What Happens If You Quit Paying Credit Cards

Ignoring your credit card bills has immediate and devastating consequences. Defaulting triggers a cascade of negative effects, from plummeting credit scores to potential lawsuits.

This article provides a clear understanding of the repercussions you face when you stop paying your credit card bills. We outline the step-by-step deterioration of your financial health, highlighting the critical stages and potential legal actions.

The Initial Impact: Missed Payments and Late Fees

The first missed payment typically triggers a late fee, usually ranging from $25 to $35. This fee is added to your outstanding balance, increasing the debt you owe.

Your credit card company will also report the missed payment to the major credit bureaus: Experian, Equifax, and TransUnion. This is where the damage to your credit score begins.

According to Experian, even a single missed payment can lower your credit score by dozens of points. The severity of the impact depends on your existing credit history.

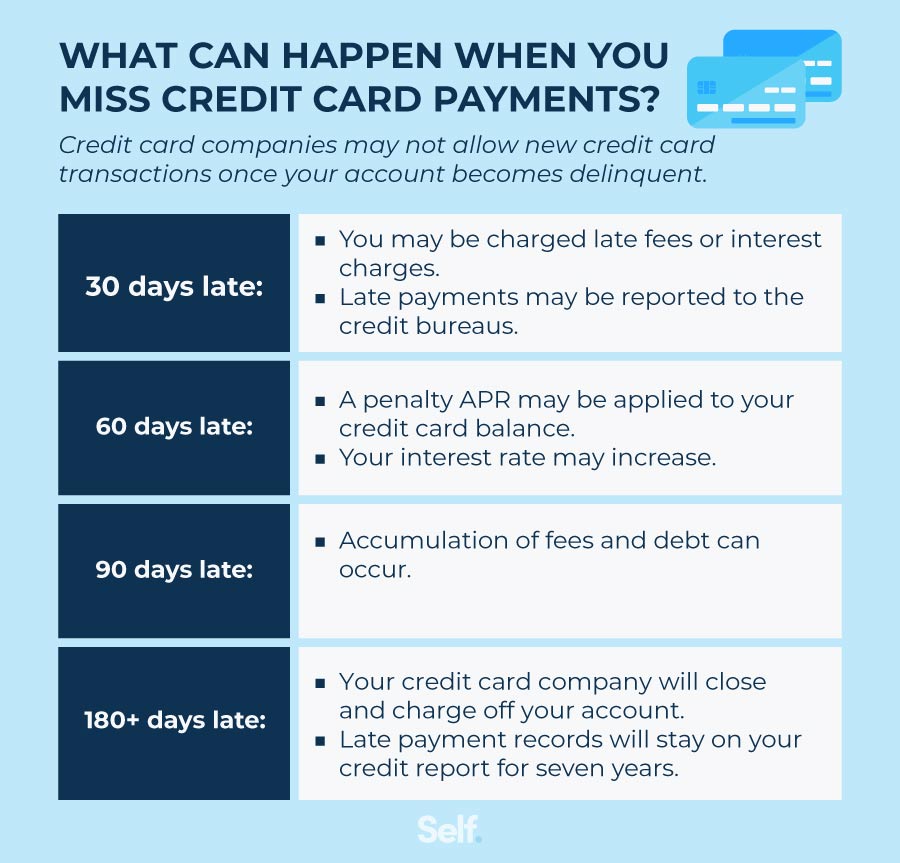

The 30-Day Mark: Delinquency and Rising Interest Rates

After 30 days of non-payment, your account is officially considered delinquent. This is a significant negative mark on your credit report.

Many credit card agreements include a penalty APR, which is a substantially higher interest rate that takes effect when you're delinquent. This can dramatically increase the cost of your debt.

Your credit card company will likely increase communication efforts, sending more frequent emails and phone calls to collect the debt. Expect persistent reminders and potential offers for hardship programs, which may come with their own sets of terms.

60-90 Days: Further Credit Score Damage and Collection Agencies

After 60 to 90 days of missed payments, the impact on your credit score intensifies. Your credit report now reflects a serious delinquency, making it harder to secure loans, rent an apartment, or even get a job.

The credit card company may begin restricting or suspending your account. This means you can no longer make new purchases with the card.

At this stage, the credit card company may assign your debt to a collection agency. These agencies are often more aggressive in their collection tactics.

120-180 Days: Charge-Off and Potential Lawsuits

After 120 to 180 days of non-payment, the credit card company will likely charge-off the debt. This means they write it off as a loss on their books.

A charge-off doesn't mean the debt disappears. You are still legally obligated to pay it. The charge-off is reported to the credit bureaus and remains on your credit report for seven years.

The credit card company or collection agency may file a lawsuit to recover the debt. If they win, they can obtain a judgment against you, allowing them to garnish your wages or levy your bank accounts.

Legal Consequences: Judgments, Wage Garnishment, and Liens

If you're sued and fail to respond, the creditor can obtain a default judgment against you. This judgment is a court order requiring you to pay the debt.

With a judgment, the creditor can seek to garnish your wages, meaning a portion of your paycheck will be automatically deducted to pay the debt. They can also levy your bank accounts, seizing funds to satisfy the judgment.

In some cases, the creditor may place a lien on your property. If you sell the property, the debt must be paid from the proceeds.

Long-Term Effects: Seven Years of Negative Credit History

The negative information from late payments, charge-offs, and judgments remains on your credit report for seven years. This significantly impacts your ability to access credit and obtain favorable interest rates during this period.

While the impact lessens over time, the initial years following the default are the most challenging.

Rebuilding your credit after defaulting on credit cards requires consistent effort and a strategic approach. This includes paying all future bills on time and potentially securing a secured credit card.

What You Should Do Now

If you're struggling to pay your credit card bills, don't ignore the problem. Contact your credit card company immediately to explore hardship programs or negotiate a payment plan.

Consider seeking help from a nonprofit credit counseling agency. These agencies can provide guidance on debt management and budgeting. They may be able to negotiate with your creditors on your behalf.

Ignoring your credit card debt will only make the situation worse. Take proactive steps to address the issue and protect your financial future.

:max_bytes(150000):strip_icc()/Why-your-credit-card-was-declined-And-what-to-do-4159790_V32-fb2b6ae205aa4728b152a9d7a5497d51.png)