How Does Robinhood Roth Ira Work

Imagine a cozy Sunday morning, sunlight streaming through your window as you sip your coffee. You're thinking about your future, about building a nest egg that will let you enjoy many more such mornings without financial worries. Maybe you've heard whispers about a Roth IRA, a magical account that promises tax-free growth in retirement. But navigating the world of investing can feel daunting, like deciphering a secret code. Luckily, platforms like Robinhood are making the process a little less mysterious, a little more accessible.

This article dives into how the Robinhood Roth IRA works. We'll break down the basics, explore its features, and help you understand if it's the right choice for securing your financial future. Think of it as a friendly guide through the sometimes-confusing landscape of retirement investing.

Understanding Roth IRAs

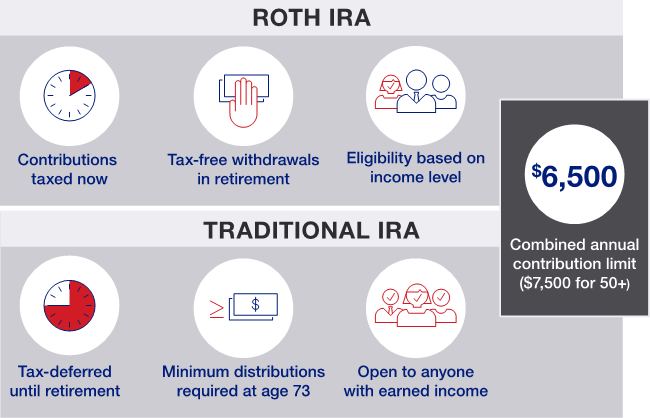

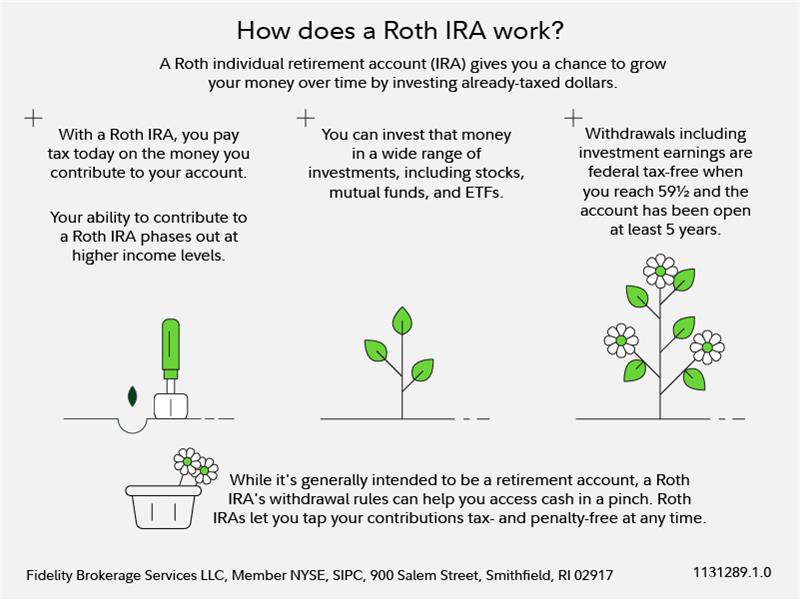

Before we focus on Robinhood's offering, let's recap what a Roth IRA actually is. A Roth IRA is a retirement account where you contribute after-tax dollars. The beauty of it is that your investments grow tax-free, and withdrawals in retirement are also tax-free.

This is a significant advantage, especially if you anticipate being in a higher tax bracket when you retire. It's a smart way to shield your hard-earned money from future taxes.

Traditional IRA vs. Roth IRA

It's important to distinguish a Roth IRA from a traditional IRA. Traditional IRAs offer a tax deduction on contributions, but withdrawals in retirement are taxed as ordinary income. The choice between the two depends on your current and anticipated future income.

If you believe your tax rate will be higher in retirement, a Roth IRA may be more beneficial. However, if you need the tax deduction now and expect a lower tax rate in retirement, a traditional IRA might be a better fit.

Robinhood Roth IRA: The Basics

Robinhood, known for its user-friendly interface and commission-free trading, also offers Roth IRA accounts. They aim to simplify the process of saving for retirement, making it accessible even to those new to investing.

With Robinhood, you can open a Roth IRA account with a low minimum balance. This removes a significant barrier to entry for many potential investors.

How to Open a Robinhood Roth IRA

Opening a Robinhood Roth IRA is a straightforward process. You'll need to download the Robinhood app, create an account, and provide personal information like your Social Security number and address.

You'll also need to link your bank account for funding your IRA. Robinhood uses security measures to protect your personal and financial information.

Contribution Limits

The IRS sets annual contribution limits for Roth IRAs. For 2024, the contribution limit is \$7,000, with an additional \$1,000 catch-up contribution allowed for those age 50 or older (according to IRS.gov). It's crucial to stay within these limits to avoid penalties.

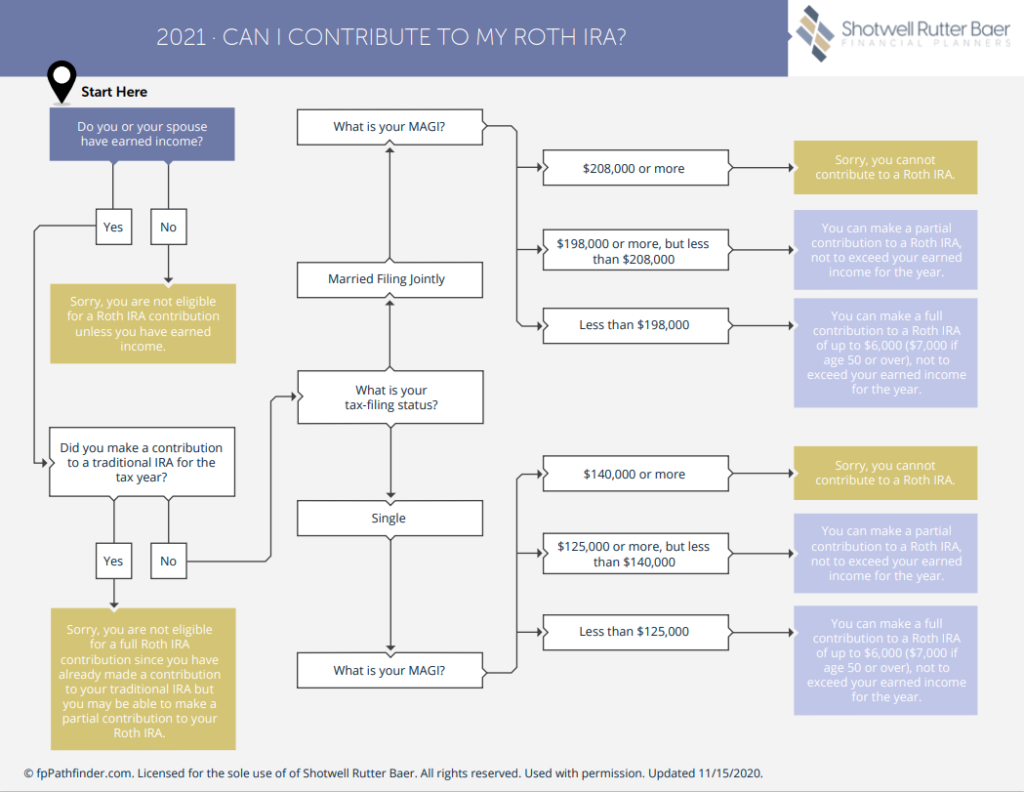

Your ability to contribute to a Roth IRA is also subject to income limitations. If your income exceeds a certain threshold, you may not be eligible to contribute or may only be able to contribute a reduced amount.

Investing with Robinhood Roth IRA

Once your Roth IRA is open and funded, you can start investing. Robinhood offers a variety of investment options, including stocks, ETFs (Exchange Traded Funds), and options.

You can choose to invest in individual stocks of companies you believe in, or diversify your portfolio with ETFs that track specific market indexes or sectors. Robinhood also offers access to fractional shares, allowing you to invest in expensive stocks even with a small amount of money.

Research and Due Diligence

While Robinhood makes investing easy, it's crucial to do your own research before investing in any asset. Don't rely solely on the platform's recommendations or the opinions of others.

Understand the risks associated with each investment and make informed decisions based on your financial goals and risk tolerance. Remember, all investments carry risk, and it's possible to lose money.

Robinhood's Features for Roth IRA

Robinhood offers several features designed to help you manage your Roth IRA. These include real-time market data, charting tools, and educational resources.

They also offer features like recurring investments, allowing you to automate your contributions and invest regularly. This can be a great way to build wealth over time, even with small amounts of money.

Robinhood Gold and its Impact on Roth IRA

Robinhood Gold is a premium subscription service that offers additional features, such as higher instant deposits and access to more in-depth research. While Robinhood Gold may be beneficial for some investors, it's not necessary to have it to use the Roth IRA.

Consider your individual needs and investment strategy before subscribing to Robinhood Gold. The cost of the subscription should be weighed against the potential benefits.

Fees and Expenses

Robinhood is known for its commission-free trading, which applies to its Roth IRA accounts as well. You won't be charged fees for buying or selling stocks, ETFs, or options.

However, it's important to be aware of other potential fees, such as regulatory fees or transfer fees. Always review the fee schedule on Robinhood's website for the most up-to-date information.

Is Robinhood Roth IRA Right for You?

Deciding whether a Robinhood Roth IRA is right for you depends on your individual circumstances. Consider your investment experience, risk tolerance, and financial goals.

If you're new to investing and appreciate a user-friendly platform, Robinhood may be a good option. However, if you require more advanced research tools or personalized financial advice, you may want to consider other brokerage firms.

Pros and Cons of Robinhood Roth IRA

Some of the advantages of Robinhood Roth IRA are its ease of use, commission-free trading, and low minimum balance. However, it may lack some of the advanced features and personalized advice offered by other brokerage firms.

It's essential to weigh these pros and cons carefully before making a decision. Consider your individual needs and preferences.

Alternative Roth IRA Providers

Robinhood isn't the only option for opening a Roth IRA. Many other brokerage firms and financial institutions offer Roth IRAs, each with its own features and benefits.

Some popular alternatives include Vanguard, Fidelity, and Charles Schwab. Researching different providers and comparing their offerings can help you find the best fit for your needs.

Tax Implications

Understanding the tax implications of a Roth IRA is crucial. As mentioned earlier, contributions are made with after-tax dollars, and withdrawals in retirement are tax-free.

This can be a significant advantage, especially if you expect to be in a higher tax bracket in retirement. Be sure to consult with a tax professional for personalized advice.

Long-Term Growth and Retirement Planning

A Roth IRA is a powerful tool for long-term growth and retirement planning. By investing early and consistently, you can take advantage of the power of compounding and build a substantial nest egg.

Even small contributions can make a big difference over time. Start saving early and often to secure your financial future.

Conclusion

The Robinhood Roth IRA offers a simplified and accessible way to save for retirement. Its user-friendly interface and commission-free trading can be appealing to those new to investing. However, it's crucial to understand the features, limitations, and tax implications before making a decision.

Ultimately, the best retirement plan is one that aligns with your individual needs and goals. Research your options, seek professional advice if needed, and take control of your financial future. The journey to a secure retirement may seem long, but every step counts, like each gentle sunrise bringing a new day filled with possibilities.