How Can I Start A Business With Little Money

The dream of entrepreneurship often collides with a harsh reality: starting a business frequently requires significant capital. For many aspiring business owners, the lack of substantial financial resources feels like an insurmountable barrier. However, the entrepreneurial landscape is evolving, with innovative strategies and business models emerging that allow individuals to launch ventures with minimal investment.

This article explores practical and actionable strategies for starting a business with limited funds. It delves into identifying low-cost business ideas, leveraging free resources, and building a strong foundation for future growth. We will examine how bootstrapping, creative financing, and a focus on lean operations can pave the way for entrepreneurial success, even on a shoestring budget.

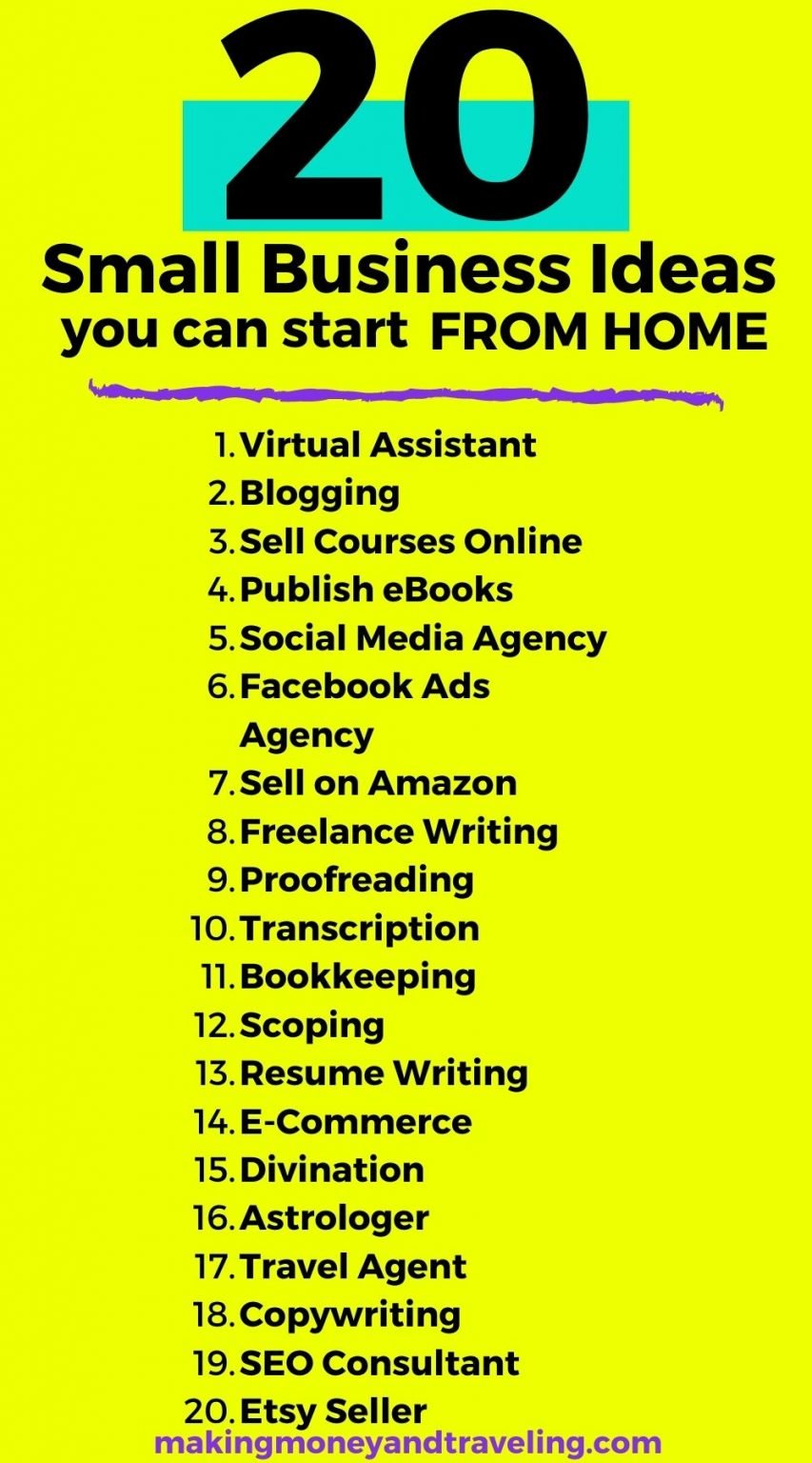

Identifying Low-Investment Business Opportunities

The first step toward starting a business with limited funds is to identify opportunities that don't require significant upfront investment. Consider service-based businesses that capitalize on your existing skills and require minimal overhead.

Examples include freelancing in areas like writing, graphic design, web development, or virtual assistance. Another avenue is offering consulting services based on your expertise in a particular field.

Leveraging Your Skills and Expertise

Assess your current skillset and identify areas where you can provide value to others. Do you have a knack for social media marketing? Can you teach a particular skill online?

Turn your expertise into a marketable service. Websites like Upwork and Fiverr provide platforms to connect with clients seeking specific skills.

The Power of E-commerce: Dropshipping and Print-on-Demand

E-commerce doesn't necessarily require a large inventory investment. Dropshipping allows you to sell products without holding any physical stock.

When a customer places an order, the supplier ships the product directly to them. Print-on-demand services offer a similar model for custom-designed products like t-shirts and mugs.

Bootstrapping: The Art of Self-Funding

Bootstrapping, or self-funding, is a common strategy for entrepreneurs with limited access to capital. It involves using personal savings, reinvesting early profits, and minimizing expenses.

This approach requires discipline and a willingness to make sacrifices, but it allows you to maintain control of your business and avoid debt.

Minimize Overhead Costs

Work from home or a co-working space to avoid expensive office leases. Utilize free or low-cost software and tools for accounting, marketing, and project management.

Embrace a "lean startup" methodology by focusing on building a minimum viable product (MVP) and iteratively improving it based on customer feedback.

Creative Financing Strategies

While bootstrapping is ideal, sometimes external funding is necessary to scale your business. Explore alternative financing options beyond traditional bank loans.

Consider crowdfunding platforms like Kickstarter or Indiegogo to raise capital from potential customers. Microloans offered by organizations like Kiva can provide small amounts of funding to entrepreneurs.

Friends, Family, and Angel Investors

Seeking financial support from friends and family can be a viable option, but it's crucial to approach it professionally. Create a formal business plan and treat the investment as a loan with clear repayment terms.

Angel investors, high-net-worth individuals who invest in startups, can provide both capital and mentorship. However, securing angel investment often requires giving up a percentage of your company's equity.

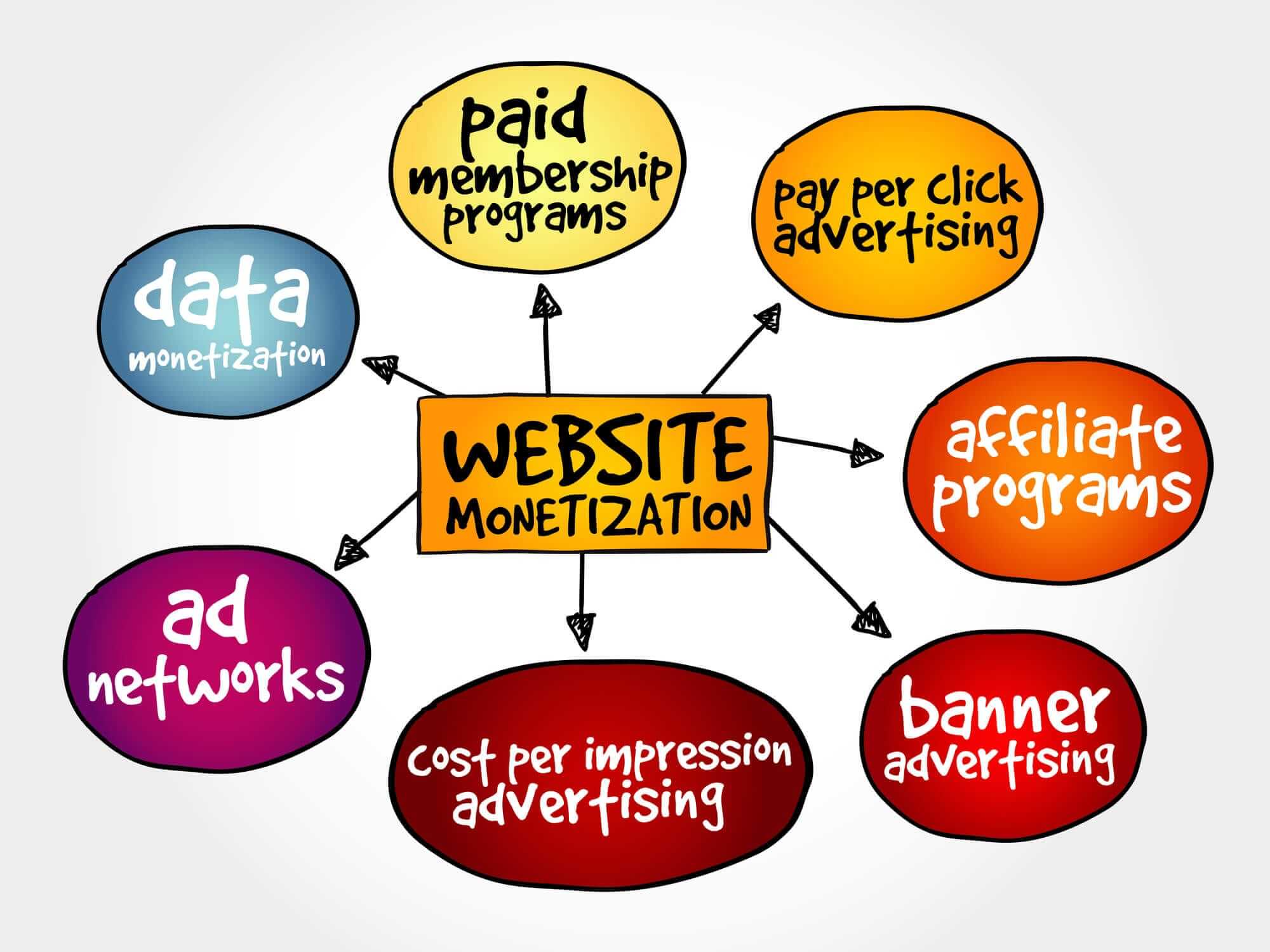

Building a Strong Online Presence

In today's digital age, a strong online presence is essential for any business, regardless of its size. Building a website and actively engaging on social media are crucial steps.

Utilize free tools like Google My Business to improve your local search ranking. Create valuable content, such as blog posts and videos, to attract potential customers and establish yourself as an authority in your industry.

The Power of Social Media Marketing

Social media platforms like Facebook, Instagram, and LinkedIn offer cost-effective ways to reach a large audience. Develop a content strategy that aligns with your target market and consistently engages your followers.

Consider running targeted advertising campaigns on social media to reach specific demographics and interests. Focus on building genuine relationships with your audience rather than simply promoting your products or services.

Conclusion: Embrace Resourcefulness and Resilience

Starting a business with little money requires creativity, resourcefulness, and unwavering determination. While the challenges may seem daunting, the opportunities are plentiful for those willing to think outside the box and leverage the resources available to them.

By focusing on low-investment business ideas, embracing bootstrapping, and building a strong online presence, aspiring entrepreneurs can turn their dreams into reality, even on a tight budget. Remember that success is not solely determined by the amount of capital you have, but by your passion, perseverance, and willingness to adapt to the ever-changing business landscape.