Credit Score Needed To Rent Commercial Property

Commercial landlords are tightening their grip, demanding higher credit scores from prospective tenants. A new analysis reveals the minimum credit score to secure a lease is rapidly escalating, potentially locking out many small businesses.

This shift in requirements is impacting the commercial real estate landscape, creating barriers for entrepreneurs and startups eager to establish their presence. Understanding these benchmarks is now critical for anyone looking to rent commercial space.

Credit Score Thresholds: What You Need to Know

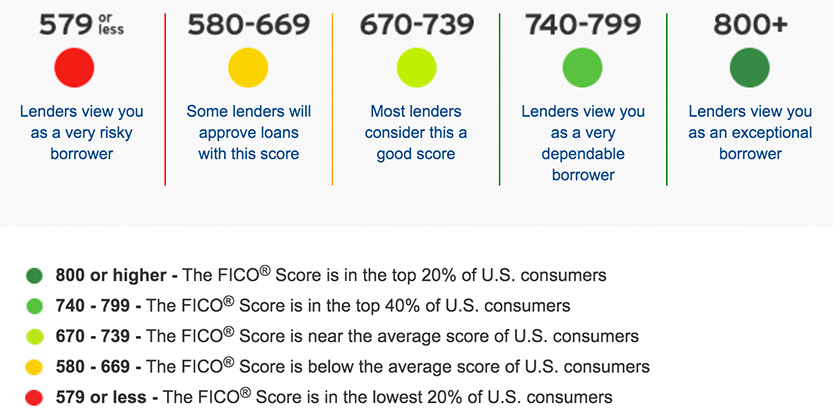

Across the board, the average minimum credit score required for commercial leases has increased. According to a recent report by Experian, a score of 680 was often sufficient just a few years ago. Now, many landlords are seeking scores of 700 or even 720 and above.

In prime locations, such as major metropolitan areas, the bar is even higher. Landlords in cities like New York and San Francisco are known to prefer scores closer to 750, reflecting the intense competition for desirable properties.

Factors Influencing Credit Score Requirements

The specific credit score needed isn't a fixed number. It depends on a number of key factors. These include the type of business, the length of the lease, and the location of the property.

Businesses with a limited operating history or those in perceived high-risk industries may face steeper requirements. Landlords are trying to mitigate their risk.

Furthermore, properties in high-demand areas give landlords the luxury of being more selective. They can demand better creditworthiness from potential renters.

What the Experts are Saying

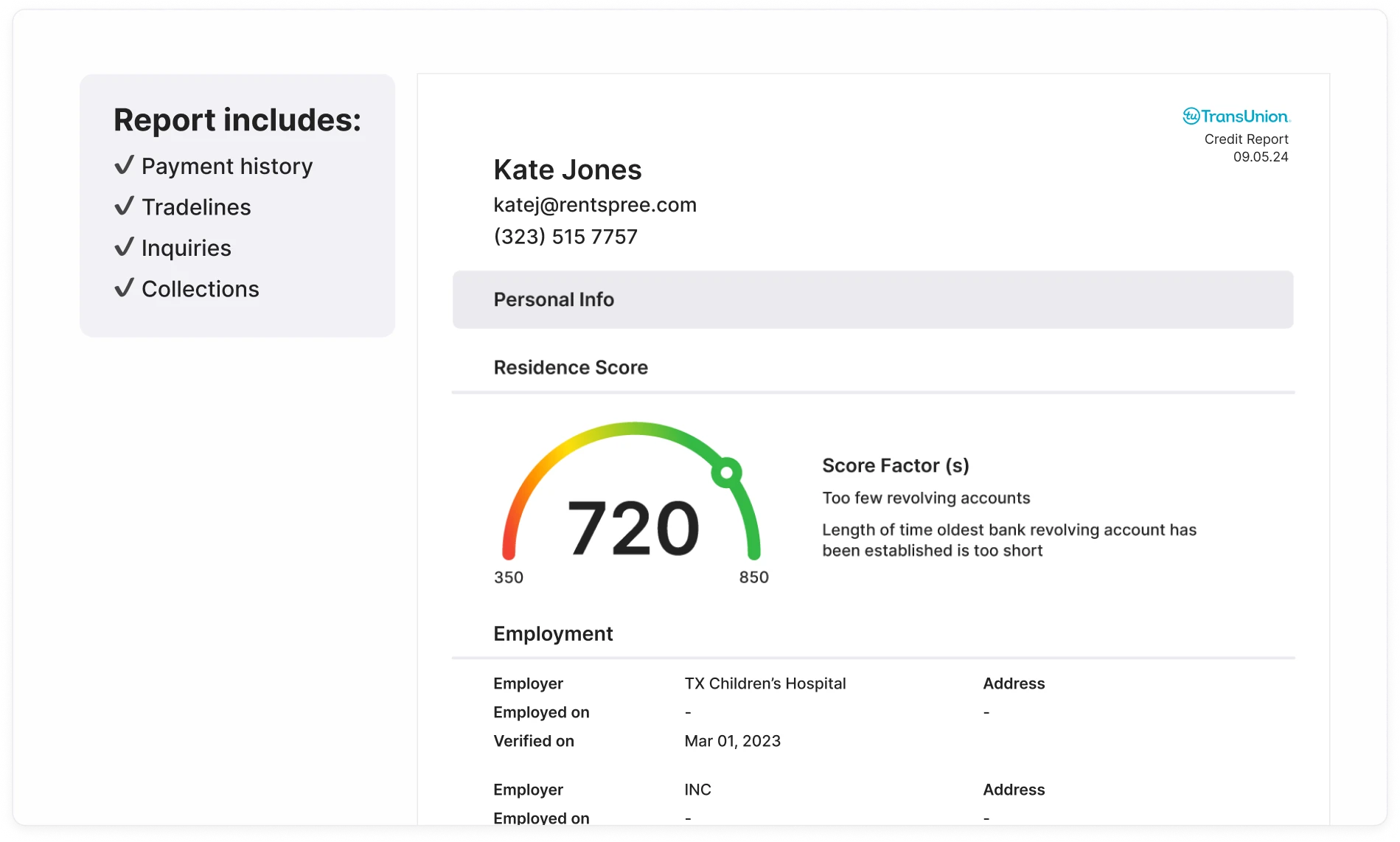

Jane Doe, a commercial real estate broker with Acme Realty, emphasizes the importance of understanding credit scores. "Tenants need to be prepared. Check your credit report and address any discrepancies before you even start looking at properties."

According to John Smith, a financial consultant specializing in small business lending, a strong credit score is essential for more than just securing a lease. "A good score can also help you negotiate better lease terms and secure financing for your business."

"Don't underestimate the impact of your credit score on your business aspirations," Smith advises. "It can be the difference between launching your dream venture and being locked out of the market."

Strategies for Renters with Lower Credit Scores

Even with a less-than-perfect credit score, there are strategies to improve your chances of securing a commercial lease. First, consider offering a larger security deposit.

Another approach is to provide a personal guarantee. This makes you personally liable for the lease obligations.

Consider finding a co-signer with a stronger credit history who is willing to back your lease. This can significantly reassure the landlord.

Impact on Small Businesses and Startups

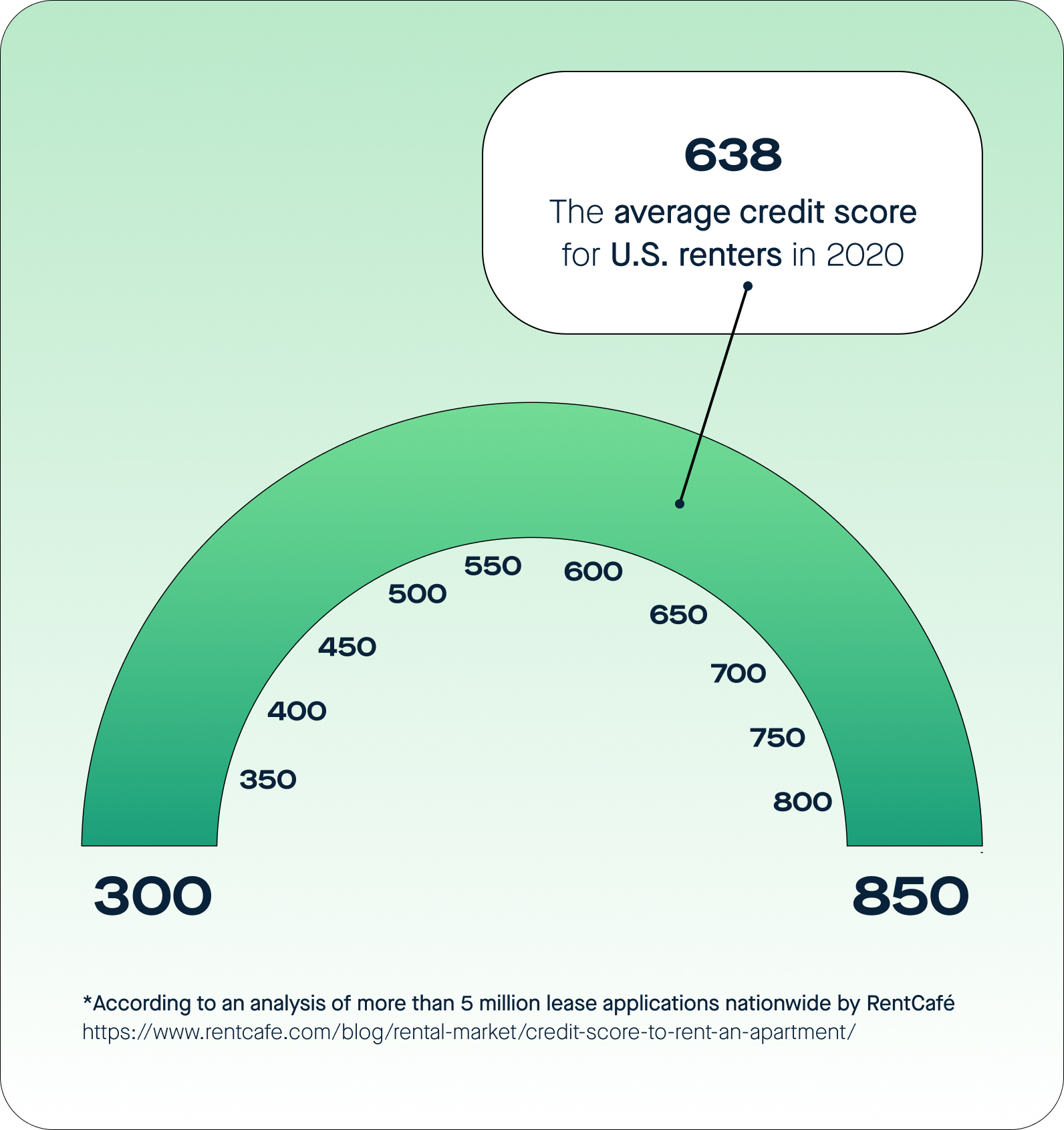

The increasing credit score requirements pose a significant challenge for small businesses and startups. These businesses often have limited credit histories or are just beginning to establish their financial stability. They may struggle to meet the stricter criteria.

This could potentially hinder economic growth and innovation. Fewer people will be able to start businesses in prime locations.

Advocacy groups are calling for landlords to consider alternative metrics beyond credit scores when evaluating tenants. This would provide a more holistic view of their financial capabilities.

The Regional Variance in Credit Score Requirements

The credit score requirements for commercial leases vary significantly across different regions. Landlords in competitive urban markets usually set higher bars. They typically look for scores exceeding 720.

In contrast, landlords in smaller towns or less competitive areas might be more lenient. They might accept scores in the 680-700 range.

Prospective tenants should research the prevailing market conditions in their target location. This will help them set realistic expectations and prepare accordingly.

The Role of Lease Guarantees and Security Deposits

Lease guarantees and security deposits play a crucial role in mitigating risk for landlords. They provide a financial safety net in case of tenant default. This is especially true for tenants with lower credit scores.

A larger security deposit, often equivalent to several months' rent, can offset concerns about creditworthiness. It demonstrates a tenant's commitment to fulfilling the lease obligations.

Lease guarantees from established companies or individuals can further bolster a tenant's application. This provides an additional layer of security for the landlord.

Next Steps and Ongoing Developments

Prospective tenants should prioritize checking their credit reports and taking steps to improve their scores if needed. Explore alternative financing options and consider working with a commercial real estate broker.

The commercial real estate industry is closely monitoring these trends. They are seeking solutions to balance landlord security with the need to support small business growth.

The situation is dynamic. Stay informed about changes in credit score requirements and evolving market conditions to navigate the commercial leasing landscape successfully.