How Long Does A Wells Fargo Personal Loan Take

In today's fast-paced financial landscape, securing funds quickly can be crucial for various personal needs, from consolidating debt to financing unexpected expenses. For many, a personal loan from a reputable institution like Wells Fargo seems like a viable option. However, the burning question remains: how long does it actually take to get a Wells Fargo personal loan?

Understanding the loan disbursement timeline is critical for borrowers to plan their finances effectively. This article delves into the typical timeframe involved in obtaining a personal loan from Wells Fargo. We'll explore the factors that can influence the speed of the process, and offer insights into what borrowers can expect from application to funding.

The Application Process: Setting the Stage

The initial application is the first step in securing a Wells Fargo personal loan. This process typically involves providing personal and financial information, including your Social Security number, employment history, income details, and desired loan amount. Accuracy and completeness are essential here; any discrepancies can lead to delays.

Wells Fargo offers various application channels, including online, in-person at a branch, and over the phone. Applying online is often the quickest route, allowing for immediate submission and preliminary assessment. However, some applicants may prefer the personalized assistance offered by applying in-person or over the phone.

Credit Score and Eligibility

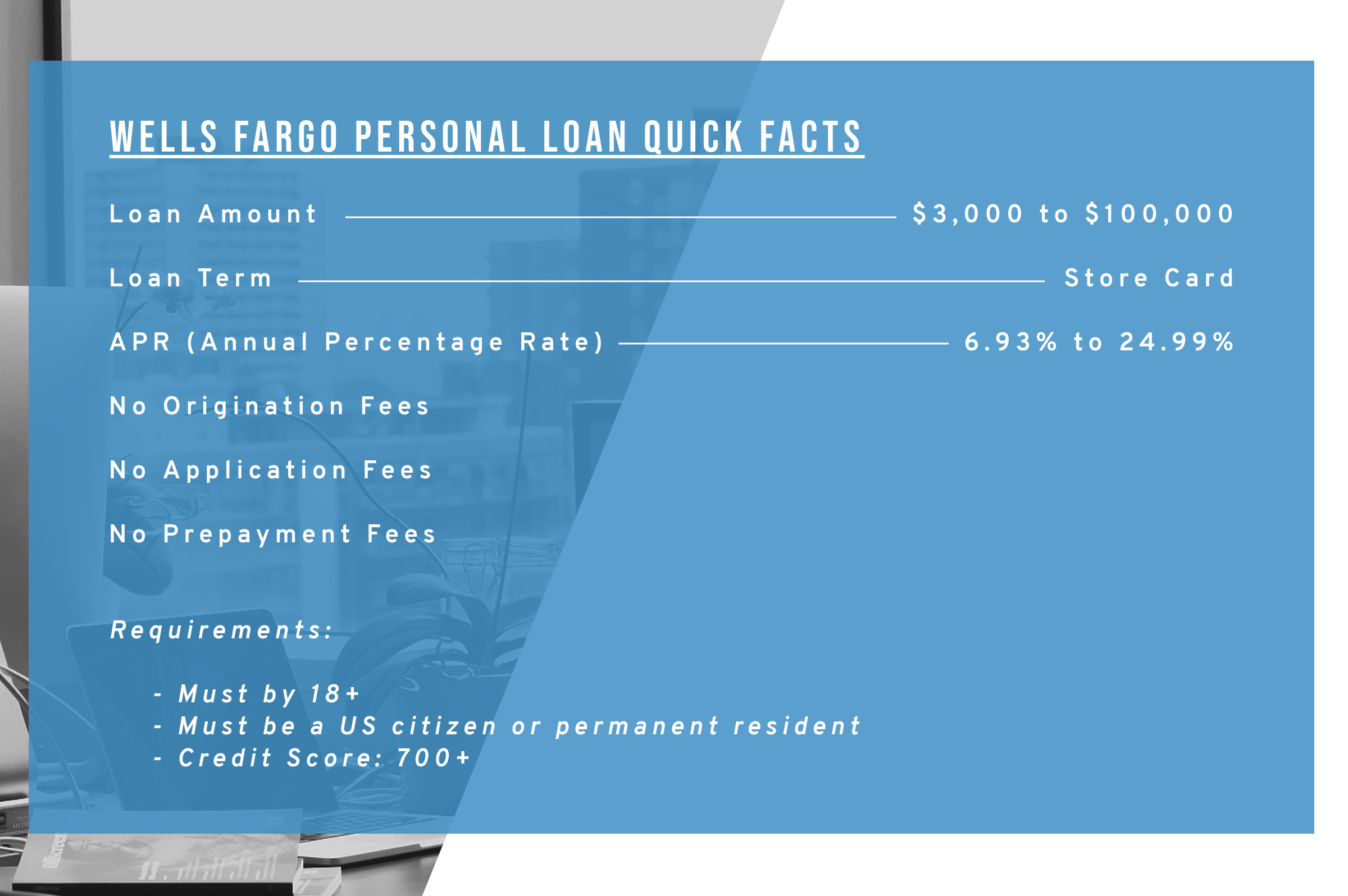

Your credit score plays a significant role in the loan approval process and can influence the speed of approval. Wells Fargo, like most lenders, prefers borrowers with good to excellent credit scores, typically ranging from 660 and above.

A higher credit score indicates a lower risk to the lender, potentially leading to faster approval times and more favorable loan terms. Conversely, a lower score might result in a longer review process or even denial of the loan application.

Underwriting and Verification: Behind the Scenes

After submitting your application, Wells Fargo initiates the underwriting process. This involves verifying the information provided, assessing your creditworthiness, and determining your ability to repay the loan. Verification may include contacting your employer, reviewing bank statements, and pulling your credit report.

The time required for underwriting can vary depending on the complexity of your financial situation and the volume of applications Wells Fargo is processing. Providing all necessary documents promptly and accurately can significantly expedite this stage.

Potential Delays and How to Avoid Them

Several factors can potentially delay the loan approval process. Incomplete applications, discrepancies in information, and difficulties in verifying employment or income are common culprits.

To avoid these delays, double-check all information before submitting your application. Respond promptly to any requests for additional documentation from Wells Fargo. Being proactive and prepared can minimize potential setbacks.

Disbursement: Receiving Your Funds

Once your loan is approved, Wells Fargo will prepare the loan documents for your review and signature. Carefully read through these documents to ensure you understand the terms and conditions of the loan, including the interest rate, repayment schedule, and any associated fees.

After signing the loan agreement, the funds are typically disbursed within a few business days. Wells Fargo may deposit the funds directly into your bank account or provide a check, depending on your preference.

According to customer reviews and reports, the timeframe from application to disbursement for a Wells Fargo personal loan can range from 1 to 5 business days, with some instances taking longer depending on individual circumstances. It's always wise to factor in a buffer period when planning your finances.

Looking Ahead: Streamlining the Process

The trend towards digitalization and automation is likely to further streamline the personal loan application and approval process in the future. Wells Fargo, like other financial institutions, is continuously investing in technology to improve efficiency and enhance the customer experience.

Borrowers can expect to see even faster processing times, more user-friendly online platforms, and greater transparency throughout the loan journey. Staying informed about these advancements will empower borrowers to navigate the loan process with confidence and secure the funds they need in a timely manner.

Ultimately, understanding the factors that influence the Wells Fargo personal loan timeline allows borrowers to manage their expectations and plan accordingly. While the exact timeframe can vary, being prepared, providing accurate information, and maintaining open communication with Wells Fargo can help ensure a smooth and efficient loan experience.

![How Long Does A Wells Fargo Personal Loan Take Personal Loan Wells Fargo: A [year] Overview Conta Ideal](https://contaideal.com/wp-content/uploads/2023/10/wells-fargo-personal-loan.jpg)

:max_bytes(150000):strip_icc()/185327267-56a0666c5f9b58eba4b0443f.jpg)