How Many Pay Stubs For Car Loan

For many aspiring car owners, the journey to securing an auto loan hinges on demonstrating financial stability. A crucial element in this process is providing pay stubs, but the exact number required can vary significantly depending on the lender and individual circumstances.

Understanding how many pay stubs are needed is vital for prospective borrowers to prepare adequately and streamline the loan application, preventing unnecessary delays or rejections. This article explores the factors influencing pay stub requirements for car loans, offering clarity for those navigating the auto financing landscape.

Why Pay Stubs Matter

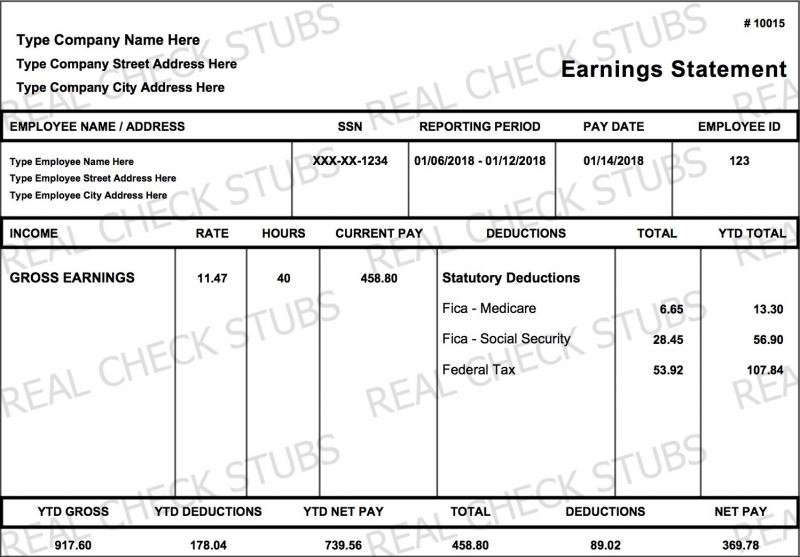

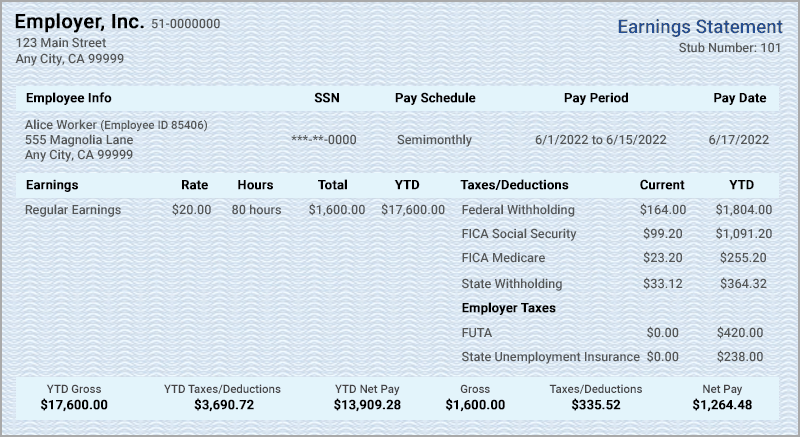

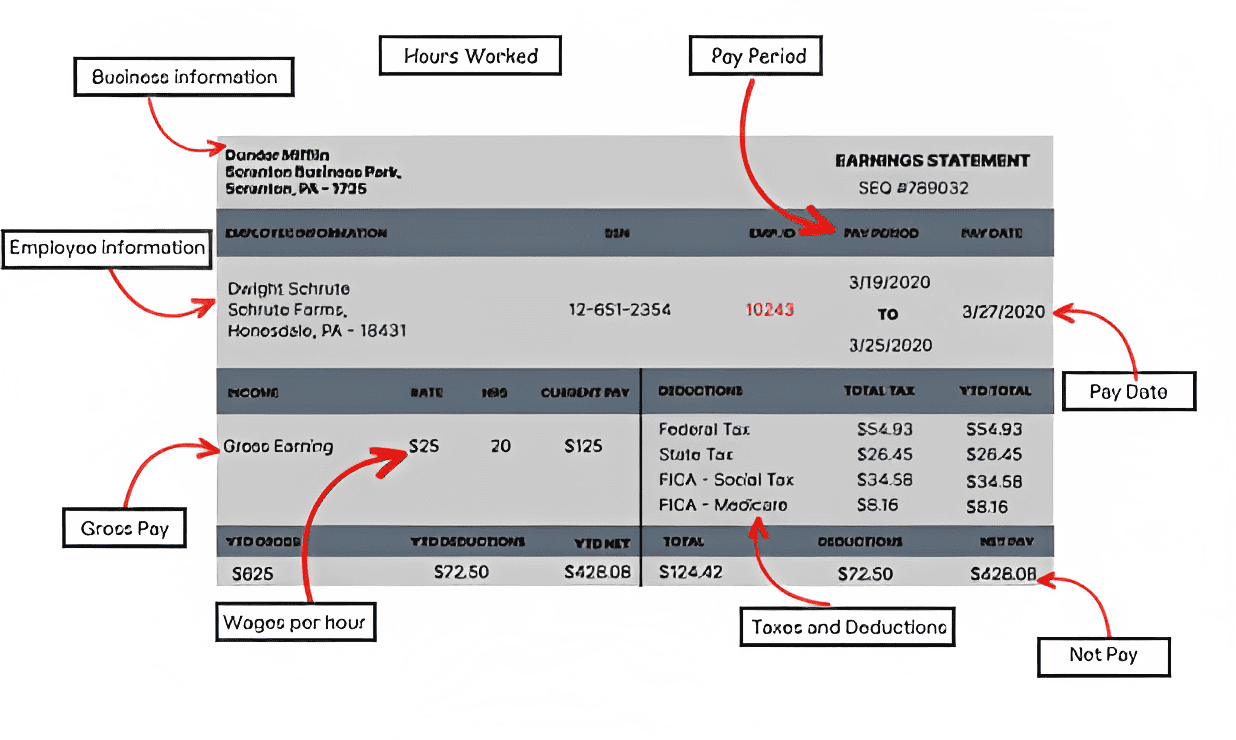

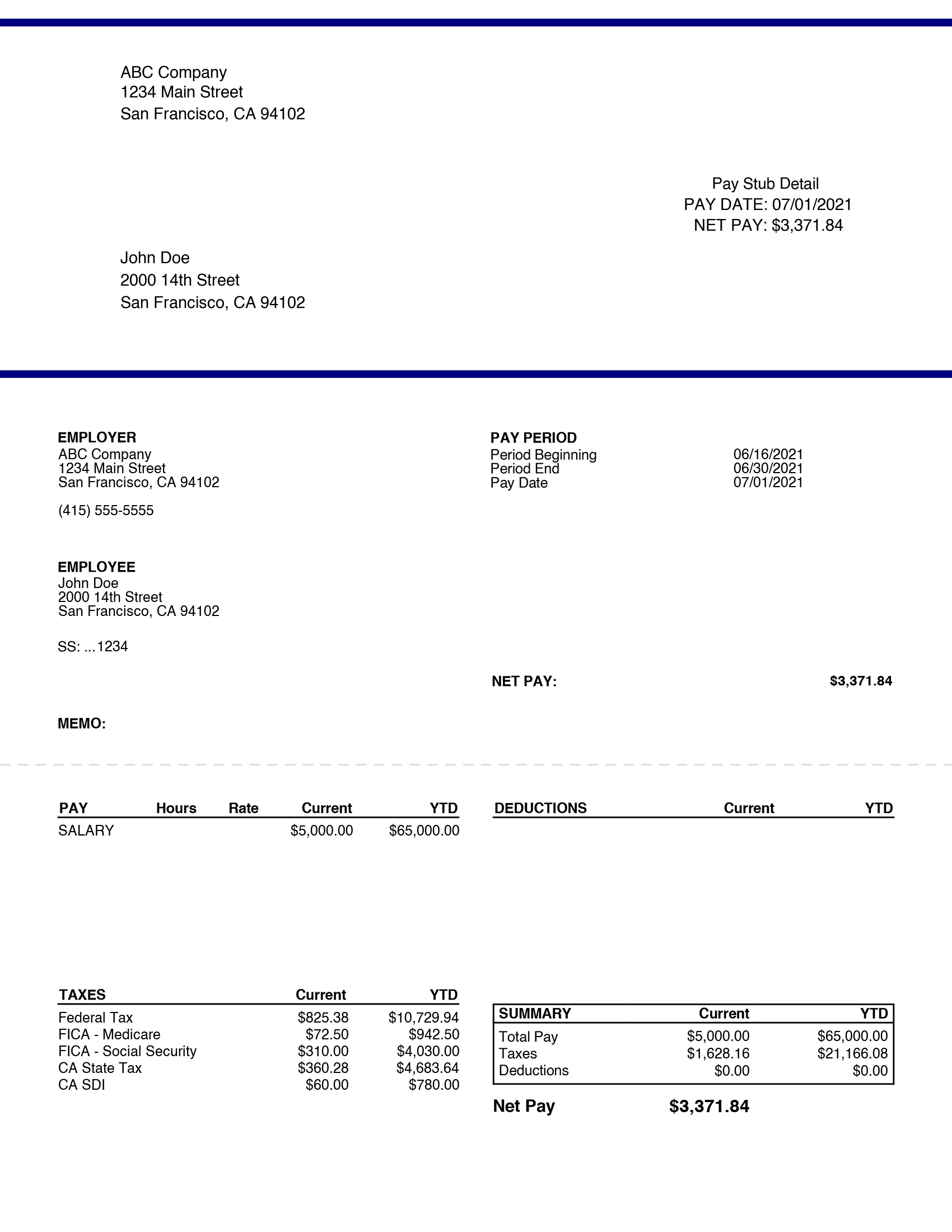

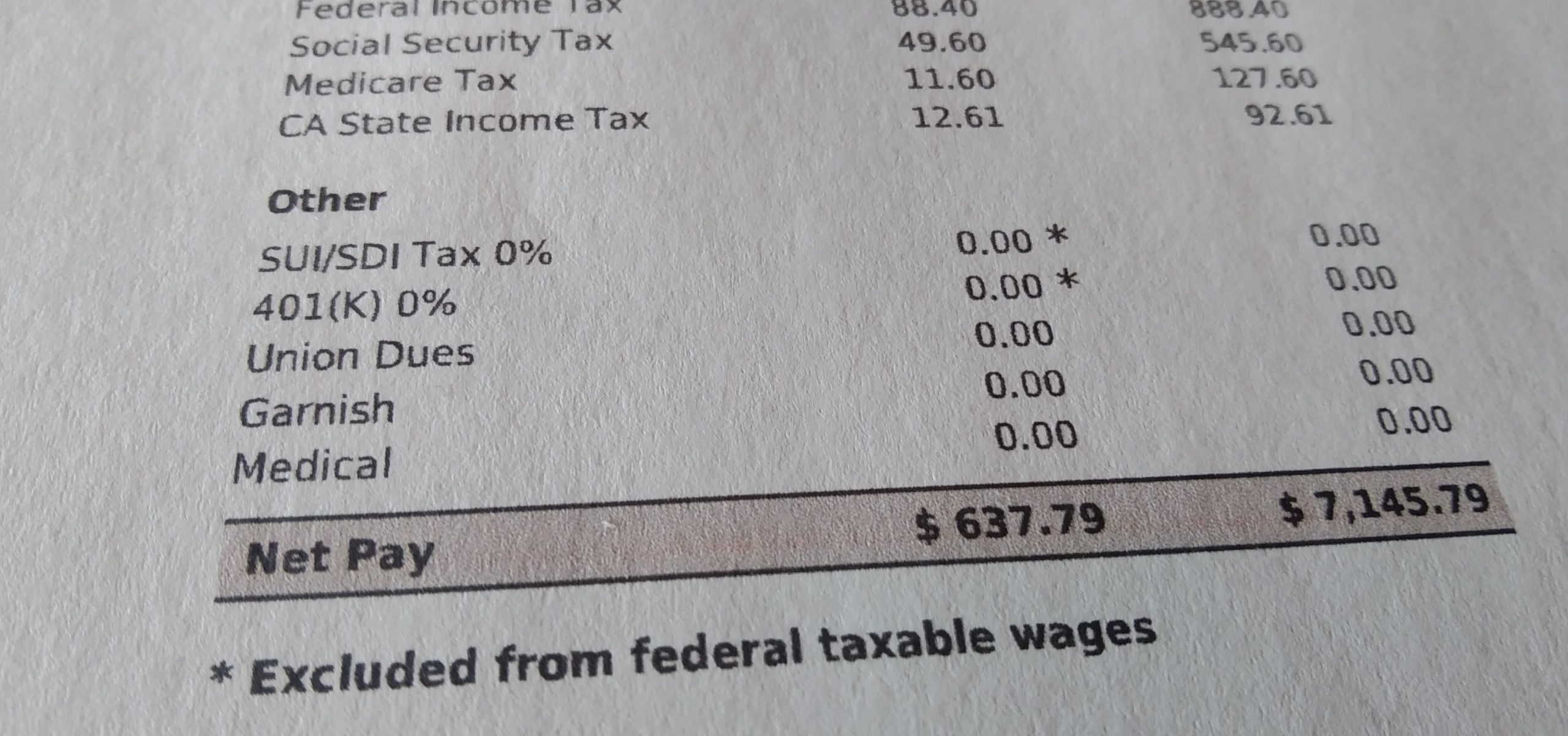

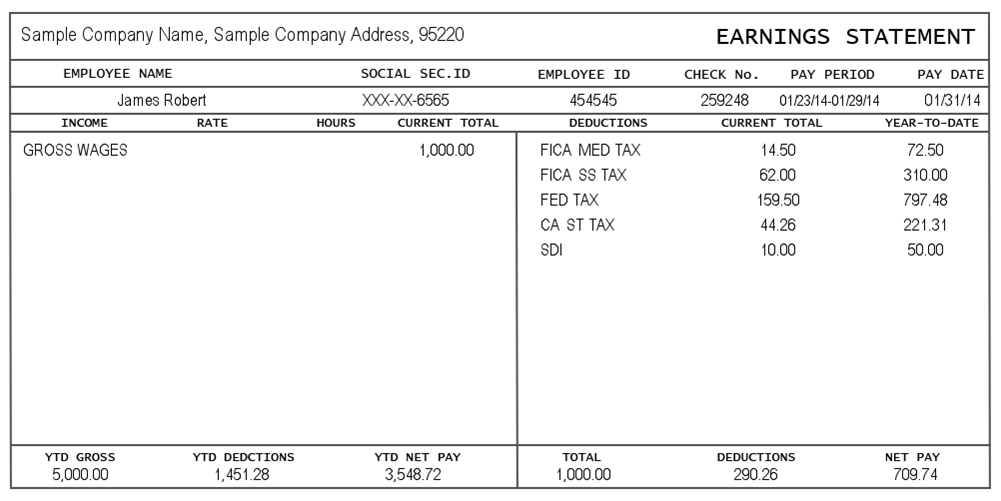

Pay stubs serve as concrete evidence of a borrower's income and employment history. Lenders use this information to assess the borrower's ability to repay the loan, mitigating their risk.

They verify the income amount, employer details, and deductions, offering a clear picture of the applicant's financial standing. This verification process is essential for lenders to make informed decisions about loan approval and interest rates.

The Standard Requirement: Two Pay Stubs

Generally, most lenders require at least two recent pay stubs. This provides a snapshot of the borrower's earnings over a relatively short period.

The timeframe usually covers the most recent 30 to 60 days. These stubs should ideally be consecutive to demonstrate consistent income.

Factors Affecting the Number of Pay Stubs Required

The number of pay stubs needed isn't always fixed at two. Several factors can influence a lender's requirement. Here are some key considerations:

Credit Score

A low credit score signals higher risk to lenders. To compensate for this, lenders might request more pay stubs, sometimes extending to three or even four, to gain a more comprehensive understanding of the borrower’s income stability.

Conversely, a high credit score often allows borrowers to qualify with minimal documentation, sometimes even with only one or two pay stubs.

Employment History

A short or unstable employment history can also lead to higher pay stub requirements. Lenders might want to see several months' worth of stubs to ascertain long-term income reliability, especially if the applicant recently changed jobs.

Self-employed individuals often need to provide more extensive documentation, such as tax returns and bank statements, instead of relying solely on pay stubs.

Loan Amount and Term

Larger loan amounts or longer loan terms typically warrant greater scrutiny from lenders. They need to be more certain that the borrower can meet the repayment obligations over an extended period.

This heightened risk often translates to a request for additional pay stubs or other income verification documents.

Lender Policies

Each lender operates with its own specific policies and risk tolerance. Some lenders might have stricter documentation requirements than others, regardless of the applicant's creditworthiness.

It's always advisable to check with the specific lender about their exact requirements before submitting an application. Researching different lenders and their policies is crucial.

Alternative Income Verification Methods

In situations where providing the standard number of pay stubs is difficult, borrowers might have alternative options for income verification. These options include:

- Bank Statements: Showing consistent deposits that reflect a steady income stream.

- Tax Returns: Providing federal tax returns, particularly for self-employed individuals.

- W-2 Forms: Submitting W-2 forms as annual income verification.

- Proof of Other Income: Including documentation for alimony, child support, or investment income.

Lenders may accept these alternatives, especially when combined with other forms of verification, to assess the borrower's ability to repay. Each

lender has discretion to determine if the alternative documentation will be accepted.

Tips for a Smooth Loan Application

To ensure a smooth loan application process, borrowers should gather all necessary documents in advance. This includes obtaining the required number of recent, consecutive pay stubs.

It's also beneficial to check the pay stubs for accuracy and completeness. Any discrepancies could cause delays or even rejection of the loan application. Ensuring all information is up-to-date is key.

If you anticipate needing alternative income verification, it's important to discuss this with the lender upfront. This allows for a clear understanding of what documentation will be accepted and helps prevent surprises later in the process.

The Impact on Borrowers

Understanding the pay stub requirements for car loans empowers borrowers to prepare adequately and avoid unnecessary stress. By knowing what to expect, applicants can streamline their loan application and increase their chances of approval.

For borrowers with unconventional income sources or employment histories, exploring alternative verification methods is crucial for securing financing. This can open doors to car ownership that might otherwise be closed.

Conclusion

While the standard requirement is typically two recent pay stubs, the exact number needed for a car loan can vary based on several factors, including credit score, employment history, loan amount, and lender policies. Preparing the appropriate documentation and understanding alternative income verification methods are vital for a successful loan application. *Consulting with a financial advisor can also provide personalized guidance and support throughout the auto financing process.*

![How Many Pay Stubs For Car Loan How Many Pay Stubs Do I Need To Get A Car [2024]](https://www.autohitch.com/wp-content/uploads/2024/03/How-Many-Pay-Stubs-Do-I-Need-To-Get-a-Car.jpg)