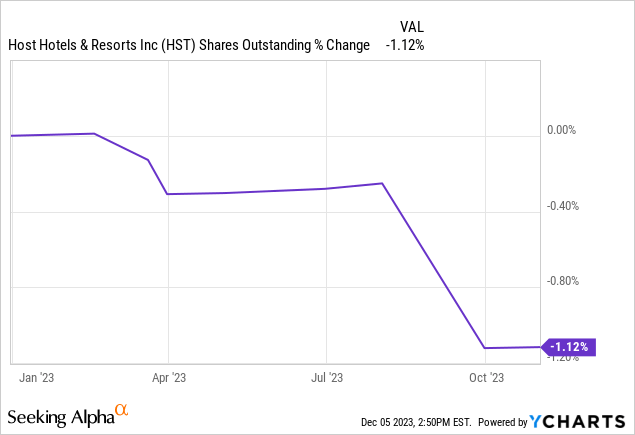

The company also repurchased approximately 1.5 million shares of its common stock at an average price of $18.50 per share, signaling confidence in its future prospects.

Outlook for the Remainder of 2025

Host Hotels provided updated guidance for the full year 2025, projecting RevPAR growth of 2% to 4%. The company anticipates continued strength in leisure travel, particularly in resort destinations.

However, they also acknowledge potential headwinds, including the ongoing uncertainty surrounding the global economy and the potential for increased competition. Management is closely monitoring economic indicators and adjusting strategies as needed.

"We remain cautiously optimistic about the remainder of the year," Risoleo commented during the call. "Our diversified portfolio and proactive management strategies position us well to navigate the evolving landscape."

Market Reaction and Analyst Commentary

Following the earnings release, Host Hotels' stock experienced a modest increase in after-hours trading. Analysts offered varied perspectives, with some highlighting the company's strong RevPAR growth and effective capital allocation.

Others expressed concerns about rising operating expenses and the potential impact of economic slowdown on travel demand. Robert W. Baird analyst Michael Bellisario maintained a "Neutral" rating on the stock, citing a balanced risk-reward profile.

JPMorgan Chase analyst Joseph Greff reiterated an "Overweight" rating, noting the company's strong management team and well-positioned portfolio.

Impact on the Hospitality Industry

Host Hotels' first-quarter results underscore the ongoing recovery in the hospitality industry, but also highlight the challenges that remain. The company's performance reflects a broader trend of increased leisure travel and a gradual return of business travel.

However, rising costs and economic uncertainties continue to pose risks for hotel operators. The industry will be closely watching how Host Hotels navigates these challenges in the coming quarters.

The results can serve as an indicator for smaller hotel chains or individual hotels. These operators might look to Host Hotels for insight into effective strategies for maximizing revenue and managing expenses in a dynamic market.

Conclusion

Host Hotels & Resorts' first-quarter 2025 earnings presented a mixed picture of progress and persistent challenges. While revenue and RevPAR showed positive growth, rising operating expenses and economic uncertainties warrant continued vigilance.

The company's strategic investments and capital allocation decisions will be critical in determining its long-term success. As the hospitality industry continues to evolve, Host Hotels' performance will remain a key indicator of the sector's overall health.

Investors and industry observers will be keenly awaiting the company's subsequent earnings reports to assess the sustainability of the current trends and the effectiveness of management's strategies.

/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)