How Do You Get Money Off Your Paypal Account

:max_bytes(150000):strip_icc()/006-withdraw-money-from-paypal-instantly-4580630-32dfeb91ced34632ad77f2eda314bb8d.jpg)

Imagine this: you've just sold that vintage guitar you've been meaning to part with, or perhaps you've received a thoughtful gift from a loved one across the country. The funds are sitting pretty in your PayPal account, a digital wallet brimming with potential. But how do you transform those digital dollars into something tangible, something you can use to pay bills, treat yourself, or invest in a future dream? It's a question many of us ponder, navigating the sometimes-murky waters of online finance.

This article serves as your friendly guide to unlocking the funds held within your PayPal account. We'll explore the various methods available for withdrawing your money, highlighting the pros and cons of each to help you make informed decisions.

Understanding Your Options: A Deep Dive

The beauty of PayPal lies in its versatility, and that extends to withdrawing your funds. There's no one-size-fits-all approach; the best method depends on your individual needs and preferences.

1. Bank Transfer: The Reliable Route

Perhaps the most common method is transferring your funds directly to your bank account. This option is typically straightforward and secure, allowing you to seamlessly integrate your PayPal balance with your existing financial infrastructure.

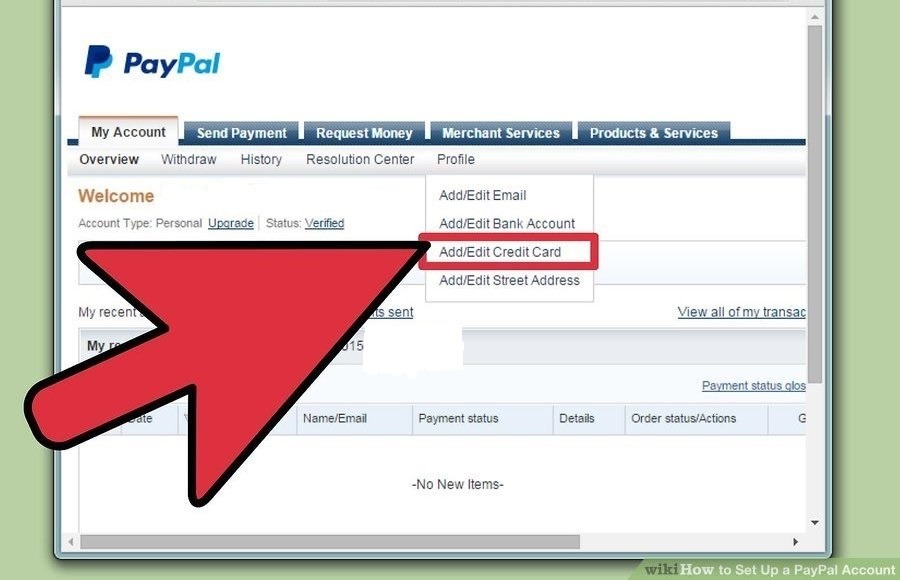

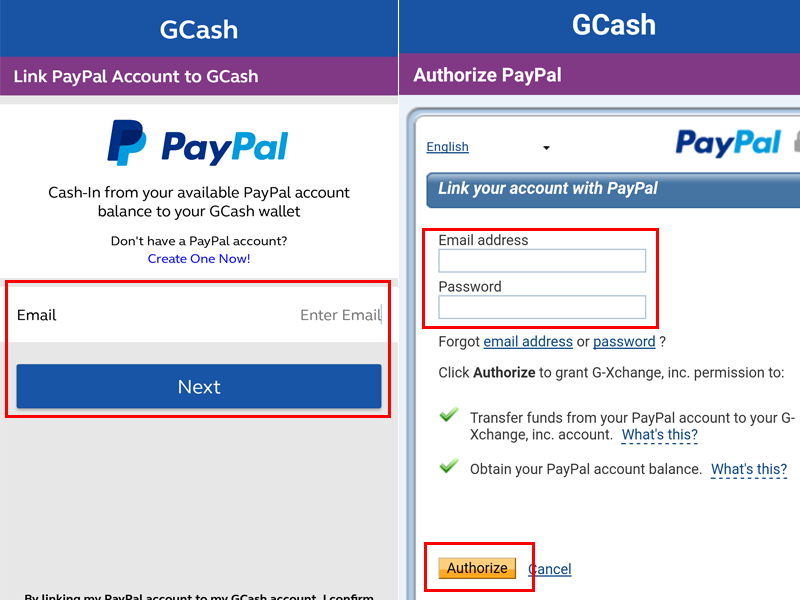

To initiate a bank transfer, you'll need to link your bank account to your PayPal account. This involves providing your bank's routing number and your account number, information readily available on your checks or through your bank's online portal.

PayPal may require you to verify your bank account for security purposes, usually by depositing a small amount into your account and asking you to confirm the exact amount. This process ensures that you are indeed the rightful owner of the linked account.

Once your bank account is linked and verified, withdrawing funds is as simple as selecting the "Transfer to Bank" option within your PayPal account. You'll be prompted to enter the amount you wish to withdraw and confirm the transaction.

The time it takes for the funds to appear in your bank account can vary, typically ranging from one to three business days. PayPal usually specifies the estimated arrival date before you finalize the transaction.

2. Debit Card Withdrawal: Speed and Convenience

For those seeking a faster alternative, withdrawing to a debit card linked to your PayPal account can be a convenient option. This method often allows for quicker access to your funds, sometimes within minutes.

Keep in mind that debit card withdrawals may incur fees, depending on your PayPal account type and the card you're using. Be sure to review the fee structure before proceeding with this option.

Similar to bank transfers, you'll need to link your debit card to your PayPal account. Once linked, you can select the "Transfer to Card" option and follow the prompts to complete the withdrawal.

3. Requesting a Check: A Traditional Approach

While less common in our increasingly digital world, PayPal still offers the option of receiving a paper check in the mail. This method may be preferred by those who prefer traditional banking methods or lack a bank account.

Requesting a check typically involves a processing fee, and the delivery time can be significantly longer compared to electronic transfer options. Be sure to factor in these considerations when choosing this method.

To request a check, navigate to the "Withdraw Funds" section of your PayPal account and select the "Request a Check" option. You'll need to provide your mailing address, and PayPal will then process and mail the check to you.

4. PayPal Cash Card: Spending Directly from Your Balance

The PayPal Cash Card is a debit card linked directly to your PayPal balance. This allows you to spend your PayPal funds anywhere that accepts Mastercard, both online and in brick-and-mortar stores.

With the PayPal Cash Card, you can avoid the need to transfer funds to your bank account before making purchases. It offers a seamless and convenient way to utilize your PayPal balance for everyday spending.

You can apply for a PayPal Cash Card through your PayPal account. Once approved, the card will be mailed to you, and you can activate it to start using your PayPal balance for purchases.

Understanding Fees and Limits

Before initiating any withdrawal, it's crucial to understand the associated fees and limits. PayPal's fee structure can vary depending on your account type, the withdrawal method you choose, and the currency involved.

Be sure to review PayPal's fee schedule carefully to avoid any surprises. You can find this information on PayPal's website or within your account settings.

PayPal also imposes withdrawal limits, which may vary depending on your account status and verification level. If you need to withdraw a large sum of money, it's advisable to check your withdrawal limits beforehand to ensure a smooth transaction.

Verifying your PayPal account often unlocks higher withdrawal limits and enhances the security of your account. This typically involves providing additional information, such as your social security number or proof of address.

Security Considerations: Protecting Your Funds

Security is paramount when dealing with online finances. Always prioritize the safety of your PayPal account and be vigilant against phishing scams and fraudulent activities.

Enable two-factor authentication to add an extra layer of security to your account. This requires you to enter a unique code from your phone in addition to your password when logging in.

Be wary of suspicious emails or messages asking for your PayPal login credentials or financial information. PayPal will never ask for your password or bank account details via email.

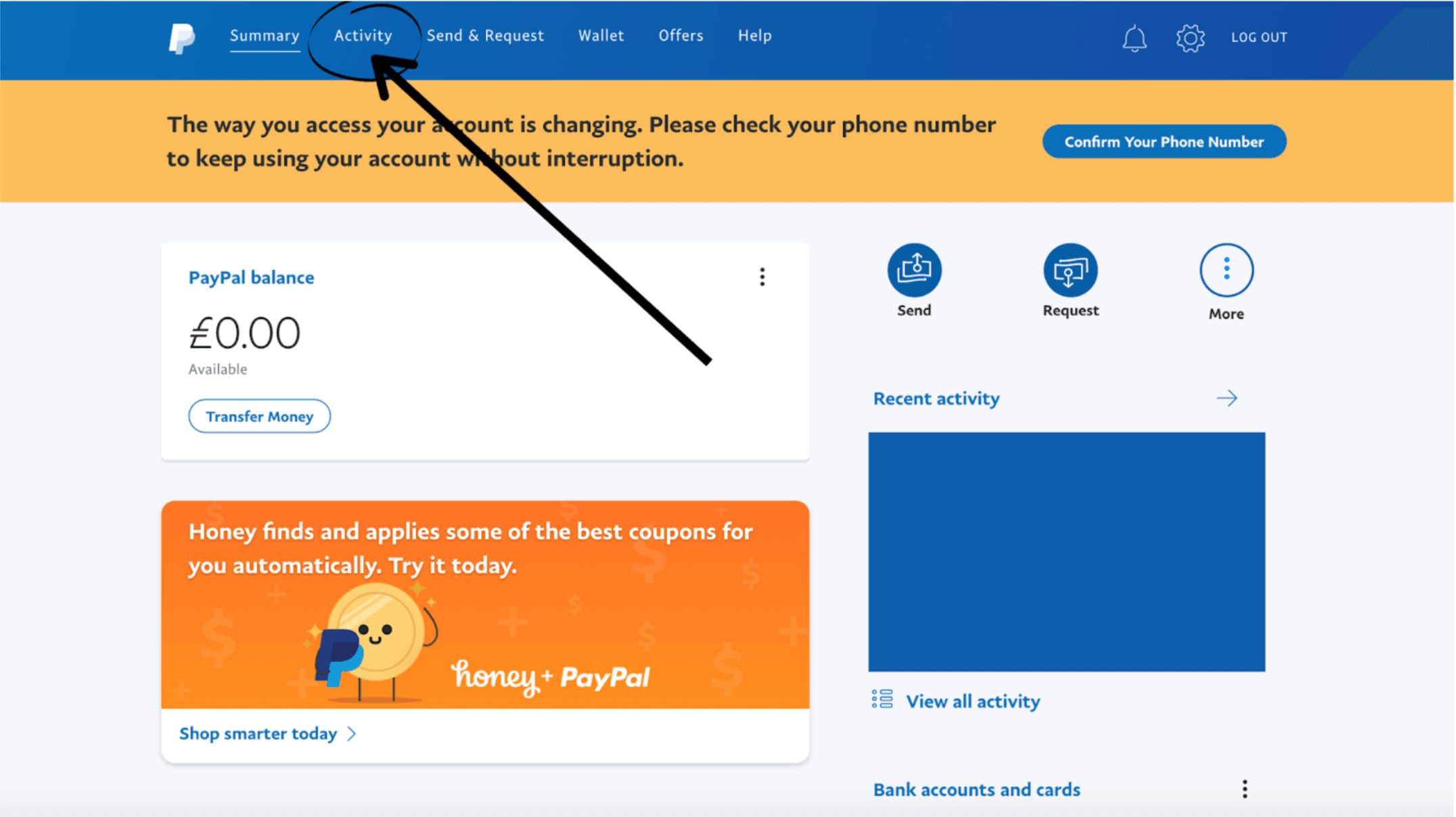

Regularly review your PayPal account activity and report any unauthorized transactions immediately. PayPal offers robust fraud protection and will investigate any suspicious activity.

Navigating the Digital Landscape: A Thoughtful Approach

Withdrawing money from your PayPal account is generally a straightforward process, but understanding the various options, fees, and security measures is essential for a smooth and secure experience. Take the time to familiarize yourself with PayPal's policies and procedures to make informed decisions about your online finances.

As the digital landscape continues to evolve, staying informed and proactive about your online financial security is more important than ever. By understanding the nuances of platforms like PayPal, you can confidently manage your digital wallet and unlock the potential of your online funds.

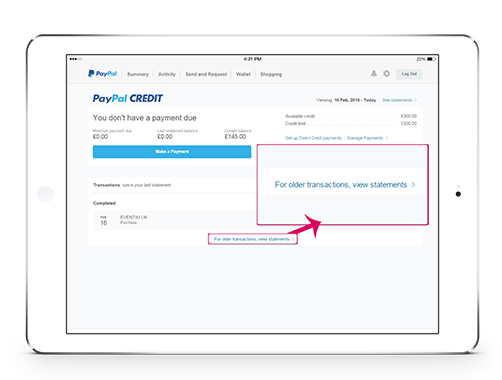

:max_bytes(150000):strip_icc()/003-001-withdraw-money-from-paypal-instantly-4580630-1c0fce114d4149069c8a3c1ba1b154ce.jpg)

:max_bytes(150000):strip_icc()/002_transfer-money-from-paypal-to-bank-account-4582759-ccada152c5dc4c9fa4a38a5d0c536cc0.jpg)