How Do You Raise Money To Start A Business

Imagine Sarah, hunched over a steaming mug, the glow of her laptop illuminating her face. Spread around her are meticulously crafted business plans, market research reports, and a half-eaten plate of cookies. She dreams of launching her eco-friendly line of children's clothing, but a significant hurdle looms: funding.

For countless aspiring entrepreneurs like Sarah, securing the necessary capital to transform an idea into a thriving business is a daunting challenge. Understanding the various avenues for raising money, weighing their pros and cons, and tailoring a strategy to fit their specific needs is crucial for success.

Bootstrapping: The Self-Funded Path

Bootstrapping, or self-funding, is a popular starting point for many entrepreneurs. This involves using personal savings, loans from friends and family, or even revenue generated from early sales to finance the business.

It offers complete control and avoids diluting equity, but it can be financially risky and limit initial growth potential. Sarah, for instance, started small, selling her initial clothing line at local farmers' markets and reinvesting the profits.

Loans: Leveraging Debt

Small business loans from banks or credit unions are a traditional source of funding. They offer structured repayment terms and can provide significant capital.

However, securing a loan often requires a solid credit history, a detailed business plan, and collateral. According to the Small Business Administration (SBA), they have programs to help small business in getting loans. Interest rates and fees also add to the overall cost.

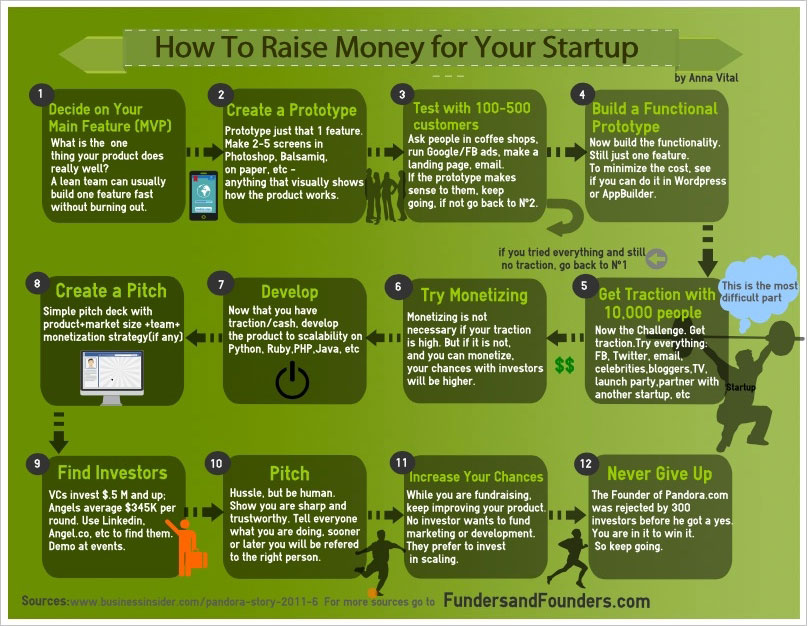

Angel Investors: Early-Stage Support

Angel investors are high-net-worth individuals who invest their personal funds in early-stage companies. They often provide not only capital but also mentorship and industry connections.

Securing angel investment requires a compelling pitch, a strong team, and a clear path to profitability. In exchange, they typically receive equity in the company. Finding the right angel investor who aligns with your business values is critical.

Venture Capital: Fueling Rapid Growth

Venture capital firms invest in high-growth potential startups in exchange for significant equity. This type of funding is typically sought after by companies looking to scale rapidly.

The process of securing venture capital is highly competitive and requires a sophisticated understanding of finance and negotiation. According to the National Venture Capital Association (NVCA), only a small percentage of startups receive venture capital funding.

Crowdfunding: Tapping into the Community

Crowdfunding platforms like Kickstarter and Indiegogo allow entrepreneurs to raise money from a large number of people, often in exchange for rewards or pre-orders.

This can be a great way to validate a product or service, build a community, and generate early revenue. However, it requires a well-executed marketing campaign and a compelling story. It also requires fulfilling promises made to backers.

Grants: Non-Dilutive Funding

Grants are a form of non-dilutive funding, meaning they don't require giving up equity in the company. They are typically awarded by government agencies, foundations, or other organizations to support specific types of businesses or projects.

Applying for grants can be time-consuming and competitive, but they can provide valuable funding without requiring repayment. The Grants.gov website is a central location to find information on over 1,000 grant programs from all federal agencies.

A Hybrid Approach

Many entrepreneurs combine multiple funding sources to meet their capital needs. Sarah, for example, initially bootstrapped her business, then secured a small business loan, and eventually ran a successful crowdfunding campaign to expand her product line.

This diversified approach can reduce risk and provide greater financial flexibility.

The journey of raising money to start a business is rarely straightforward. It requires persistence, creativity, and a willingness to adapt. By understanding the various options available and tailoring a strategy to fit their specific needs, entrepreneurs can increase their chances of turning their dreams into reality. Just like Sarah, who now ships her eco-friendly clothing line worldwide, every successful business begins with a spark of an idea and the courage to find the fuel to ignite it.