How Companies Make Money From Stocks

For many, the stock market is synonymous with individual investors seeking personal wealth. However, publicly traded companies themselves actively participate in the market, leveraging it not just for capital raising, but also as a revenue stream. Understanding how companies profit from their own stock, and those of others, sheds light on a vital aspect of the modern financial landscape.

This article examines the various strategies companies employ to generate income from stocks. We will explore methods ranging from direct sales and stock buybacks to more complex financial maneuvers. This analysis will also look at the implications of these practices on the overall market stability and investor confidence.

Direct Stock Sales: Raising Capital

One of the most straightforward ways companies make money from stocks is through direct sales. This typically occurs during an Initial Public Offering (IPO), where a private company offers shares to the public for the first time.

The company sets an initial price and sells a specific number of shares, raising capital that can be used for expansion, research and development, debt repayment, or other strategic initiatives. Subsequent stock offerings, also known as secondary offerings, can also generate funds in a similar way.

Stock Buybacks: Boosting Share Value

Companies can also repurchase their own shares in the open market, a process known as a stock buyback. This reduces the number of outstanding shares, potentially increasing the earnings per share (EPS) and thus making the remaining shares more valuable.

A smaller supply of shares can also drive up the stock price, benefiting shareholders. While stock buybacks can be a legitimate way to return value to shareholders, they have also faced scrutiny, particularly when companies use them to inflate stock prices without investing in long-term growth or employee benefits.

Strategic Investments and Dividends

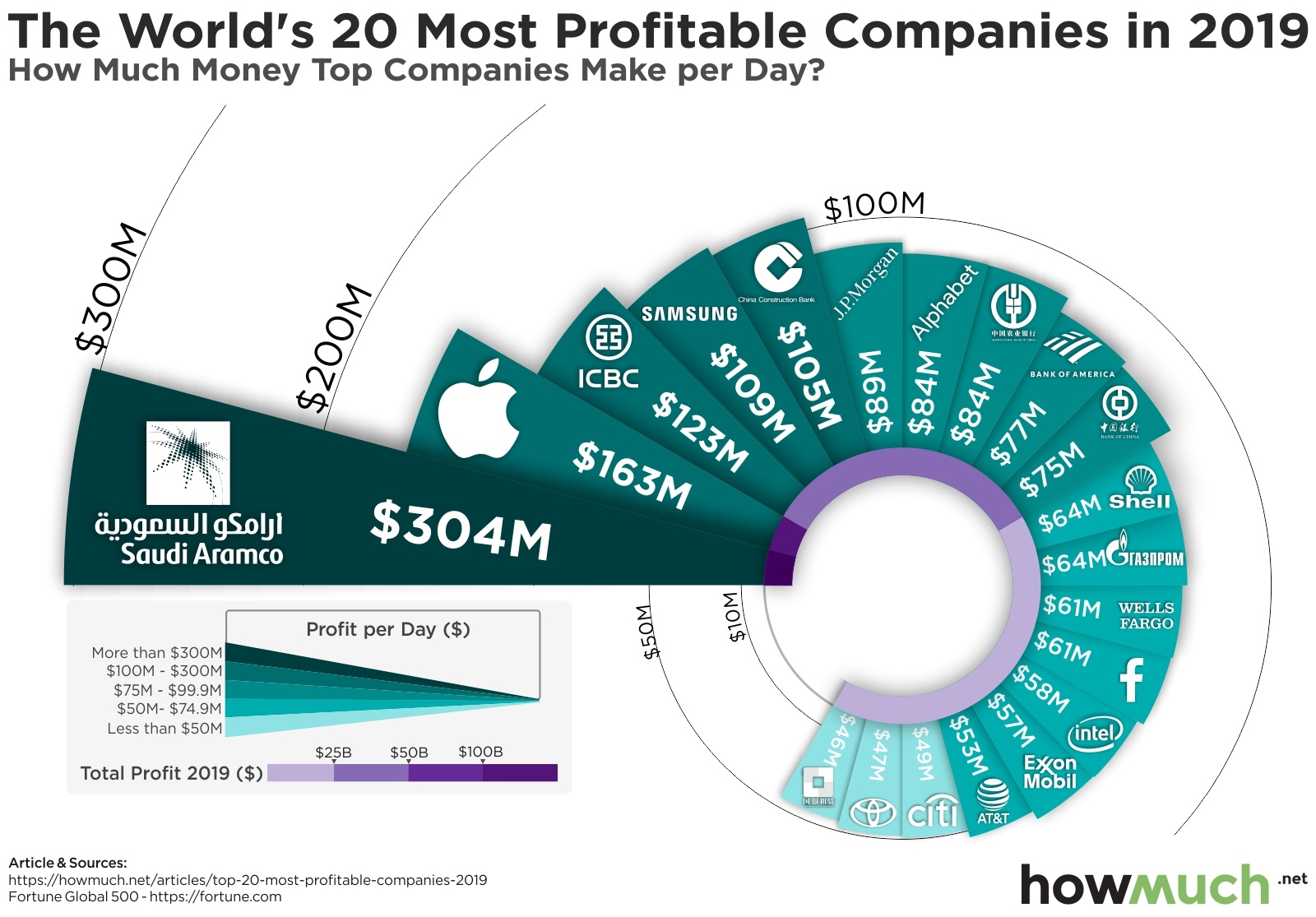

Many companies invest in the stocks of other companies, often for strategic reasons such as gaining influence in a particular industry or diversifying their holdings. These investments can generate income through dividend payments, where a portion of the company's profits is distributed to shareholders.

For example, a large technology company might invest in a smaller, innovative startup in order to gain access to its technology or talent. Beyond dividend income, companies can also profit from the appreciation in the value of these invested stocks.

Employee Stock Options: Aligning Interests

Companies frequently offer employee stock options as part of their compensation packages. These options give employees the right, but not the obligation, to purchase company stock at a predetermined price, typically the market price at the time the options are granted.

When the stock price rises above this price, employees can exercise their options, buy the stock at the lower price, and immediately sell it at the higher market price for a profit. While this is primarily intended to incentivize employees and align their interests with the company's success, the company itself benefits by attracting and retaining talent, potentially leading to increased productivity and profitability.

Potential Impact and Considerations

The various methods companies use to profit from stocks have a significant impact on the financial markets and the broader economy. Direct stock sales can fuel innovation and growth, while stock buybacks can enhance shareholder value, but both practices require careful management and transparency.

Concerns arise when companies prioritize short-term stock price manipulation over long-term investments in their businesses. Regulatory bodies like the Securities and Exchange Commission (SEC) play a crucial role in monitoring these activities and ensuring fair market practices.

Ultimately, understanding how companies make money from stocks is essential for both individual investors and policymakers. It enables informed decision-making and promotes a more stable and equitable financial system.

By analyzing these strategies, we can foster a better understanding of corporate finance and its influence on the global economy.