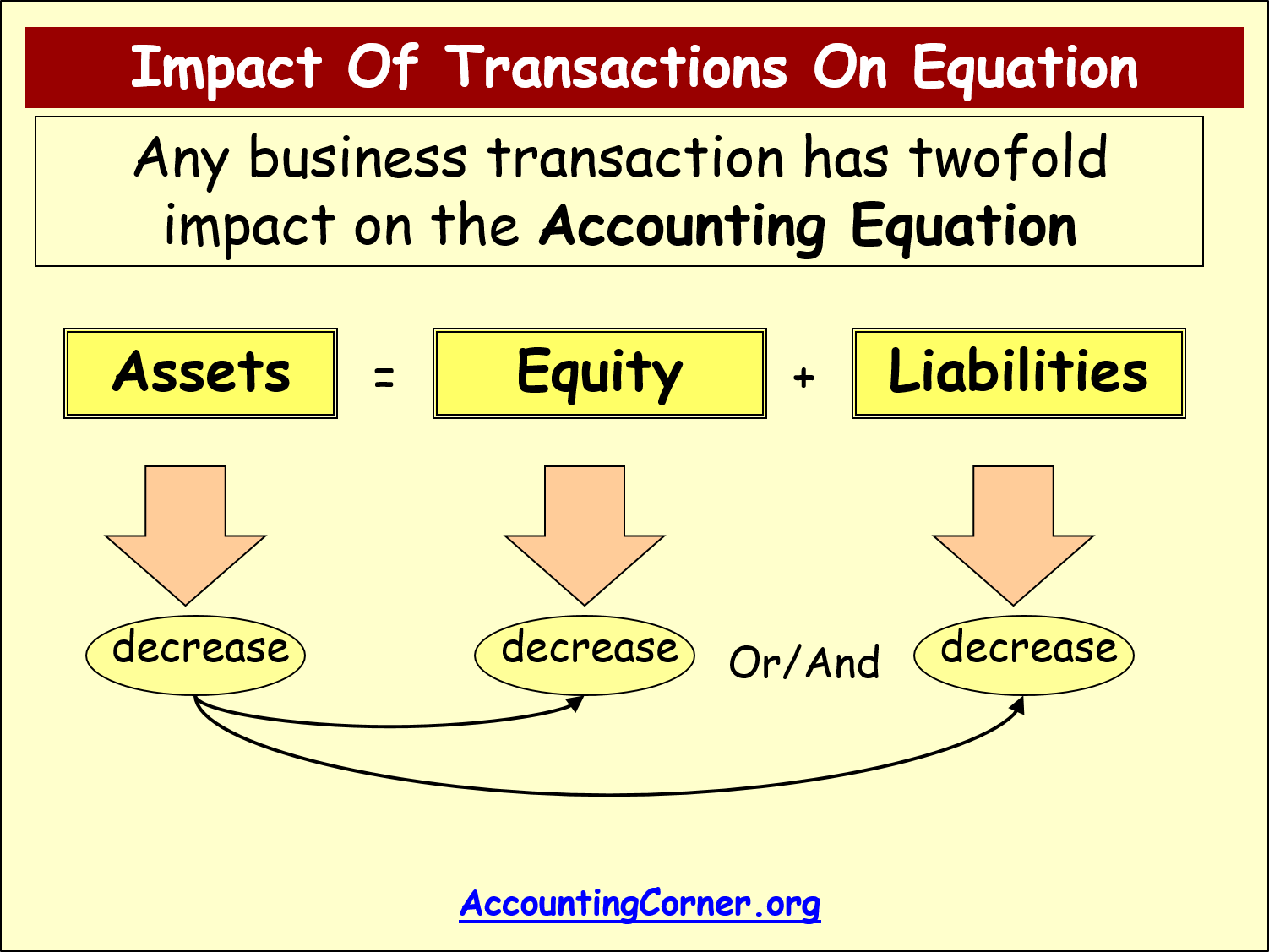

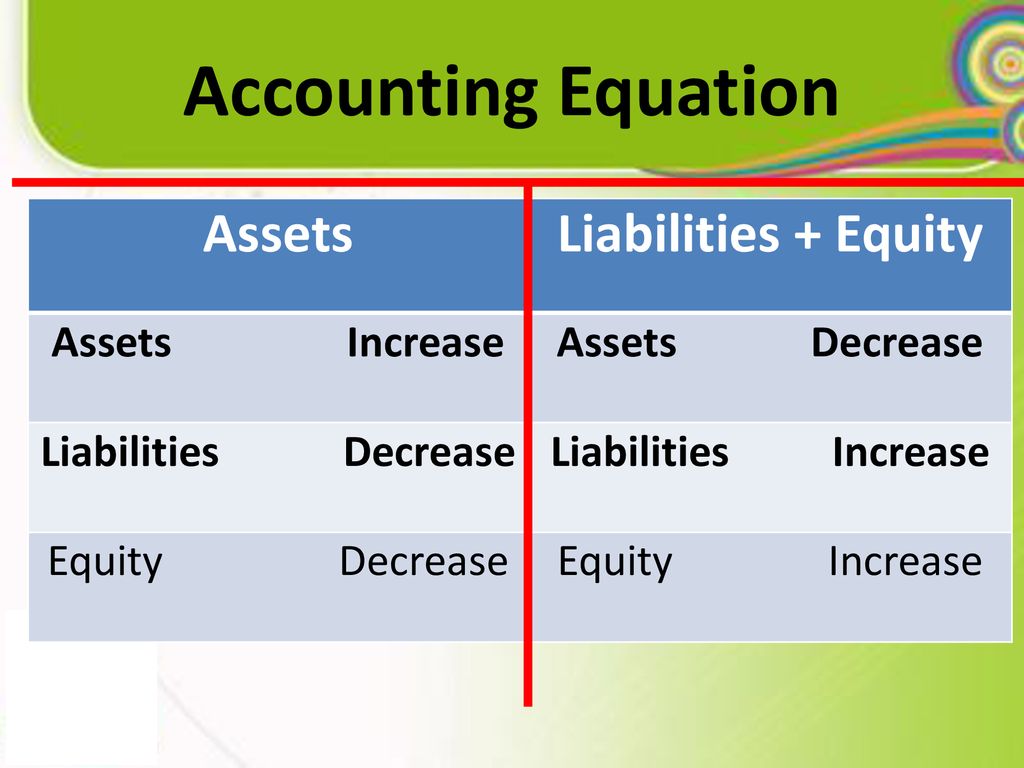

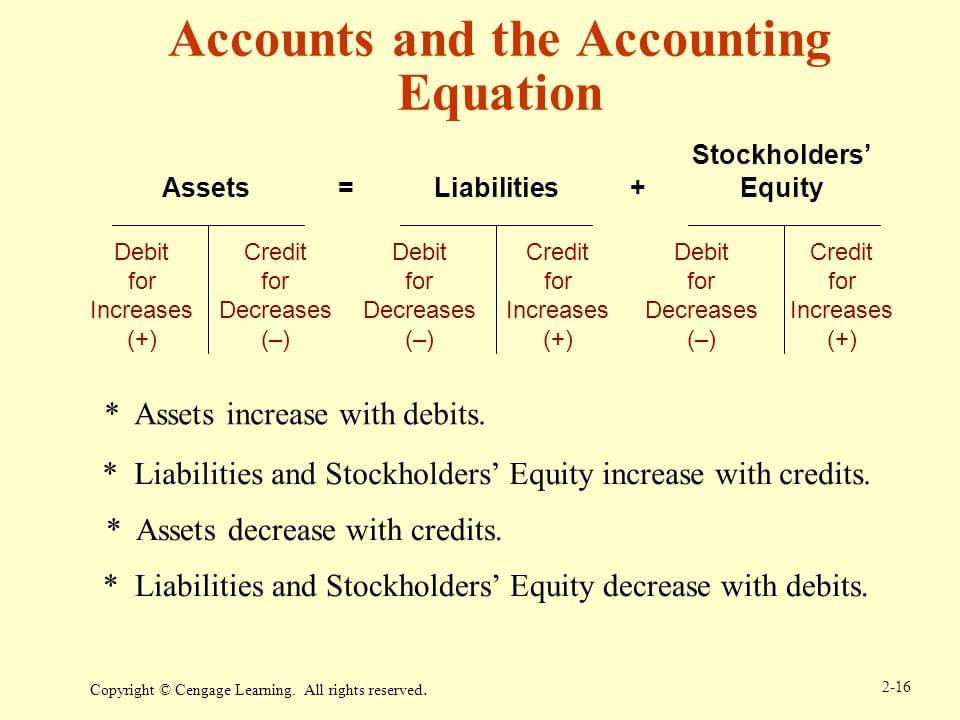

Increase Assets Decrease Liabilities And Stockholders' Equity

Financial markets are reeling as XYZ Corporation announced a significant shift in its balance sheet, reporting a surge in assets coupled with a simultaneous decline in liabilities and stockholders' equity. The news, released early this morning, has sent shockwaves through investor circles and raised immediate questions about the company's long-term financial strategy.

This unprecedented financial restructuring sparks debate about XYZ Corporation's stability and future performance. Experts are scrambling to understand the implications of this unusual adjustment. It demands immediate scrutiny of the company's financial dealings and strategic direction.

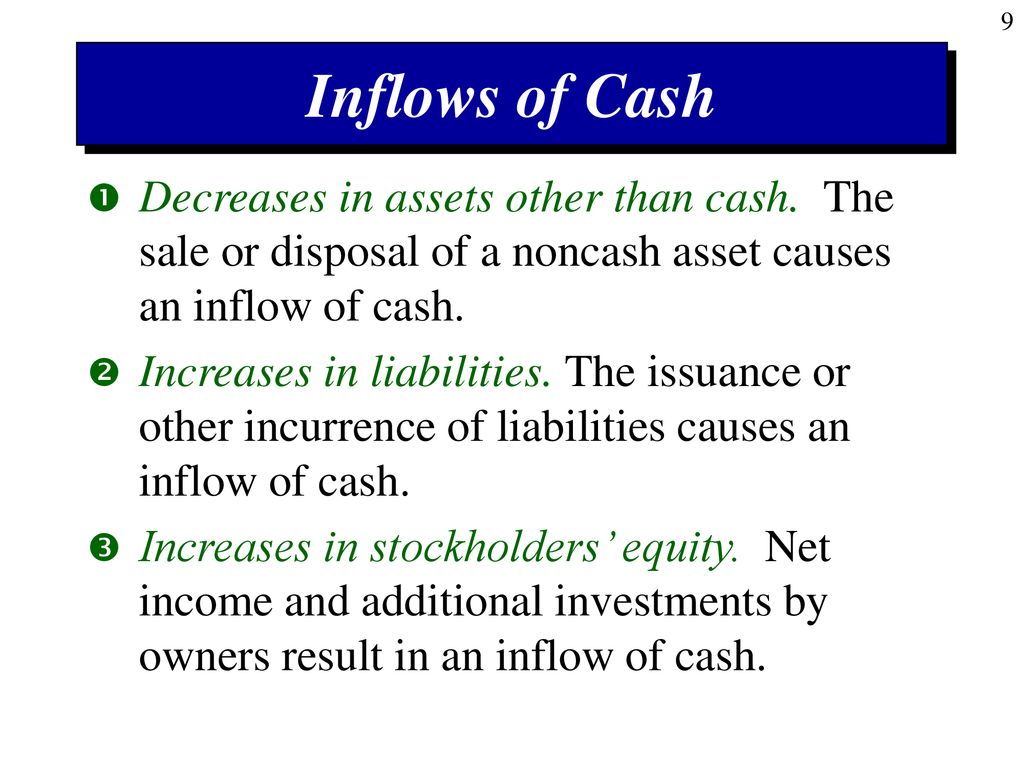

Asset Surge

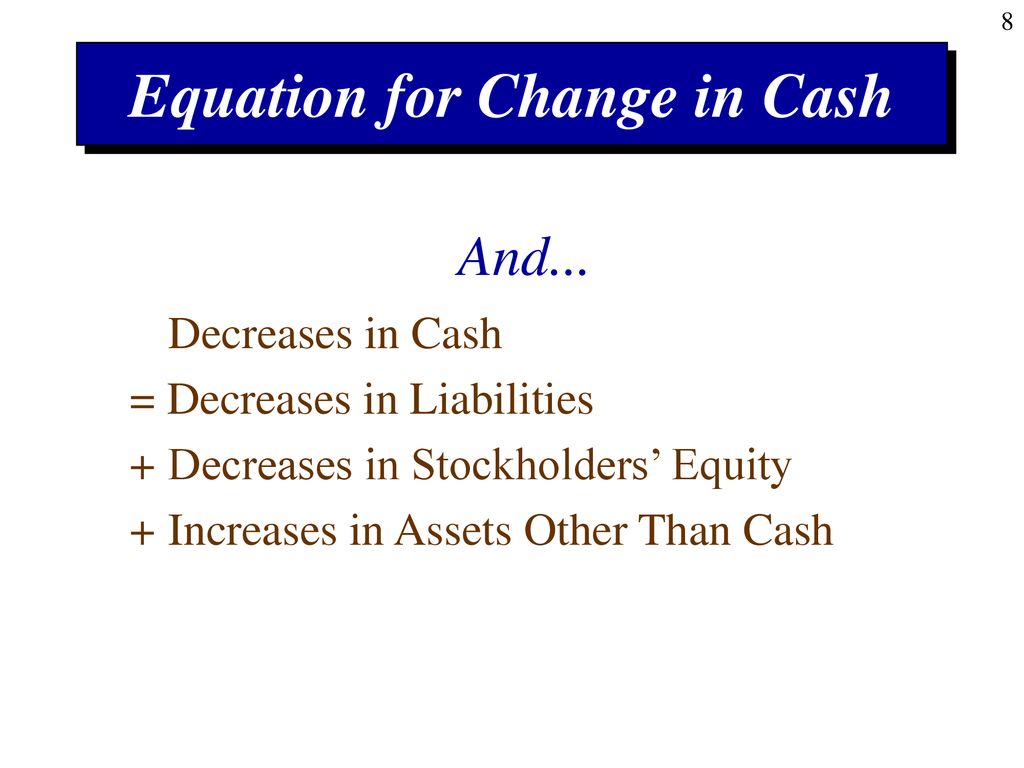

The company reported a $500 million increase in total assets. This growth stems primarily from newly acquired intellectual property rights, valued at $300 million. The remaining $200 million reflects a boost in cash reserves, primarily due to divestitures.

XYZ Corporation confirmed the sale of its subsidiary, AlphaTech, contributing significantly to the cash increase. The acquisition of the new intellectual property aims to bolster its competitive edge.

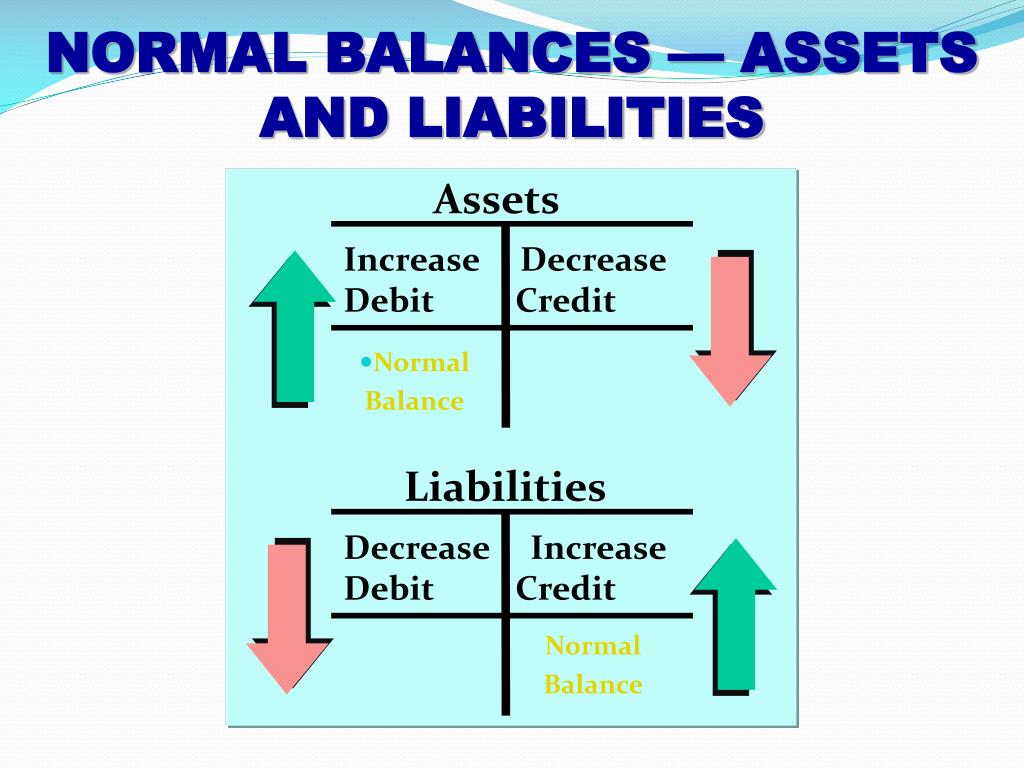

Liability Reduction

Simultaneously, XYZ Corporation disclosed a $300 million decrease in total liabilities. This reduction comes from settling several long-term debt obligations early. Negotiated discounts with creditors enabled the early settlement, freeing up cash flow.

The company stated it strategically prioritized debt reduction for improved financial flexibility. This move is expected to enhance its credit rating and lower future borrowing costs.

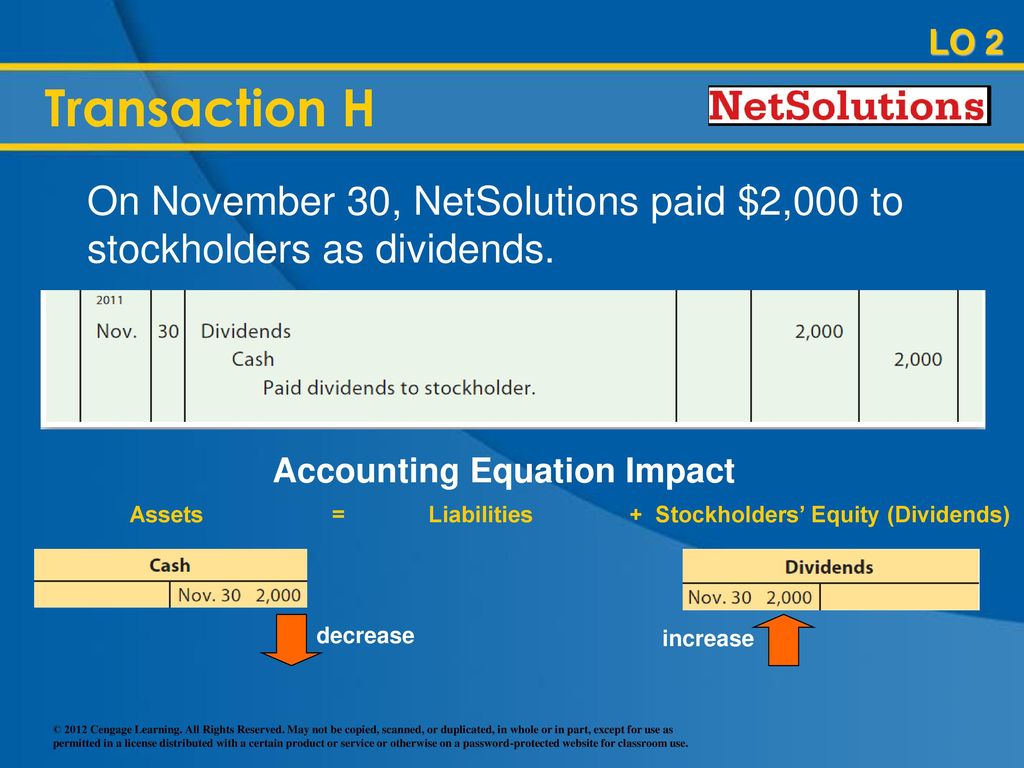

Stockholders' Equity Decline

The most unsettling element is the reported $200 million decrease in stockholders' equity. This decline is attributed to a share repurchase program executed over the past quarter. XYZ Corporation bought back a significant portion of its outstanding shares.

This buyback program aimed to increase earnings per share (EPS) and boost the stock price. However, the move resulted in a reduction of equity, raising concerns about potential leverage.

Impact on Market

Following the announcement, XYZ Corporation's stock price initially surged by 5%. This was followed by a rapid decline as investors digested the full implications. Trading volume has been exceptionally high, reflecting market uncertainty.

Analysts are divided on the long-term impact. Some argue the asset increase and debt reduction are positive signs. Others express concerns about the reduced equity and potential risks associated with the buyback program.

Expert Opinions

Dr. Anya Sharma, a leading financial analyst, stated, "The simultaneous increase in assets and decrease in liabilities initially appears positive. However, the reduction in stockholders' equity raises serious questions."

"This requires a thorough audit to determine the sustainability of this strategy," she added. Her analysis suggests careful monitoring of XYZ Corporation's cash flow and profitability.

John Miller, a portfolio manager at Global Investments, commented, "Share buybacks are often used to artificially inflate stock prices. While shareholders may benefit in the short-term, it can weaken the company's financial foundation long-term."

Company Statement

In an official statement, XYZ Corporation's CEO, Robert Davis, defended the company's financial maneuvers. He emphasized that the changes are part of a long-term strategy to improve shareholder value. Davis assured investors that the company remains financially sound and committed to growth.

He believes reducing liability and focusing on high-value assets will lead to long-term prosperity. He said a more detailed explanation would follow next week during the investor meeting.

Next Steps

The Securities and Exchange Commission (SEC) has confirmed it is reviewing XYZ Corporation's financial reports. The inquiry will focus on the share repurchase program and its impact on stockholders' equity.

Investors are advised to exercise caution and carefully consider the risks before trading XYZ Corporation's stock. The company is scheduled to hold an investor conference call next week to provide further details.

The situation surrounding XYZ Corporation's financial restructuring remains fluid. Ongoing developments are anticipated in the coming days and weeks. The market awaits further clarification and data to fully assess the implications.

..jpg)