How Can Wealthcounsel Help Me Improve My Client Intake Process

In the competitive landscape of legal services, client intake can be the critical factor that separates a thriving practice from one that struggles. A disorganized or inefficient intake process can lead to missed opportunities, frustrated potential clients, and ultimately, lost revenue. Recognizing this crucial need for optimization, many attorneys are turning to specialized resources like Wealthcounsel to streamline and enhance their client engagement strategies.

This article delves into how Wealthcounsel, a leading provider of legal document drafting software and educational resources for estate planning and business law attorneys, can revolutionize the client intake process. We will explore the specific tools and strategies Wealthcounsel offers, examining how they address common pain points and empower firms to deliver a superior client experience from the very first interaction.

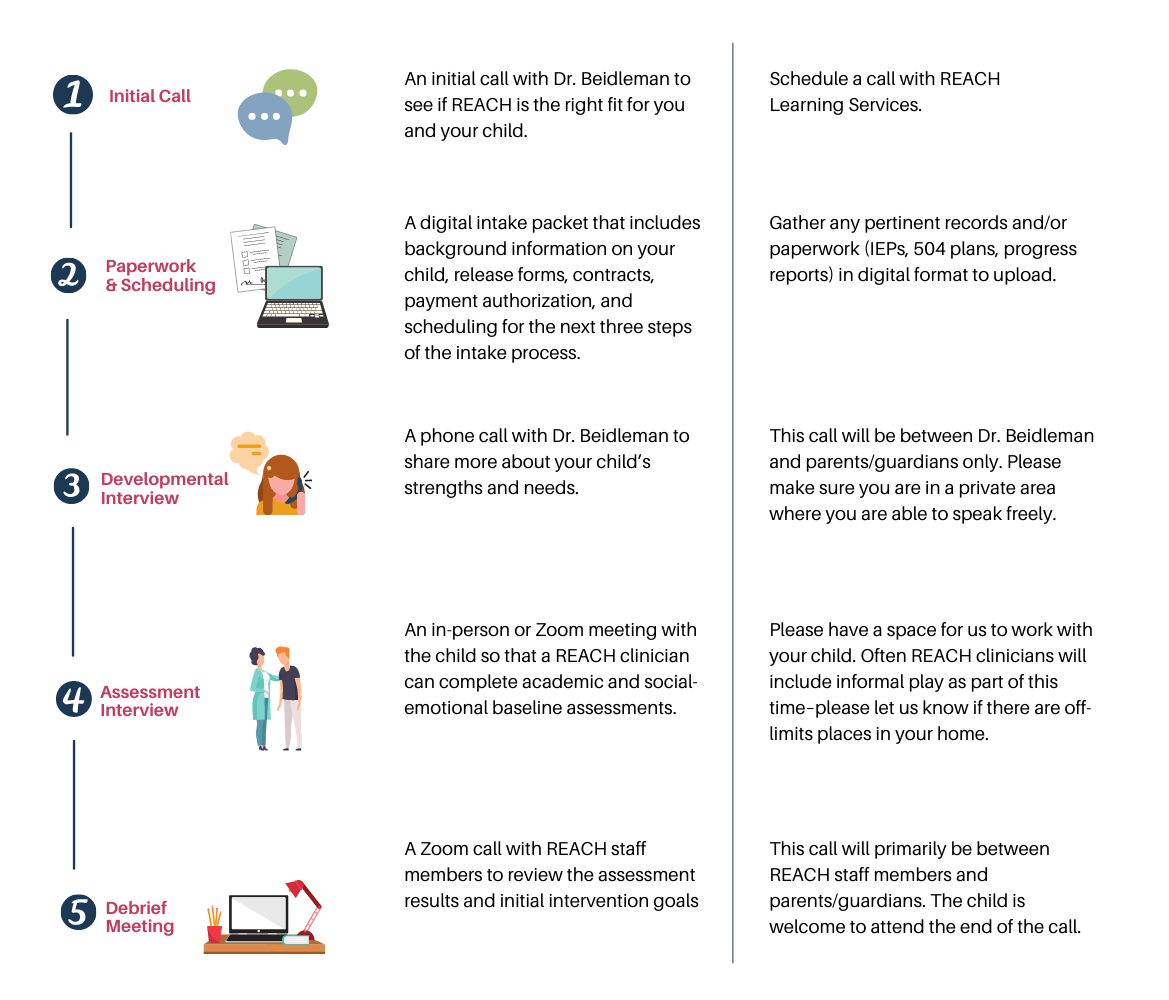

Understanding the Client Intake Challenge

The client intake process is often the first impression a potential client has of a law firm. It encompasses everything from initial contact and information gathering to determining suitability and onboarding.

A poorly managed intake can result in incomplete information, increased administrative burden, and a negative client experience, potentially leading the client to seek services elsewhere.

Many firms struggle with fragmented systems, manual data entry, and a lack of standardized procedures, all of which contribute to inefficiencies and errors.

The Cost of Inefficient Intake

Inefficient client intake can have significant financial consequences. It can waste valuable attorney and staff time, reduce billable hours, and increase the risk of errors and omissions.

Lost opportunities are another major concern; a slow or unresponsive intake can cause potential clients to move on to more agile competitors.

"A smooth intake process not only attracts clients but also sets the stage for a successful attorney-client relationship,"explains Sarah Johnson, a practice management consultant specializing in legal services.

Moreover, inadequate data collection during intake can lead to incomplete or inaccurate legal documents, potentially exposing the firm to liability.

Wealthcounsel's Solution: A Holistic Approach

Wealthcounsel offers a suite of tools and resources designed to address the multifaceted challenges of client intake. These include specialized software, comprehensive training programs, and a supportive community of legal professionals.

At the core of their solution is document assembly software that automates the creation of client questionnaires, engagement letters, and other essential intake documents. This automation significantly reduces the time and effort required to gather client information and onboard new clients.

Beyond software, Wealthcounsel provides extensive training and educational resources to help attorneys and their staff master the art of effective client communication and relationship building. This includes workshops on client interviewing techniques, ethical considerations, and best practices for managing client expectations.

Key Features and Benefits

Wealthcounsel's client intake solutions are built around several key features, each designed to streamline a specific aspect of the process.

Automated Questionnaires: Generate customized client questionnaires based on practice area and specific client needs. These questionnaires can be completed online or in print, saving time and ensuring consistent data collection.

Engagement Letter Automation: Quickly create legally sound engagement letters tailored to each client engagement. This ensures clarity on scope of work, fees, and responsibilities, minimizing the risk of misunderstandings and disputes.

CRM Integration: Seamlessly integrate with popular CRM systems to manage client data, track interactions, and automate follow-up communications. This helps maintain organized records and nurture client relationships.

Workflow Automation: Automate repetitive tasks such as document generation, scheduling appointments, and sending reminders. This frees up staff time to focus on more strategic activities.

Real-World Impact: Success Stories

Many law firms have reported significant improvements in their client intake process after implementing Wealthcounsel's solutions. These improvements translate to increased efficiency, improved client satisfaction, and ultimately, higher profitability.

One estate planning firm in California saw a 30% reduction in the time required to onboard new clients after adopting Wealthcounsel's automated questionnaires. This allowed the firm to handle a larger volume of clients without increasing staff workload.

Another firm reported a significant improvement in client satisfaction scores after implementing Wealthcounsel's client communication training program. Clients felt more informed and engaged throughout the process, leading to stronger relationships and more referrals.

Addressing Concerns and Considerations

While Wealthcounsel offers a robust suite of tools, it is important to consider certain factors before implementing their solutions. The initial investment in software and training can be a barrier for some firms, particularly smaller practices.

Furthermore, successful implementation requires a commitment to change management and a willingness to adapt existing workflows. Attorneys and staff must be properly trained on the new systems and processes to realize the full benefits.

It's also crucial to assess the specific needs of your practice and choose the Wealthcounsel features that align with your goals. Not every feature is necessary for every firm.

The Future of Client Intake

The legal industry is constantly evolving, and client intake is no exception. As technology advances and client expectations rise, law firms must adapt their strategies to remain competitive.

Artificial intelligence (AI) is poised to play an increasingly important role in client intake, automating tasks such as initial consultations, document review, and risk assessment. Wealthcounsel is actively exploring opportunities to integrate AI into its platform to further enhance efficiency and accuracy.

By embracing innovation and investing in tools like Wealthcounsel, law firms can position themselves for success in the rapidly changing legal landscape, attracting and retaining more clients while delivering exceptional service.

.png)