The Balance In The Accumulated Depreciation Account Represents The

Imagine a trusty old delivery truck, its once vibrant paint now faded, its engine humming with a weariness earned over countless miles. It's a workhorse, undeniably, but its value isn't what it used to be when it first rolled off the lot. That difference, that subtle yet significant decline in worth, is tracked diligently in the world of accounting, a silent chronicle of use and time.

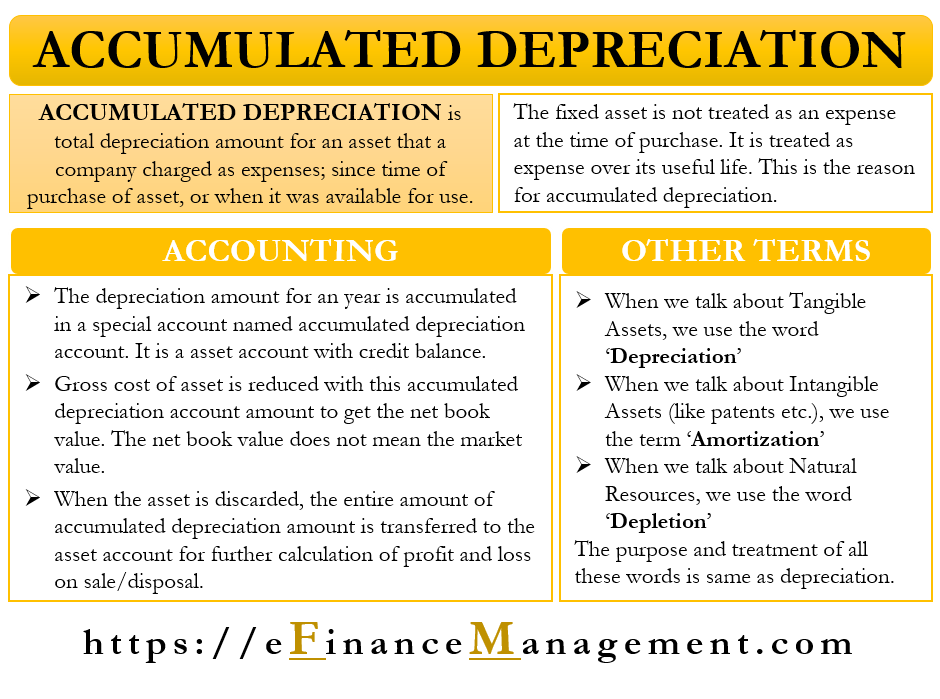

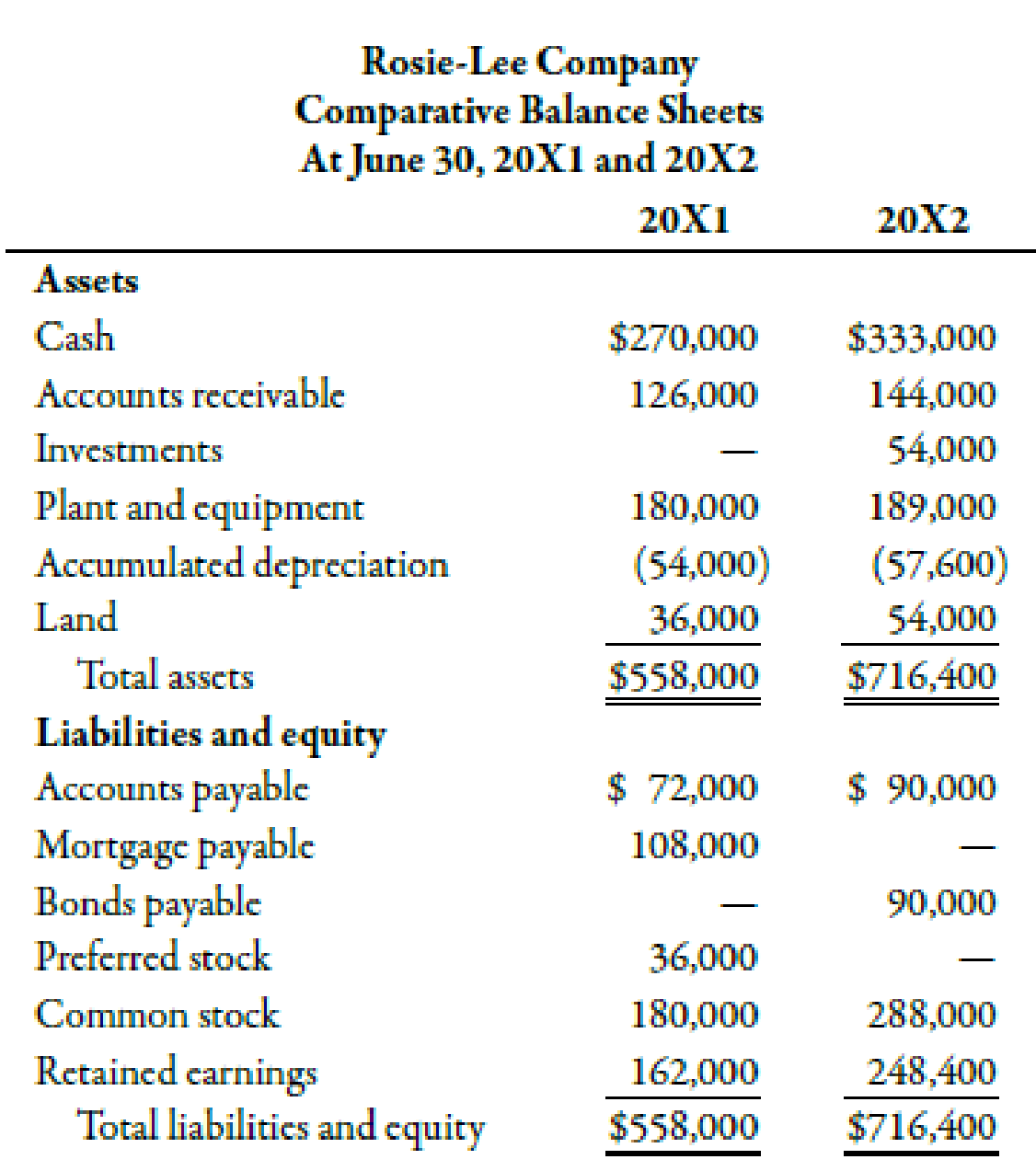

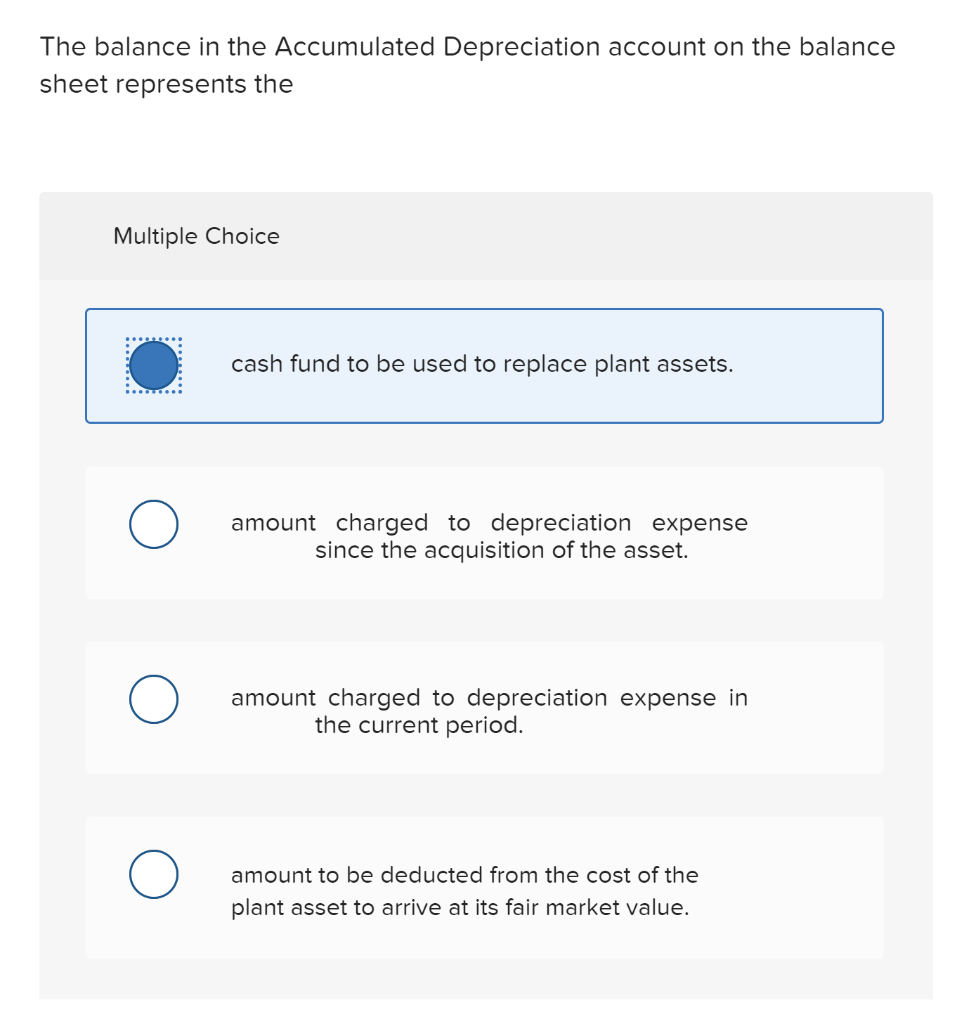

At the heart of understanding the financial health of any business lies the concept of accumulated depreciation. The balance in the accumulated depreciation account represents the total amount of an asset's cost that has been expensed over its useful life. It's a crucial element in assessing a company's true financial standing, going beyond simple balance sheets to paint a more nuanced picture of asset valuation and profitability.

Understanding Depreciation

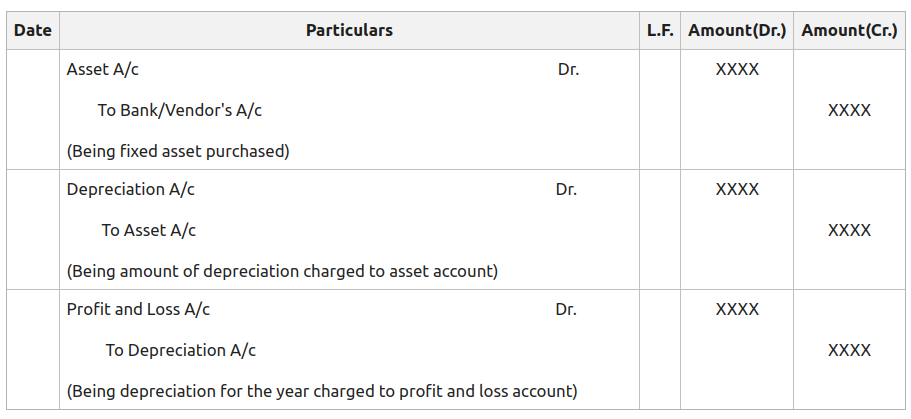

Depreciation, in its simplest form, is the allocation of an asset's cost over its useful life. Instead of expensing the entire cost of a new machine or building in the year it's purchased, depreciation allows businesses to spread that expense out, mirroring the asset's gradual contribution to revenue generation. This adheres to the matching principle, which dictates that expenses should be recognized in the same period as the revenues they help to create.

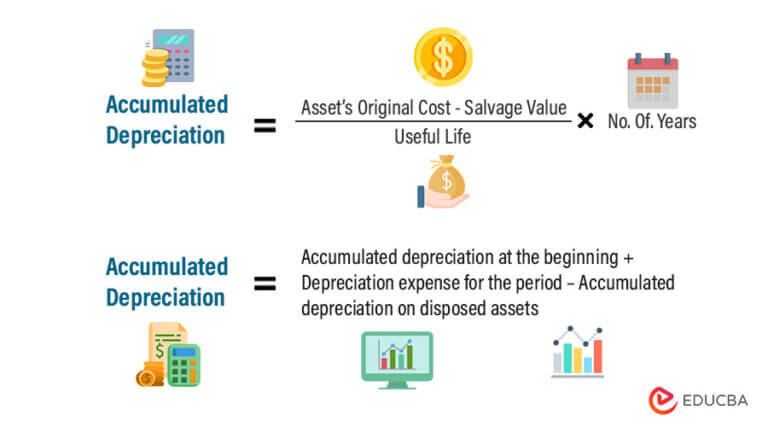

There are various methods to calculate depreciation, including straight-line, declining balance, and units of production. The straight-line method, perhaps the most common, spreads the cost evenly over the asset's life. Other methods, like declining balance, recognize more depreciation expense in the early years and less later on, reflecting the likely decline in an asset's efficiency over time. The units of production method is based on the actual usage of the asset.

The Accumulated Depreciation Account

Accumulated depreciation isn't just a number; it's a story. It resides on the balance sheet as a contra-asset account, meaning it reduces the book value of the asset it relates to. The balance in this account grows each period as depreciation expense is recorded.

Think of our trusty delivery truck again. Each year, a portion of its original cost is recognized as depreciation expense. This expense is recorded in the income statement, reducing the company's profit. Simultaneously, the accumulated depreciation account increases, gradually lowering the truck's net book value on the balance sheet.

Significance in Financial Reporting

The accumulated depreciation account plays a vital role in financial reporting and analysis. It provides stakeholders with a clearer understanding of a company's assets and their true economic value. Without it, financial statements would paint an inaccurate picture, potentially misleading investors and creditors.

For example, consider two companies with similar revenues. One company uses newer equipment while the other relies on older, depreciated assets. The company with newer equipment may report higher expenses due to larger depreciation charges. However, it may also be more efficient and have lower maintenance costs in the long run. Accumulated depreciation helps to evaluate the overall financial strategy of each company.

Impact on Profitability and Taxes

Depreciation expense, driven by the accumulated depreciation balance, directly impacts a company's profitability. Higher depreciation expense reduces net income, which can affect key metrics like earnings per share (EPS) and price-to-earnings (P/E) ratios. However, this isn't necessarily a bad thing.

Depreciation is a non-cash expense, meaning it doesn't involve an actual outflow of cash. It can also reduce a company's tax burden, as depreciation expense is tax-deductible. This creates a valuable tax shield, allowing companies to retain more cash for reinvestment and growth. According to the IRS Publication 946, depreciation guidelines are constantly updated to reflect economic changes and incentivize investment in new assets.

Interpreting the Balance

The balance in the accumulated depreciation account isn't just a number to be passively observed; it's a piece of information to be actively interpreted. A high balance relative to the original cost of the asset suggests that the asset is nearing the end of its useful life. This might signal the need for future capital expenditures to replace aging equipment.

A low balance, conversely, indicates that the asset is relatively new. However, this could also raise questions if the company is using accelerated depreciation methods, which front-load depreciation expense. Understanding the depreciation method used is critical for accurate analysis. Data from the Financial Accounting Standards Board (FASB) emphasizes the importance of transparency in disclosing depreciation methods.

Example: Real-World Application

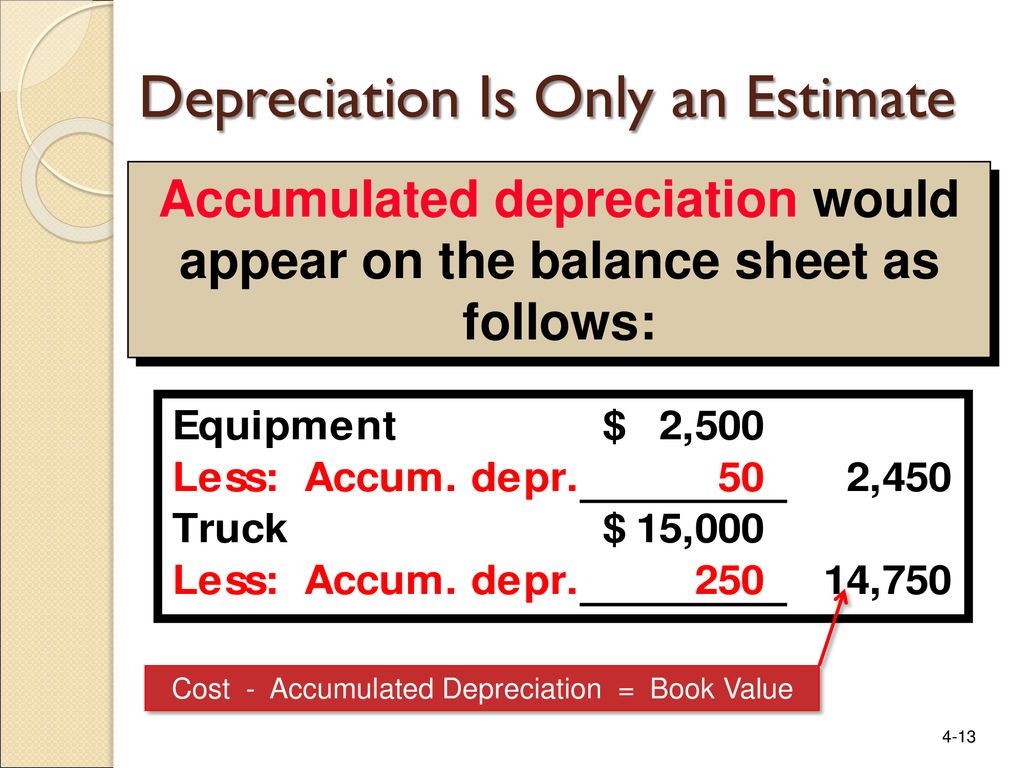

Consider a construction company with a fleet of bulldozers. The initial cost of each bulldozer is $200,000, and they are expected to last 10 years. Using the straight-line method, the annual depreciation expense would be $20,000 per bulldozer.

After five years, the accumulated depreciation account for each bulldozer would be $100,000. This means that the book value of each bulldozer is now $100,000 (original cost of $200,000 minus accumulated depreciation of $100,000). The company can use this information to determine if it needs to start planning for replacements.

Limitations and Considerations

While accumulated depreciation provides valuable insights, it's essential to acknowledge its limitations. Depreciation is based on estimates, and the actual useful life of an asset can differ from the initial projection. Market conditions and technological advancements can also render an asset obsolete sooner than expected.

Moreover, depreciation doesn't account for potential increases in an asset's value due to market appreciation. While rare for depreciable assets like machinery, it's a factor to consider in specific circumstances. It's also crucial to remember that accumulated depreciation is an accounting concept and may not reflect the actual physical condition of the asset.

The Human Element

Ultimately, the accumulated depreciation account, like all accounting entries, is a human construct. It's a reflection of judgments and estimations made by accountants and managers, based on available data and industry practices. These judgments can have a significant impact on a company's financial statements and overall perceived value.

Understanding these nuances is essential for investors, creditors, and other stakeholders who rely on financial information to make informed decisions. The balance in the accumulated depreciation account, therefore, is more than just a number; it's a key piece of the puzzle in understanding a company's past, present, and future.

Just like that old delivery truck, weathered but reliable, the story of accumulated depreciation reminds us that everything changes with time. And understanding these changes, meticulously tracking them, allows for better planning, smarter decisions, and a more accurate portrayal of the world around us.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)