How Do You Dissolve A 50/50 Partnership

Businesses teetering on the brink: a 50/50 partnership dissolving can quickly become a high-stakes legal battle. Understanding the exit strategy now is critical to prevent financial disaster.

This article provides an immediate guide to navigating the complexities of dissolving a 50/50 partnership, ensuring compliance and minimizing potential legal fallout.

Immediate Steps to Take

First, immediately review the partnership agreement. This document is your roadmap, outlining procedures for dissolution, asset distribution, and dispute resolution.

If no formal agreement exists, the process becomes significantly more complex, often defaulting to state partnership laws.

Next, secure all financial records. Transparency and accurate accounting are vital to avoid accusations of misappropriation or fraud during the dissolution process.

Notification and Valuation

Notify all relevant parties: clients, vendors, and employees. Maintaining open communication can mitigate damage to business relationships during this transition.

Obtain a professional business valuation. This is crucial for determining the fair market value of the company's assets, a key factor in equitable distribution.

According to a 2023 study by the Small Business Administration (SBA), disputes over asset valuation are the leading cause of partnership dissolution lawsuits.

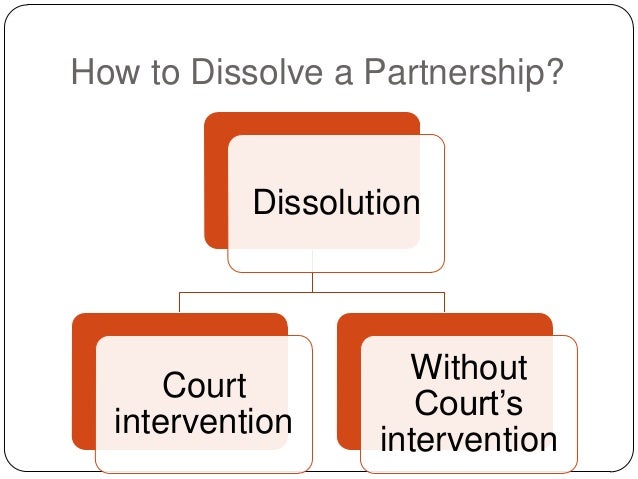

Legal Considerations

Engage an experienced business attorney immediately. A lawyer can guide you through the legal complexities and represent your interests during negotiations.

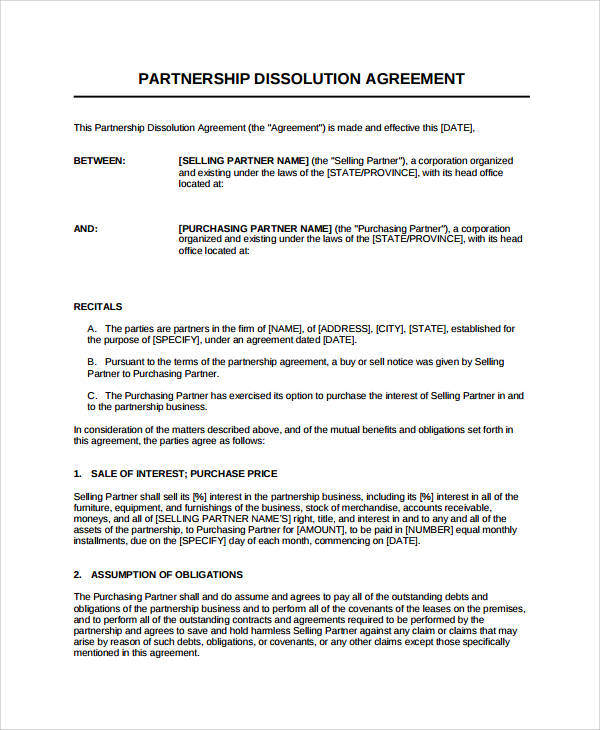

Dissolution can trigger various legal ramifications, including potential liability for existing debts and contracts.

Consider mediation or arbitration. These alternative dispute resolution methods can often be faster and less expensive than litigation.

Asset Distribution Strategies

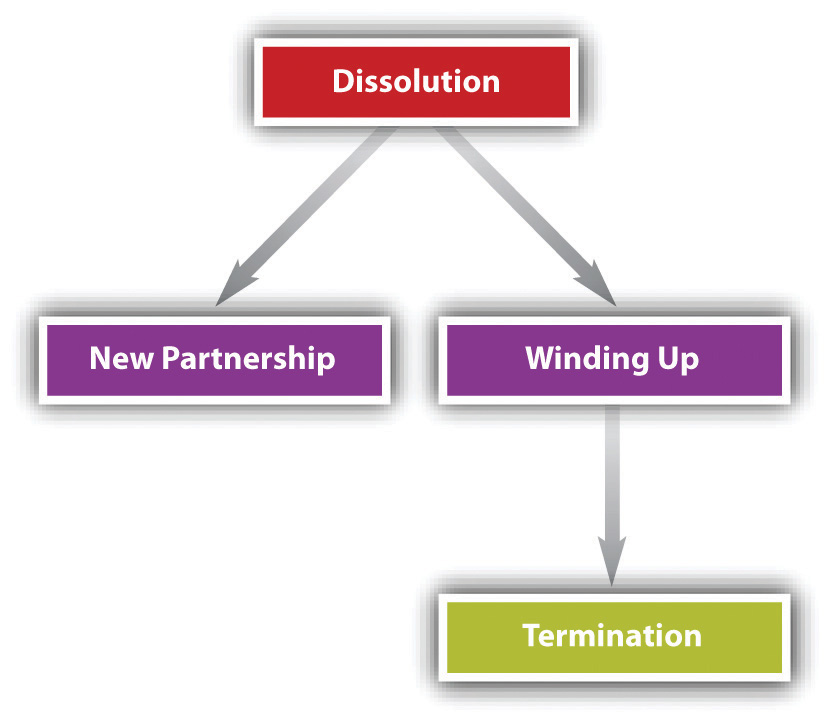

Negotiate a buyout. One partner can buy out the other's interest in the business, allowing for continued operation under sole ownership.

Liquidate the assets. This involves selling all business assets and distributing the proceeds to the partners according to their ownership percentages.

Formulate a detailed separation agreement. This legally binding document should outline the terms of the dissolution, including asset distribution, liability allocation, and non-compete clauses.

Potential Pitfalls to Avoid

Do not attempt to hide assets or manipulate financial records. This can lead to severe legal consequences, including criminal charges.

Avoid making unilateral decisions without consulting your partner or legal counsel. This can create animosity and escalate disputes.

Do not ignore existing contracts or obligations. Failing to fulfill contractual obligations can lead to lawsuits and reputational damage.

Financial Implications

Understand the tax implications of dissolution. Seek advice from a qualified tax professional to minimize tax liabilities.

Dissolution may trigger capital gains taxes on the sale of assets or the buyout of a partner's interest.

Closure costs, including legal fees and accounting expenses, must also be factored into the financial planning.

Next Steps

Schedule a consultation with a business attorney specializing in partnership dissolutions today. Time is of the essence.

Document all communication and agreements in writing. This creates a clear record of events and can be crucial in resolving disputes.

Prepare for a potentially lengthy and challenging process. Patience and strategic planning are key to achieving a favorable outcome.