How Do I Get Capital To Start A Business

Time is money: securing startup capital is the first, crucial hurdle for any aspiring entrepreneur. Don't let funding be the reason your business idea stays just an idea.

This guide provides a concise overview of essential strategies for raising capital, focusing on actionable steps you can take *now* to fuel your entrepreneurial dream. From bootstrapping to venture capital, understand your options and navigate the funding landscape effectively.

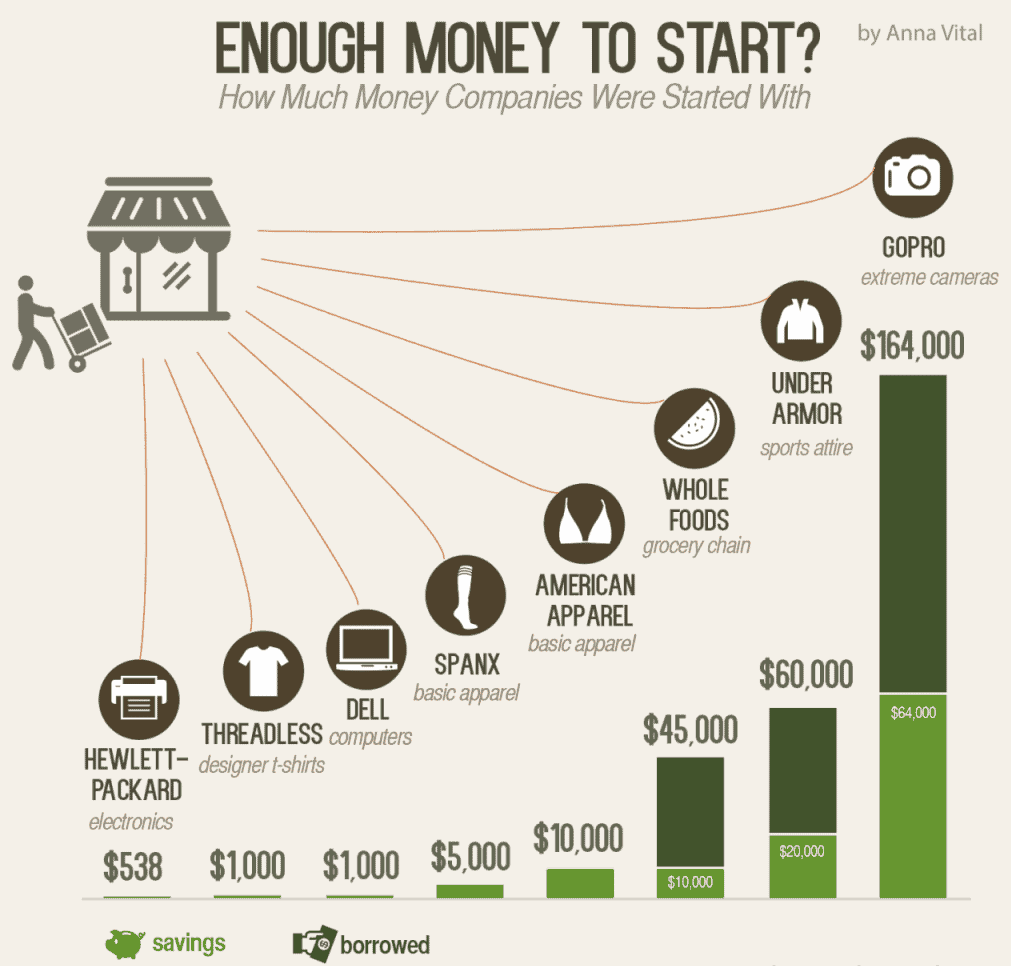

Bootstrapping: Funding From Your Own Pocket

Bootstrapping involves using your own savings, personal loans, and revenue from early sales to fund your business. It's the most common method for startups, granting you full control and avoiding external debt or equity dilution.

Who? Entrepreneurs with personal funds and a high tolerance for risk. What? Self-funding through savings and early revenue. Where? Everywhere, but especially suitable for businesses with low initial capital needs.

When? Ideal for the very beginning of your venture. How? Meticulously track expenses and prioritize profitability from day one.

Friends and Family: A Double-Edged Sword

Seeking investment from friends and family can be a quick source of capital. However, it’s crucial to treat these investments as formal transactions to avoid damaging relationships.

Who? Entrepreneurs with supportive networks willing to invest. What? Loans or equity investments from close contacts. Where? Within your immediate personal circle. When? Early stages, with caution. How? Create a formal agreement outlining terms and expectations.

Remember to maintain professionalism at all times. Clarity is key.

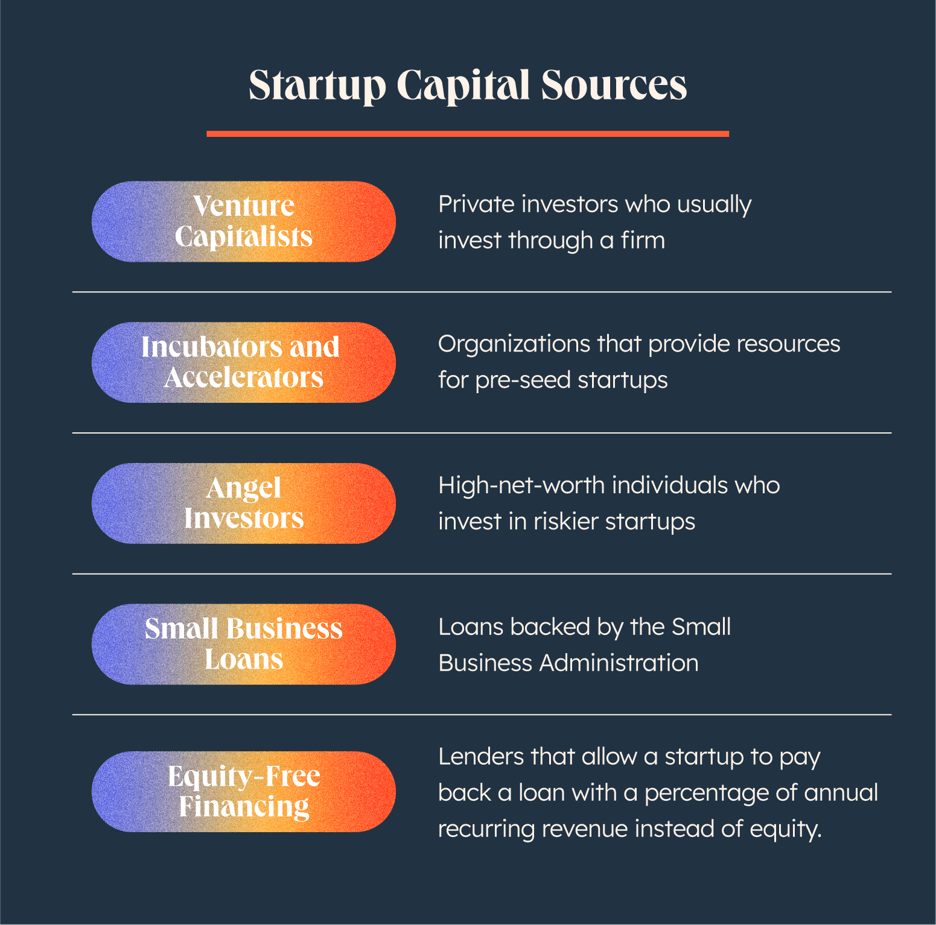

Small Business Loans: Debt Financing Options

Small business loans from banks and credit unions offer a structured way to secure larger sums of capital. These loans typically require collateral and a solid business plan.

Who? Established businesses with strong credit scores and a detailed business plan. What? Term loans, lines of credit, and SBA loans. Where? Banks, credit unions, and online lenders. When? After establishing some initial traction and a clear financial forecast. How? Prepare a comprehensive loan application, including financial statements and a business plan.

Angel Investors: Seed Funding from High-Net-Worth Individuals

Angel investors are wealthy individuals who invest in early-stage companies in exchange for equity. They often bring industry expertise and valuable connections to the table.

Who? Startups with high growth potential and a compelling business model. What? Equity investments in exchange for a percentage of ownership. Where? Angel investor networks, pitch events, and through referrals. When? After developing a minimum viable product (MVP) and demonstrating market validation. How? Craft a compelling pitch deck and network with angel investors in your industry.

Venture Capital: High-Risk, High-Reward Funding

Venture capital (VC) firms invest in high-growth startups with the potential for significant returns. VC funding is highly competitive and often involves a significant equity stake.

Who? Companies with disruptive technologies and scalable business models. What? Large equity investments. Where? Silicon Valley, major tech hubs, and through VC networks. When? After achieving significant traction and demonstrating the potential for rapid growth. How? Prepare a detailed business plan, financial projections, and a compelling pitch deck.

Crowdfunding: Tapping into the Power of the Crowd

Crowdfunding allows you to raise capital from a large number of people online, typically in exchange for rewards or equity. Platforms like Kickstarter and Indiegogo are popular options.

Who? Startups with innovative products or services that resonate with a broad audience. What? Donations, pre-sales, or equity investments from the public. Where? Online crowdfunding platforms. When? Before launching your product or service to generate early interest and funding. How? Create a compelling crowdfunding campaign with a clear value proposition and attractive rewards.

Kickstarter and Indiegogo are popular platforms.

Government Grants and Programs: Non-Dilutive Funding

Government grants and programs offer non-dilutive funding, meaning you don't have to give up equity. These programs are often competitive but can provide significant financial support.

Who? Startups in specific industries or those meeting certain criteria (e.g., minority-owned businesses). What? Grants and loans with favorable terms. Where? Government agencies at the federal, state, and local levels. When? Throughout the startup lifecycle, depending on the program requirements. How? Research available grants and programs, and prepare a detailed application.

The Small Business Administration (SBA) is a key resource.

Next Steps: Immediate Actions to Take

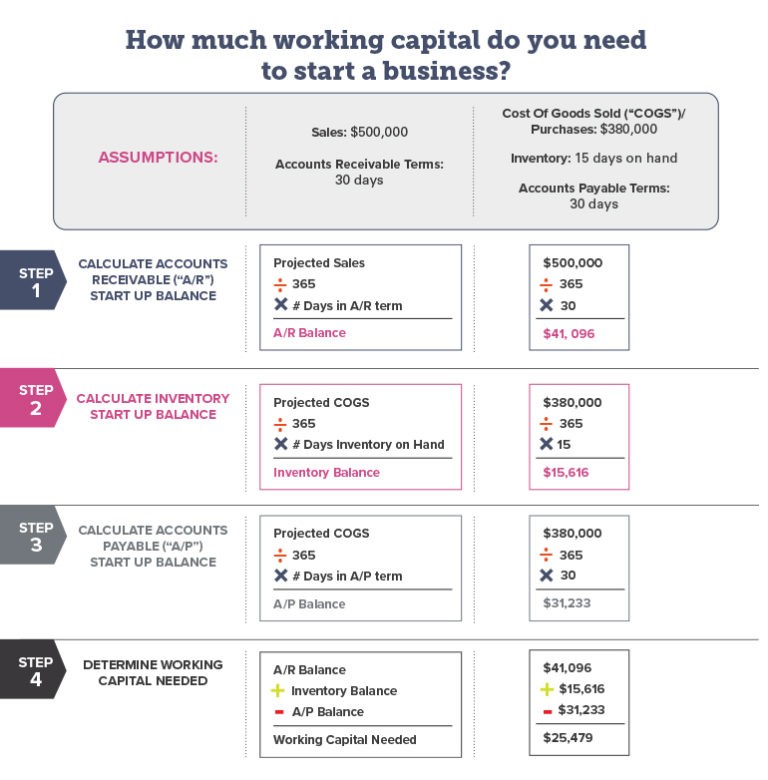

Assess your financial needs and determine the most appropriate funding sources for your business. Develop a detailed business plan and financial projections.

Start networking with potential investors and attending industry events. Prepare your pitch and practice your presentation.

Act now: your entrepreneurial journey starts with securing the necessary capital. Don't delay, start planning your financial strategy today.