Importance Of Cash Flow Management Pdf

In today's volatile economic climate, businesses are facing unprecedented challenges. From fluctuating market demands to supply chain disruptions, the ability to navigate these complexities hinges on one critical factor: effective cash flow management. Failing to prioritize this essential aspect can lead to insolvency, regardless of a company's profitability.

The importance of mastering cash flow management cannot be overstated, particularly for small and medium-sized enterprises (SMEs). These entities often lack the financial resources and resilience of larger corporations, making them especially vulnerable to cash flow shortages. Numerous resources, including downloadable PDFs and comprehensive guides, are available to aid businesses in understanding and implementing robust cash flow strategies.

Understanding the Core Principles

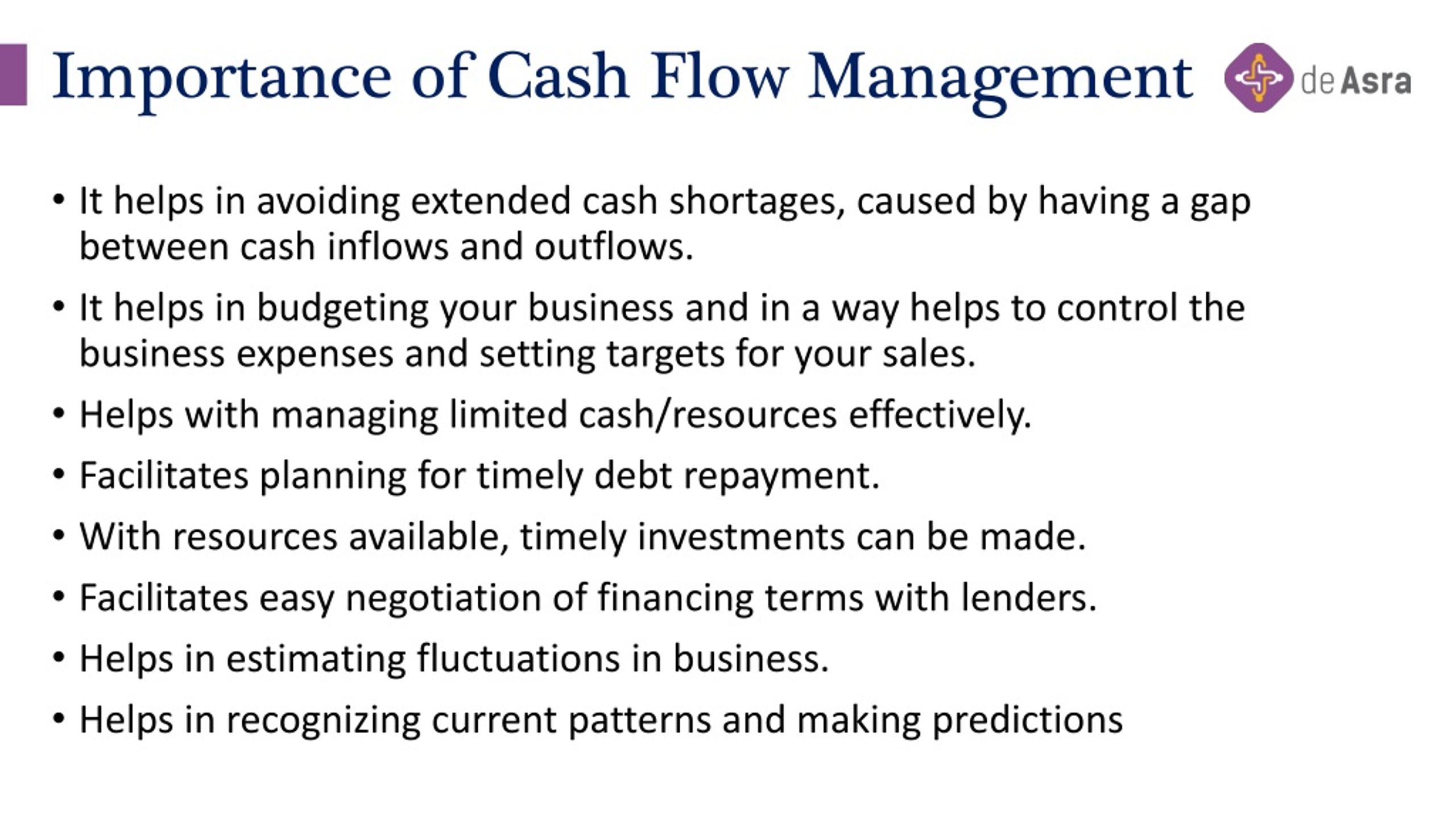

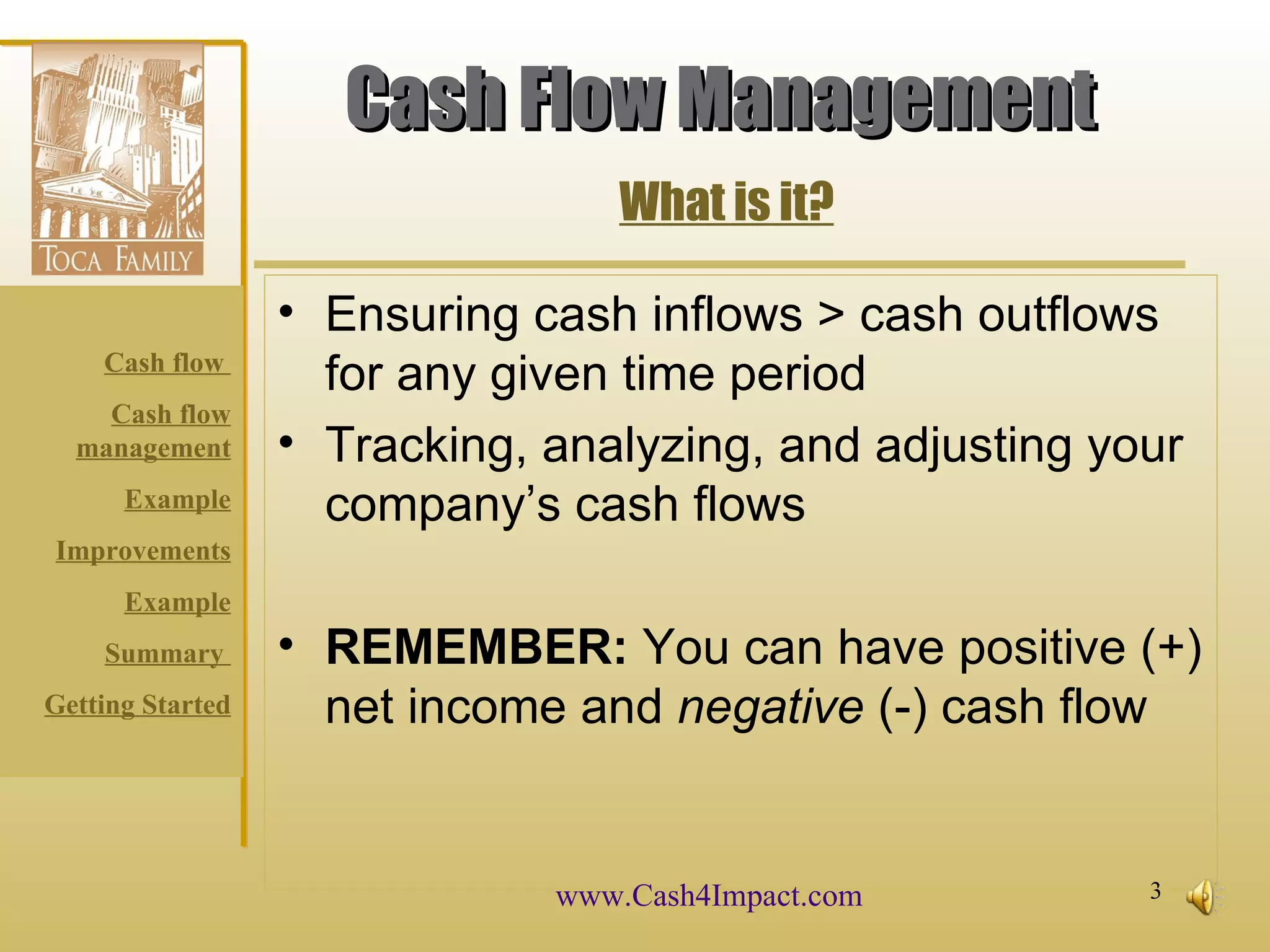

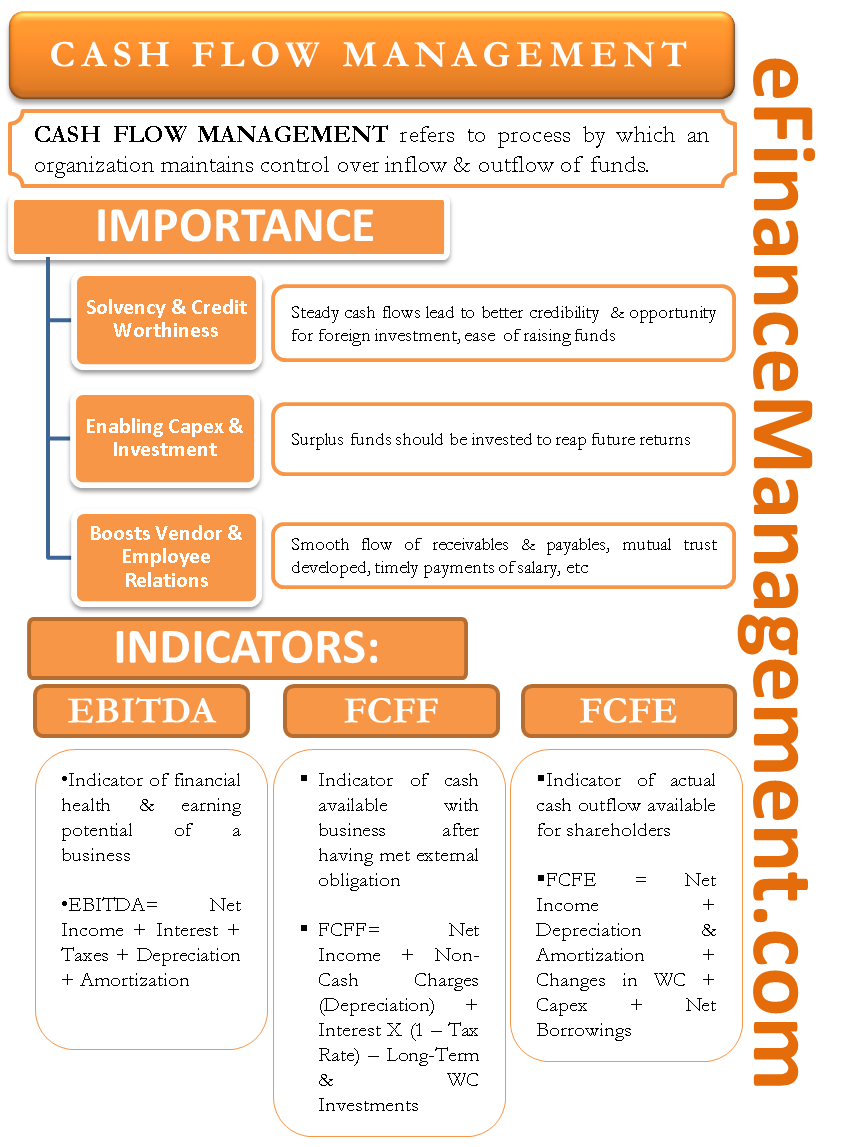

At its heart, cash flow management involves tracking the movement of money both into and out of a business. This process requires meticulous monitoring of income, expenses, and investments. Accurately predicting future cash inflows and outflows is essential for informed decision-making.

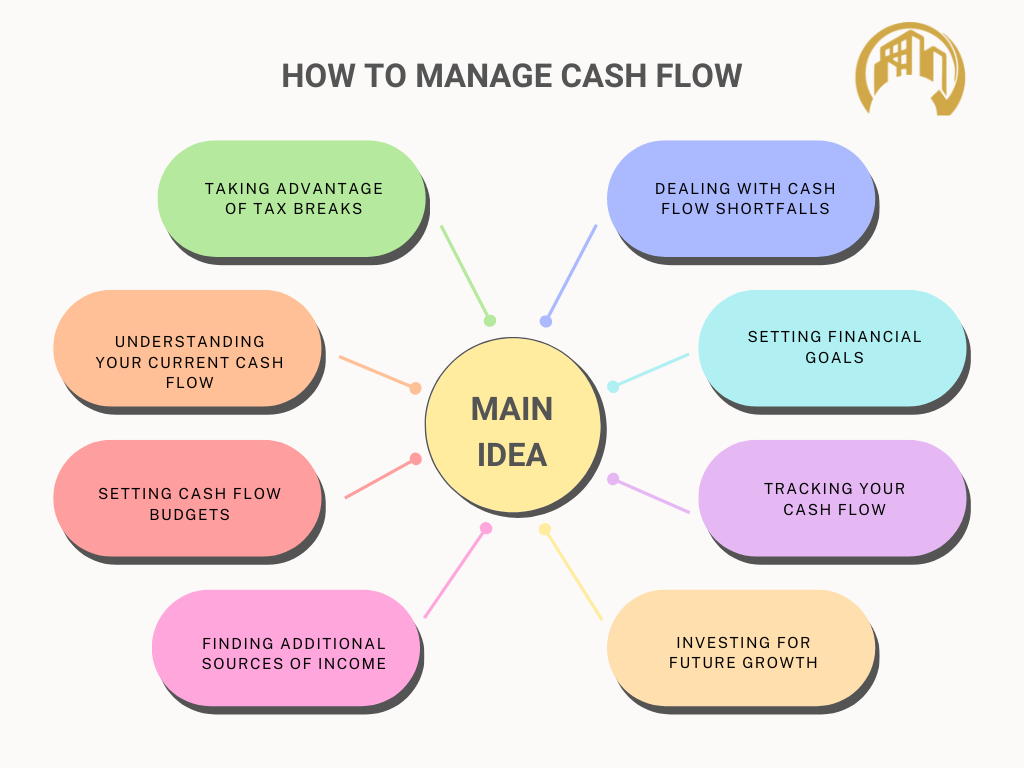

Several key elements are critical for effective cash flow management. These include creating a realistic budget, closely monitoring accounts receivable and payable, and managing inventory effectively. Implementing strategies to accelerate cash inflows and delay outflows is also crucial.

The Role of Cash Flow Forecasting

Cash flow forecasting is a fundamental aspect of proactive cash flow management. It involves projecting future cash inflows and outflows over a specific period. By anticipating potential cash shortages or surpluses, businesses can make informed decisions about investments, borrowing, and expense management.

Accurate cash flow forecasts allow businesses to identify potential problems early on. This proactive approach enables them to take corrective action before a crisis occurs. Several tools and templates are available to assist businesses in creating effective cash flow forecasts, often found within comprehensive cash flow management PDFs.

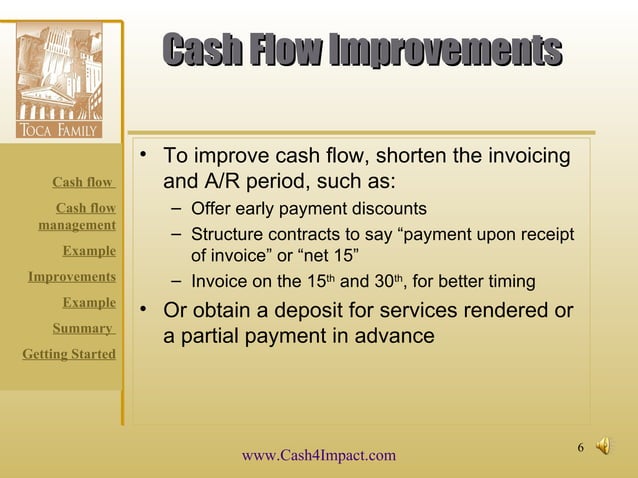

Strategies for Improving Cash Flow

Several strategies can be employed to improve a company's cash flow position. These strategies focus on accelerating cash inflows and managing cash outflows.

Offering discounts for early payments, implementing stricter credit control policies, and diversifying revenue streams are all effective ways to boost cash inflows. Negotiating favorable payment terms with suppliers, reducing unnecessary expenses, and optimizing inventory levels can significantly reduce cash outflows.

Leveraging Available Resources

Numerous resources are available to help businesses improve their cash flow management. These include online guides, webinars, and downloadable templates. One particularly valuable resource is the cash flow management PDF, which often provides a comprehensive overview of best practices, tools, and templates.

Organizations like the Small Business Administration (SBA) and various financial institutions offer training programs and resources specifically designed to help SMEs manage their cash flow effectively. Consulting with a financial advisor or accountant can also provide valuable insights and guidance.

"Effective cash flow management is not just about survival; it's about creating opportunities for growth and investment." - *Financial Management Institute*

These PDFs often cover topics ranging from basic accounting principles to advanced financial modeling. They serve as a valuable reference for business owners and financial managers seeking to improve their understanding of cash flow management principles.

The Consequences of Poor Cash Flow Management

Failing to manage cash flow effectively can have severe consequences for a business. Shortages can lead to an inability to pay suppliers, employees, and creditors. This can damage a company's reputation and credit rating.

In extreme cases, poor cash flow management can lead to insolvency and business failure. Even profitable businesses can struggle to survive if they are unable to manage their cash flow effectively. This is why mastering cash flow management is so crucial.

Looking Ahead

In an increasingly uncertain economic environment, effective cash flow management will become even more critical. Businesses must prioritize this essential function to ensure their long-term sustainability and success. The ability to anticipate and manage cash flow challenges will be a key differentiator between thriving businesses and those that struggle to survive.

By leveraging available resources, implementing best practices, and continuously monitoring their financial performance, businesses can build a strong foundation for future growth. Regularly reviewing and updating cash flow forecasts is essential to adapt to changing market conditions. This proactive approach will enable businesses to navigate the challenges ahead and capitalize on new opportunities.

![Importance Of Cash Flow Management Pdf Cash Flow Management: [PDF] Example, Benefits, Drawbacks, Strategies](https://educationleaves.com/wp-content/uploads/2023/02/MANAGEMENT.png)

![Importance Of Cash Flow Management Pdf What is the Cash Flow Statement? [PDF inside] Parts, Importance](https://educationleaves.com/wp-content/uploads/2023/03/CASH-FLOW-STATEMENT.png)