How Do I Correct Information On My Credit Report

Errors on your credit report can impact your ability to secure loans, rent an apartment, or even get a job. Immediate action is crucial to rectify any inaccuracies and protect your financial well-being.

This guide provides a straightforward approach to correcting mistakes on your credit report. Learn how to identify errors and initiate disputes with credit bureaus to ensure your credit history accurately reflects your financial standing.

Identifying Errors: Your First Line of Defense

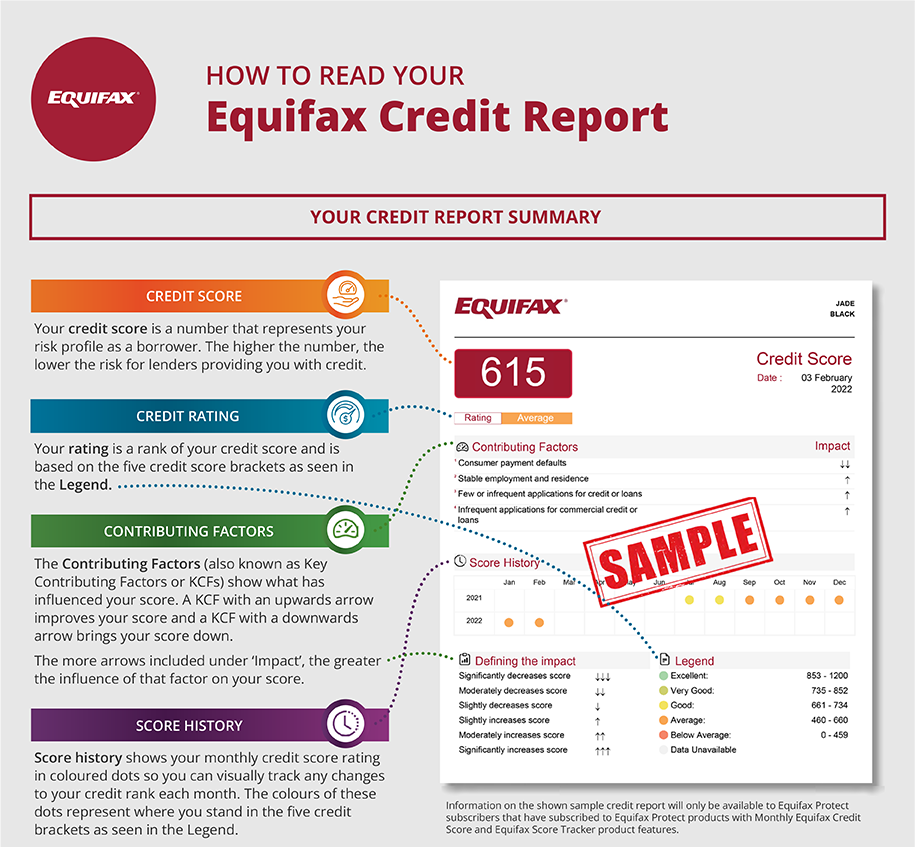

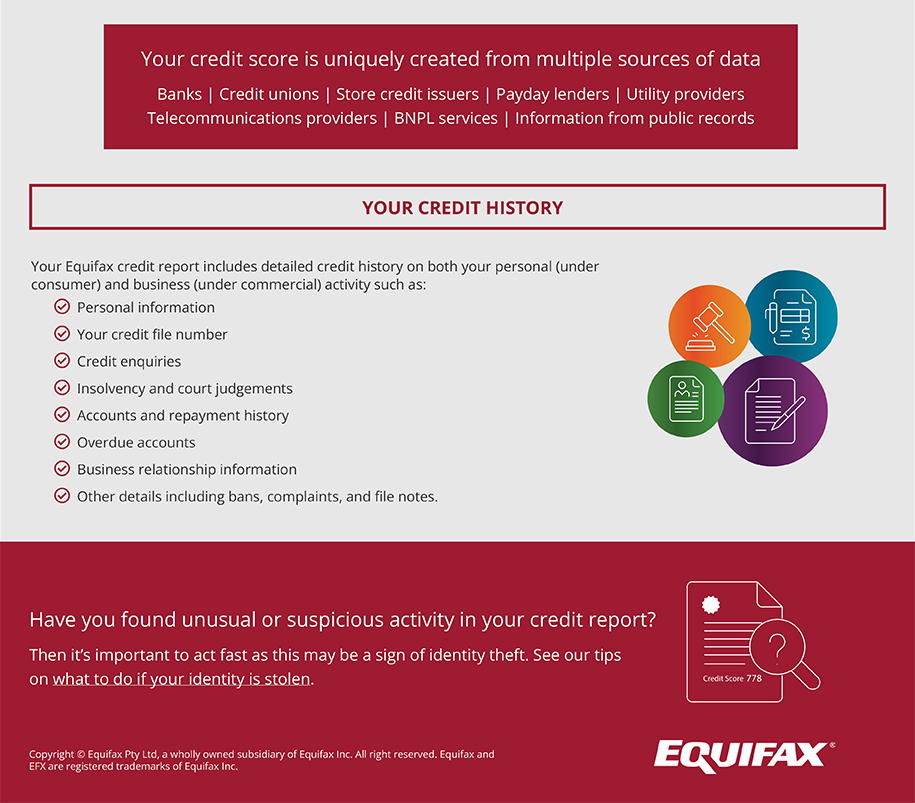

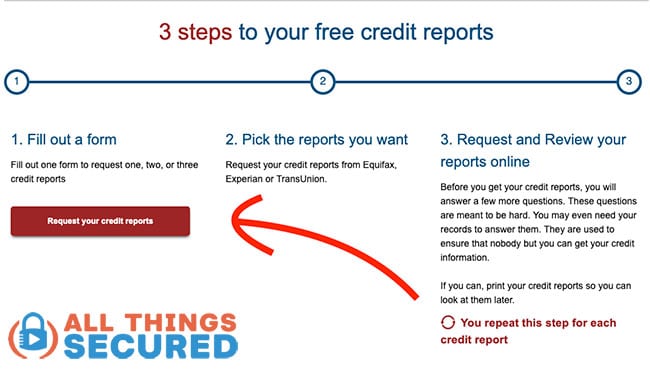

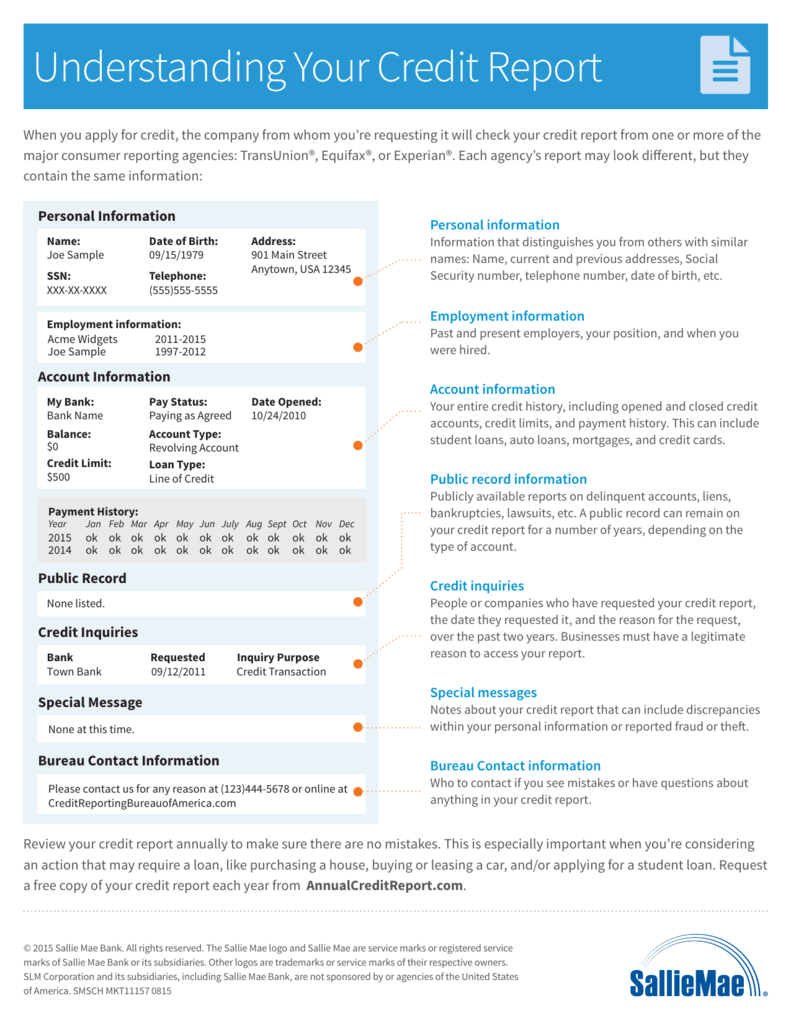

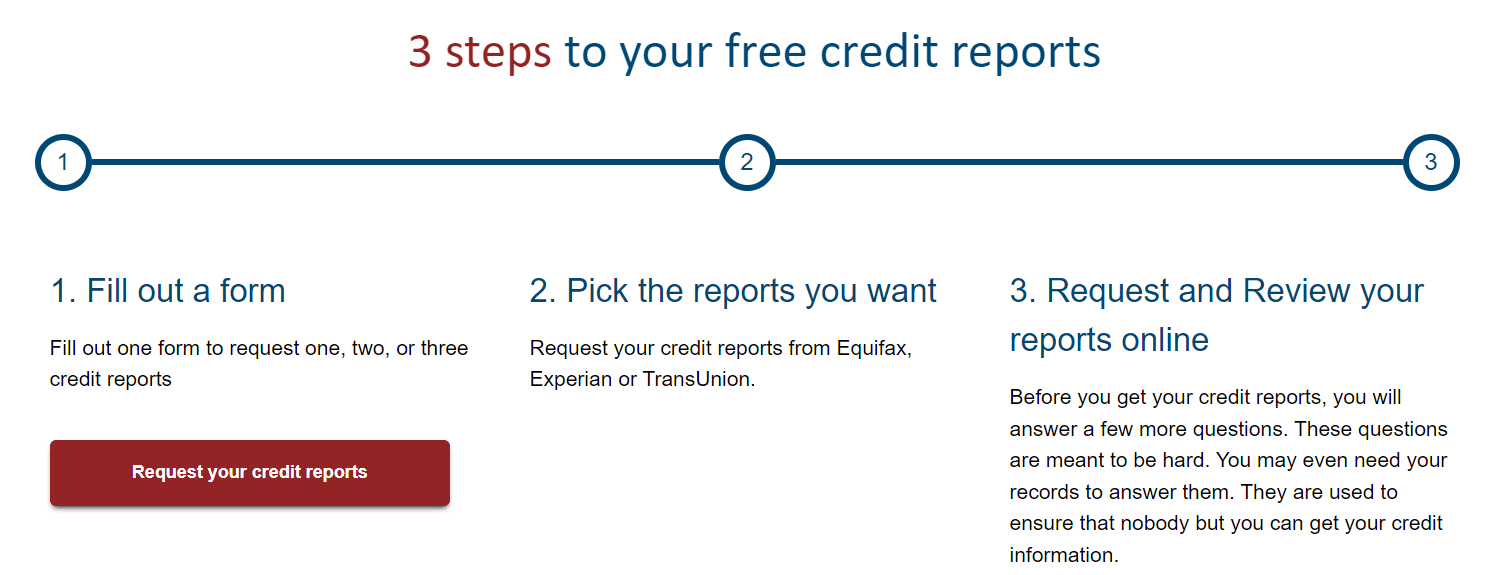

Obtain free copies of your credit reports from AnnualCreditReport.com. You are entitled to one free report annually from each of the three major credit bureaus: Equifax, Experian, and TransUnion.

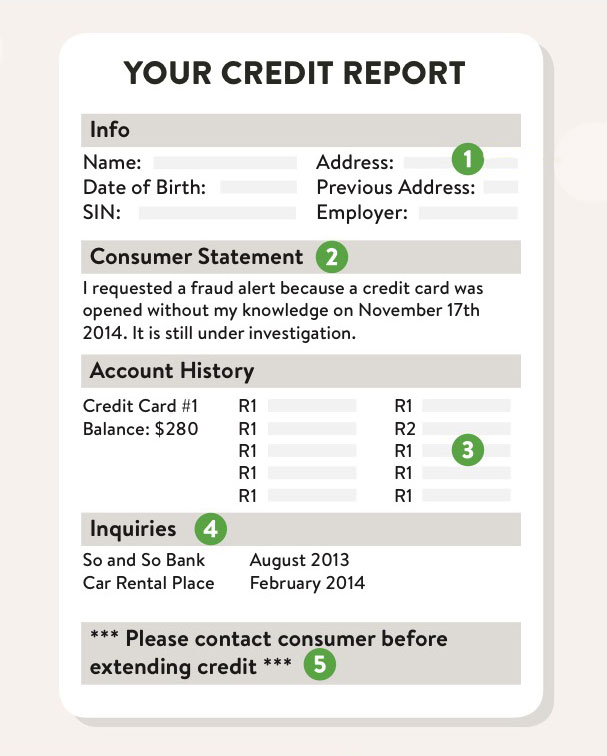

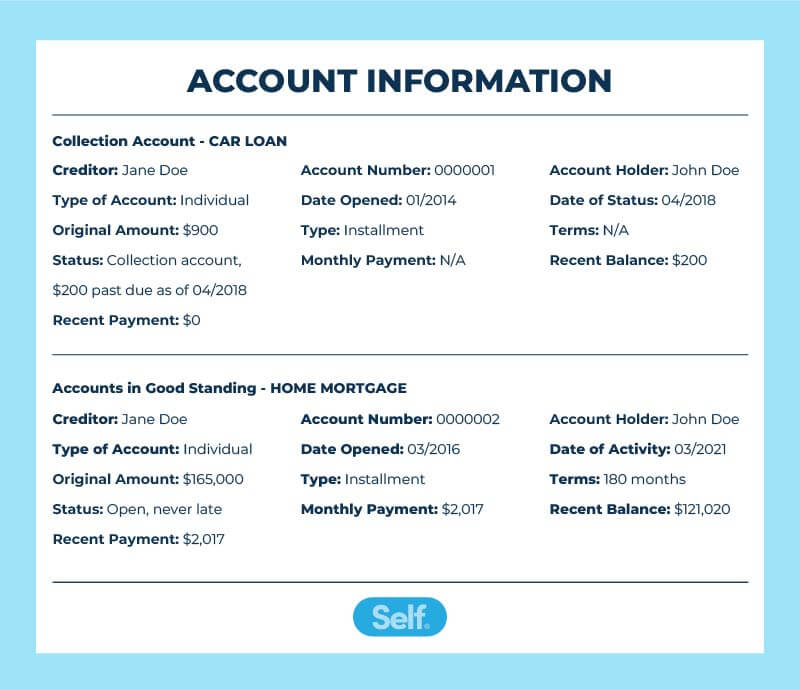

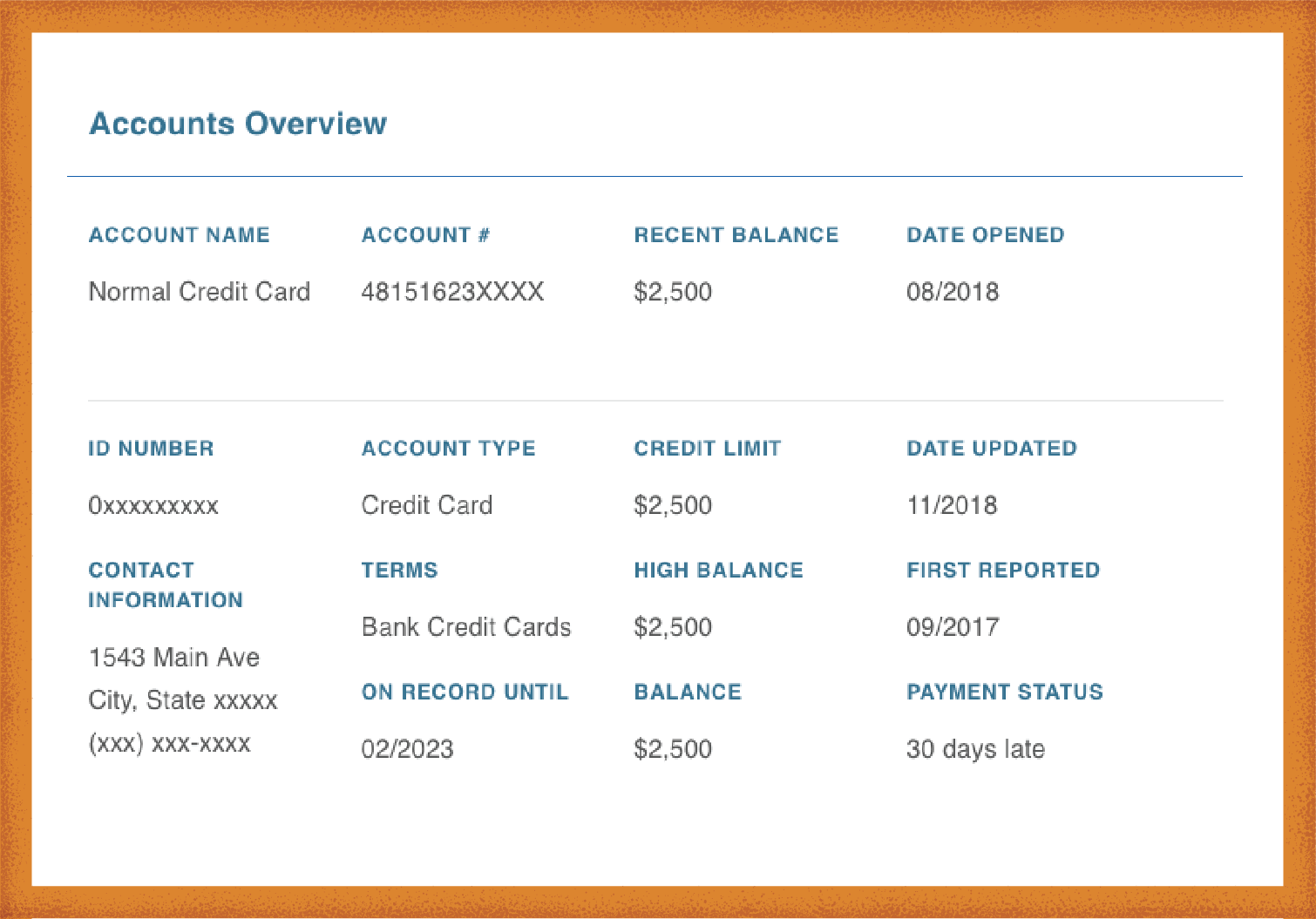

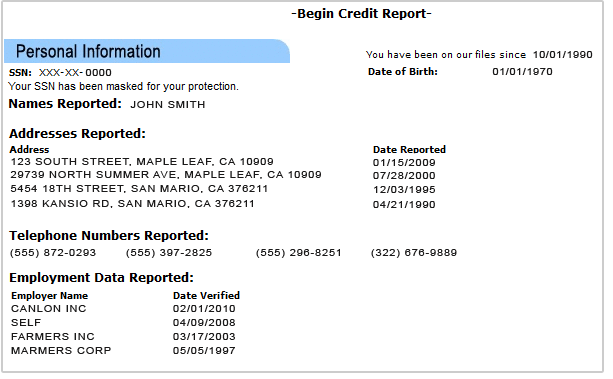

Carefully review each report for inaccuracies. Look for incorrect personal information (name, address, Social Security number), erroneous account details (balances, payment history), and unfamiliar accounts.

Common Errors to Watch For

Be vigilant for these red flags: mistaken identity (accounts belonging to someone else with a similar name), inaccurate payment statuses (reported late when paid on time), and accounts listed multiple times.

Also scrutinize incorrect credit limits, closed accounts reported as open, and fraudulent accounts opened without your knowledge.

Initiating a Dispute: Taking Action

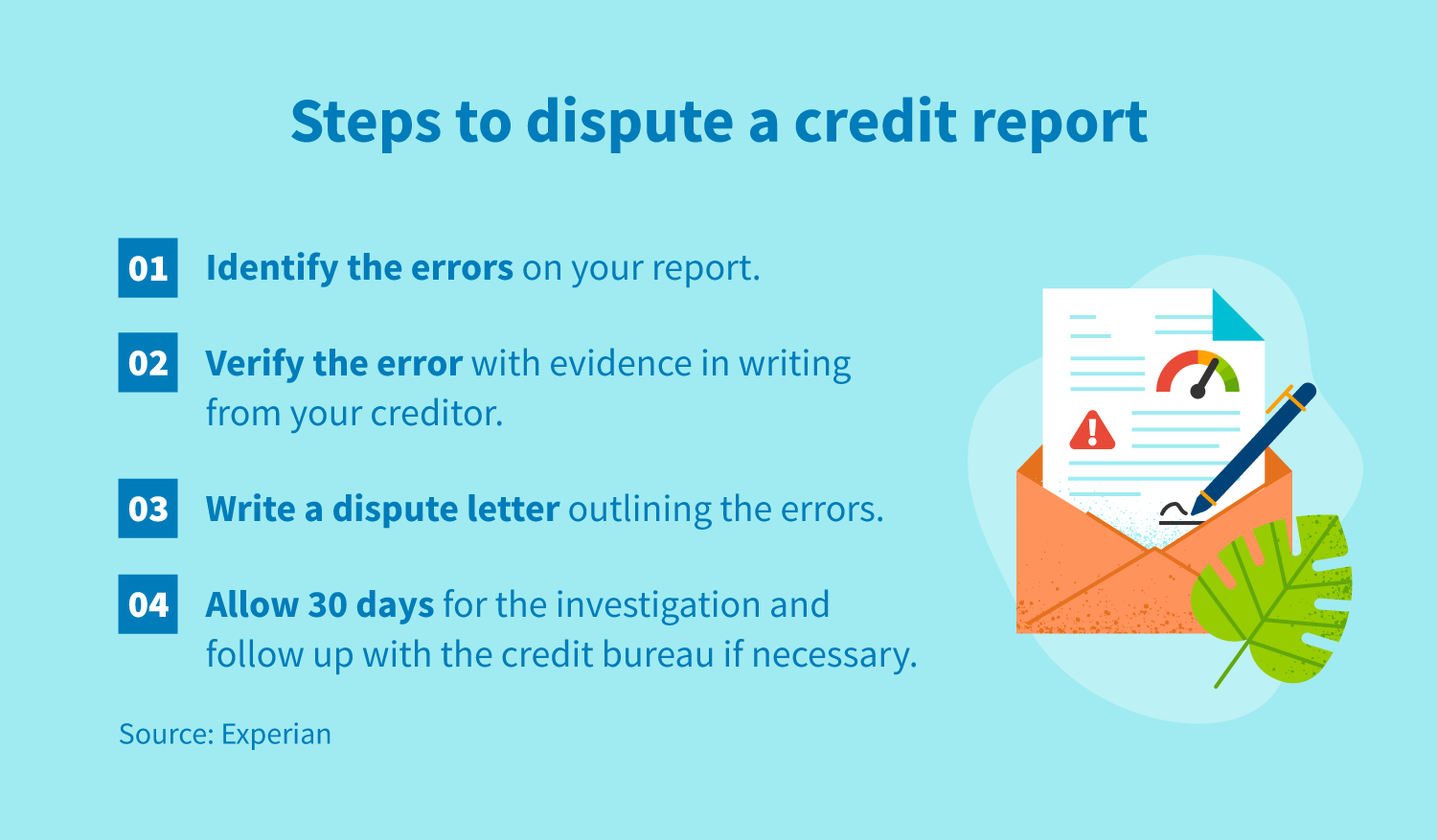

If you find an error, immediately file a dispute with the credit bureau that issued the incorrect report. You can do this online, by mail, or, in some cases, by phone.

Gather all supporting documentation. This might include payment confirmations, account statements, or any proof that supports your claim of inaccuracy.

Crafting Your Dispute Letter

Your dispute letter should be clear, concise, and factual. Include your full name, address, Social Security number, and a copy of your credit report with the disputed item circled.

Clearly explain the error and why you believe it is inaccurate. Attach copies of your supporting documentation, but never send originals.

Example Dispute Letter Excerpt: "I am writing to dispute the following inaccurate information on my credit report: Account number XXXXX, listed as late payments for three months. I have attached copies of my bank statements showing timely payments during those months."

The Credit Bureau's Investigation: What to Expect

The credit bureau has 30 days to investigate your dispute. They will contact the creditor who reported the information to verify its accuracy.

If the creditor confirms the error, the credit bureau must correct or delete the information from your report.

You will receive written notification of the results of the investigation. This will outline whether the disputed item was corrected, remains unchanged, or was deleted.

What if the Error Persists?

If the credit bureau upholds the error despite your evidence, you have further options. You can request that a statement of dispute be added to your credit report.

This statement will be included whenever your credit report is accessed, providing context to potential lenders about the disputed item. Consider contacting the creditor directly to resolve the issue.

Ongoing Monitoring: Staying Vigilant

Continue to monitor your credit reports regularly, even after correcting errors. This helps ensure new inaccuracies are promptly identified and addressed.

Consider signing up for credit monitoring services, which provide alerts when changes occur to your credit reports.

Taking proactive steps to manage your credit and dispute errors is crucial. Maintaining an accurate credit report is essential for your financial future.