How Do You Know If You Owe On Taxes

The tax season can be a stressful time, leaving many Americans wondering whether they'll receive a refund or face an unexpected tax bill. Understanding how to determine if you owe taxes is crucial for financial planning and avoiding penalties.

This article aims to provide clarity on how to assess your tax obligations, identify potential red flags, and navigate the resources available to help you stay on top of your taxes. Knowing your tax standing empowers you to take proactive steps, minimizing surprises and ensuring compliance with IRS regulations.

Understanding Withholding and Estimated Taxes

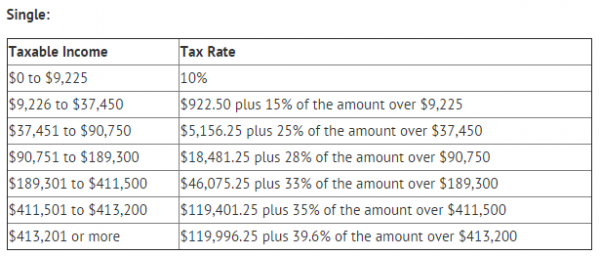

The primary way most people pay taxes is through withholding from their paycheck. Your employer withholds a portion of your earnings and sends it to the IRS on your behalf.

The amount withheld is based on the information you provide on Form W-4. Reviewing your W-4 regularly is important, especially after significant life changes like marriage, divorce, or the birth of a child.

Individuals who are self-employed, receive income from investments, or have other sources of income that are not subject to withholding are usually required to pay estimated taxes. These payments are made quarterly to the IRS.

Key Indicators That You May Owe Taxes

Several factors can indicate that you may owe taxes at the end of the year. Significant life changes, such as starting a new job or experiencing a change in marital status, often necessitates adjustment in withholdings.

Itemizing deductions instead of taking the standard deduction can also lead to owing taxes if your itemized deductions are not high enough to offset your income. Income from side hustles or investments that are not subject to withholding are prime examples.

Receiving unemployment benefits can also trigger a tax liability, as these benefits are generally taxable. Remember to consider all income sources.

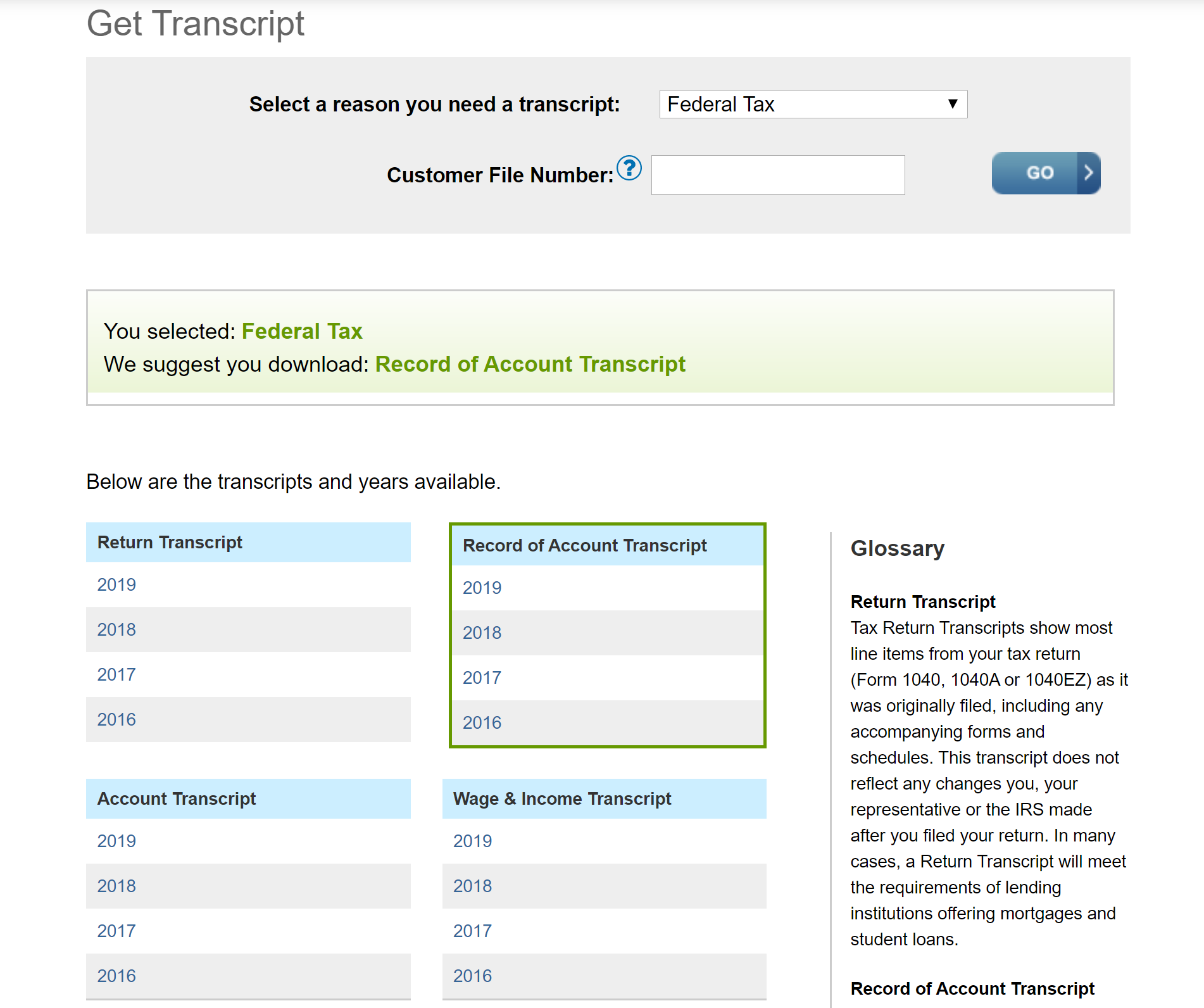

Checking Your Tax Liability

The IRS provides several tools and resources to help you estimate your tax liability. The IRS Tax Withholding Estimator is a free online tool that can help you determine if your current withholding is sufficient to cover your tax obligations.

By inputting your income, deductions, and credits, the estimator will project your tax liability for the year. Review your tax returns from previous years, if you owed last year you need to check this year.

You can also consult with a tax professional, a Certified Public Accountant (CPA) can provide personalized advice and guidance based on your specific financial situation. They can analyze your income, deductions, and credits to accurately assess your tax liability.

Addressing a Tax Bill

If you determine that you owe taxes, don't panic. The IRS offers several options for paying your tax bill, including online payments, payments by phone, and payments by mail.

If you are unable to pay your tax bill in full, you may be eligible for an installment agreement or an offer in compromise. An installment agreement allows you to pay your tax bill over time, while an offer in compromise allows you to settle your tax debt for a lower amount than you owe.

Ignoring a tax bill can lead to penalties and interest, so it's important to take action as soon as possible. Reach out to the IRS or a tax professional to discuss your options.

Staying Informed and Proactive

Staying informed about tax laws and regulations is essential for avoiding surprises and ensuring compliance. Subscribe to the IRS email updates, follow them on social media, or consult with a tax professional to stay up-to-date on the latest tax changes.

Regularly review your withholding and estimated tax payments to ensure that you are paying enough taxes throughout the year. By taking a proactive approach to your taxes, you can minimize the risk of owing taxes at the end of the year and avoid penalties.

"Understanding your tax obligations is a key component of financial literacy," says Lisa Thompson, a financial advisor. "By taking the time to assess your tax liability and plan accordingly, you can avoid surprises and ensure that you are meeting your tax obligations."

Ultimately, determining whether you owe taxes is a matter of understanding your income, deductions, and credits, and utilizing the resources available to you. With careful planning and attention to detail, you can navigate the tax season with confidence and avoid unexpected tax bills.