How Do I Get Money To Start My Own Business

Imagine this: you’re sketching ideas on a napkin, a business plan swirling in your mind, the scent of opportunity thick in the air. That entrepreneurial spark has ignited, and the fire is burning bright. But then reality hits – how do you actually get the money to turn that dream into a thriving business?

Securing funding is often the biggest hurdle for aspiring business owners. Navigating the landscape of loans, grants, and investments can feel daunting, but understanding your options and preparing strategically can dramatically increase your chances of success.

Understanding Your Funding Options

The first step is to identify your funding needs. How much money do you actually need to get started? A detailed business plan is crucial here, outlining your projected expenses, revenue, and profitability.

Once you have a clear picture of your financial requirements, you can explore various funding avenues. These generally fall into a few broad categories: bootstrapping, loans, grants, and investments.

Bootstrapping: The DIY Approach

Bootstrapping involves using your own resources to finance your business. This could mean tapping into personal savings, selling assets, or even working a second job to generate capital.

It offers maximum control and avoids debt, but it can also be slow-going and require significant personal sacrifice. Many successful companies, including Mailchimp, started with bootstrapping.

Loans: Borrowing for Growth

Loans are a common way to fund a business, providing a lump sum of capital that you repay over time with interest. Small Business Administration (SBA) loans are often a good option, offering government-backed guarantees that can make it easier to qualify for favorable terms.

Traditional bank loans are another possibility, but they typically require strong credit and collateral. Online lenders have also emerged, offering faster application processes and potentially higher interest rates.

Grants: Free Money (with Strings Attached)

Grants are essentially free money, offered by government agencies, foundations, and corporations to support specific types of businesses or initiatives. Competition for grants can be fierce, and they often come with strict requirements and reporting obligations.

The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs, for example, provide grants to small businesses engaged in research and development. Be sure to thoroughly research eligibility criteria before applying.

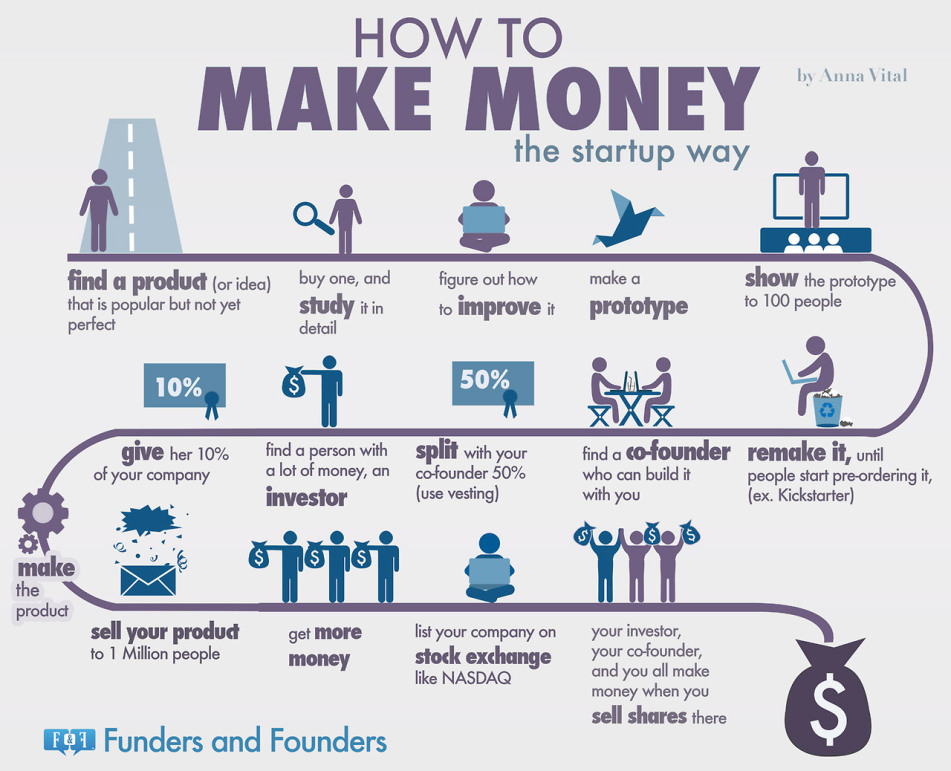

Investments: Partnering for Growth

Seeking investment involves selling a portion of your company to investors in exchange for capital. This can be a great way to access significant funding and gain valuable expertise, but it also means giving up some control.

Angel investors are individuals who invest their own money in early-stage companies, while venture capitalists are firms that manage funds from other investors. According to the National Venture Capital Association (NVCA), venture capital investment reached record levels in recent years, demonstrating strong investor interest in promising startups.

Preparing for Success

Regardless of the funding source you pursue, preparation is key. A well-crafted business plan is essential, demonstrating your understanding of the market, your competitive advantage, and your financial projections.

Your credit score is also important, as it can impact your ability to qualify for loans and secure favorable interest rates. Building a strong personal and business credit history is a long-term investment that will pay off in the long run.

Networking and building relationships with potential investors and lenders can also be beneficial. Attend industry events, connect with other entrepreneurs, and seek mentorship from experienced business owners.

The Journey Ahead

Securing funding is a challenging but achievable goal. By understanding your options, preparing strategically, and persevering through setbacks, you can increase your chances of bringing your business dream to life.

Remember that the entrepreneurial journey is a marathon, not a sprint. There will be obstacles along the way, but with passion, determination, and a well-funded plan, you can build a successful and rewarding business.