How Do I Check All My Subscriptions

In today's subscription-based economy, it's easy to lose track of recurring payments for streaming services, software, and various online platforms. Many individuals find themselves unknowingly paying for services they no longer use or need, leading to significant financial waste. The sheer volume of subscriptions can make it a daunting task to identify and manage them all effectively.

This article provides a comprehensive guide on how to check all your subscriptions, offering actionable steps and resources to regain control of your finances. It will explore various methods, from manually reviewing bank statements to leveraging specialized apps and services. The goal is to equip readers with the knowledge and tools necessary to audit their subscriptions and eliminate unnecessary expenses.

Manual Review: A Deep Dive into Your Accounts

The most basic method for checking your subscriptions involves a manual review of your financial accounts. This includes checking your bank statements, credit card statements, and even your PayPal or other digital wallet transaction histories.

Examining Bank and Credit Card Statements

Carefully review your statements for any recurring charges from unfamiliar companies or services. Look for patterns in the transaction descriptions that indicate a subscription payment, such as "Netflix Monthly," "Spotify Premium," or "Adobe Creative Cloud." Document each subscription, noting the service, payment amount, and billing frequency.

Delving into Digital Wallets

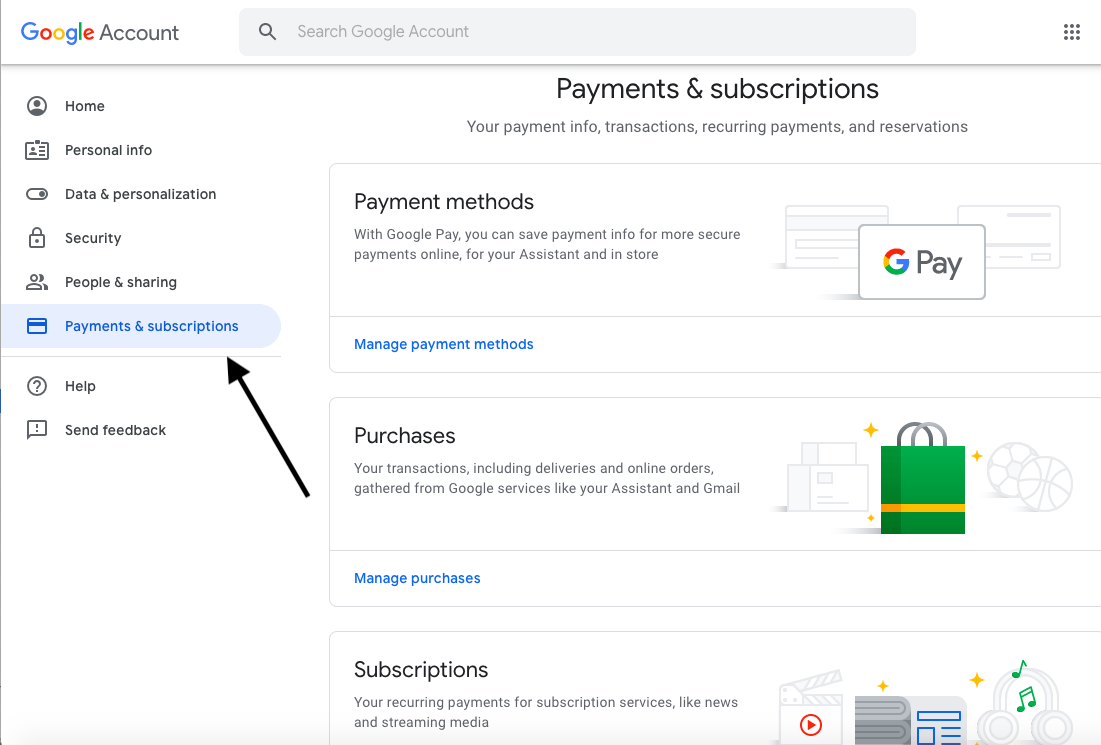

Many subscriptions are linked to digital wallets like PayPal or Google Pay. Log into each platform and review your transaction history to identify recurring payments.

Pay close attention to any automatic payments that may be set up.

Subscription Management Apps and Services

For a more automated approach, consider utilizing subscription management apps or services. These platforms are designed to aggregate your subscription information and provide a centralized view of your recurring expenses. Some popular options include Rocket Money (formerly Truebill), Trim, and Clarity Money.

How Subscription Managers Work

These apps typically connect to your bank and credit card accounts to automatically identify recurring charges. They categorize these transactions as subscriptions and present you with a consolidated list. Some apps also offer features to help you cancel subscriptions directly through the platform.

Choosing the Right App

When selecting a subscription management app, consider factors like security, privacy, and features. Read reviews and compare different options to find the one that best suits your needs. Be sure to understand the app's data security policies and how they handle your sensitive financial information.

Leveraging Account Settings and Email Archives

Another useful method involves checking the settings of various online accounts and searching your email archives for subscription confirmations. This can help uncover subscriptions that may not be immediately apparent in your bank statements.

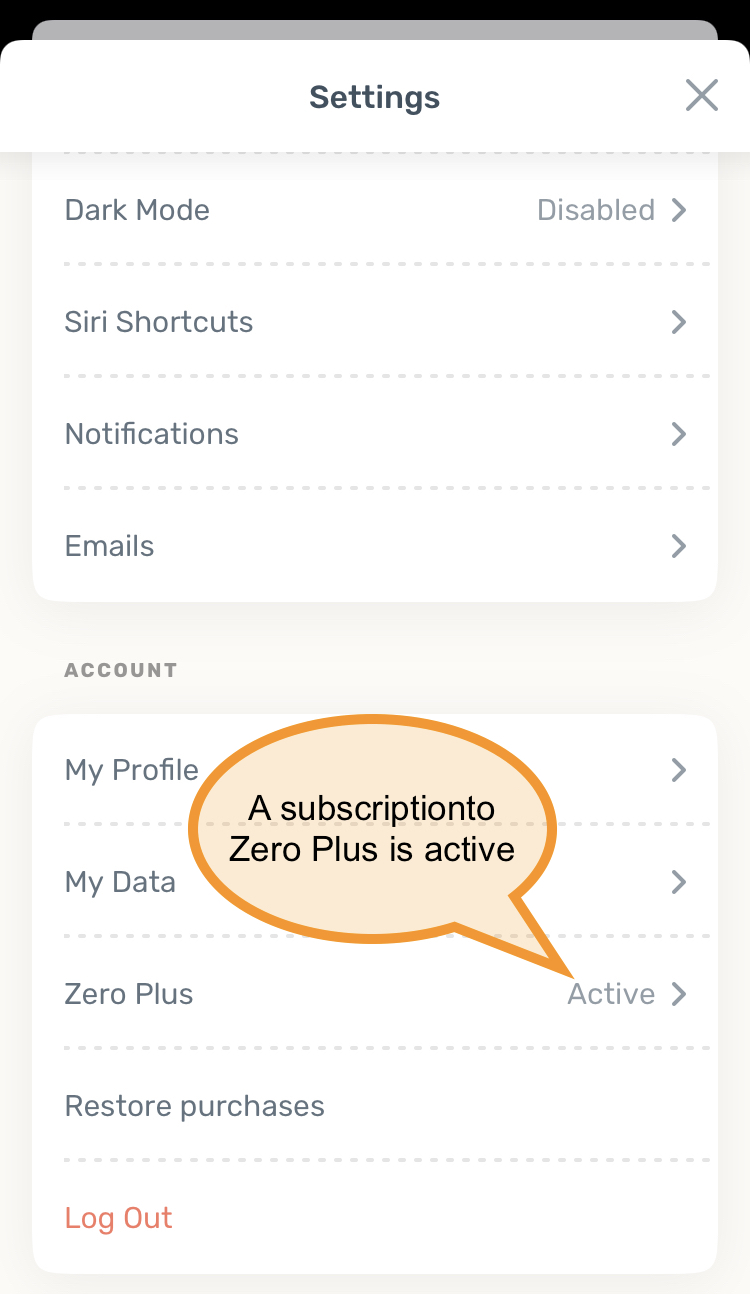

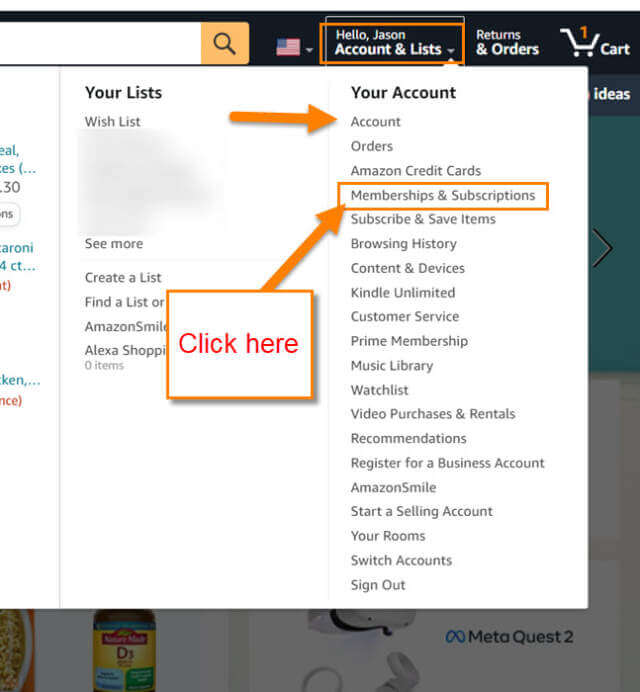

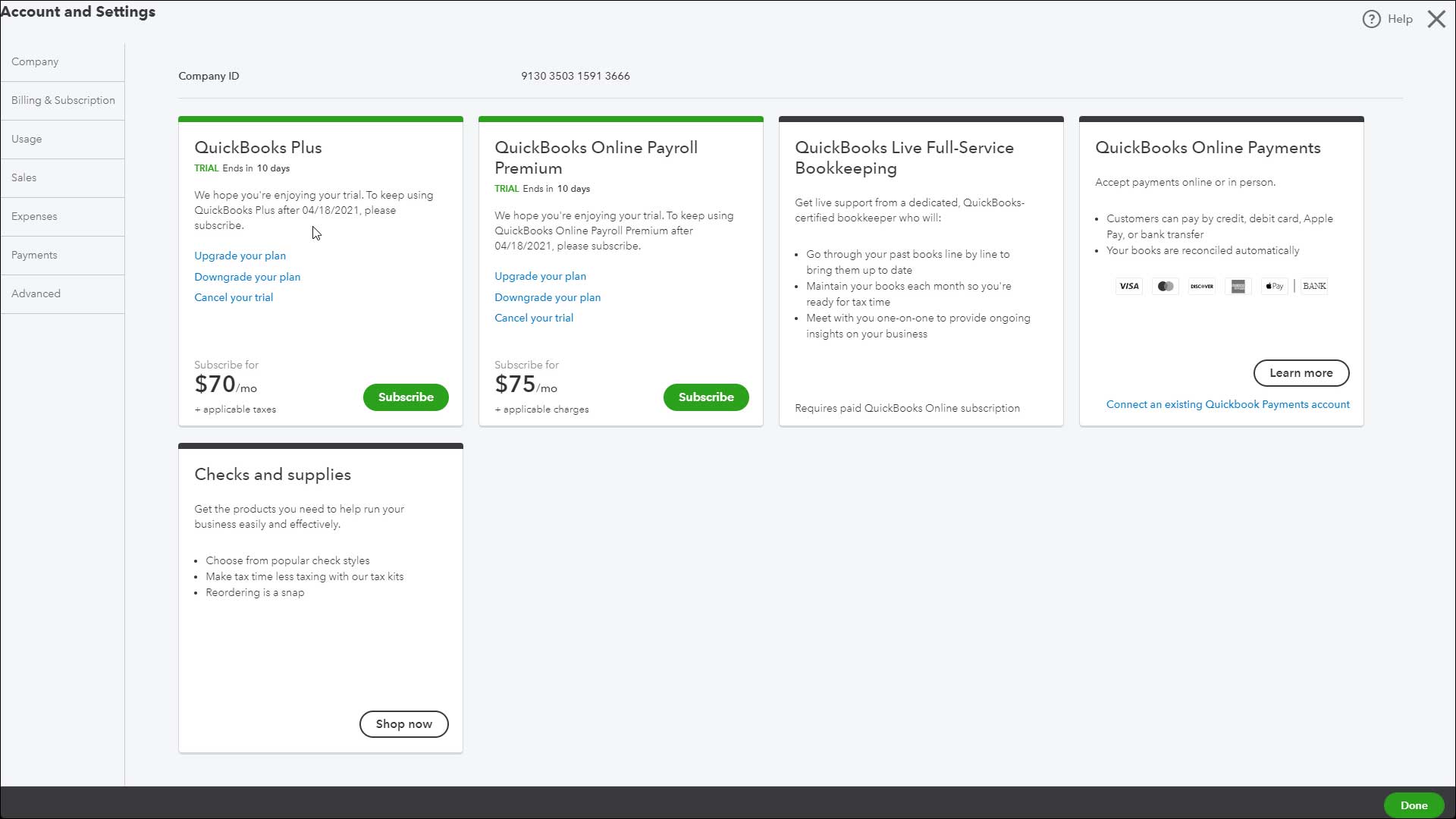

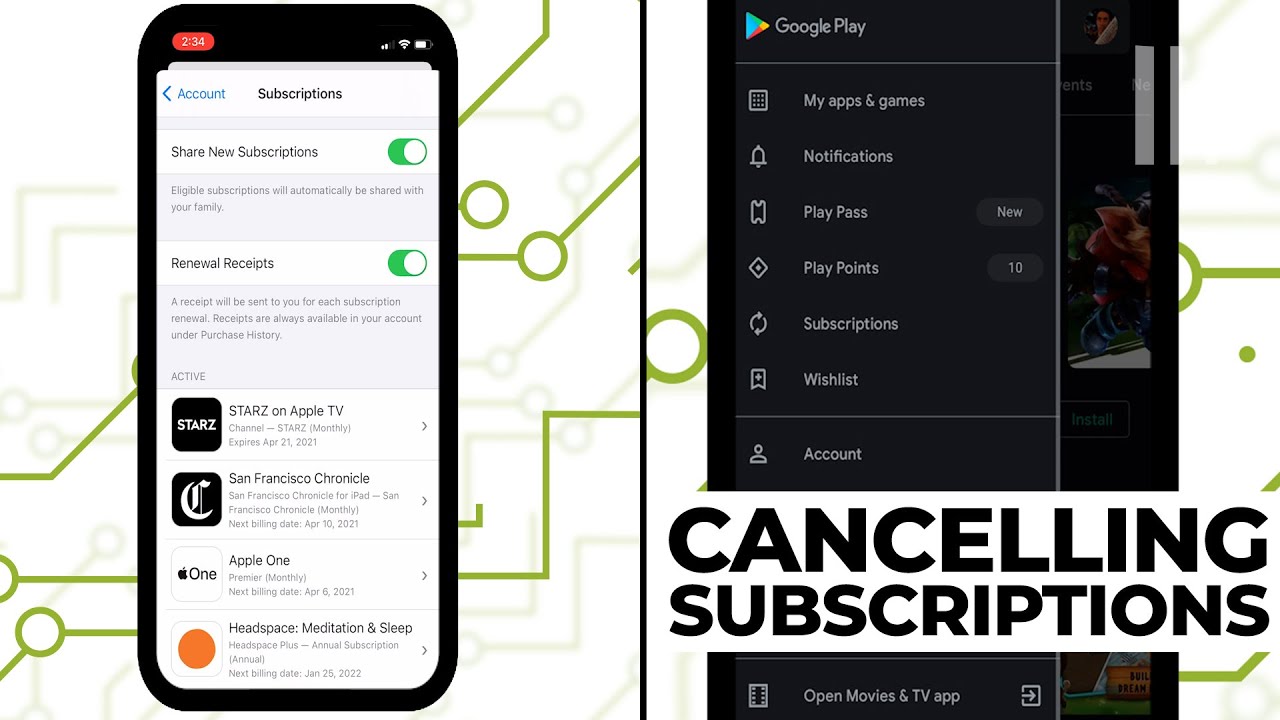

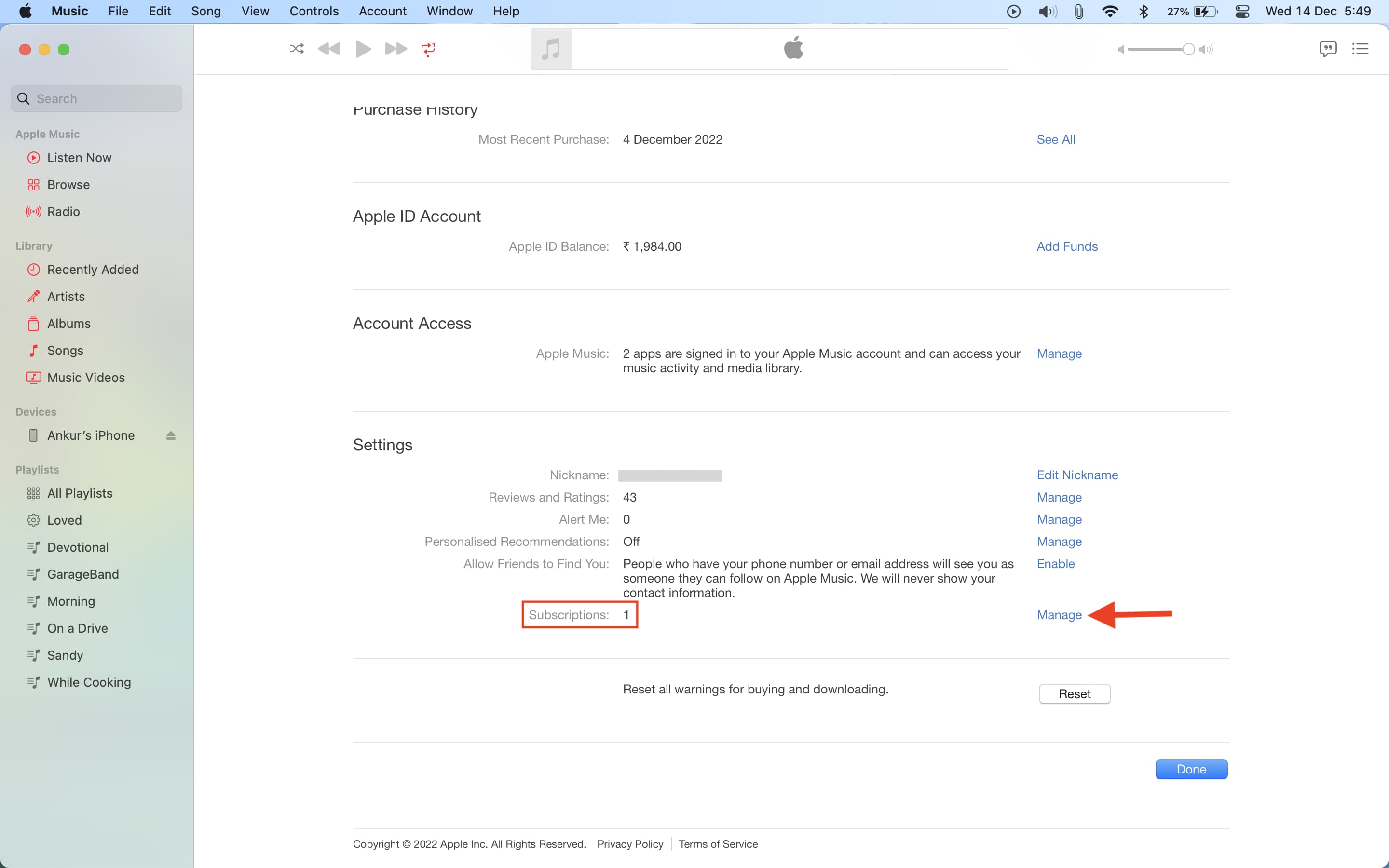

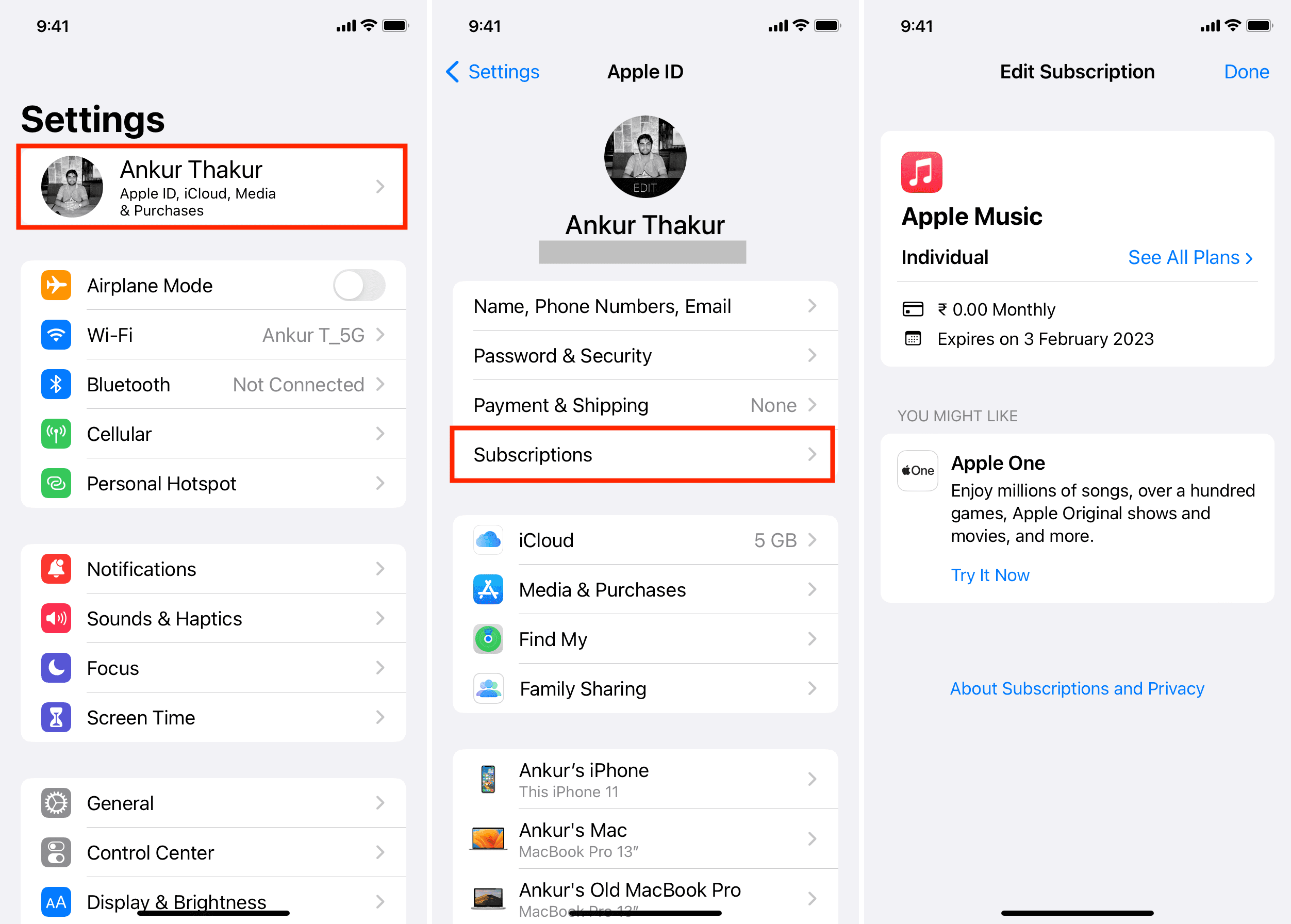

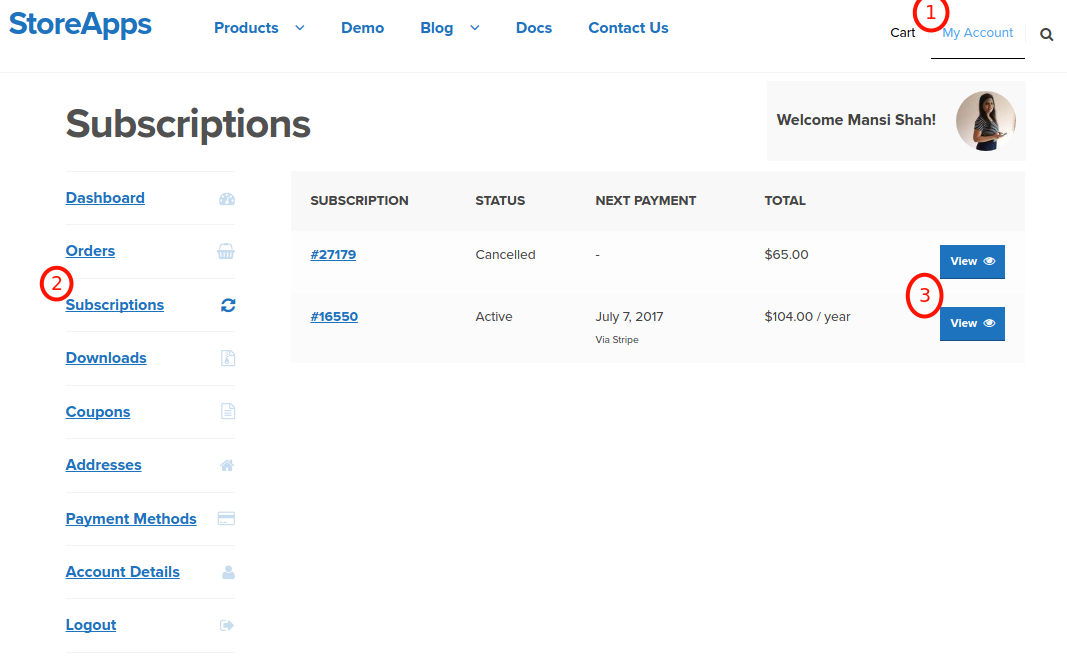

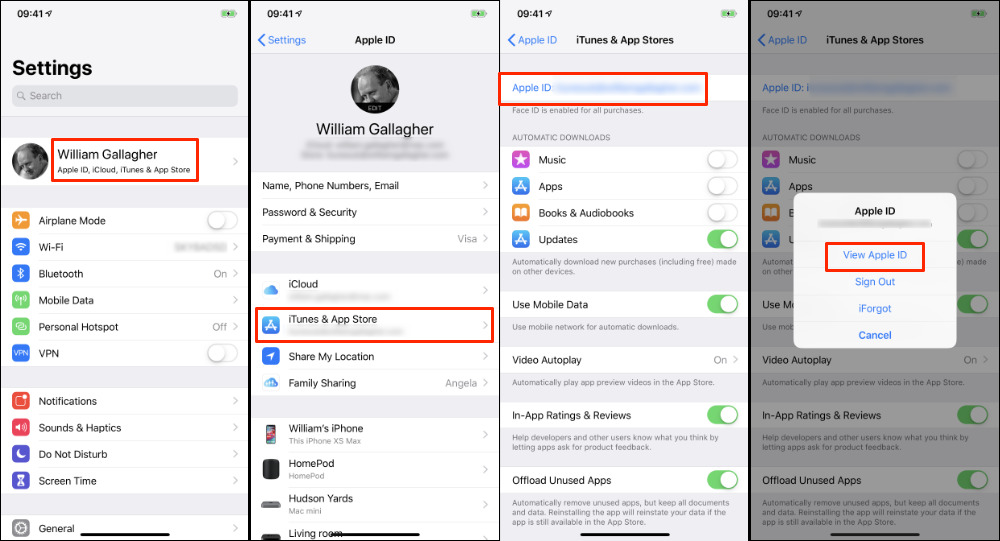

Checking Account Settings

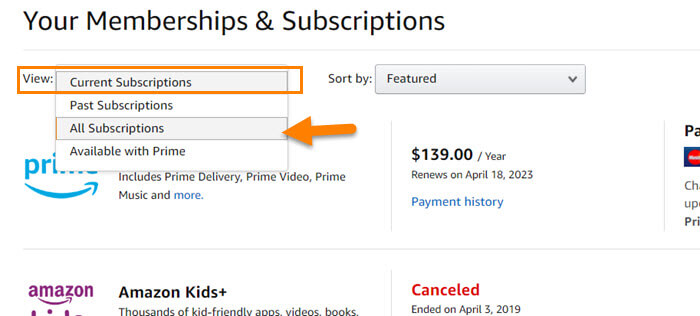

Log into your frequently used online accounts, such as streaming services, gaming platforms, and software providers. Navigate to the account settings or subscription management section to view your active subscriptions. This may reveal subscriptions you forgot about or accidentally signed up for during a trial period.

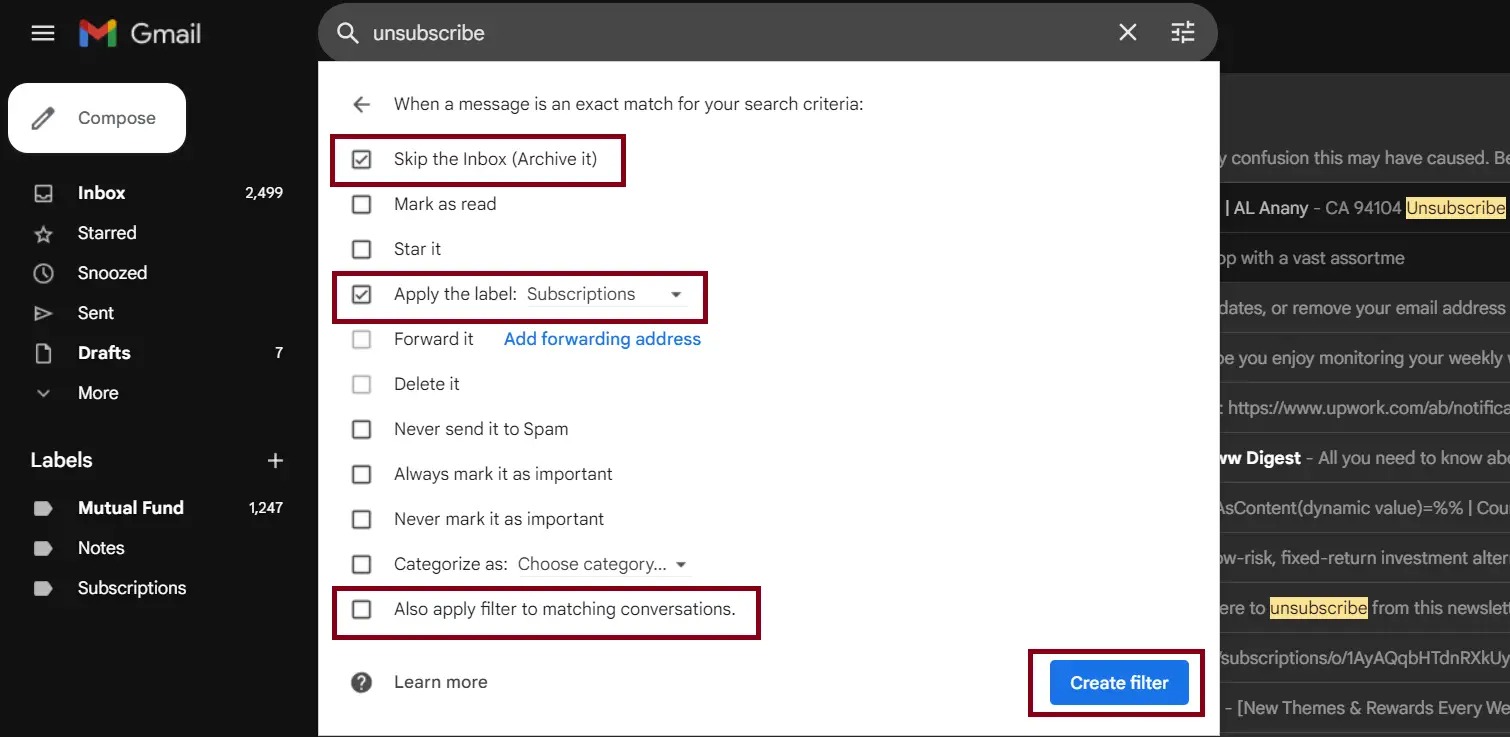

Searching Your Email Archives

Search your email inbox for keywords like "subscription," "renewal," "billing," or "welcome." This can help you find confirmation emails and billing notifications related to your subscriptions. These emails often contain valuable information about the subscription terms and cancellation policies.

The Importance of Regular Audits

Checking your subscriptions should not be a one-time task but rather a regular practice. Experts recommend conducting a subscription audit at least every few months to ensure you are not paying for unwanted services. This proactive approach can save you a significant amount of money over time.

Furthermore, be wary of free trials that automatically convert into paid subscriptions. Always set reminders to cancel the trial before the billing cycle begins.

In conclusion, managing your subscriptions effectively requires a combination of manual review, automated tools, and diligent monitoring. By following the steps outlined in this article, you can gain control of your finances and eliminate unnecessary subscription expenses. Staying informed and proactive is key to maintaining a healthy financial life in the age of subscriptions.

:max_bytes(150000):strip_icc()/iOSSubscriptions01-97b8e9ce685c441fbb6ea6223be11698.jpg)