How Do You Get Your W2 From A Previous Employer

Missing your W2 from a previous employer? Time is ticking, as you need it to file your taxes accurately and on time. Here's how to track it down and avoid potential penalties.

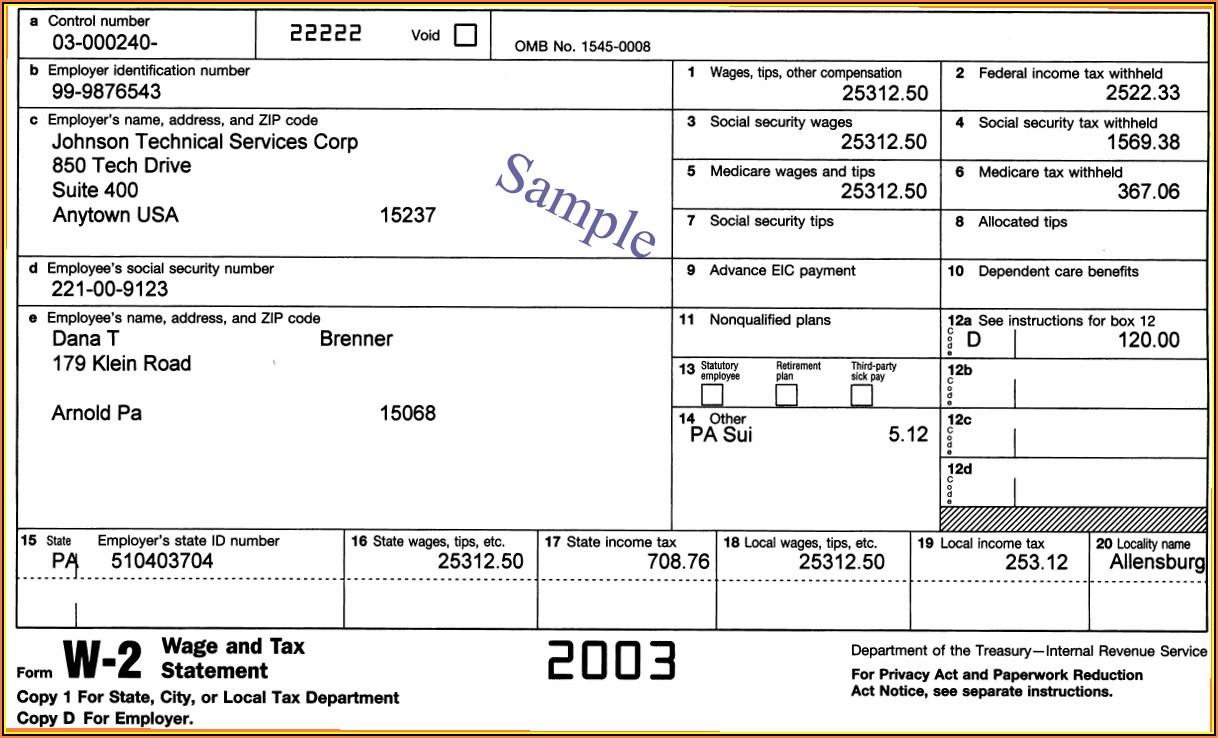

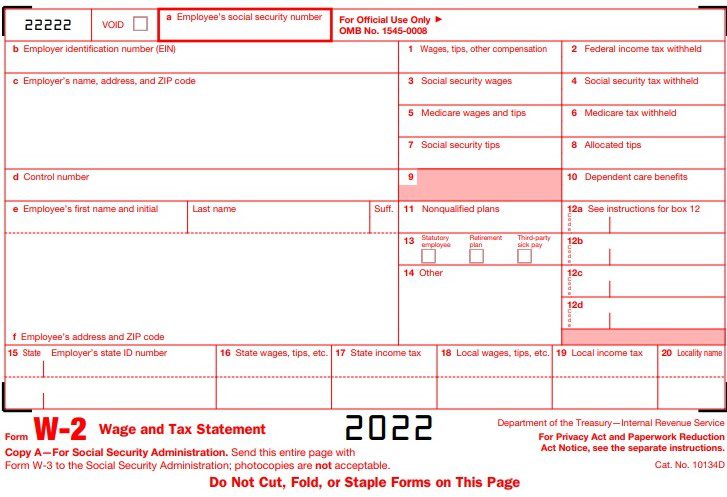

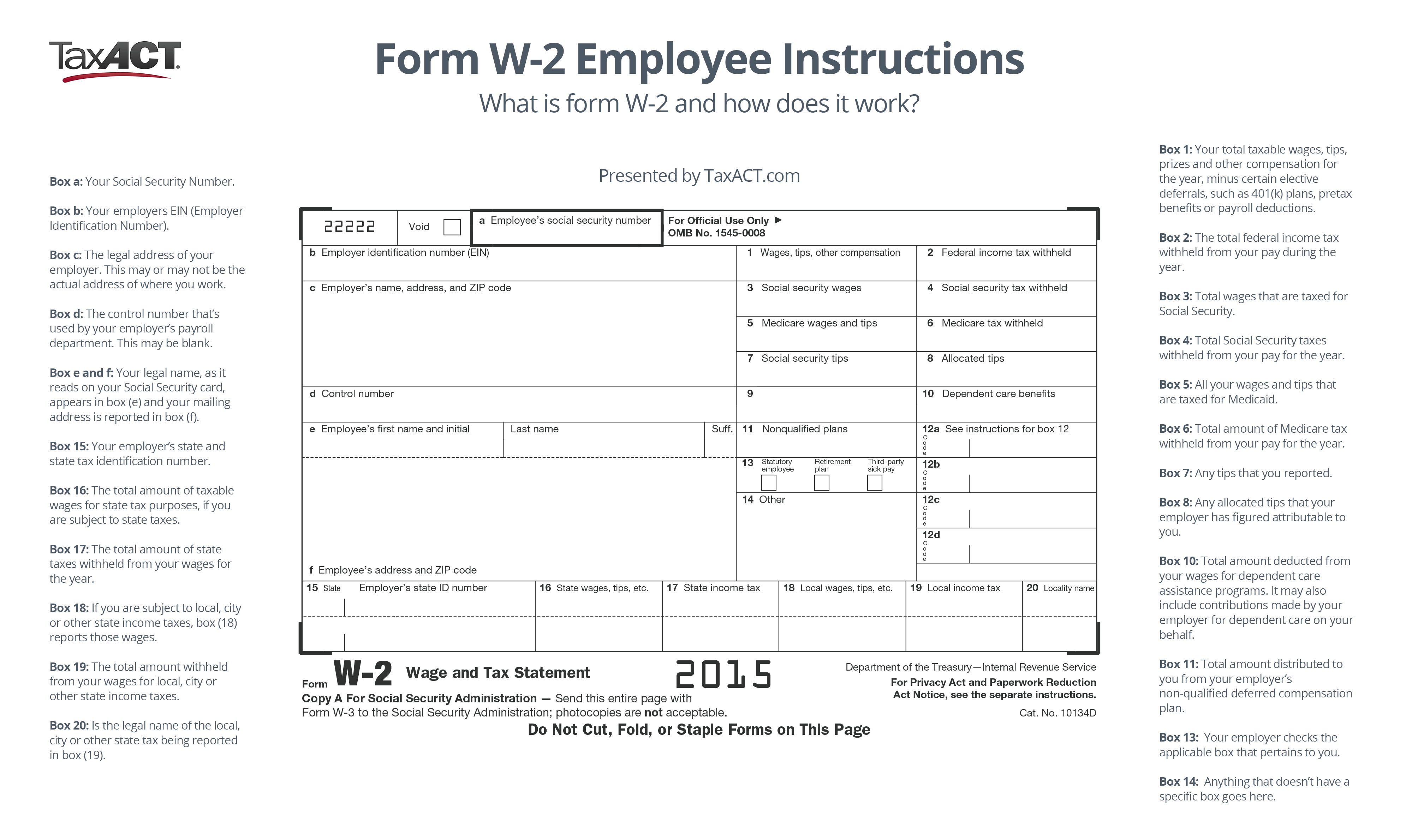

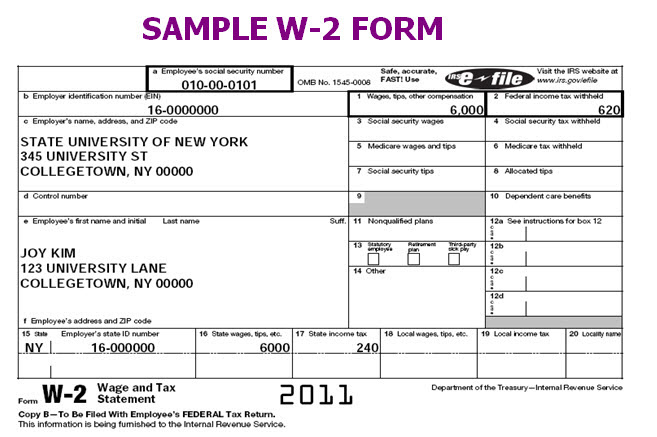

Getting your W2 is crucial for filing your taxes by the April deadline. This document details your earnings and taxes withheld, ensuring you get the correct refund or pay the necessary amount. Don't panic, here's what you need to do.

Contact Your Former Employer Immediately

Your first step should always be to directly contact your previous employer's HR department or payroll department. According to the IRS, employers are legally required to furnish W2s to their employees by January 31st of each year.

Request that they send you a copy of your W2, either electronically or via mail. Provide them with your current mailing address and any other identifying information they may need. Make sure to ask if they have an online portal you can access to retrieve it.

Check Your Former Employer's Online Portal

Many companies now use online portals to distribute W2 forms. Check if your previous employer offered such a system and attempt to log in. You might need to reset your password if you haven't accessed the portal recently.

If you can access the portal, download and save your W2 immediately.

Contact the IRS If You Can't Get Your W2

If you haven't received your W2 by mid-February and attempts to contact your employer have been unsuccessful, contact the IRS. The IRS can assist in obtaining your W2, but you'll need to take specific steps.

Call the IRS at 1-800-829-1040. You will need to provide your name, address, Social Security number, phone number, the dates of employment, and your former employer’s name, address, and phone number.

File Form 4852 as a Last Resort

If you still haven't received your W2 by the tax filing deadline, you may need to file Form 4852, Substitute for Form W-2, Wage and Tax Statement. This form allows you to estimate your wages and taxes withheld based on your best available records.

Fill out Form 4852 with as much information as possible. It's crucial to be as accurate as possible to avoid potential issues with the IRS. You'll need to explain why you didn't receive your W2 and how you estimated your wages.

Keep Accurate Records

Keep copies of all communications with your former employer and the IRS. This documentation will be helpful if any issues arise during the tax filing process.

It is also advisable to retain your final pay stub from the relevant tax year, as it contains valuable information that can aid in completing Form 4852.

What Happens Next?

The IRS will contact your former employer to request the missing W2. Filing Form 4852 allows you to meet the tax filing deadline even without the official document. Be prepared to amend your return if you receive the W2 later and the information differs from your estimates.

:max_bytes(150000):strip_icc()/W-2-6a38541136824d2481dfde8e6146cf44.jpeg)