How Many Payday Loans Can You Get

Imagine you're juggling bills, a sudden car repair throws everything off, and payday feels like a lifetime away. A payday loan seems like a quick fix, a life raft in a sea of financial strain. But is it really that simple? Can you grab multiple life rafts, or will they just weigh you down further?

The question of how many payday loans you can get isn't straightforward. It largely depends on state regulations and individual lender policies. Understanding these limitations is crucial to avoid falling into a cycle of debt.

The Patchwork Quilt of State Regulations

Payday loans are heavily regulated, but the specifics vary wildly. Some states have outright banned them, effectively answering the question with a resounding zero. Other states have strict caps on interest rates and loan amounts, while still others have minimal oversight.

For example, states like North Carolina and Georgia have usury laws that make payday lending effectively illegal. This protects consumers from the predatory practices often associated with high-interest, short-term loans.

On the other hand, states with less stringent regulations may allow multiple payday loans. However, even in these states, there are often limits in place. These restrictions aim to prevent borrowers from becoming overly reliant on payday loans.

Understanding State-Specific Limits

To get a clear picture, it's essential to research the laws in your specific state. State attorney general websites and consumer protection agencies are valuable resources. They offer detailed information on payday lending regulations and consumer rights.

Some states limit the number of outstanding payday loans a person can have at any one time. For example, a state might allow only one outstanding loan at a time. This prevents borrowers from taking out multiple loans to cover previous ones.

Other states might cap the total amount a borrower can borrow, regardless of the number of loans. This total debt limit prevents individuals from accumulating unmanageable debt from payday loans.

Lender Policies and Databases

Even within a state, individual lenders can have their own policies regarding multiple loans. Some lenders may choose not to offer loans to individuals who already have outstanding payday loans, regardless of state law. They may view it as too risky, as the borrower is already in debt.

Furthermore, many states utilize shared databases to track payday loan activity. These databases allow lenders to see if a potential borrower already has outstanding loans with other companies.

This system helps to enforce state regulations and prevent borrowers from exceeding the permitted number or amount of loans. Lenders can easily verify a borrower's loan history before issuing a new loan.

The Potential Debt Trap

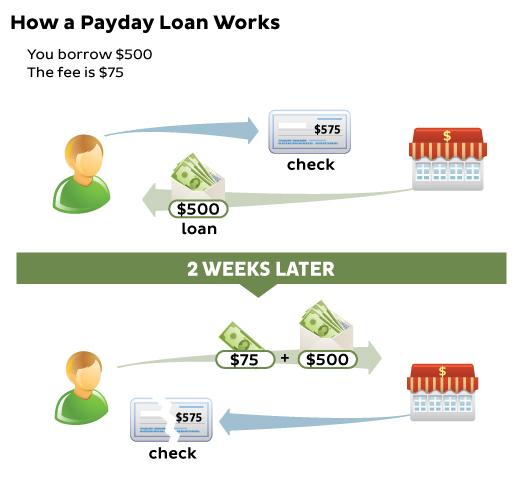

The allure of quick cash can be strong, especially when facing unexpected expenses. However, taking out multiple payday loans can quickly lead to a debt trap. The high interest rates and short repayment periods make it difficult to break free.

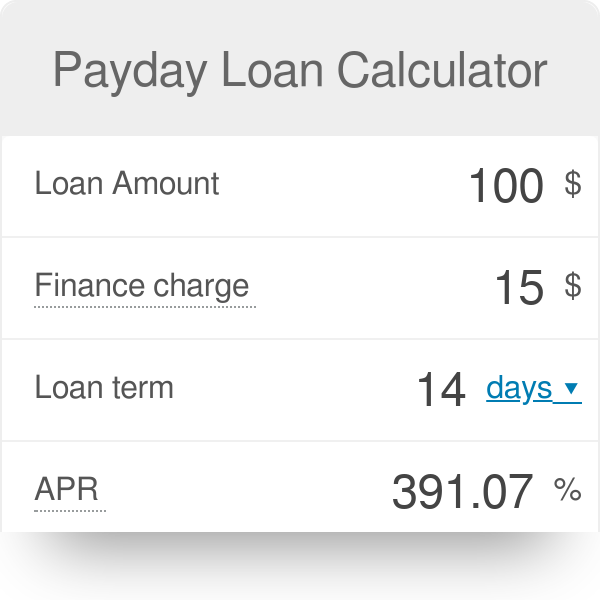

Consider this: If you take out multiple loans with APRs of 400% or higher, a significant portion of each paycheck goes toward interest and fees. This leaves less money for essential expenses, potentially requiring you to take out further loans.

This cycle can be incredibly difficult to escape, leading to financial instability and stress. It's a situation best avoided by exploring alternative options and understanding the true cost of payday loans.

Alternatives to Payday Loans

Before considering a payday loan, explore other options. These might include borrowing from friends or family, seeking assistance from local charities, or negotiating a payment plan with creditors.

Credit counseling can also be a valuable resource. A credit counselor can help you create a budget, manage debt, and explore debt relief options. They offer expert advice and support to help you regain control of your finances.

Another option is to consider a personal loan from a bank or credit union. While these loans require a credit check, they often come with lower interest rates and more manageable repayment terms compared to payday loans.

Building a Financial Safety Net

The best way to avoid relying on payday loans is to build a financial safety net. This involves saving regularly, even if it's just a small amount each month. Over time, these savings can provide a cushion for unexpected expenses.

Creating a budget is another essential step. Understanding where your money is going can help you identify areas where you can cut back and save more. This allows you to have more money available for unexpected events.

Automating your savings can also make it easier to reach your financial goals. Set up automatic transfers from your checking account to your savings account each month. This way, saving becomes a habit rather than an afterthought.

A Word of Caution

While payday loans may seem like a convenient solution in the short term, they can have long-term consequences. The high interest rates and fees can quickly spiral out of control, leading to financial hardship.

Before taking out a payday loan, carefully consider the risks and explore all other available options. Understand the terms of the loan, including the interest rate, fees, and repayment schedule. Ensure you can realistically afford to repay the loan on time.

Financial literacy is key to making informed decisions about borrowing. Educate yourself about different types of loans, interest rates, and the potential risks involved. This knowledge will empower you to make choices that benefit your financial well-being.

Conclusion

The number of payday loans you can get isn't a simple question with a universal answer. It hinges on a complex interplay of state laws and lender policies. Navigating this landscape requires diligence and a proactive approach to financial well-being.

Ultimately, the wisest course of action is to view payday loans as a last resort. By building a financial safety net and exploring alternative options, you can avoid the potential debt trap and secure a brighter financial future.

Remember, financial stability is a marathon, not a sprint. Small, consistent steps towards responsible financial management will yield the most significant rewards in the long run.