How Many Points Does An Eviction Drop Your Credit Score

Eviction can trigger a significant credit score drop, potentially devastating for future financial stability. The impact varies, but understanding the ramifications is crucial for both renters and landlords.

This article breaks down the complex relationship between eviction and credit scores, providing essential information to navigate this challenging situation. We delve into the factors influencing the score reduction, exploring how to mitigate damage and rebuild credit after an eviction.

The Immediate Impact: How Many Points Are We Talking?

There's no fixed number of points an eviction will deduct from your credit score. The impact depends on several factors, including your existing credit score, the reason for the eviction, and how the eviction is reported.

However, sources like Experian indicate that the *most substantial* damage arises not directly from the eviction itself, but from the unpaid rent or fees that typically accompany it. These debts are often reported to credit bureaus.

These reported debts from unpaid rent or fees can lead to a score drop ranging from 50 to 100 points, or even more, particularly for those with already lower credit scores. The higher your initial score, the larger the potential drop.

Why Eviction Doesn't Directly Appear on Credit Reports (Usually)

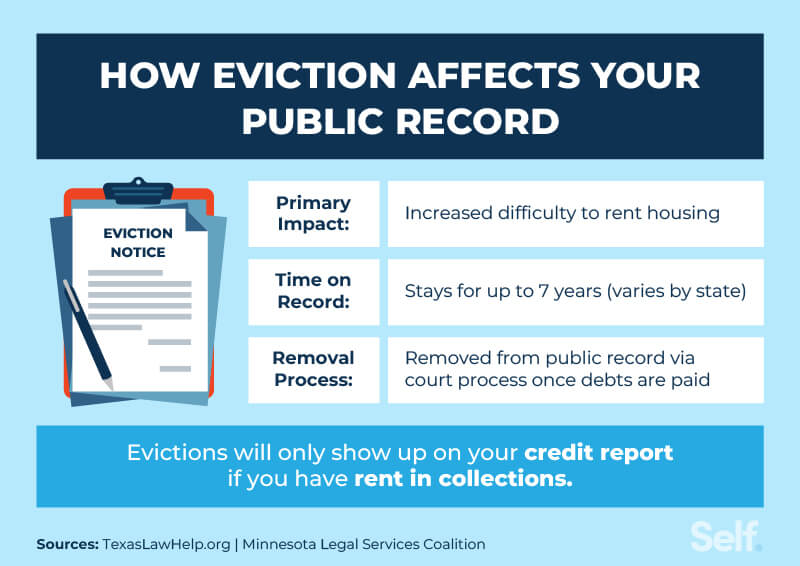

Evictions *themselves* are typically court proceedings and public records. However, they are *not* usually directly reported to credit bureaus like Equifax, Experian, or TransUnion.

It’s the *unpaid rent, late fees, and property damage* associated with the eviction that ultimately stain your credit report. Landlords often pursue these debts through collections agencies, who then report them.

This is a critical distinction to understand. Focusing on managing the underlying debt is the key to mitigating the damage.

The Role of Public Records and Background Checks

While an eviction *itself* might not directly hit your credit report, it will appear in public records. These records are often accessed during background checks.

Landlords routinely use background checks to screen potential tenants. An eviction record can make it significantly harder to find housing in the future, even if your credit score is relatively good.

The presence of an eviction record on your public record can affect your ability to secure housing for years to come. The exact timeframe varies depending on local laws and reporting practices.

Navigating the Aftermath: Rebuilding Your Credit

Rebuilding credit after an eviction-related score drop is a marathon, not a sprint. It requires patience and a strategic approach.

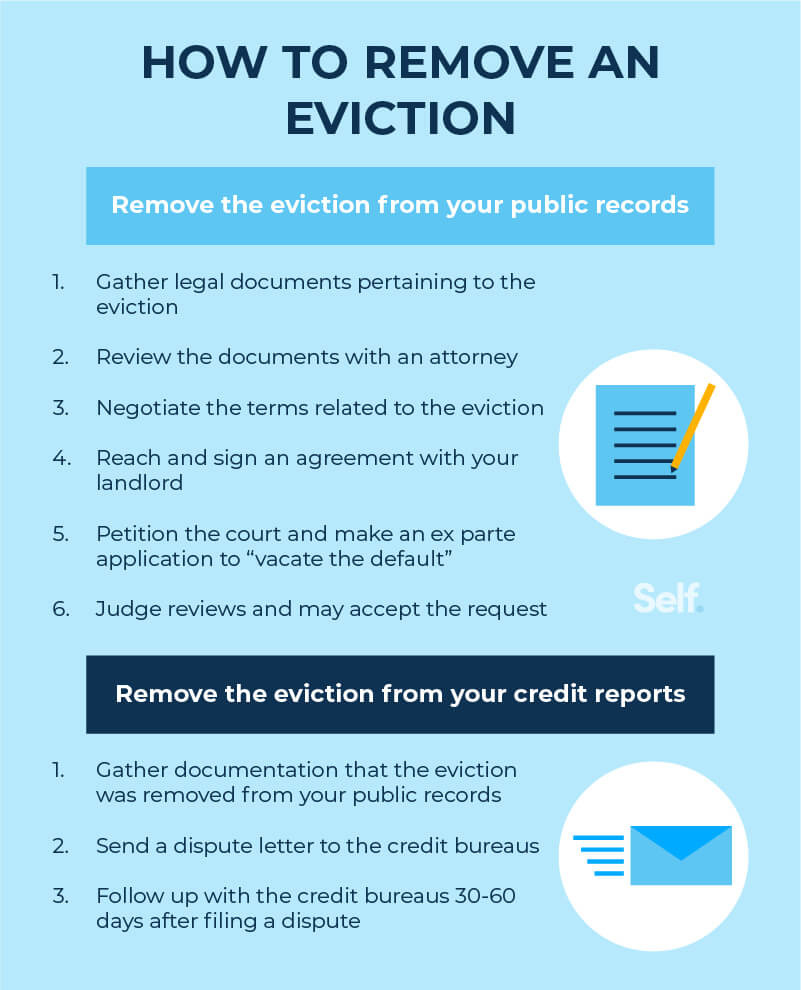

The first step is to address the underlying debt. Negotiate a payment plan with the landlord or collection agency if possible. Settling the debt, even for a reduced amount, can help improve your credit profile over time.

Securing a secured credit card can be a helpful way to rebuild credit. These cards require a security deposit, which typically serves as your credit limit.

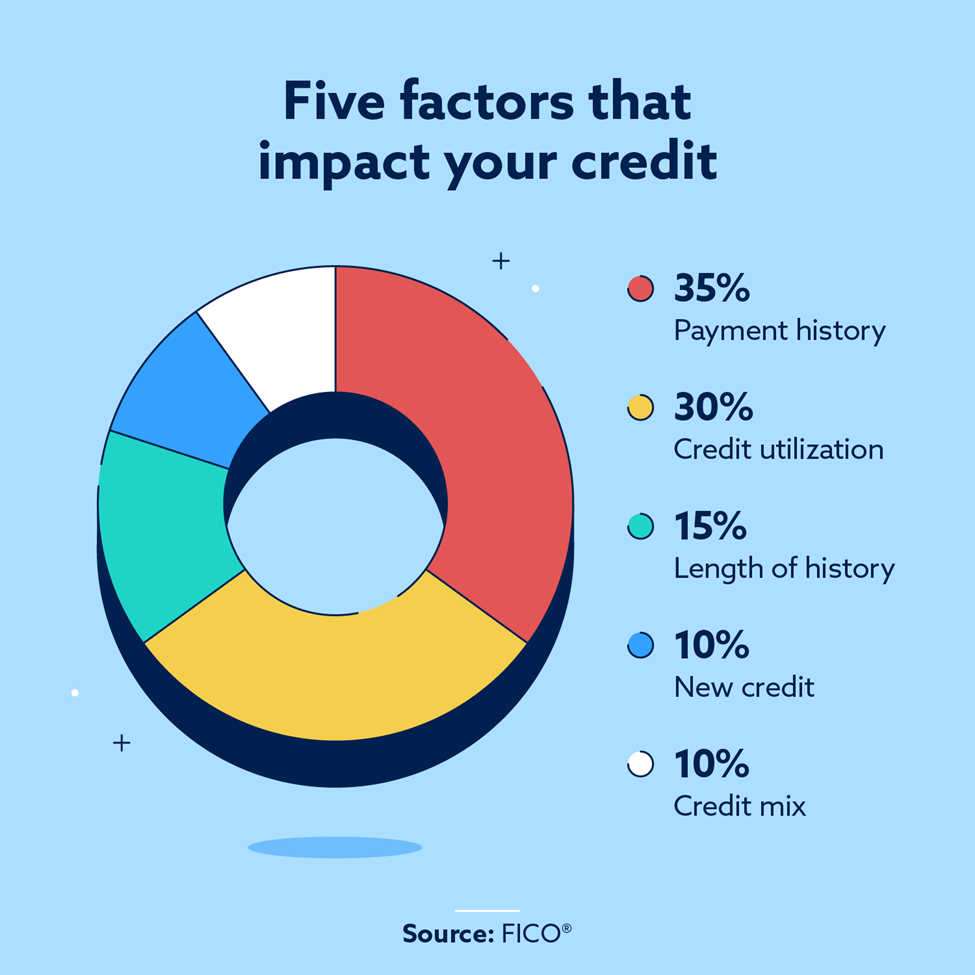

Make sure to pay your bills on time, every time. Consistent, on-time payments are crucial for rebuilding a positive credit history.

Legal Considerations and Your Rights

It's crucial to understand your rights as a tenant facing eviction. Consult with a legal aid organization or attorney to explore your options.

Review the eviction notice carefully for any errors or inconsistencies. You may have grounds to challenge the eviction if proper procedures weren't followed.

Document everything related to the eviction, including communication with the landlord, payment records, and any notices received. This documentation can be valuable if you need to defend yourself in court or challenge inaccurate reporting.

Where to Find Help: Resources for Renters

Several organizations offer assistance to renters facing eviction. The *U.S. Department of Housing and Urban Development (HUD)* provides resources and information on tenant rights.

Local legal aid societies and tenant advocacy groups can provide legal representation and guidance. These organizations can help you understand your rights and navigate the eviction process.

Additionally, credit counseling agencies can offer guidance on managing debt and rebuilding credit. Be sure to choose a reputable agency accredited by the *National Foundation for Credit Counseling (NFCC)*.

Looking Ahead: What's Next?

The issue of eviction and its impact on credit is an ongoing concern. Advocates are pushing for reforms to protect renters and prevent inaccurate reporting.

Stay informed about your rights as a tenant. Knowing your rights is essential for navigating the eviction process and protecting your financial future.

Continue to monitor your credit report regularly. Dispute any inaccuracies you find to ensure your credit report is accurate and up-to-date.