Standard Vs Broad Form Vs Limited

Navigating the complexities of insurance coverage can feel like deciphering a foreign language. Three common terms—Standard Form, Broad Form, and Limited Form—often cause confusion for homeowners and business owners alike. Understanding the nuances of each type is crucial to ensuring adequate protection against potential losses.

This article aims to demystify these terms, providing a clear comparison of their coverage levels and helping you determine which option best suits your specific needs. The goal is to provide an objective overview of the three insurance forms.

Understanding the Basics

Insurance policies are designed to protect individuals and businesses from financial losses due to unforeseen events. The extent of this protection, however, varies significantly depending on the type of policy and the specific coverage form chosen.

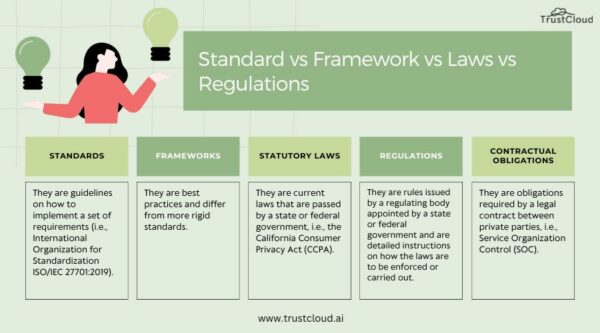

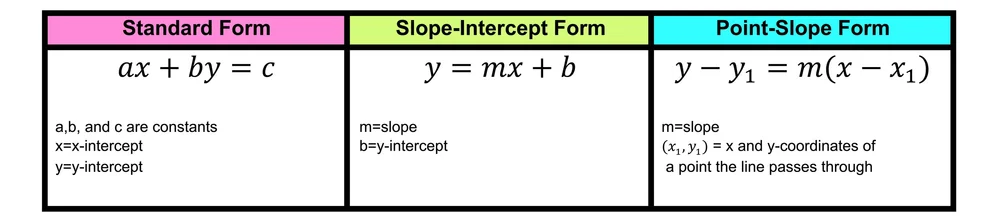

Standard Form, Broad Form, and Limited Form represent different tiers of coverage, each offering varying levels of protection against different types of perils.

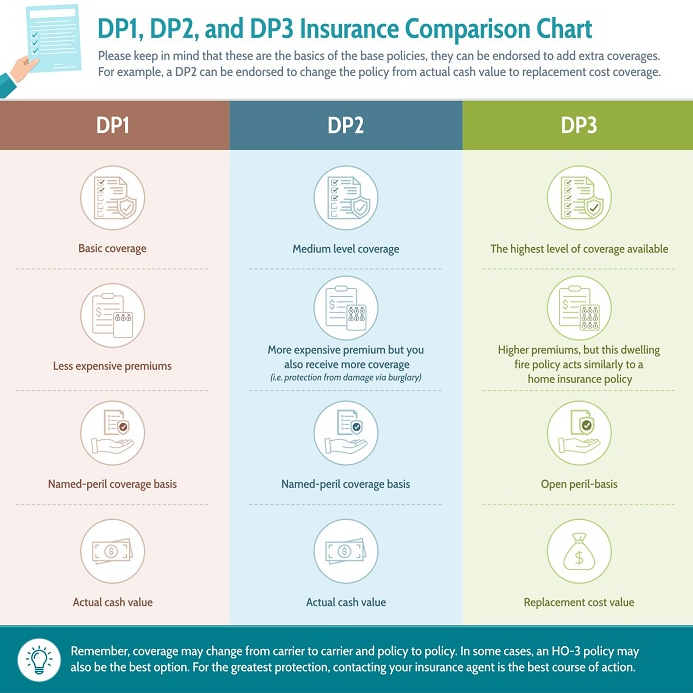

Limited Form (Basic Form)

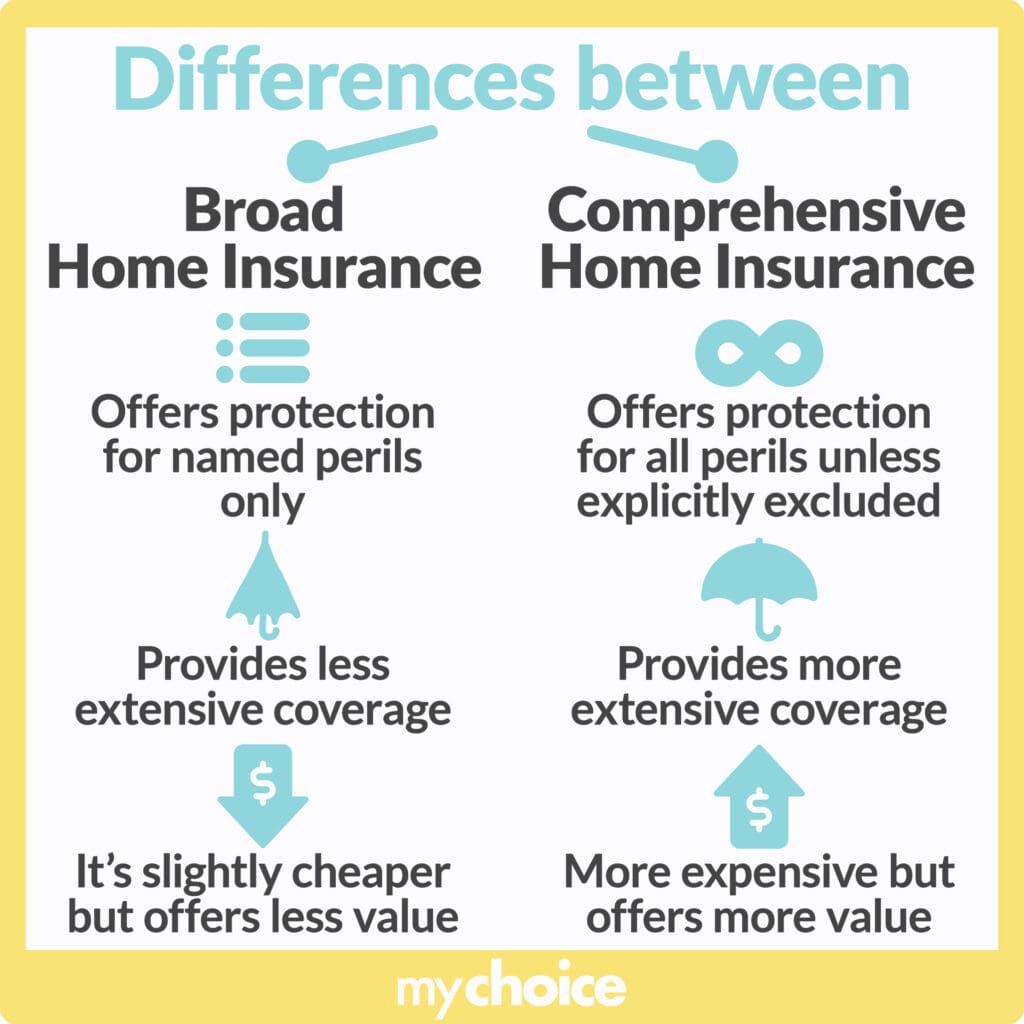

Limited Form, also sometimes referred to as Basic Form, offers the most restricted coverage of the three. It typically covers only a specified list of perils, meaning that if a loss is caused by something not explicitly named in the policy, it won't be covered.

Common perils covered under a Limited Form policy often include fire, lightning, windstorm, hail, explosion, vandalism, smoke, and certain types of aircraft or vehicle damage. This option is generally the least expensive due to its limited scope.

However, the lower cost comes with a significant trade-off: potential exposure to uncovered losses. It is critical to carefully review the list of covered perils and assess the risks specific to your location and circumstances.

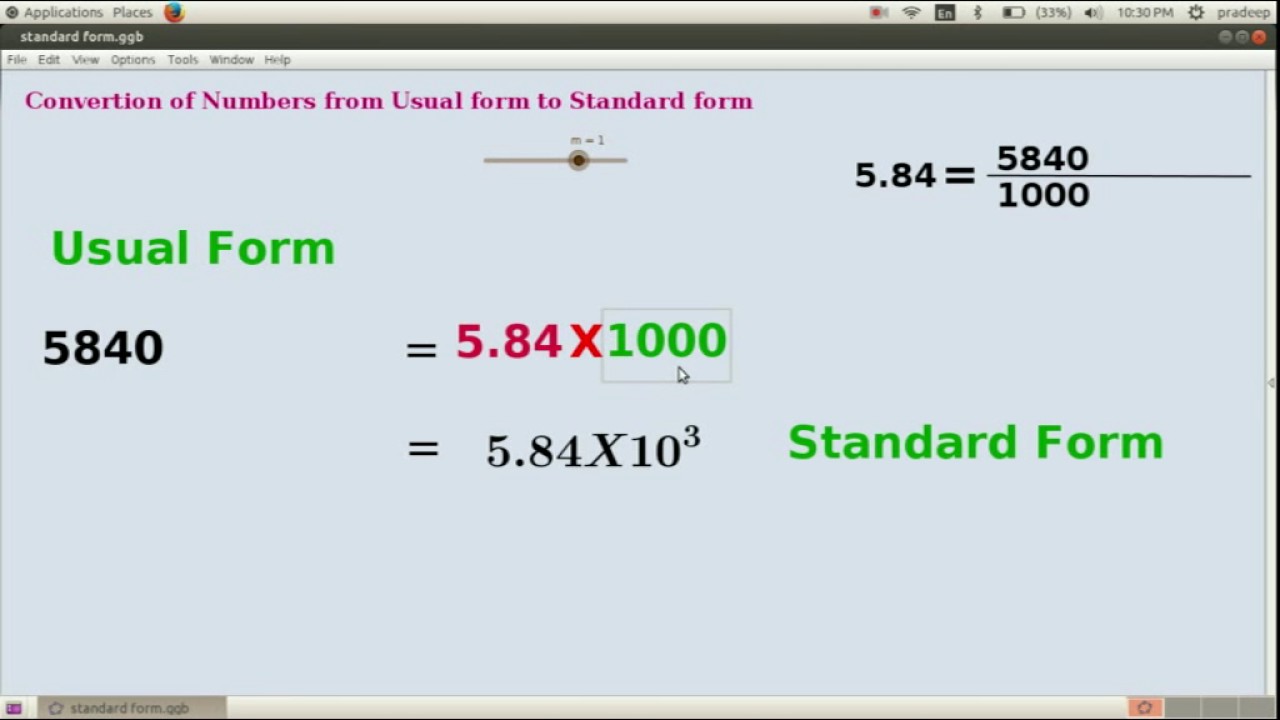

Standard Form (Named Perils Form)

The Standard Form, also known as a Named Perils Form, offers broader protection than the Limited Form. Like the Limited Form, it covers only those perils specifically listed in the policy.

However, the list of covered perils is generally more extensive. The Standard Form typically includes all the perils covered under the Limited Form, as well as additional perils like riot, civil commotion, volcanic eruption, and sprinkler leakage.

The key difference between the Limited Form and the Standard Form lies in the number of perils listed. While offering greater coverage than the Limited Form, the Standard Form still leaves homeowners or business owners vulnerable to losses caused by perils not explicitly named.

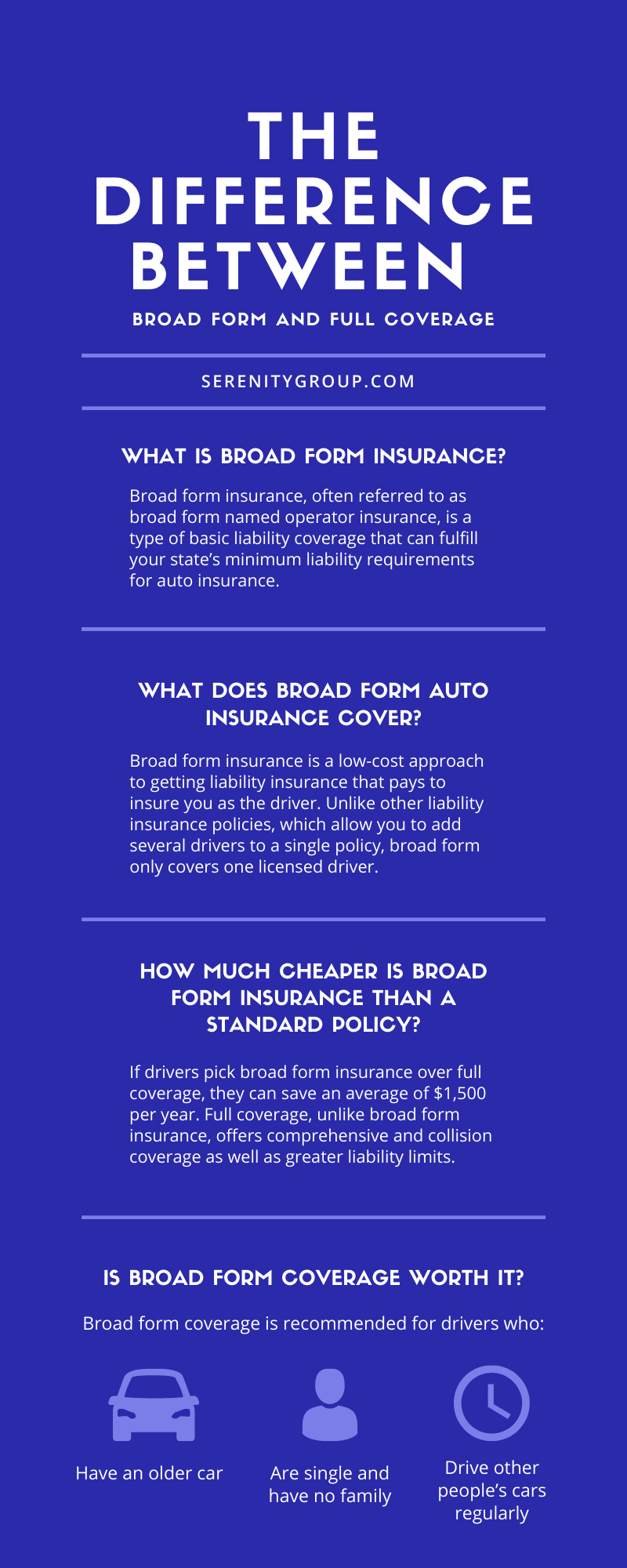

Broad Form (All Risks Form)

Broad Form coverage, often referred to as an All-Risks Form or Open Perils Form, provides the most comprehensive protection. Instead of listing covered perils, it covers all risks of loss unless specifically excluded in the policy.

This means that if a loss occurs and the cause is not specifically excluded, it is covered. Common exclusions under a Broad Form policy include flood, earthquake, wear and tear, inherent vice, and acts of war.

The Broad Form offers the greatest peace of mind due to its comprehensive coverage. The burden of proof falls on the insurance company to demonstrate that a loss is excluded, rather than on the policyholder to prove it's covered.

Choosing the Right Coverage

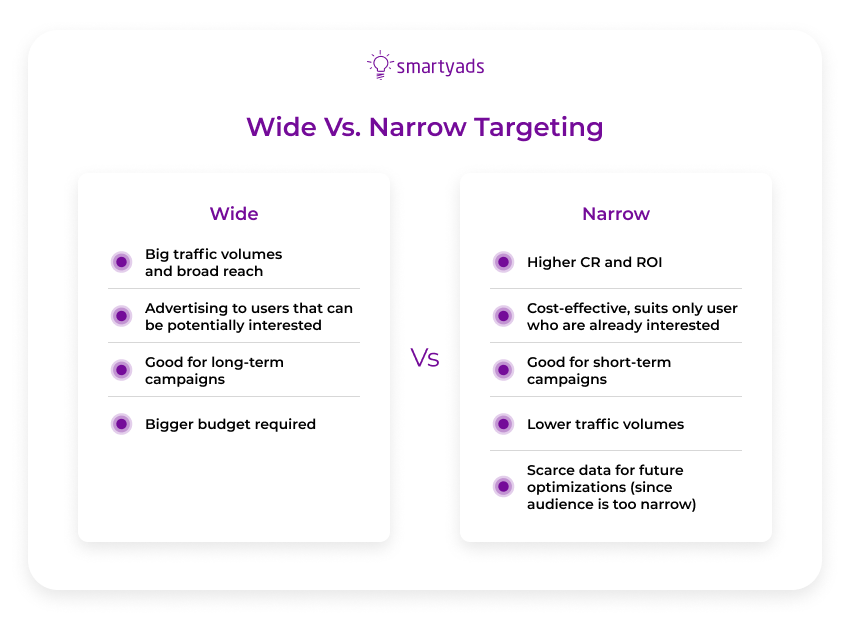

Selecting the appropriate coverage form depends on various factors, including budget, risk tolerance, and specific needs. A homeowner in an area prone to windstorms might prioritize broader coverage than someone in a relatively sheltered location.

Similarly, a business owner with specialized equipment might opt for Broad Form coverage to protect against a wider range of potential risks. It's crucial to carefully assess the risks associated with your property or business and choose the coverage that best mitigates those risks.

Consulting with an insurance professional is highly recommended. An experienced agent can help you evaluate your needs, compare different coverage options, and select the policy that provides the most appropriate protection at a reasonable cost.

Impact and Significance

The choice between Standard Form, Broad Form, and Limited Form coverage can have significant financial implications. An inadequate policy could leave homeowners or business owners facing substantial out-of-pocket expenses in the event of a covered loss.

Conversely, over-insuring can lead to unnecessary expenses without providing any additional benefit. A thorough understanding of the different coverage forms is essential for making informed decisions and ensuring adequate protection.

Recent events, such as increasingly frequent and severe weather events, highlight the importance of comprehensive insurance coverage. As climate change continues to impact our environment, the need for adequate protection against unforeseen losses will only continue to grow.

According to the Insurance Information Institute (III), understanding the nuances of your insurance policy is crucial for effective risk management. The III emphasizes that homeowners and business owners should regularly review their policies and make necessary adjustments to ensure they have adequate coverage.

The goal is to strike a balance between affordability and comprehensive protection. Choosing the right insurance coverage can provide peace of mind and financial security in the face of unexpected events.

:max_bytes(150000):strip_icc()/broad-form-property-damage-endorsement.asp_finalv2-efc9e99563b04237a9ac94a33716326f.png)