How Do You Get The Money To Start A Business

The dream of starting a business is a powerful one, driving countless individuals to take the leap into entrepreneurship. However, turning that dream into reality often hinges on a critical resource: funding. Securing the necessary capital can seem daunting, but understanding the available avenues and strategies is the first step towards launching a successful venture.

This article explores the various funding options available to aspiring business owners, providing a comprehensive overview of the resources and strategies that can help them secure the financial backing needed to bring their ideas to life. We will delve into the details of each option and highlight potential benefits and challenges for entrepreneurs.

Bootstrapping and Personal Savings

For many entrepreneurs, the journey begins with bootstrapping. This approach involves utilizing personal savings, assets, and revenue generated directly by the business to fund its operations. It requires frugality and resourcefulness, but allows the founder to maintain complete control and avoid external debt early on.

Relying on personal savings can be a significant risk, but it demonstrates commitment and can be a stepping stone to attracting other investors later. However, it is crucial to carefully assess personal finances to ensure that dipping into savings won't jeopardize one's financial stability.

Friends and Family

Seeking financial support from friends and family is a common early-stage funding strategy. These individuals often invest based on their belief in the entrepreneur and their idea. Such investments can be structured as loans or equity stakes.

While potentially more accessible than traditional funding sources, borrowing from loved ones can strain relationships if not managed carefully. Formalizing the agreement with a clear repayment plan is crucial. Furthermore, consulting a legal professional to create legally binding document is recommended.

Small Business Loans

Small Business Administration (SBA) loans are a popular option for startups and established businesses. These loans are partially guaranteed by the SBA, reducing risk for lenders and making it easier for businesses to qualify.

According to the SBA, its loan programs provide access to capital for businesses that might not otherwise qualify for traditional financing. The SBA offers a variety of loan programs tailored to different business needs.

However, securing an SBA loan can be a lengthy process, requiring detailed documentation and a solid business plan. Moreover, the repayment terms and interest rates must be carefully considered.

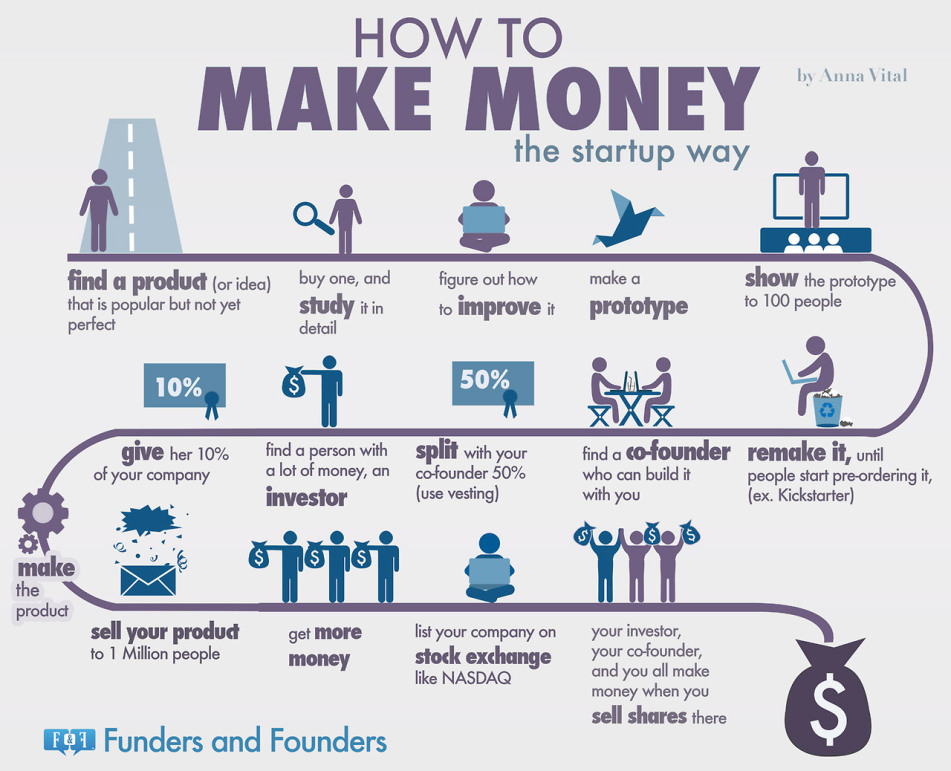

Angel Investors

Angel investors are high-net-worth individuals who invest their own money in early-stage companies. They often provide not only capital but also mentorship and industry expertise. Finding the right angel investor is key to having a great supporter.

Angel investors typically seek a significant equity stake in the company in exchange for their investment. This means that the entrepreneur will have to share ownership and potentially control of the business.

Venture Capital

Venture capital (VC) firms invest in high-growth potential companies in exchange for equity. VC funding is generally reserved for businesses with a proven track record and a clear path to significant returns. For more info, you can check National Venture Capital Association (NVCA) for data statistics of investment activities.

Securing VC funding is a highly competitive process. Entrepreneurs must present a compelling business plan and demonstrate the potential for significant market disruption.

Crowdfunding

Crowdfunding platforms like Kickstarter and Indiegogo allow entrepreneurs to raise capital from a large number of individuals, typically in exchange for rewards or pre-orders. It is important to carefully prepare a promotional campaign before hand.

Crowdfunding can be an effective way to validate a product or service and generate early buzz. However, it requires significant marketing effort and carries the risk of not reaching the funding goal.

Grants

Grants, offered by government agencies and private foundations, provide funding that does not need to be repaid. This makes them a highly desirable source of capital for eligible businesses. Be sure to check Grants.gov to discover available federal grants.

Grants are often highly competitive and targeted towards specific industries or demographics. The application process can be lengthy and rigorous.

Conclusion

Securing funding is a critical step in launching and growing a successful business. Understanding the various funding options available, from bootstrapping to venture capital, is essential for entrepreneurs. Researching the available programs and consulting with financial advisors can significantly increase the chances of obtaining the necessary capital to turn a business dream into a reality.

![How Do You Get The Money To Start A Business How to Start a Business: A Startup Guide for Entrepreneurs [Template]](https://blog.hubspot.com/hs-fs/hubfs/tips-for-starting-a-business.png?width=1125&name=tips-for-starting-a-business.png)