James Altucher Ai 2.0 Stock Picks

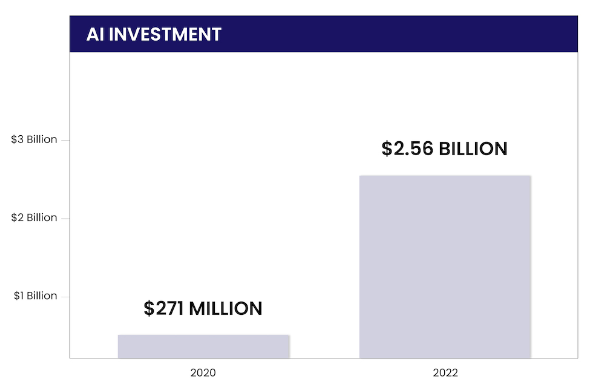

The intersection of artificial intelligence and financial markets continues to captivate investors, fueled by the promise of unprecedented predictive capabilities. Amidst this fervor, James Altucher, a well-known author, entrepreneur, and investor, has unveiled his "AI 2.0" stock picks, igniting both excitement and skepticism within the investment community. This latest venture, leveraging the power of advanced AI, promises to identify companies poised for significant growth, but its methodology and potential risks are subjects of intense scrutiny.

At the heart of Altucher's "AI 2.0" initiative lies a proprietary AI system designed to analyze vast datasets and identify patterns indicative of future market performance. This article delves into the specifics of this AI system, the methodology behind its stock selections, and the potential rewards and risks associated with investing based on its recommendations. We'll examine the performance claims made by Altucher, the publicly available information regarding his picks, and the perspectives of other market analysts on the viability and sustainability of such AI-driven investment strategies.

The "AI 2.0" System: Unveiling the Black Box

Specific details regarding the inner workings of Altucher's "AI 2.0" system remain largely undisclosed, adding an element of mystery to its stock-picking process. Altucher has stated that the system analyzes a multitude of factors, including financial statements, news articles, social media sentiment, and macroeconomic indicators.

The claim is that this data is then processed through complex algorithms to identify companies with high growth potential that may be overlooked by traditional analysts. However, the precise nature of these algorithms and the weighting assigned to different factors are not publicly available.

Transparency and the Algorithm's "Edge"

The lack of transparency surrounding the AI system raises concerns for some investors. Critics argue that without a clear understanding of the model's inputs and decision-making process, it's impossible to assess its validity and reliability. This is further complicated by the inherent "black box" nature of many advanced AI models.

This secrecy is often attributed to the protection of proprietary information. The argument is that revealing the specifics of the algorithm would erode its competitive edge and allow others to replicate its strategy.

Altucher's Stock Picks: A Closer Look

Several of Altucher's "AI 2.0" stock picks have been publicly identified through his promotional materials and investment newsletters. These picks typically span a range of sectors, including technology, healthcare, and energy, reflecting the AI's ability to identify opportunities across diverse industries.

Companies mentioned frequently in association with the "AI 2.0" system include firms involved in areas like cloud computing, cybersecurity, and renewable energy. These sectors are generally recognized as having high growth potential, aligning with the AI's stated objective of identifying promising investments.

Performance Claims and Due Diligence

Altucher and his team often highlight the potential for significant returns on these AI-selected stocks, citing backtested performance data and projected growth rates. However, it's crucial to approach these claims with a healthy dose of skepticism and conduct independent due diligence.

Backtesting, while useful for evaluating a strategy's historical performance, is not a guarantee of future success. Market conditions are constantly evolving, and an AI system trained on past data may not be able to adapt effectively to new challenges.

Expert Perspectives: Skepticism and Support

The investment community remains divided on the merits of AI-driven stock picking. Some analysts express caution, citing the lack of transparency and the potential for algorithmic bias.

Others acknowledge the potential benefits of AI in financial markets, but emphasize the importance of human oversight and a balanced approach. They believe that AI should be used as a tool to augment, rather than replace, traditional investment strategies.

"AI is a powerful tool, but it's not a crystal ball. Investors should be wary of anyone promising guaranteed returns based solely on an algorithm," warns Dr. Anya Sharma, a financial analyst specializing in quantitative modeling.

On the other hand, some experts are optimistic about the future of AI in finance. They believe that AI can provide a significant edge in identifying market opportunities and managing risk.

They argue that the increasing availability of data and the advancements in machine learning are making AI-driven investment strategies more sophisticated and effective.

The Risks and Rewards of AI-Driven Investing

Investing based on AI-generated recommendations carries inherent risks. Algorithmic bias, data errors, and unforeseen market events can all lead to inaccurate predictions and potential losses. Furthermore, the complexity of AI models can make it difficult to understand why certain stocks are selected, potentially increasing investor anxiety during market downturns.

However, the potential rewards of successful AI-driven investing are substantial. If an AI system can consistently identify undervalued or high-growth companies, it could generate significant returns for investors. Additionally, AI can analyze vast amounts of data far more quickly and efficiently than humans, potentially uncovering opportunities that would otherwise be missed.

The use of AI in finance is still in its early stages. While the potential is undeniable, the technology is constantly evolving, and its long-term impact on the market remains uncertain.

Looking Ahead: The Future of "AI 2.0" and Beyond

The success of James Altucher's "AI 2.0" initiative will ultimately depend on its ability to consistently generate positive returns for investors. As the AI system continues to learn and adapt to changing market conditions, its performance will be closely scrutinized.

Regardless of the specific outcomes of "AI 2.0", the trend toward incorporating AI into investment strategies is likely to continue. As AI technology advances, we can expect to see even more sophisticated and innovative applications in the financial markets.

Investors should remain informed about the latest developments in AI and its potential impact on their portfolios. A critical approach to evaluating AI-driven investment opportunities is crucial, considering both the potential rewards and the inherent risks.