How Many Quarters In Ten Dollars

The sun streamed through Mrs. Peterson's classroom window, illuminating dust motes dancing in the air. Little hands, some smudged with crayon and others clutching well-worn pennies, sorted piles of coins. The air buzzed with the quiet murmur of counting, as first-graders grappled with a fundamental question: how many quarters made up the grand sum of ten dollars?

At its core, figuring out how many quarters are in ten dollars is a simple math problem. However, this seemingly basic calculation opens a gateway to understanding fundamental concepts like currency, value, and the relationship between different denominations of money. It's a practical lesson in financial literacy that resonates far beyond the classroom.

The Quarter's History and Significance

The quarter, as a unit of currency, has a rich history. The United States Mint first began producing quarters in 1796. Originally made of silver, the quarter has undergone design and composition changes throughout its existence.

The most recognizable quarter design, the Washington quarter, has been a staple since 1932. With a portrait of George Washington on the obverse and an eagle on the reverse (with some exceptions), it is instantly recognizable to Americans of all ages.

Beyond its aesthetic appeal, the quarter holds practical significance. It's the denomination most often used in vending machines, parking meters, and laundry facilities. Its utility makes it a ubiquitous part of everyday life.

Unlocking the Mystery: How Many Quarters?

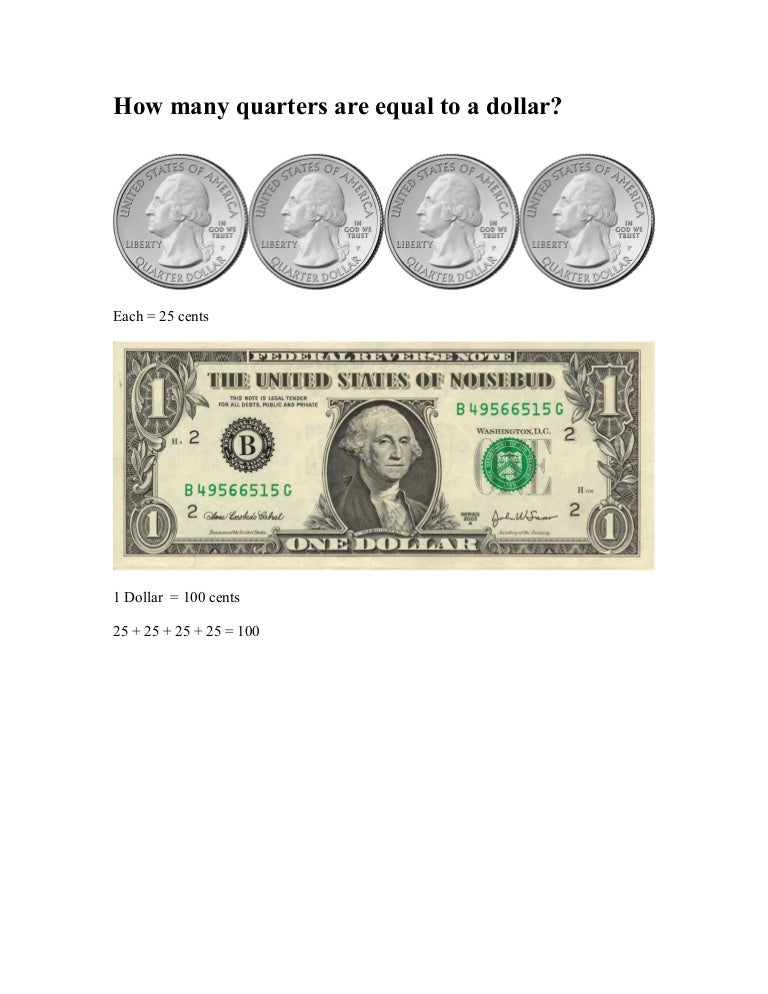

So, how many quarters are actually in ten dollars? Each quarter is worth $0.25, or one-fourth of a dollar. To find the answer, we need to divide the total amount, $10.00, by the value of a single quarter.

The calculation is as follows: $10.00 / $0.25 = 40. Therefore, there are 40 quarters in ten dollars.

This simple division reveals a valuable insight into the structure of the monetary system. It illustrates how smaller denominations combine to form larger values.

The Importance of Financial Literacy

Teaching children how to count coins, including quarters, is a crucial step towards financial literacy. Understanding the value of money and how to manage it responsibly is essential for their future well-being.

Organizations like the Council for Economic Education (CEE) emphasize the importance of financial education at all levels. According to the CEE, providing children with early exposure to financial concepts equips them with the skills they need to make informed decisions as adults.

Learning about money doesn't have to be dry and academic. Incorporating games, real-life scenarios, and hands-on activities can make the learning process engaging and memorable.

Real-World Applications

The seemingly simple exercise of counting quarters has numerous real-world applications. It helps children understand how to save money for a desired item, calculate the cost of a purchase, or even estimate the amount of change they should receive.

Furthermore, understanding the relationship between different denominations can prevent misunderstandings and potential exploitation. Being able to quickly and accurately calculate value is a valuable life skill.

Moreover, understanding money relates to understanding budgeting. Budgeting skills are not only useful for children, but necessary for adults. Financial literacy is a life skill that should be taught at the early stages of life.

Beyond the Numbers: The Value of Patience and Perseverance

Beyond the mathematical answer, the exercise of counting quarters teaches valuable life lessons. It instills patience, as children carefully sort and count their coins. It fosters perseverance, as they work through the problem to arrive at the correct solution.

It also provides an opportunity to discuss the importance of saving and setting financial goals. These values extend beyond the classroom, shaping their attitudes towards money and financial responsibility.

Mrs. Peterson knew this, as did many parents, children should learn these important financial skills. Teaching them about the value of money is an invaluable skill.

"Financial education is not just about numbers; it's about empowering individuals to make informed decisions and achieve their financial goals." - Annamaria Lusardi, Founder and Academic Director of the Global Financial Literacy Excellence Center.

A Continuing Lesson

The question of how many quarters are in ten dollars is not just a first-grade math problem. It is a stepping stone towards a deeper understanding of money, value, and financial responsibility.

As the first-graders in Mrs. Peterson's class carefully counted their coins, they were not simply solving a math problem. They were laying the foundation for a financially secure future.

And as they proudly announced, "Forty!" they weren't just reciting a number. They were demonstrating a fundamental understanding that will serve them well for years to come, and will help them start on a path to being financially responsible, something that will help with long term well-being.

/number-of-coins-in-roll-768862_final-5b3f7ec046e0fb00371742cb.png)