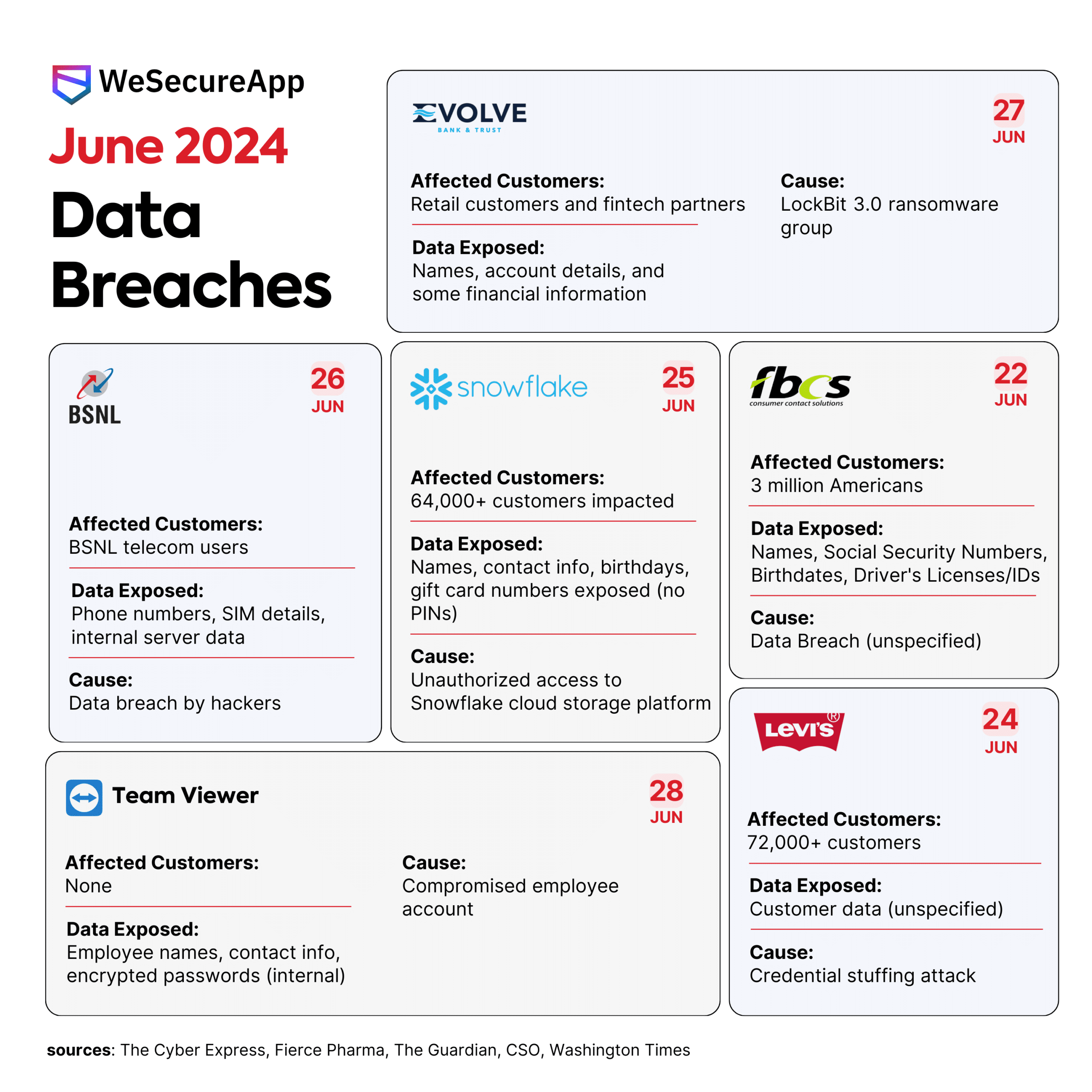

Evolve Bank & Trust Data Breach

Customers of several fintech companies are facing potential fallout after a data breach at Evolve Bank & Trust, a crucial backend banking provider for many popular financial applications. The breach, disclosed recently, exposed sensitive personal and financial information, raising concerns about identity theft and financial fraud.

The incident underscores the growing risks associated with the interconnectedness of the financial technology sector, where a single point of vulnerability can have ripple effects across numerous platforms. This article delves into the details of the breach, its impact on consumers, and the steps being taken to mitigate the damage.

Scope and Impact

Evolve Bank & Trust, based in Memphis, Tennessee, provides banking-as-a-service (BaaS) to a wide range of fintech companies. This means they handle critical financial infrastructure, including processing payments, holding customer funds, and managing accounts for various applications.

The data breach, the specifics of which remain under investigation, reportedly compromised data belonging to customers of multiple fintech partners. While Evolve Bank & Trust has not publicly disclosed the names of the affected companies or the exact number of individuals impacted, reports suggest the number could be substantial.

Information potentially exposed includes names, addresses, social security numbers, account numbers, transaction histories, and other sensitive financial data. This type of information is highly valuable to cybercriminals and can be used for identity theft, fraudulent transactions, and other malicious activities.

Timeline of Events

The exact timeline of the breach is still unfolding. However, Evolve Bank & Trust has stated that they detected unauthorized access to their systems on a specific date (the specific date is not publicly available, hindering reporting precision).

Upon discovering the breach, the bank initiated its incident response plan, which included engaging cybersecurity experts to investigate the incident, contain the damage, and restore system security. They also notified law enforcement and relevant regulatory agencies.

Notifications to affected fintech partners and, subsequently, to their customers, have been rolling out in phases. The delay in comprehensive notification has drawn criticism from some customers who feel they should have been informed sooner to take preventative measures.

Affected Fintech Companies and Customer Response

While Evolve Bank & Trust has not publicly named the affected fintech companies, some companies have independently acknowledged their involvement. This lack of transparency from the bank has been a source of frustration for customers seeking clarity on their potential exposure.

Customers are advised to monitor their credit reports, bank accounts, and other financial statements for any suspicious activity. Placing fraud alerts on credit reports and changing passwords for online accounts are also recommended preventative measures.

Some customers have expressed anger and frustration with both Evolve Bank & Trust and the affected fintech companies, citing concerns about the security of their data and the lack of timely communication. Several class-action lawsuits are reportedly being considered.

Regulatory Scrutiny and Industry Impact

The data breach at Evolve Bank & Trust is likely to attract significant regulatory scrutiny. The Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) are both agencies that could investigate the incident and impose penalties if the bank is found to have violated data security regulations.

This incident highlights the need for stricter cybersecurity standards within the fintech industry, particularly for companies that provide BaaS. Regulators may consider implementing more stringent requirements for data encryption, access controls, and incident response planning.

The breach could also lead to increased due diligence by fintech companies when selecting banking partners. They may be more inclined to conduct thorough security audits and risk assessments to ensure their partners have adequate safeguards in place.

The Human Cost

Beyond the technical and regulatory implications, the Evolve Bank & Trust data breach has a real human cost. Individuals whose personal and financial information has been compromised face the risk of identity theft, financial fraud, and significant emotional distress.

One affected customer, who wished to remain anonymous, shared their experience, “I feel completely violated. Knowing that my social security number and bank account information are out there is terrifying. I’m constantly checking my credit report and bank statements, and I’m afraid to answer the phone for fear of scammers.”

The anxiety and uncertainty experienced by affected individuals underscore the importance of data security and the need for companies to prioritize the protection of customer information. It is a reminder that data breaches are not just abstract events but have tangible consequences for real people.

Moving Forward

Evolve Bank & Trust is working to address the vulnerabilities that led to the data breach and enhance its security measures. The bank has stated its commitment to cooperating with law enforcement and regulatory agencies and to providing support to affected customers.

However, the long-term impact of the breach remains to be seen. The incident could damage Evolve Bank & Trust’s reputation and lead to a loss of business. It also serves as a cautionary tale for the entire fintech industry about the importance of robust cybersecurity and proactive risk management.

Ultimately, the Evolve Bank & Trust data breach is a stark reminder of the ever-present threat of cybercrime and the need for individuals, companies, and regulators to remain vigilant in protecting sensitive data.

![Evolve Bank & Trust Data Breach Data Breaches Cause Loss of Customer Trust [Studies]](https://www.breachsense.com/images/blog/Data Breaches Cause Loss of Customer Trust [Studies].png)