How Important Is Cash Flow To A Business

In the high-stakes world of business, where innovation and ambition often take center stage, a more fundamental element quietly dictates survival and success: cash flow. The lifeblood of any enterprise, from a burgeoning startup to a multinational corporation, cash flow is not just about profit; it's about liquidity, solvency, and the ability to seize opportunities.

Cash flow management is the process of monitoring and controlling the movement of cash both into and out of a business. It is the difference between solvency and bankruptcy. A company can be profitable on paper, but if it cannot pay its bills, it will eventually fail.

The Crucial Role of Cash Flow: Understanding the Nut Graf

This article delves into the multifaceted importance of cash flow for businesses. It examines how effective cash flow management fuels growth, provides a financial cushion during economic downturns, and empowers strategic decision-making. We will explore the consequences of neglecting cash flow and provide insights into best practices for optimizing this critical aspect of business finance, drawing on expert opinions and empirical data to underscore its significance.

Cash Flow vs. Profit: A Critical Distinction

Many entrepreneurs mistakenly equate profit with cash flow, but this can be a fatal error. Profit is an accounting metric, representing revenue minus expenses over a specific period. Cash flow, on the other hand, reflects the actual movement of money in and out of the business.

A company can be profitable while still struggling with cash flow, for example, if it has a lot of outstanding invoices or has invested heavily in inventory. According to a study by Intuit QuickBooks, poor cash flow management is cited as a leading cause of small business failure.

Fueling Growth and Investment

Positive cash flow allows businesses to invest in growth opportunities. This includes expanding operations, developing new products, and hiring more employees.

Without sufficient cash, even the most promising ventures can stagnate.

"Cash is king,"as the saying goes, and it's particularly true when it comes to seizing opportunities and outpacing competitors.

Navigating Economic Downturns and Unexpected Expenses

A healthy cash reserve acts as a financial buffer during economic downturns or unexpected crises. The Small Business Administration (SBA) consistently advises businesses to maintain a cash cushion equivalent to at least three to six months of operating expenses.

This allows companies to weather storms, meet obligations, and avoid taking on expensive debt during periods of reduced revenue. Businesses with strong cash flow are more resilient and better positioned to survive challenging times.

Strategic Decision-Making and Financial Stability

Sound cash flow management provides businesses with the financial stability needed to make informed strategic decisions. It enables leaders to evaluate investment opportunities, negotiate favorable terms with suppliers, and avoid making hasty decisions driven by short-term cash needs.

As Deloitte noted in a recent report on financial planning, "Organizations that prioritize cash flow forecasting and management are better equipped to adapt to changing market conditions and achieve their long-term goals." Businesses can choose to invest in research and development, engage in marketing campaigns or even consider acquisitions.

Consequences of Neglecting Cash Flow

Ignoring cash flow can have severe consequences. These can range from missed payments and damaged credit ratings to insolvency and ultimately, bankruptcy.

A study by Dun & Bradstreet found that a significant percentage of business failures are directly attributable to poor cash flow management. Late payments, uncollected receivables, and excessive spending are common culprits.

Best Practices for Optimizing Cash Flow

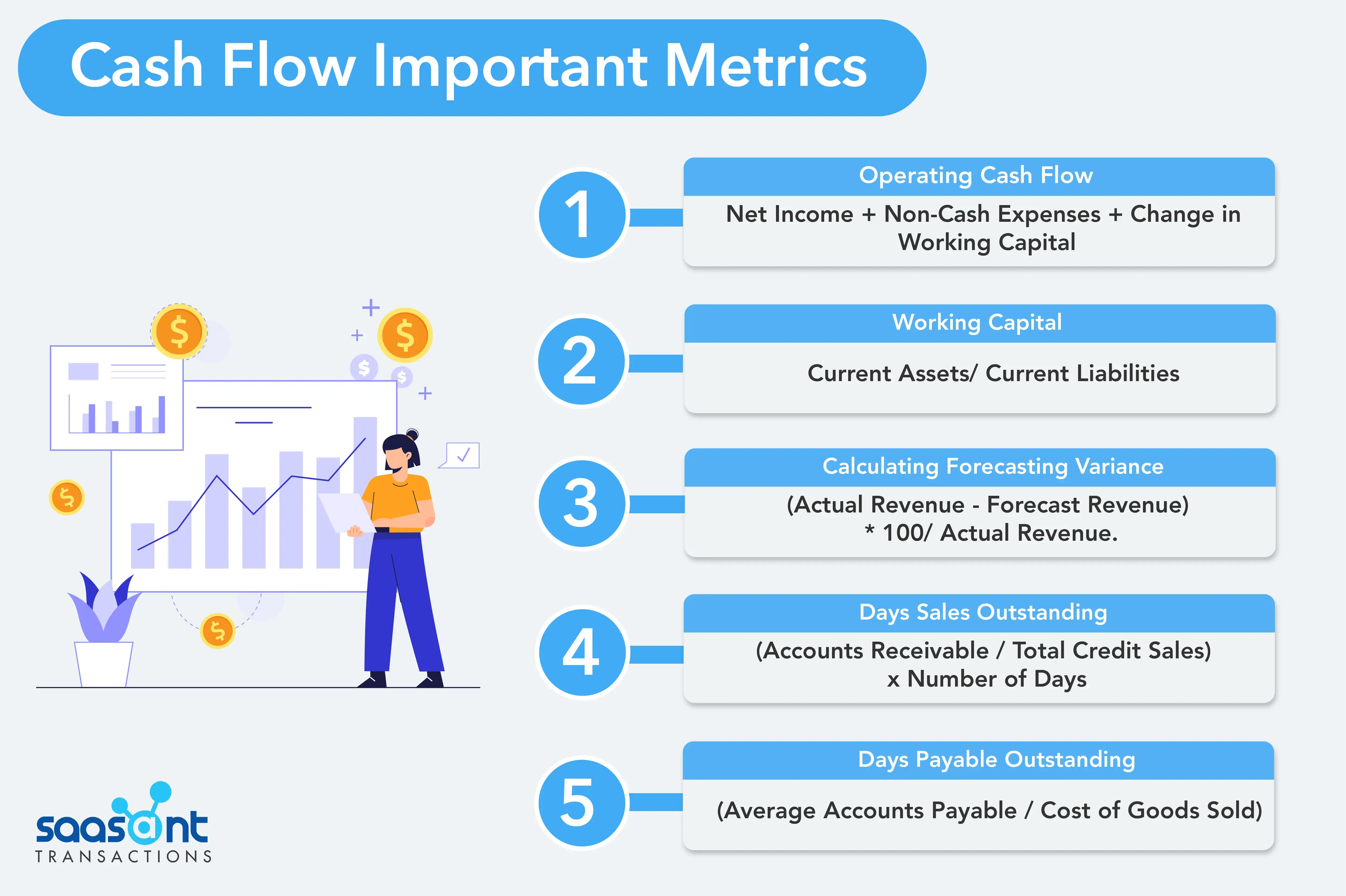

Several strategies can help businesses optimize cash flow. These include accurate forecasting, efficient invoice management, and proactive expense control.

Implementing robust accounting practices, negotiating payment terms with suppliers and customers, and exploring financing options can also improve cash flow. Consider offering discounts for early payments to incentivize timely invoice settlements. Leverage technology, such as cloud-based accounting software, for real-time visibility into cash flow positions.

The Future of Cash Flow Management

Looking ahead, the importance of cash flow management will only intensify. Digitalization, globalization, and increasing market volatility demand more sophisticated cash flow strategies.

Businesses are increasingly adopting predictive analytics and artificial intelligence to improve cash flow forecasting and optimize working capital. Embracing these advancements is crucial for staying ahead of the curve and ensuring long-term financial sustainability. Effective cash flow management isn't just a reactive measure; it's a proactive strategy for achieving sustainable growth and building a resilient enterprise.

/GettyImages-490024232-ce77fc165c6147d2a4a6fa1c28824297.jpg)