Blackstone's Stock Rose Due To An Analyst's Recommendation Upgrade

Shares of Blackstone, the world's largest alternative asset manager, surged this week following a prominent analyst's decision to upgrade the company's stock rating. The upgrade, citing a more favorable outlook on fee-related earnings growth and potential for increased asset valuations, injected a fresh wave of optimism into the market, prompting investors to re-evaluate their positions on the financial giant.

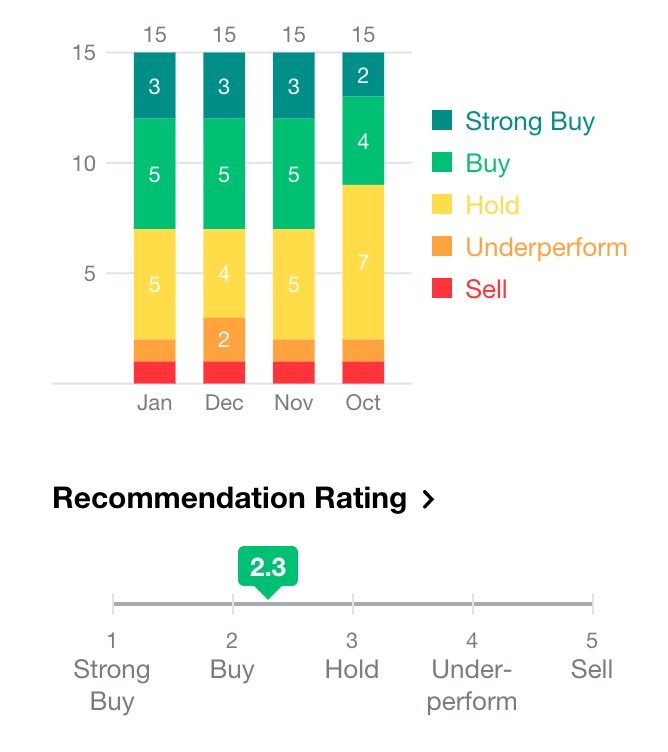

The stock's performance reflects the significant influence analyst ratings can have on market sentiment, particularly when it comes to large-cap companies like Blackstone. This upgrade serves as a crucial signal to investors, potentially impacting trading volumes and long-term investment strategies.

The Analyst Upgrade: A Deep Dive

The upgrade, issued by [Analyst Name] at [Firm Name], moved Blackstone's rating from [Previous Rating] to [New Rating]. The analyst's report highlighted several key factors driving the revised outlook. These factors include strong performance in key investment sectors, a robust pipeline of new investment opportunities, and effective cost management strategies.

The analyst also pointed to Blackstone's ability to adapt to evolving market conditions as a key strength. The firm’s diversified investment portfolio and experienced management team were cited as critical advantages.

Key Drivers Behind the Upgrade

At the core of the upgrade lies the expectation of accelerated fee-related earnings (FRE) growth. Blackstone generates FRE from managing assets, and higher asset values combined with increased assets under management (AUM) directly translate to higher FRE. The analyst believes that strong performance across various asset classes, including private equity, real estate, and credit, will continue to drive AUM growth.

Furthermore, the report suggested that improved market conditions could lead to increased asset valuations. This would, in turn, boost performance-based incentive fees, commonly known as carried interest. This would significantly enhance Blackstone's profitability.

The analyst also commended Blackstone's disciplined approach to capital allocation and its commitment to returning value to shareholders. Share buybacks and dividend payments were specifically mentioned as positive factors contributing to the firm’s appeal.

Market Reaction and Investor Sentiment

The market reacted swiftly to the analyst's upgrade. Trading volume for Blackstone shares increased significantly, indicating heightened investor interest. The stock price experienced a notable jump, reflecting the positive sentiment generated by the revised outlook.

Several other analysts have since weighed in on Blackstone's prospects. While some echoed the sentiments of the initial upgrade, others maintained a more cautious stance. This highlights the inherent subjectivity involved in financial analysis and the importance of considering multiple perspectives.

"We see significant upside potential in Blackstone's stock," stated [Another Analyst Name] from [Another Firm Name] in a research note. "The company is well-positioned to benefit from the ongoing growth in alternative asset investing."

Blackstone's Perspective

Blackstone has not issued an official statement directly addressing the analyst upgrade. However, the company’s recent earnings calls and investor presentations provide insights into its strategic priorities and financial performance. The company consistently emphasizes its focus on delivering strong returns for its investors and building long-term value.

During the most recent earnings call, Blackstone's CEO, Stephen Schwarzman, highlighted the firm's strong performance across all business segments. He also expressed confidence in the company's ability to navigate the evolving macroeconomic landscape.

Blackstone's CFO, [CFO Name], reiterated the company's commitment to maintaining a strong balance sheet and returning capital to shareholders. These statements suggest a confident outlook from within the company itself.

Potential Risks and Challenges

Despite the positive outlook, Blackstone faces several potential risks and challenges. Economic downturns, rising interest rates, and increased regulatory scrutiny could all negatively impact the company’s performance. Competition in the alternative asset management industry remains intense.

Changes in investor sentiment towards alternative assets could also pose a threat. Any shift away from private equity, real estate, or credit investments could reduce demand for Blackstone's services. Geopolitical instability is another potential concern, as it could disrupt global markets and impact investment returns.

"While we acknowledge the positive momentum, investors should remain aware of the potential downside risks," cautioned [A Third Analyst Name] from [A Third Firm Name]. "The alternative asset management industry is inherently cyclical, and Blackstone is not immune to market fluctuations."

Looking Ahead

The analyst upgrade has undoubtedly provided a boost to Blackstone's stock. Whether this momentum can be sustained remains to be seen. The company's ability to continue delivering strong investment performance and adapting to changing market conditions will be crucial to its long-term success.

Investors will be closely watching Blackstone's upcoming earnings reports and management commentary for further insights into the company's performance and outlook. The performance of key investment sectors, such as real estate and private equity, will be particularly important to monitor.

Ultimately, Blackstone's future success hinges on its ability to navigate the complexities of the global financial landscape and continue to generate attractive returns for its investors. The analyst upgrade serves as a vote of confidence, but it is only one piece of the puzzle.

:max_bytes(150000):strip_icc()/INV_BlackstoneHQ_GettyImages-1252025150-1fcd571ad4154d898d21b9279d5a3a4e.jpg)