How Many Acca Exams Are There

For aspiring accountants worldwide, the path to becoming a Chartered Certified Accountant often begins with a crucial question: how many ACCA exams are there? This seemingly simple query unveils a comprehensive and rigorous qualification process, demanding significant dedication and strategic planning.

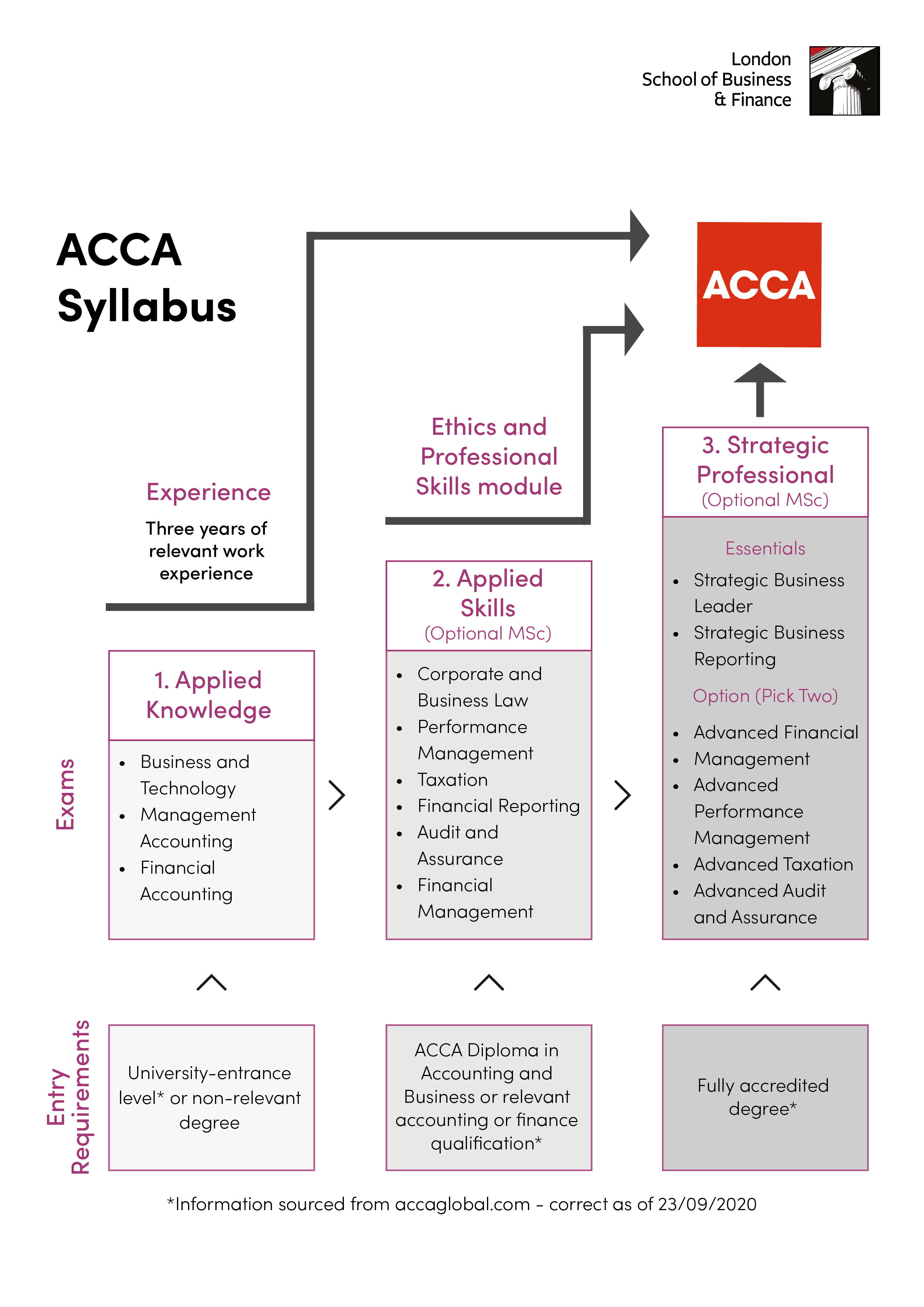

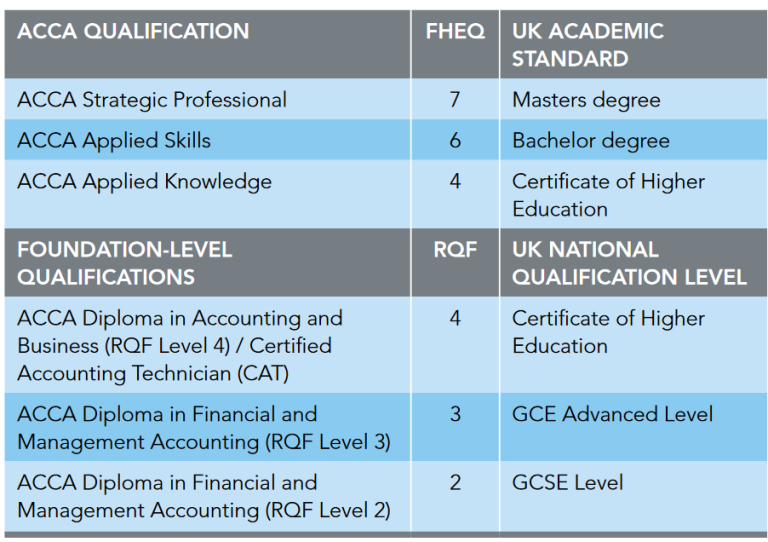

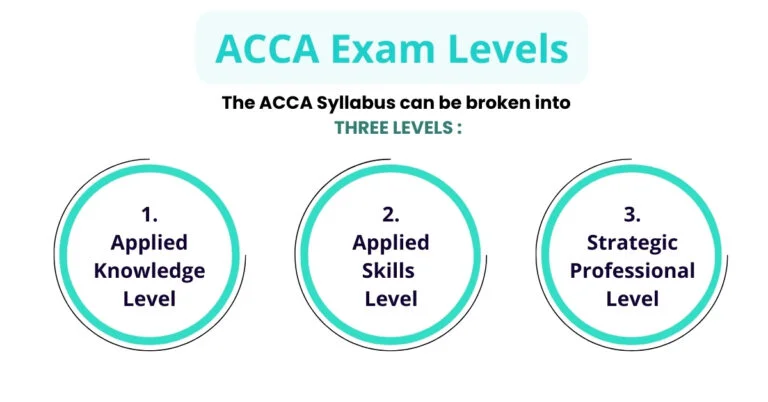

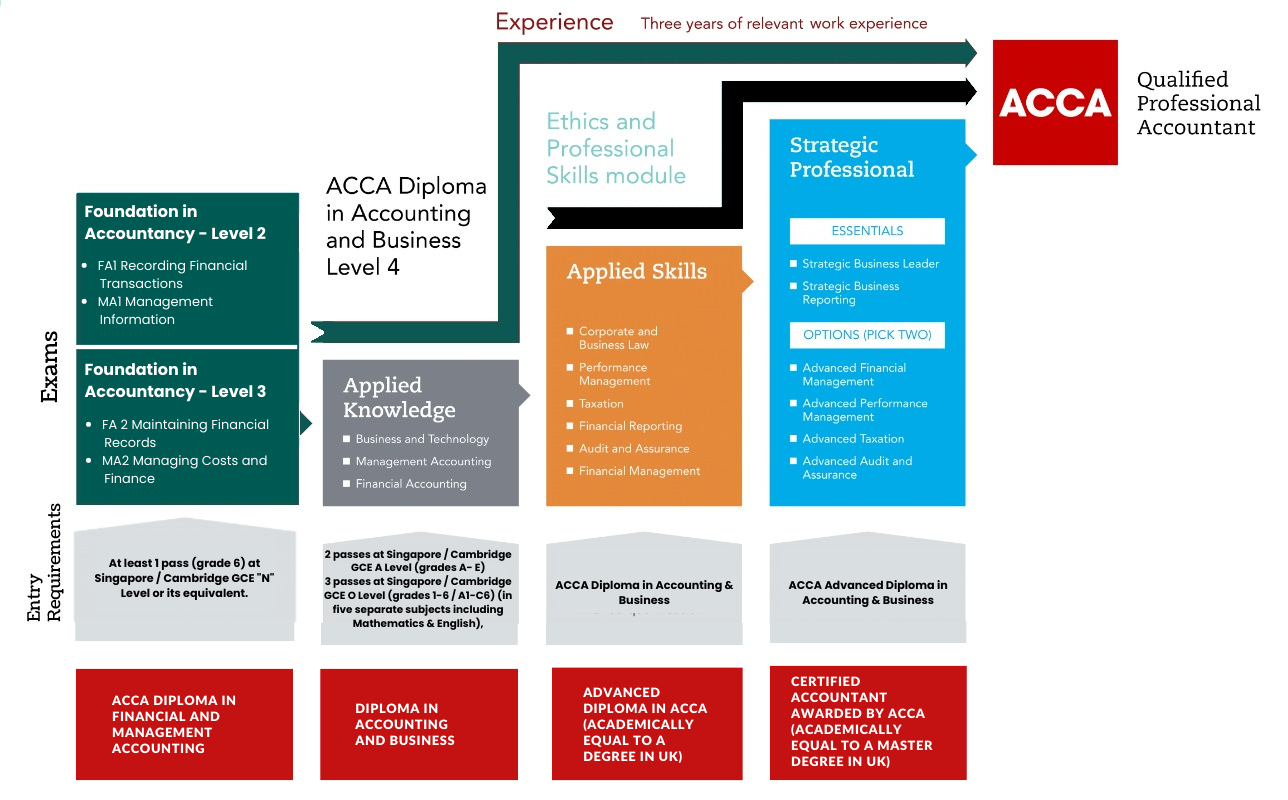

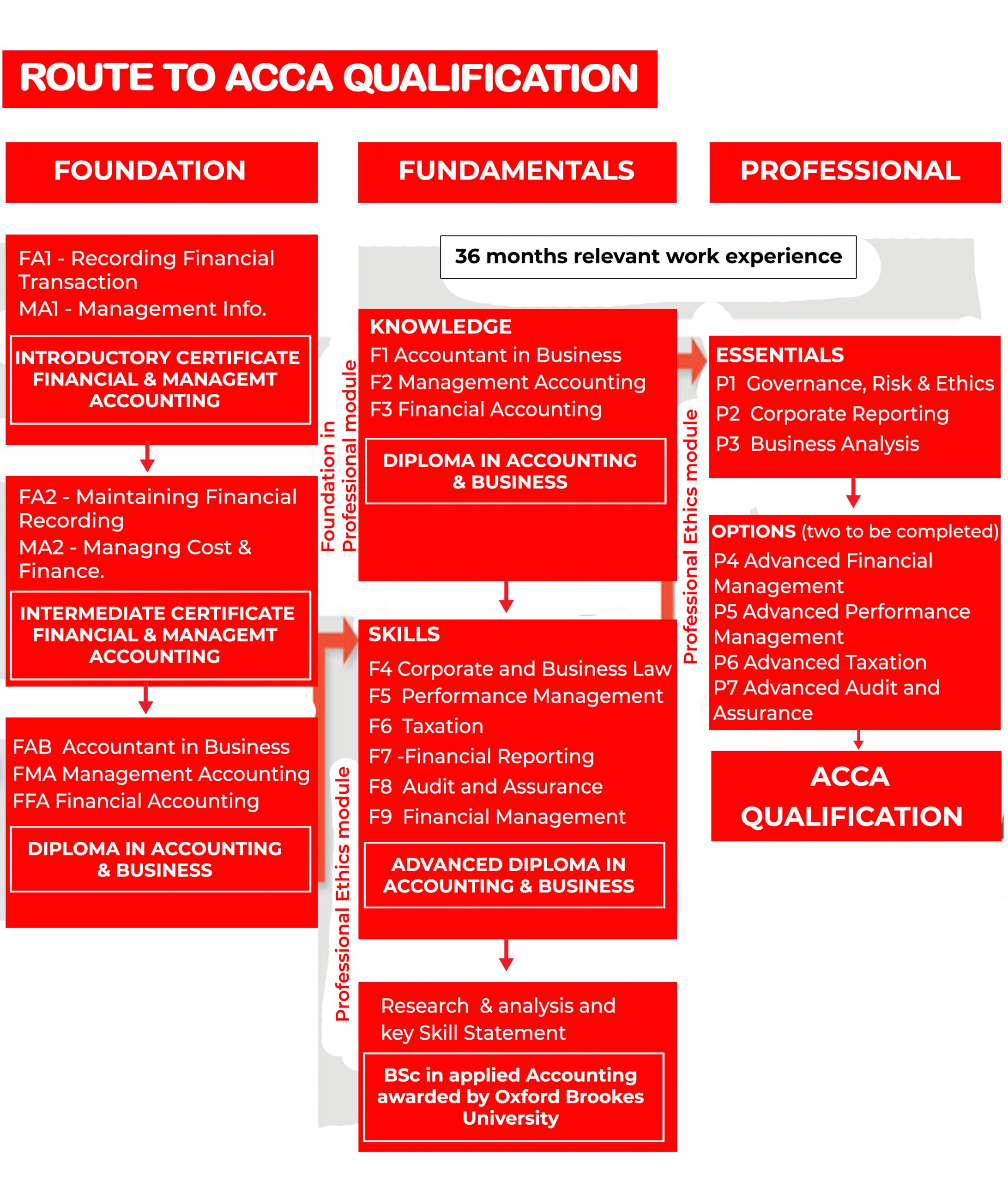

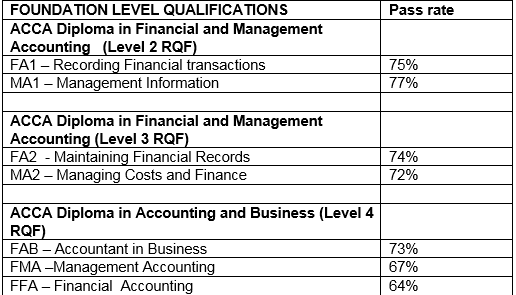

The ACCA qualification requires candidates to pass a total of 13 exams, though exemptions may reduce this number depending on prior qualifications. This qualification is structured into three levels: Applied Knowledge, Applied Skills, and Strategic Professional, each designed to build upon the previous level and equip candidates with the necessary knowledge and expertise for a successful accounting career. Understanding this structure is paramount for anyone considering the ACCA route.

The Structure of the ACCA Qualification

The ACCA qualification is meticulously designed, ensuring a comprehensive understanding of accounting principles and practices. It progresses through three distinct levels, offering a structured and progressive learning experience.

Applied Knowledge Level

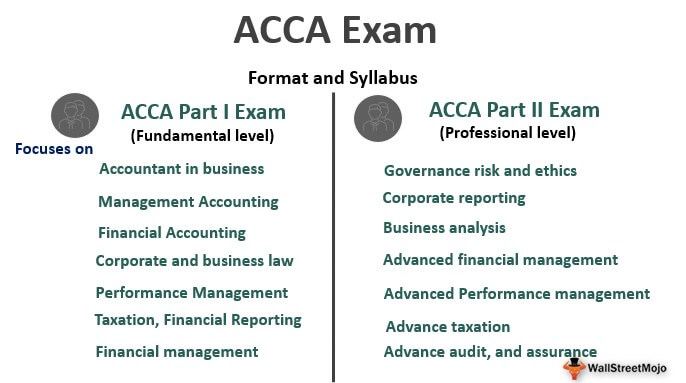

This foundational level comprises three exams: Business and Technology (BT), Management Accounting (MA), and Financial Accounting (FA). These exams introduce fundamental concepts and are primarily assessed through computer-based exams (CBEs).

Candidates gain a basic understanding of business organizations, management accounting techniques, and the principles of financial accounting. Success in these exams demonstrates a grasp of the essential building blocks for further study.

Applied Skills Level

Building on the foundational knowledge, the Applied Skills level consists of six exams. These are Corporate and Business Law (LW), Performance Management (PM), Taxation (TX), Financial Reporting (FR), Audit and Assurance (AA), and Financial Management (FM).

This level delves deeper into specific areas of accounting, developing practical skills and professional judgment. Exams are typically assessed through a combination of objective questions and constructed response questions.

"The Applied Skills level is where students begin to apply theoretical knowledge to real-world scenarios," explains a senior lecturer at a renowned accountancy college. Candidates learn to analyze performance, manage financial risk, and ensure compliance with laws and regulations.

Strategic Professional Level

The Strategic Professional level represents the pinnacle of the ACCA qualification. It requires candidates to complete two mandatory exams: Strategic Business Leader (SBL) and Strategic Business Reporting (SBR).

In addition to these core exams, candidates must choose two optional exams from a selection that includes Advanced Financial Management (AFM), Advanced Performance Management (APM), Advanced Taxation (ATX), and Advanced Audit and Assurance (AAA). This allows for specialization in areas of particular interest or career focus.

The Strategic Professional level emphasizes critical thinking, strategic analysis, and ethical decision-making. These exams are designed to assess a candidate's ability to operate at a senior level within an organization.

Exemptions and Prior Qualifications

While the standard pathway involves 13 exams, many candidates are eligible for exemptions based on their prior academic qualifications. A relevant degree or professional qualification can significantly reduce the number of exams required.

The ACCA website provides a comprehensive exemptions calculator, allowing prospective students to determine their eligibility. Some exemptions are automatically granted, while others may require supporting documentation.

It's crucial for candidates to thoroughly investigate their eligibility for exemptions to optimize their study plan and reduce the overall time required to complete the qualification.

"Checking exemption eligibility is the first step for anyone considering ACCA,"advises a careers advisor specializing in accountancy qualifications.

Exam Format and Assessment

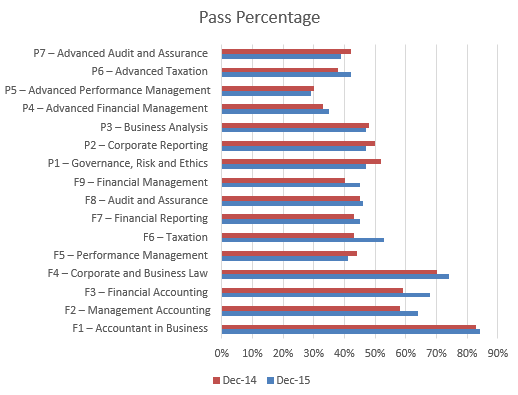

The ACCA exams utilize a variety of assessment methods, designed to evaluate different skills and knowledge. Computer-based exams (CBEs) are primarily used for the Applied Knowledge level, offering instant results.

The Applied Skills and Strategic Professional levels employ a combination of objective questions, constructed response questions, and case studies. These assessments require candidates to demonstrate analytical skills, problem-solving abilities, and professional judgment.

ACCA emphasizes the importance of practical application and critical thinking in its assessments. Candidates are expected to demonstrate a thorough understanding of the subject matter and the ability to apply it in real-world contexts.

The Value of the ACCA Qualification

The ACCA qualification is globally recognized and highly respected within the accounting profession. It provides graduates with a competitive advantage in the job market and opens doors to a wide range of career opportunities.

Many employers actively seek ACCA qualified professionals, recognizing the rigorous training and comprehensive knowledge they possess. ACCA members hold senior positions in finance, accounting, and business management across various industries.

Furthermore, the ACCA qualification equips individuals with the skills and knowledge necessary to adapt to the ever-changing business landscape. It fosters a commitment to lifelong learning and ethical conduct.

Looking Ahead: The Future of ACCA

The ACCA continuously evolves its qualification to meet the demands of the modern business world. Adaptations are made to the curriculum to incorporate emerging technologies, evolving regulations, and changing industry practices.

The organization is committed to providing its members with the skills and knowledge they need to thrive in their careers. This includes investing in resources, training programs, and professional development opportunities.

The number of exams required to achieve the ACCA qualification might seem daunting at first, but the rigorous structure, globally recognized status, and the career prospects it unlocks make it a worthwhile endeavor for aspiring accounting professionals. With strategic planning, dedication, and a thorough understanding of the exam structure, individuals can successfully navigate the ACCA journey and achieve their professional goals.