How Can I Get Money To Start A Business

The dream of launching a business, of building something from the ground up, burns brightly for countless individuals. Yet, for many aspiring entrepreneurs, that dream flickers precariously, threatened by the cold reality of funding. Access to capital remains a significant hurdle, a seemingly insurmountable barrier that separates aspiration from achievement.

This article delves into the multifaceted landscape of securing startup funding. It aims to equip future business owners with the knowledge and resources needed to navigate the complex world of financing. From bootstrapping to venture capital, we'll explore a range of options, highlighting their pros, cons, and suitability for different business types and stages.

Understanding Your Funding Needs

Before pursuing any funding avenue, a thorough understanding of your financial needs is crucial. This involves creating a detailed business plan, including projected revenues, expenses, and cash flow statements. Accurately assessing the required capital prevents underfunding, which can cripple a startup, and overfunding, which dilutes ownership unnecessarily.

Consider what stage your business is in. Are you pre-launch, requiring seed funding for product development and initial marketing? Or are you seeking expansion capital to scale an existing, profitable operation? Your stage dictates the appropriate funding sources.

Bootstrapping: The Self-Funded Route

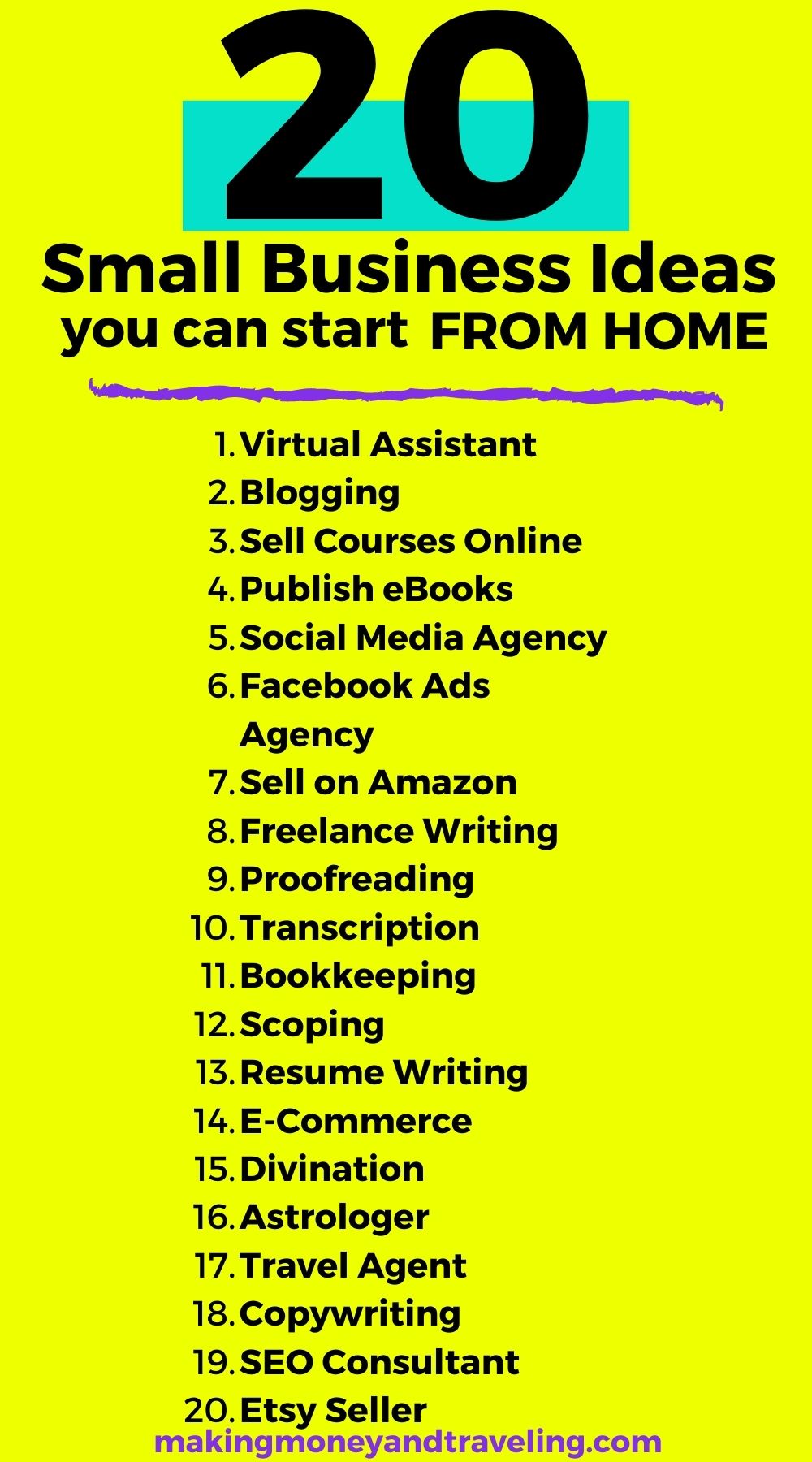

Bootstrapping, or self-funding, involves using personal savings, credit cards, and revenue generated from early sales to finance your business. This method allows entrepreneurs to retain full ownership and control. Bootstrapping demands frugality, resourcefulness, and a high degree of personal risk tolerance.

Many successful businesses, like Mailchimp, initially bootstrapped their way to success. It's a viable option, particularly for service-based businesses or those with low startup costs. The SBA recommends exploring personal assets before seeking external funding.

Friends, Family, and Fools (FFF)

The "FFF" round involves raising capital from your immediate social circle. While potentially easier to access than traditional loans or venture capital, it comes with its own set of challenges. Mixing personal relationships with business can lead to awkwardness and strain if the business struggles.

Treat these investments as seriously as any other. Create a formal agreement outlining the terms of the loan or investment, including interest rates (if applicable) and repayment schedules. Transparency and clear communication are key to preserving relationships.

Small Business Loans

Small business loans, offered by banks and credit unions, are a common source of funding. These loans typically require a strong credit history, a solid business plan, and collateral. The Small Business Administration (SBA) guarantees a portion of these loans, reducing risk for lenders and making them more accessible to entrepreneurs.

SBA loans often come with more favorable terms than conventional loans, including lower interest rates and longer repayment periods. 7(a) loans are a popular option, while microloans, offered by non-profit organizations, provide smaller amounts of funding to startups and underserved communities.

Angel Investors and Venture Capital

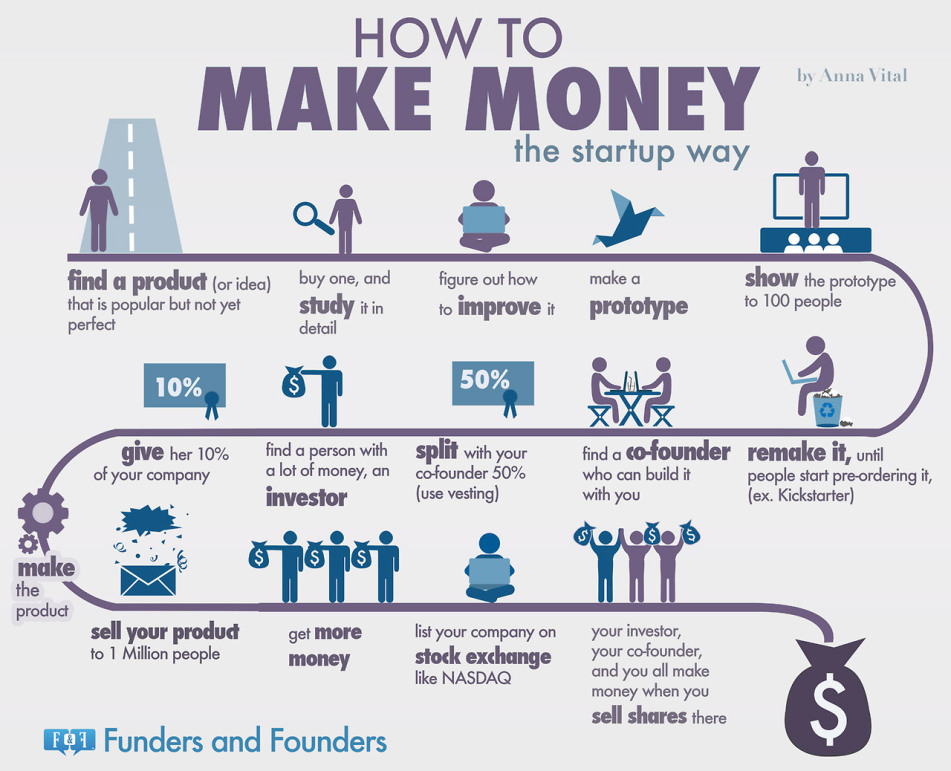

Angel investors are high-net-worth individuals who invest their own money in early-stage companies. Venture capitalists (VCs), on the other hand, invest on behalf of institutional investors. Both seek high-growth potential and typically require a significant equity stake in the company.

Securing angel or VC funding is highly competitive. Entrepreneurs must present a compelling pitch deck, demonstrating a strong market opportunity, a scalable business model, and a capable management team. These investors provide not only capital but also valuable mentorship and industry connections.

Crowdfunding: Tapping into the Crowd

Crowdfunding platforms like Kickstarter and Indiegogo allow entrepreneurs to raise funds from a large number of individuals, often in exchange for rewards or equity. This approach can be particularly effective for businesses with innovative products or strong community appeal. Crowdfunding offers valuable market validation and early customer acquisition.

Success in crowdfunding requires a well-executed campaign, including a compelling story, high-quality visuals, and effective marketing. It's not just about raising money; it's about building a community around your brand.

Government Grants and Programs

Various government agencies offer grants and programs to support small businesses, particularly those in specific industries or demographics. The National Institutes of Health (NIH), for example, offers grants to biotech and healthcare startups. The USDA supports rural businesses.

These grants are often highly competitive and require a rigorous application process. However, they can provide significant non-dilutive funding, meaning you don't have to give up equity in your company.

Looking Ahead: The Evolving Funding Landscape

The startup funding landscape continues to evolve, with new platforms and models emerging regularly. Cryptocurrency and blockchain technologies are creating new avenues for raising capital. Staying informed about these trends is crucial for entrepreneurs seeking to navigate the funding process successfully.

Ultimately, securing funding is about more than just money. It's about building relationships, validating your business idea, and demonstrating your commitment to success. By understanding the available options and preparing thoroughly, entrepreneurs can increase their chances of turning their dreams into reality.