Underwriters Can Acquire Information From All Of The Following

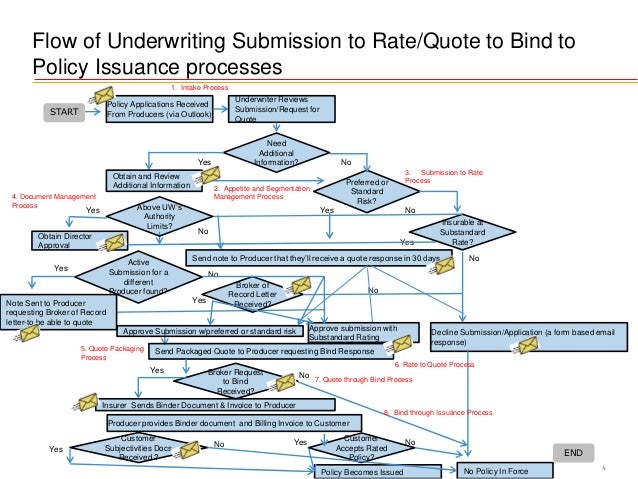

A seismic shift is occurring in the underwriting landscape, raising critical questions about data privacy and access. Underwriters are now leveraging an unprecedented range of information sources, prompting both concern and opportunity.

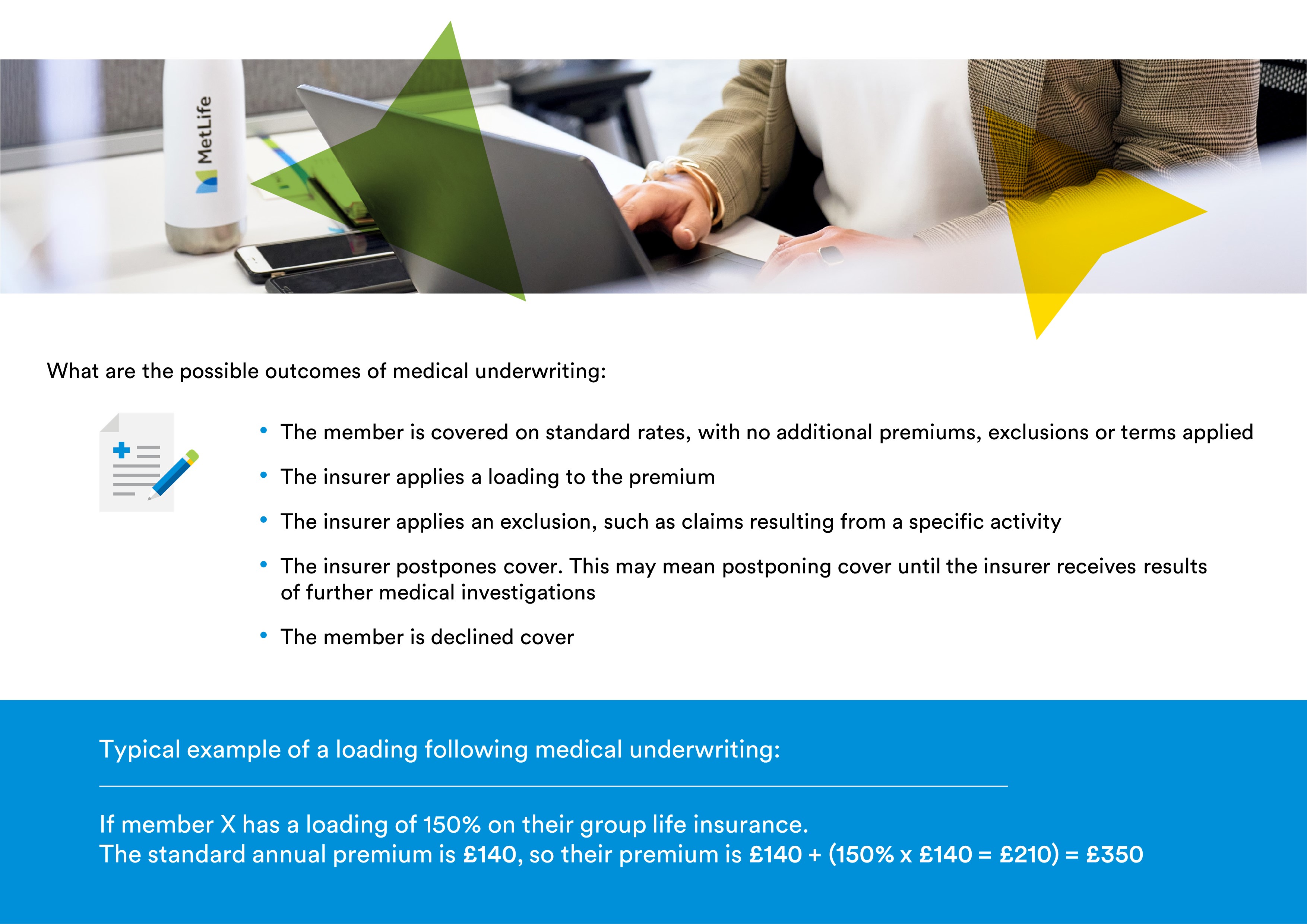

This expansion of data access allows for more accurate risk assessment but also opens the door to potential biases and ethical dilemmas. The changes are rapidly reshaping how insurers evaluate applicants, affecting everything from loan approvals to insurance premiums.

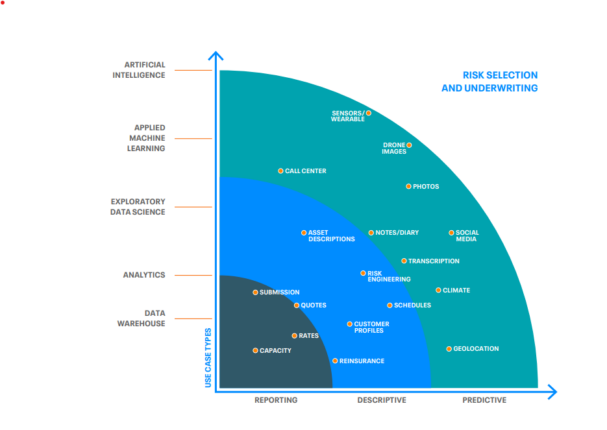

The Expanding Data Universe

Underwriters can now access a vast array of information, far beyond traditional credit scores and application forms. This includes data gleaned from social media, public records, and even wearable technology.

Credit reports remain a cornerstone of underwriting, providing a detailed history of an applicant's financial responsibility. But their weight is diminishing relative to these newer sources.

Public records, such as property ownership, criminal history, and court filings, are also readily available. These provide a broader context of an applicant's background.

Social Media's Growing Influence

Social media platforms are becoming increasingly valuable sources of information for underwriters. What individuals post, like, and share can reveal insights into their lifestyle, habits, and even personality traits.

While using social media data offers potential benefits, it also raises significant ethical concerns. There are concerns about bias and discrimination based on protected characteristics.

Many are asking: How do we balance the desire for accurate risk assessment with the need to protect individual privacy?

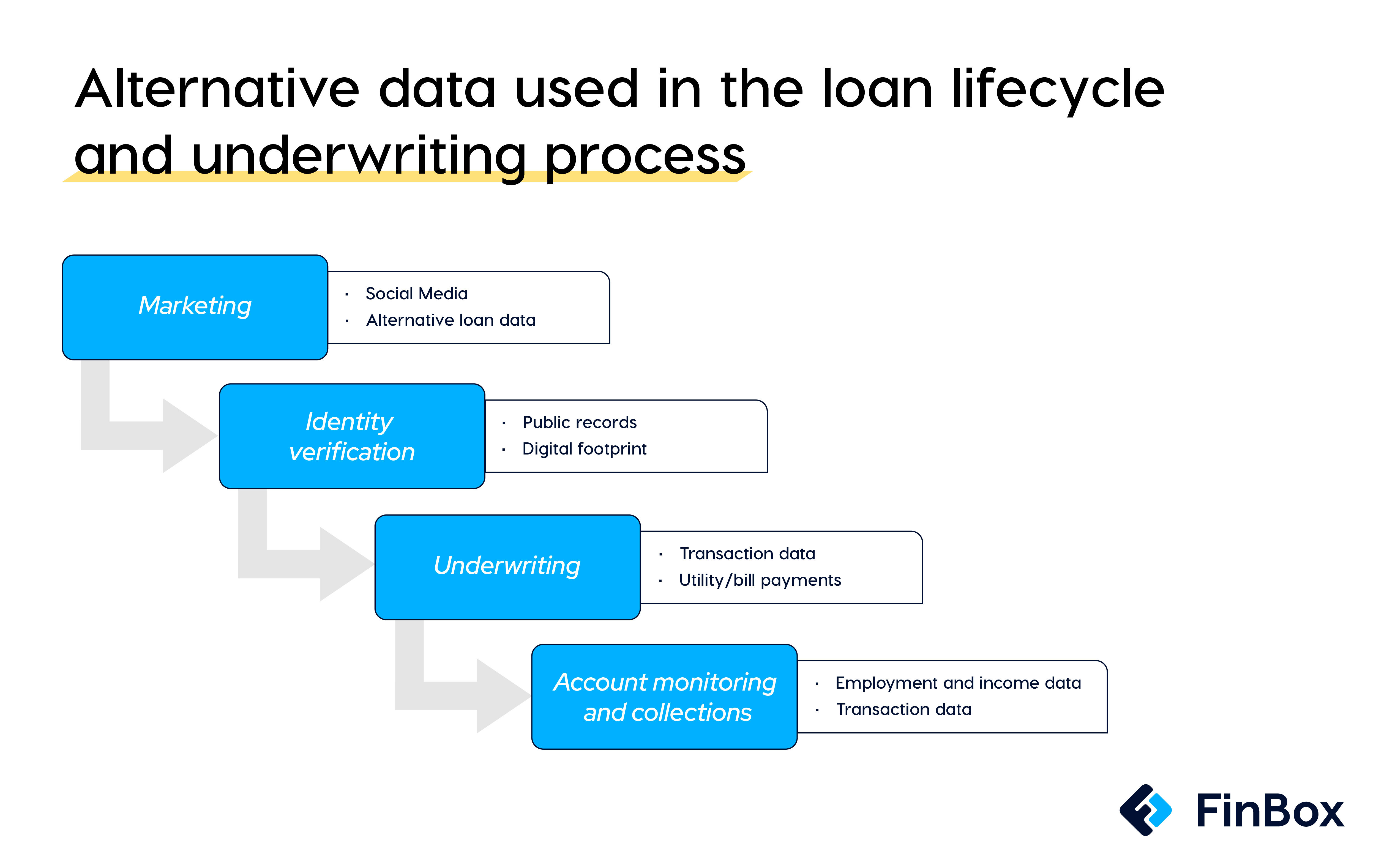

The Rise of Alternative Data

Beyond traditional and social media sources, underwriters are exploring what is called "alternative data". This encompasses a wide range of unconventional information.

This includes things like utility bill payment history, rental payment records, and even mobile phone usage patterns. All are being used to build a more comprehensive profile of applicants.

Data from wearable technology, like fitness trackers, can provide insights into an individual's health and lifestyle. This data can impact health insurance premiums.

Impact on Consumers

The expanded access to data has a direct impact on consumers. It affects their ability to obtain loans, insurance, and other financial products.

Transparency is crucial. Consumers need to understand what data is being collected about them and how it is being used.

The increased use of alternative data could help individuals with limited credit histories gain access to financial services. But this also means greater scrutiny.

The Legal and Ethical Landscape

The increased use of data raises complex legal and ethical questions. Existing regulations may not be sufficient to address the challenges posed by these new data sources.

Fair lending laws and privacy regulations must be updated to protect consumers from unfair discrimination.

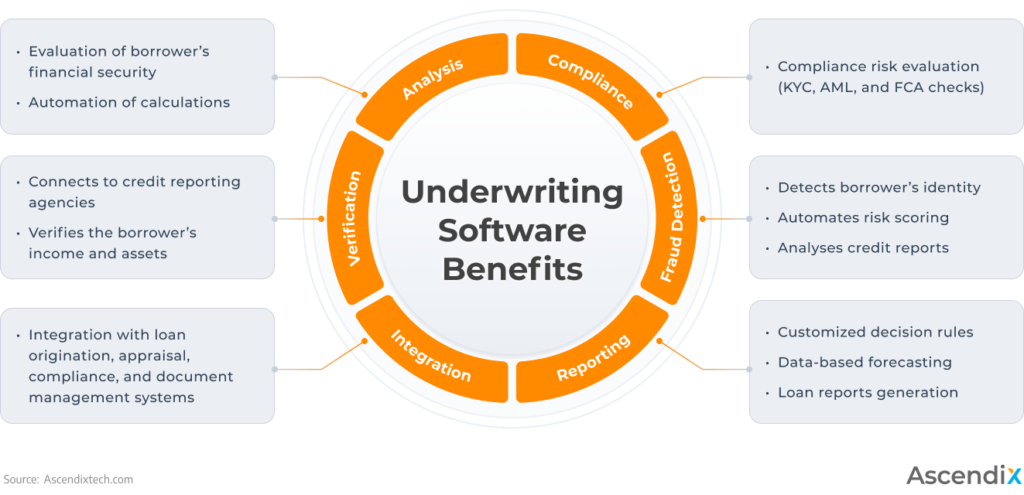

The use of artificial intelligence in underwriting further complicates the legal and ethical landscape. Algorithmic bias is a major concern.

Industry Response

The insurance and financial services industries are grappling with these changes. Many companies are developing internal guidelines and best practices for using alternative data.

Industry groups are working with regulators to develop clearer standards for data usage. This will help ensure fair and responsible practices.

Some insurers are hesitant to adopt these new data sources due to concerns about legal compliance and reputational risk. Others see it as essential to staying competitive.

The Future of Underwriting

The future of underwriting is undoubtedly data-driven. However, the path forward must be carefully navigated.

Regulators, industry stakeholders, and consumer advocates must work together to ensure that these new technologies are used ethically and responsibly. Consumer protection must be a priority.

The conversation around data privacy and algorithmic fairness is only just beginning. Expect increased scrutiny and regulation in the coming years.