How Can A Profitable Business Run Out Of Cash

Imagine a bustling bakery, the air thick with the scent of warm bread and sweet pastries. Customers line up eagerly, their wallets open, ready to purchase the delicious treats. Yet, behind the scenes, the owner is wrestling with a gnawing anxiety – the bank account is dwindling, and bills are piling up. This isn't just a story; it's a common, perplexing reality for many businesses: profitable on paper, yet struggling with cash flow.

How can a business that's making money, selling products, and seemingly thriving, suddenly find itself gasping for financial air? The answer lies in understanding the critical difference between profit and cash flow. This article explores the nuances of this business paradox and delves into the factors that contribute to this phenomenon, offering insights into how businesses can avoid this perilous situation.

The Profit vs. Cash Flow Conundrum

Profitability reflects the difference between revenue and expenses over a period. Cash flow, on the other hand, is the actual movement of money in and out of a business.

A profitable business can still face a cash crunch if its cash inflows don't align with its cash outflows. This misalignment can stem from various operational and financial factors.

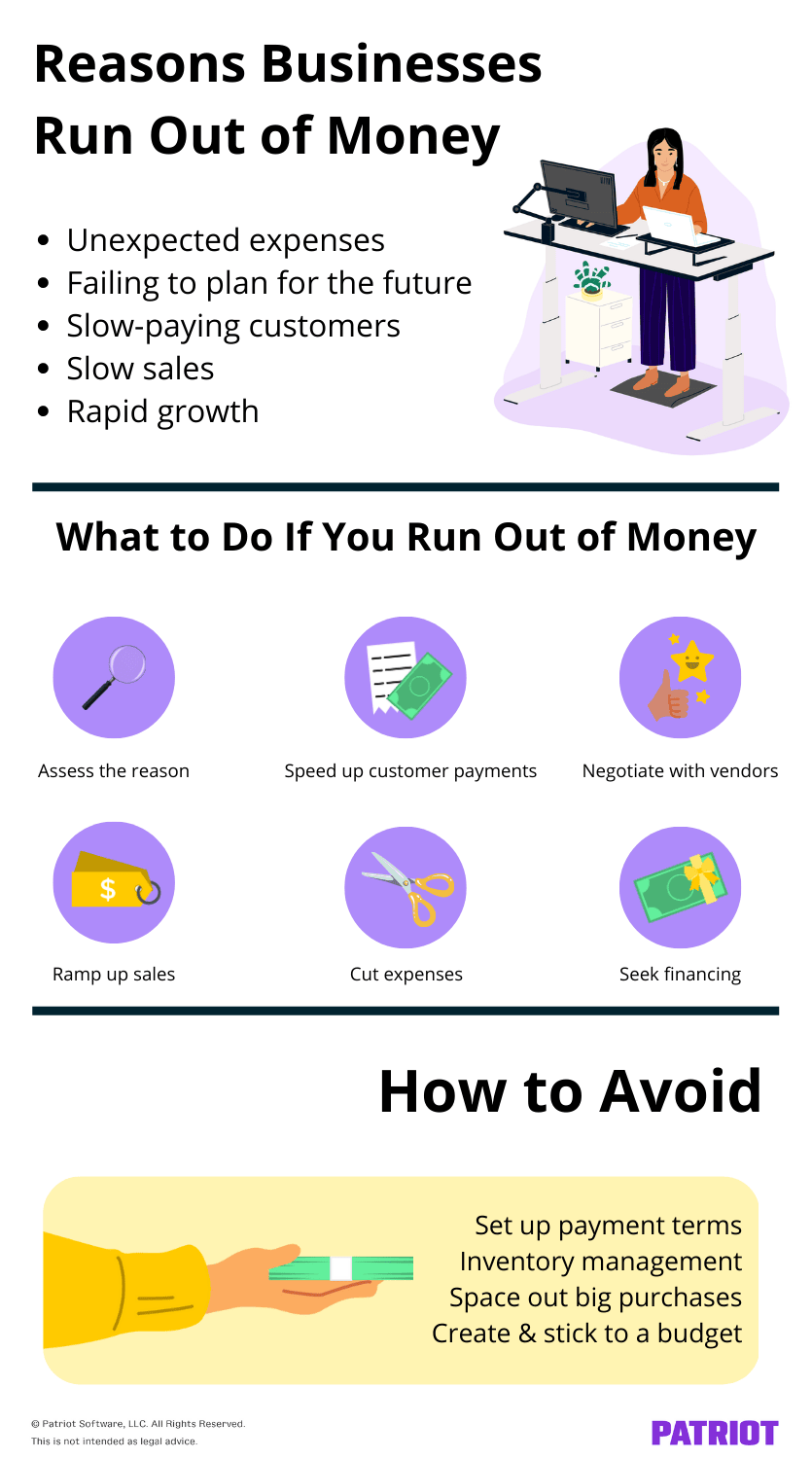

Common Culprits Behind the Cash Crunch

One major factor is delayed payments. Imagine our bakery selling a large order to a local cafe on credit, expecting payment in 60 days.

While the sale boosts the bakery's profit margin, it doesn't immediately translate to cash in hand. This delay creates a gap between the time the goods are sold and the money is received, a gap that can strain the business's short-term liquidity.

Inventory management is another crucial aspect. Overstocking ties up a significant amount of cash in raw materials or finished goods.

If those goods aren't selling quickly enough, the business is essentially sitting on a pile of money that it can't readily access, potentially hindering its ability to meet other financial obligations.

Rapid growth, while seemingly positive, can also drain cash. Expanding operations, hiring new staff, and investing in new equipment all require upfront capital.

If the revenue generated from this expansion doesn't keep pace with the increased expenses, the business can quickly find itself in a cash flow deficit.

Unexpected expenses, like equipment breakdowns or sudden increases in material costs, can also throw a wrench into the financial works. Without sufficient cash reserves, even a relatively small unexpected expense can trigger a crisis.

Poor financial planning, including inaccurate forecasting and inadequate budgeting, is often at the root of cash flow problems. Businesses need to meticulously track their cash inflows and outflows, anticipate potential shortfalls, and have a plan in place to address them.

Navigating the Cash Flow Maze

Fortunately, businesses can take proactive steps to manage their cash flow more effectively. Negotiating favorable payment terms with suppliers is a good start.

Offering early payment discounts to customers can also incentivize quicker payments, improving cash inflow.

Careful inventory management, employing just-in-time inventory systems where possible, can minimize the amount of cash tied up in stock. Regularly reviewing sales data helps to identify slow-moving items and adjust ordering practices accordingly.

Developing a comprehensive cash flow forecast is essential. This involves projecting cash inflows and outflows over a specific period, allowing businesses to anticipate potential shortfalls and take corrective action.

"Cash flow is the lifeblood of any business," emphasizes a report by the Small Business Administration (SBA). "Effective cash flow management is critical for survival and growth."

Exploring financing options, such as lines of credit or short-term loans, can provide a safety net during periods of cash flow strain. However, it's crucial to use these options judiciously and avoid accumulating excessive debt.

A Shift in Perspective

Running a profitable business that's also cash-rich requires a shift in mindset. It's not enough to simply focus on generating revenue; businesses must also prioritize efficient cash flow management.

By understanding the intricacies of cash flow and implementing proactive strategies, businesses can ensure they have the financial resources they need to thrive, even in challenging times. Thinking proactively can prevent the business from being a profitable one on paper only.

The bakery, now armed with a solid understanding of cash flow principles, shifts its focus. They negotiate better payment terms, carefully manage their inventory, and develop a detailed cash flow forecast. The aroma of pastries still fills the air, but now it's accompanied by the sweet scent of financial security, ensuring the bakery's longevity for years to come.