Transunion Risk And Alternative Data Solutions Inc

Imagine a world where opportunity knocks louder for everyone, where credit scores aren't the only gatekeepers to financial well-being. Picture entrepreneurs with innovative ideas finally accessing capital, and individuals with unconventional income sources building secure futures. This vision isn't a distant dream; it's a reality being shaped by companies like TransUnion Risk and Alternative Data Solutions Inc., a division dedicated to expanding financial inclusion.

The core mission of TransUnion Risk and Alternative Data Solutions Inc. is to broaden access to financial services by leveraging alternative data sources and innovative risk assessment models. This allows lenders to make more informed decisions about individuals and businesses who might be overlooked by traditional credit scoring systems.

The Quest for Financial Inclusion

The financial landscape is often tilted against those with limited or unconventional credit histories. Many individuals, particularly those from underserved communities, struggle to secure loans, insurance, or even rental housing because their credit scores don't reflect their true financial capabilities.

This is where the concept of *alternative data* comes into play. It encompasses a wide range of information not typically found in credit reports, such as utility payments, rental history, mobile phone bills, and even data from online marketplaces.

A Deeper Dive into Alternative Data

Think about the single mother who diligently pays her rent and utility bills on time, but has a thin credit file due to limited borrowing. Or the small business owner whose consistent sales on an e-commerce platform demonstrate their ability to generate revenue, yet they lack a traditional business credit history.

These individuals are often unfairly penalized by traditional credit scoring models. Alternative data provides a more holistic and nuanced picture of their financial responsibility, offering a pathway to financial inclusion.

TransUnion's Role in the Transformation

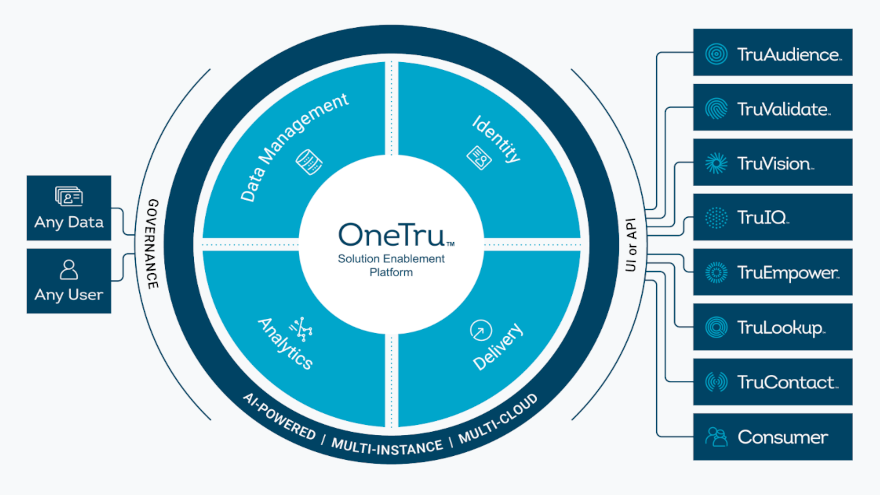

TransUnion Risk and Alternative Data Solutions Inc. is at the forefront of integrating alternative data into risk assessment. They work with lenders and other businesses to develop models that incorporate this information, enabling them to extend credit and other financial services to a wider range of consumers.

Their approach involves not only gathering and analyzing alternative data, but also ensuring its accuracy, reliability, and compliance with privacy regulations. This commitment to responsible data usage is crucial for building trust and fostering a fair and equitable financial system.

According to a TransUnion study, incorporating alternative data into credit scoring models can significantly increase approval rates for individuals with thin or no credit files, without necessarily increasing risk for lenders.

The Impact on Businesses

The benefits of alternative data extend beyond individual consumers. Small businesses, particularly those in emerging markets, often face challenges in accessing capital due to a lack of traditional credit history.

By leveraging alternative data, lenders can gain a better understanding of a business's financial health and potential, enabling them to provide much-needed funding for growth and expansion. This can have a ripple effect, creating jobs and stimulating economic activity in underserved communities.

"Alternative data has the potential to unlock access to capital for millions of small businesses around the world,"says a representative from TransUnion in a recent press release.

The Challenges and Opportunities

While the potential of alternative data is undeniable, there are also challenges to overcome. Ensuring data privacy and security is paramount, as is addressing concerns about bias and discrimination.

It's crucial to develop ethical guidelines and regulatory frameworks that govern the use of alternative data, ensuring that it is used responsibly and fairly. Transparency is key.

TransUnion actively participates in industry discussions and collaborations to address these challenges and promote responsible data practices. They are committed to working with regulators, lenders, and consumer advocates to build a sustainable and inclusive financial ecosystem.

Looking Ahead: The Future of Financial Inclusion

The integration of alternative data into risk assessment is an ongoing evolution. As technology advances and new data sources emerge, the possibilities for expanding financial inclusion will continue to grow.

TransUnion Risk and Alternative Data Solutions Inc. is committed to staying at the forefront of this transformation, developing innovative solutions that empower individuals and businesses to achieve their financial goals.

The journey towards a truly inclusive financial system is a collaborative effort. By working together, stakeholders can create a world where everyone has the opportunity to build a secure and prosperous future.

A Story of Hope and Opportunity

Consider Maria, a single mother who dreamed of starting her own catering business. Despite her culinary skills and unwavering work ethic, she was repeatedly denied loans due to her limited credit history.

However, after a local lender began using alternative data provided by TransUnion, Maria's application was approved. Her consistent on-time rental payments and positive reviews from her early catering gigs demonstrated her financial responsibility and entrepreneurial spirit.

Maria's story is just one example of the transformative power of alternative data. It highlights the potential to unlock opportunities for individuals and businesses who have been historically excluded from the financial mainstream.

The work of TransUnion Risk and Alternative Data Solutions Inc. isn't just about data and algorithms; it's about empowering people like Maria to realize their dreams and build a better future for themselves and their families.

As the financial landscape continues to evolve, the role of alternative data will become even more critical. By embracing innovation and promoting responsible data practices, we can create a more inclusive and equitable financial system for all.