How Much Should Small Business Owners Pay Themselves

The question of how much a small business owner should pay themselves is a complex one, often fraught with conflicting priorities. Balancing personal financial needs with the business's growth, stability, and investment potential requires careful consideration. There is no one-size-fits-all answer, as optimal compensation hinges on a multitude of factors.

This article delves into the intricacies of owner compensation, exploring the variables that influence the decision and offering insights from financial experts.

Understanding the Factors at Play

The decision of how much to draw as salary involves a delicate balancing act. The business's profitability, cash flow, stage of development, and industry benchmarks are all crucial considerations.

Owner's personal financial obligations, such as mortgage payments, family expenses, and retirement savings, also play a significant role. Furthermore, tax implications and legal structures further complicate the process.

Profitability and Cash Flow

A business's profitability is a primary determinant. A consistently profitable business can generally afford to pay its owner a higher salary compared to a struggling startup.

However, profitability alone isn't enough. A business might be profitable on paper but still face cash flow challenges, making it difficult to allocate funds for owner compensation. Cash flow is king, as many business advisors reiterate.

According to the Small Business Administration (SBA), understanding your financial statements, including profit and loss statements and cash flow statements, is vital for making informed decisions about owner compensation.

Stage of Business Development

The stage of the business's life cycle significantly impacts compensation decisions. In the early stages, reinvesting profits for growth is often prioritized.

Established businesses with stable revenue streams may have more flexibility to increase owner pay. A new business owner should consider prioritizing the long-term health of the company over immediate personal gain.

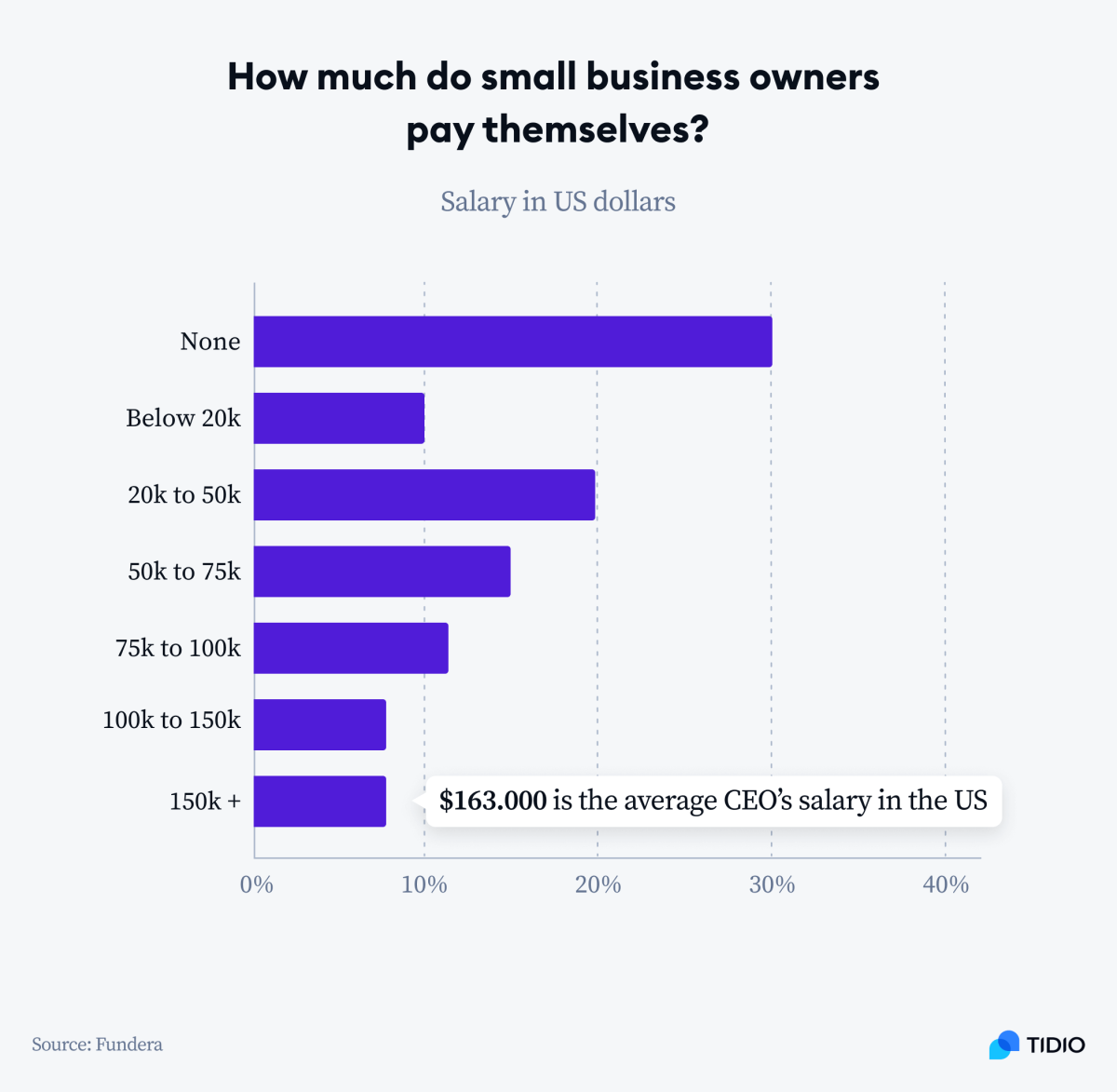

Industry Benchmarks

Researching industry benchmarks can provide valuable context. Resources like Bureau of Labor Statistics (BLS) offer salary data for various occupations within specific industries.

This data can help owners determine a reasonable salary range based on their role and responsibilities within the company. It's important to consider the size of the business when reviewing benchmark data, as smaller companies may offer lower salaries compared to larger corporations.

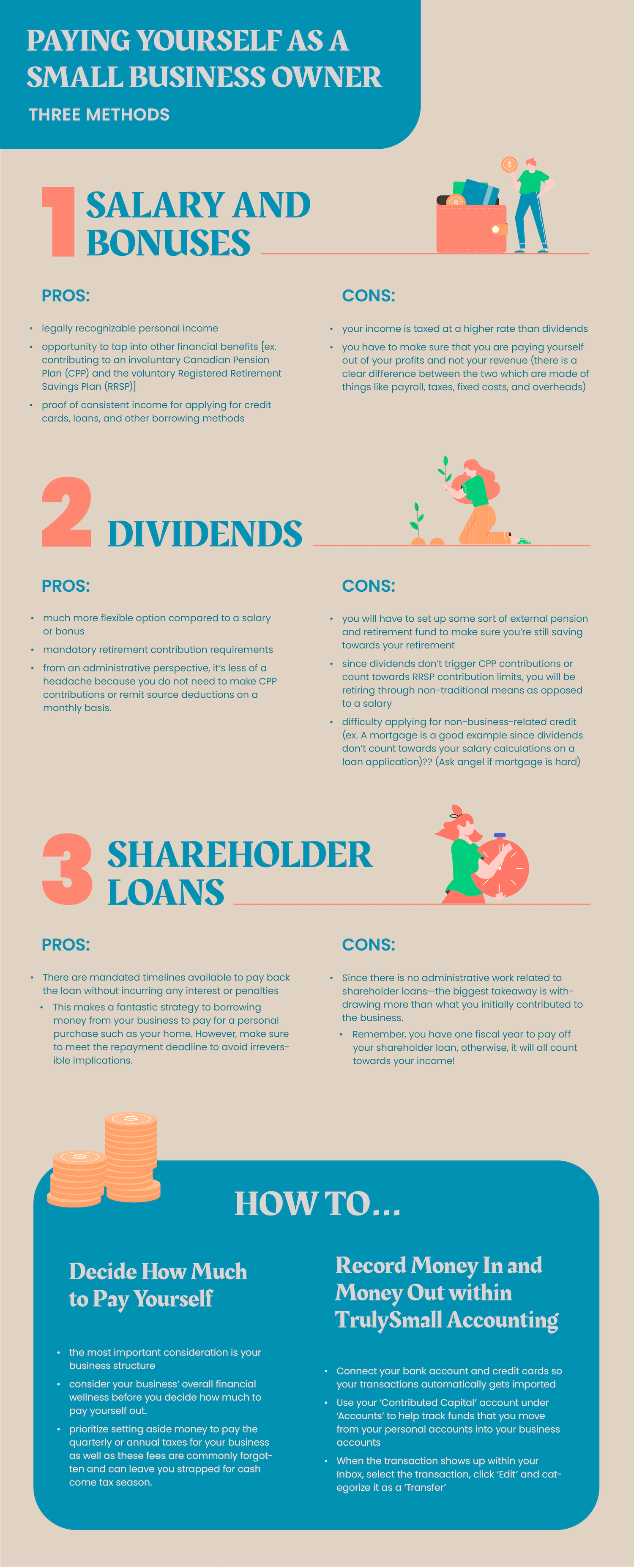

Legal Structure and Tax Implications

The legal structure of the business (sole proprietorship, partnership, LLC, S-corp, C-corp) significantly affects how owner compensation is handled for tax purposes. Different structures have different tax implications.

For example, S-corps require owners to take a "reasonable salary" before taking distributions, which are taxed differently. Seeking advice from a qualified tax professional is essential to optimize tax strategies related to owner compensation.

"The most important thing is to work with a tax advisor and CPA that understands your business and your goals, to make sure you’re compliant with all of the regulations." - Jane Smith, Certified Public Accountant.

Finding the Right Balance

The optimal owner compensation strategy involves finding a balance between personal needs and business requirements. Owners should create a realistic budget that outlines their personal expenses and financial goals.

They should also develop a comprehensive business plan that projects revenue, expenses, and cash flow. These projections will help them to determine how much they can afford to pay themselves without jeopardizing the business's financial health.

Regularly reviewing these plans and adjusting compensation accordingly is crucial. As the business grows and evolves, owner compensation should be reevaluated to ensure it remains aligned with the company's performance and the owner's needs.

Human-Interest Angle

Consider Maria Rodriguez, the owner of a small bakery in a bustling city. In the early years, Maria prioritized reinvesting profits to expand her business, often taking a minimal salary.

She worked tirelessly, juggling multiple roles and making personal sacrifices. Today, her bakery is thriving, allowing her to take a more comfortable salary while still investing in the company's future.

Her journey illustrates the importance of patience, perseverance, and strategic financial planning in determining owner compensation.

Conclusion

Determining appropriate owner compensation is a nuanced process that requires careful consideration of various factors. Profitability, cash flow, stage of development, industry benchmarks, legal structure, and tax implications all play a role.

By seeking expert advice, creating realistic financial plans, and regularly reviewing compensation strategies, small business owners can strike a balance between their personal needs and the long-term success of their ventures.

Ignoring either aspect can lead to detrimental outcomes, either personal financial strain or stunted business growth. Prioritizing both requires diligence and sound financial acumen.