Questions To Ask When Buying A Company

The allure of acquiring a company is undeniable: instant market share, established revenue streams, and a leap forward in strategic positioning. However, beneath the surface of impressive financials and confident pronouncements can lie hidden liabilities, operational inefficiencies, and cultural mismatches that can quickly turn a dream acquisition into a costly nightmare. Savvy buyers know that due diligence is not merely a formality, but a critical process that demands a comprehensive and insightful line of questioning.

Acquiring a business is a multifaceted endeavor, fraught with risks that can impact the acquiring company's financial health and strategic goals. The core of successful due diligence lies in asking the right questions, unveiling potential red flags, and ensuring a transparent understanding of the target company's operations, finances, legal standing, and future prospects. This article delves into the essential questions buyers should ask when considering a company acquisition, drawing on expert advice and industry best practices to provide a comprehensive guide for navigating this complex process.

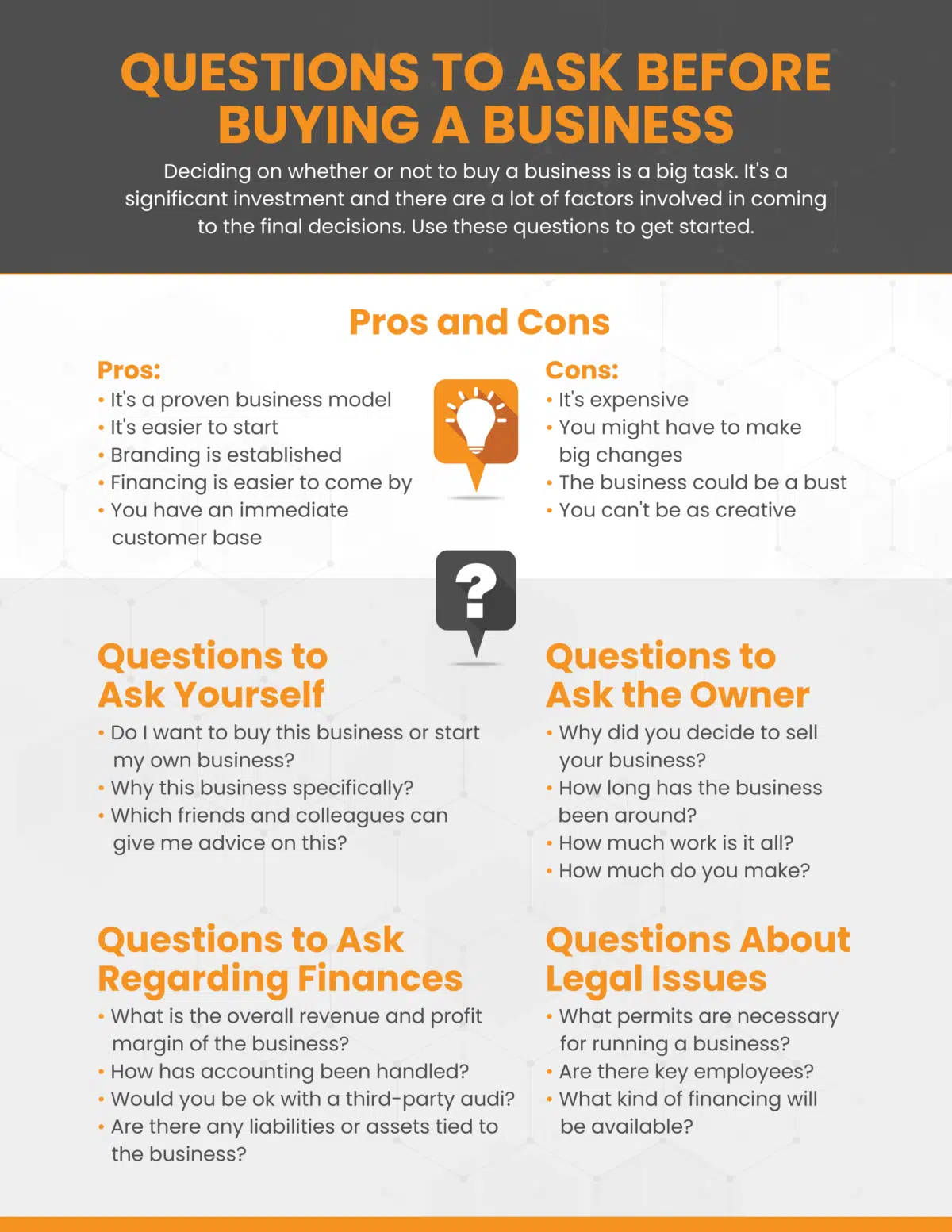

Financial Due Diligence: Unveiling the Numbers

The financial health of the target company is paramount. Start with the basics: "Can you provide independently audited financial statements for the past three to five years?" Audited statements offer a level of assurance that internal reports cannot.

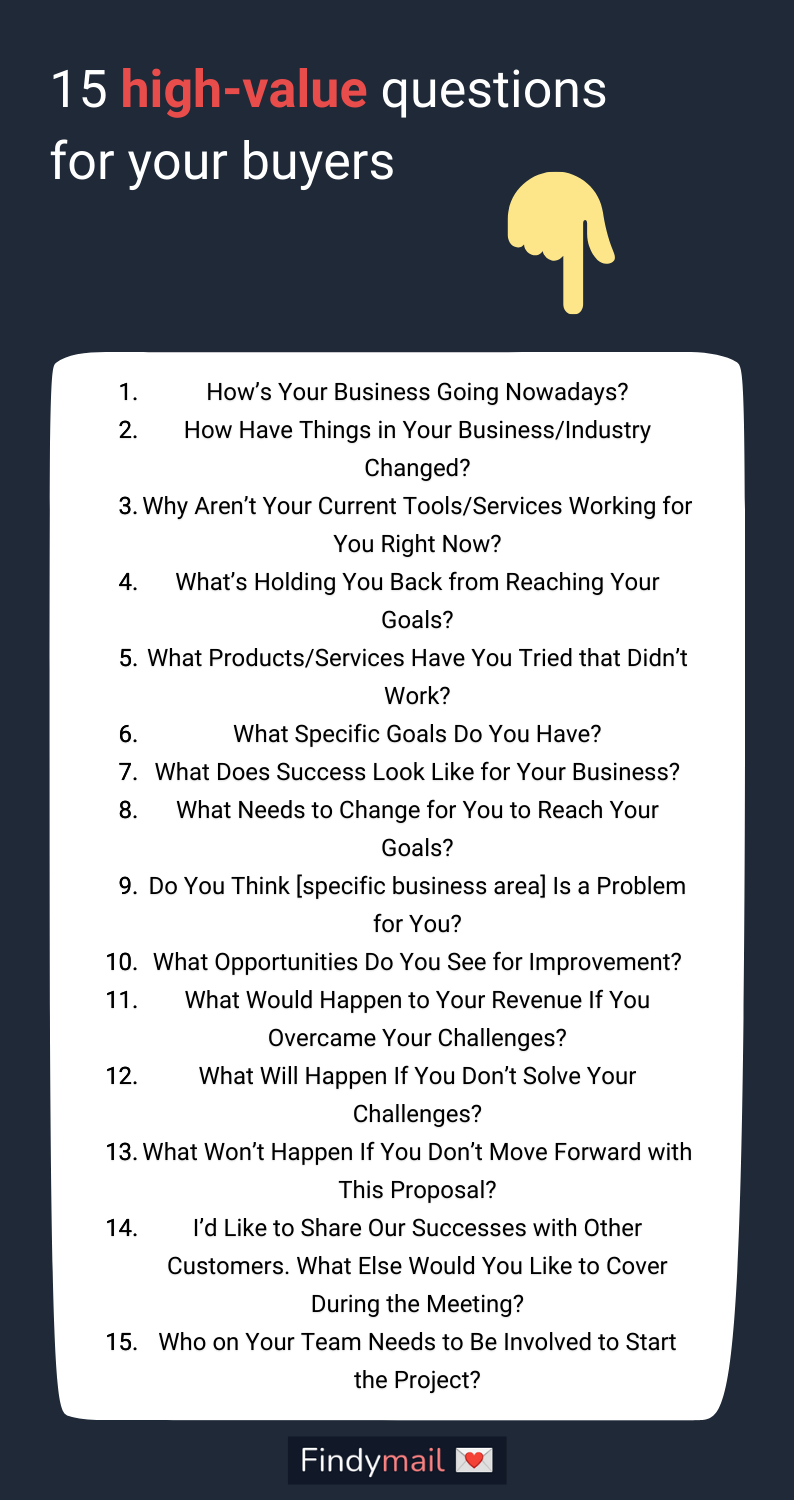

Delve deeper into the revenue streams. "What are your key revenue drivers, and how have they performed over time?" Understanding the sources and stability of revenue is crucial for projecting future performance.

Scrutinize the cost structure. "Can you break down your key expenses and provide insights into any recent cost-saving initiatives?" Identifying areas of potential savings or hidden costs is essential for accurate valuation.

Inquire about debt. "What is the total amount of outstanding debt, and what are the terms and conditions of each loan?" Understanding the debt burden and associated obligations is critical for assessing financial risk.

Don't overlook accounts receivable. "What is your average collection period, and what percentage of your accounts receivable are considered past due?" Uncollectible accounts can significantly impact cash flow.

Operational Due Diligence: Examining the Engine

Operational efficiency is just as vital as financial stability. "Can you provide details on your key operational processes, including production, distribution, and customer service?" Understanding the company's core operations is fundamental to assessing its efficiency and scalability.

Assess the technology infrastructure. "What technology systems do you use, and how are they maintained and updated?" Outdated or inadequate technology can hinder future growth and require significant investment.

Evaluate the supply chain. "Who are your key suppliers, and what are the terms of your contracts with them?" Supply chain disruptions can significantly impact production and profitability.

Explore the workforce. "What is your employee turnover rate, and what strategies do you have in place to retain talent?" A high turnover rate can indicate underlying problems with company culture or management.

Legal and Regulatory Compliance: Avoiding the Pitfalls

Legal compliance is non-negotiable. "Are there any pending lawsuits or regulatory investigations involving the company?" Legal liabilities can significantly impact the value of the acquisition.

Examine contracts carefully. "Can you provide copies of your key contracts with customers, suppliers, and employees?" Reviewing contracts is essential for understanding obligations and potential risks.

Investigate intellectual property. "What patents, trademarks, and copyrights does the company own, and are there any challenges to their validity?" Intellectual property can be a valuable asset, but only if it is properly protected.

Assess environmental compliance. "Are there any environmental liabilities associated with the company's operations?" Environmental issues can be costly to remediate and can damage the company's reputation.

Strategic Fit and Cultural Compatibility: Ensuring Long-Term Success

A successful acquisition requires more than just financial and operational alignment. "What is the company's competitive advantage, and how sustainable is it?" Understanding the company's position in the market is crucial for assessing its long-term potential.

Evaluate cultural compatibility. "What is the company's culture like, and how well will it integrate with our own?" Cultural clashes can lead to employee attrition and integration challenges.

Assess the leadership team. "Who are the key members of the management team, and what are their plans for the future?" The expertise and commitment of the management team are essential for a smooth transition.

Don't underestimate customer relationships. "What is the company's customer retention rate, and what strategies do they have in place to maintain customer loyalty?" Strong customer relationships are a valuable asset.

The Path Forward: Informed Decision-Making

The questions outlined above provide a starting point for a thorough due diligence process. Engaging experienced legal, financial, and operational advisors is crucial for navigating the complexities of an acquisition and mitigating potential risks. By asking the right questions and conducting thorough due diligence, buyers can make informed decisions, protect their investment, and ensure a successful acquisition that drives long-term value.

Ultimately, the success of an acquisition hinges on a buyer's willingness to delve beneath the surface and uncover the true nature of the target company. Proactive investigation and thoughtful consideration will pave the way for a smooth integration and a prosperous future. Remember, due diligence is not merely a checklist; it's a strategic imperative.

+(1).png?format=1500w)

![Questions To Ask When Buying A Company 3 questions to ask before buying a business [infographic]](https://blog.jpabusiness.com.au/hs-fs/hubfs/3. Infographics and cheat sheets/3 questions to ask yourself before buying a business.png?width=300&name=3 questions to ask yourself before buying a business.png)

+(59).png)