How Many Sources Of Income Should I Have

Economic uncertainty is skyrocketing: are you prepared? Experts are urging individuals to diversify their income streams to weather potential financial storms.

This article cuts through the noise, providing data-backed insights on the optimal number of income sources to safeguard your financial future. We deliver actionable advice for immediate implementation.

The Magic Number: Is There One?

Forget the myth of a single golden goose. While there's no universal magic number, financial advisors overwhelmingly recommend having multiple income streams.

Why? Reliance on a single source leaves you vulnerable to job loss, economic downturns, or unforeseen circumstances.

According to a recent survey by Bankrate, nearly 40% of Americans have a side hustle, indicating a growing awareness of the importance of diversification. This trend highlights a proactive shift towards financial security.

Digging Into the Data

A study by The Ascent found that individuals with three or more income streams reported higher levels of financial stability and lower stress levels. This suggests a direct correlation between diversification and peace of mind.

However, the optimal number isn't arbitrary. Consider your available time, skills, and risk tolerance.

For some, two well-managed income streams might suffice. Others might thrive with three or more, carefully balancing part-time gigs, investments, and passive income sources.

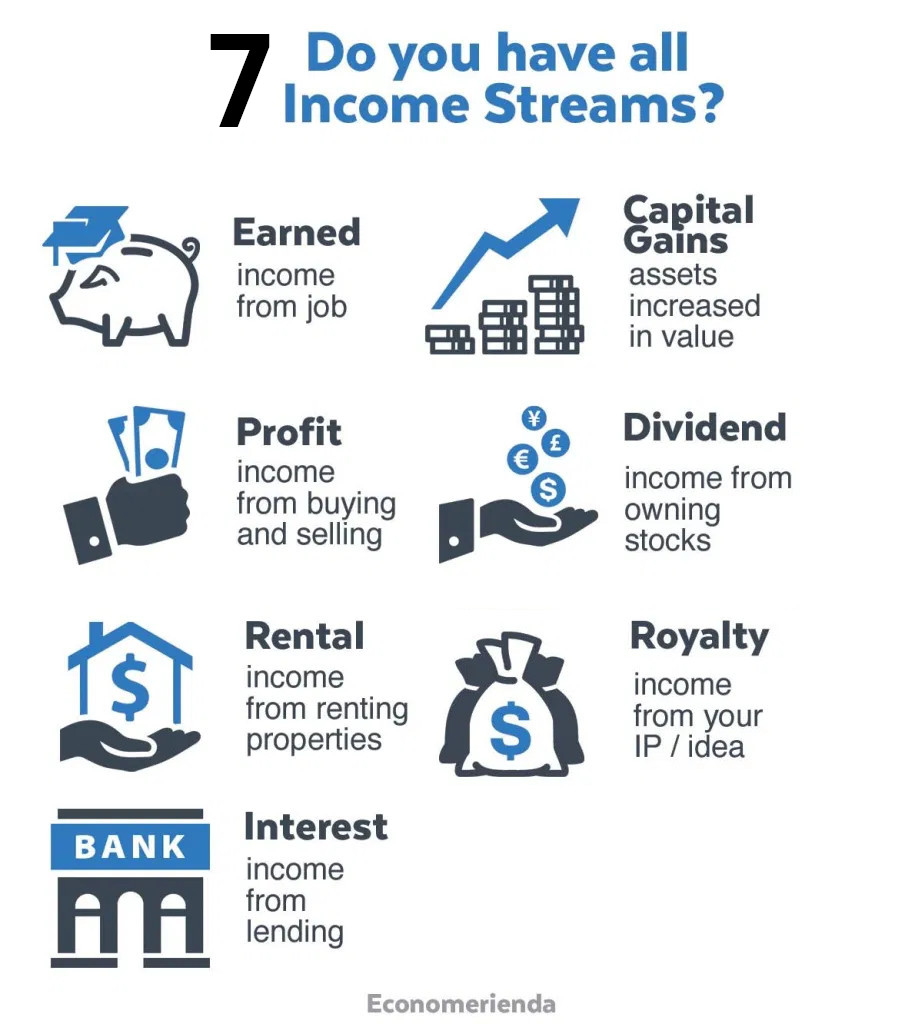

Identifying Your Income Opportunities

The key is strategic diversification, not reckless pursuit of every opportunity.

Freelancing: Leverage your existing skills. Platforms like Upwork and Fiverr connect freelancers with clients globally.

Investments: Consider stocks, bonds, and real estate. Consult a financial advisor to create a diversified investment portfolio.

Passive Income: Explore options like online courses, ebooks, or affiliate marketing. These require upfront investment but can generate ongoing income.

Time Commitment: A Critical Factor

Don't spread yourself too thin. Each income stream demands time and attention. Avoid burnout by carefully managing your workload.

Prioritize streams that align with your interests and skills to maximize efficiency. Automate tasks where possible to free up your time.

Remember, quality over quantity. Focus on building sustainable, profitable income streams rather than chasing fleeting opportunities.

Who Needs Multiple Income Streams?

The answer is: almost everyone. Especially those with significant debt, limited savings, or unpredictable income.

Young professionals starting their careers can benefit from side hustles to accelerate debt repayment or build an emergency fund.

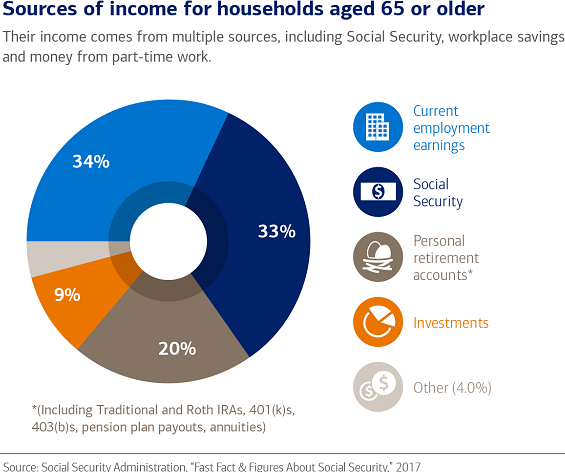

Older adults nearing retirement can supplement their savings and create a more secure financial future.

Risks and Mitigation Strategies

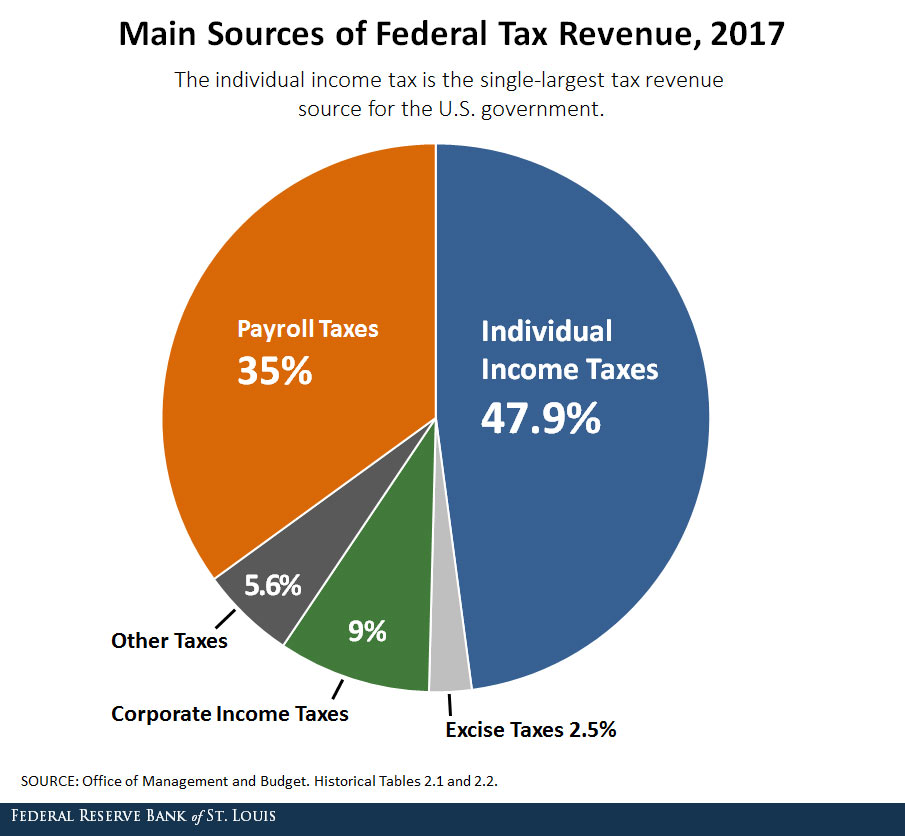

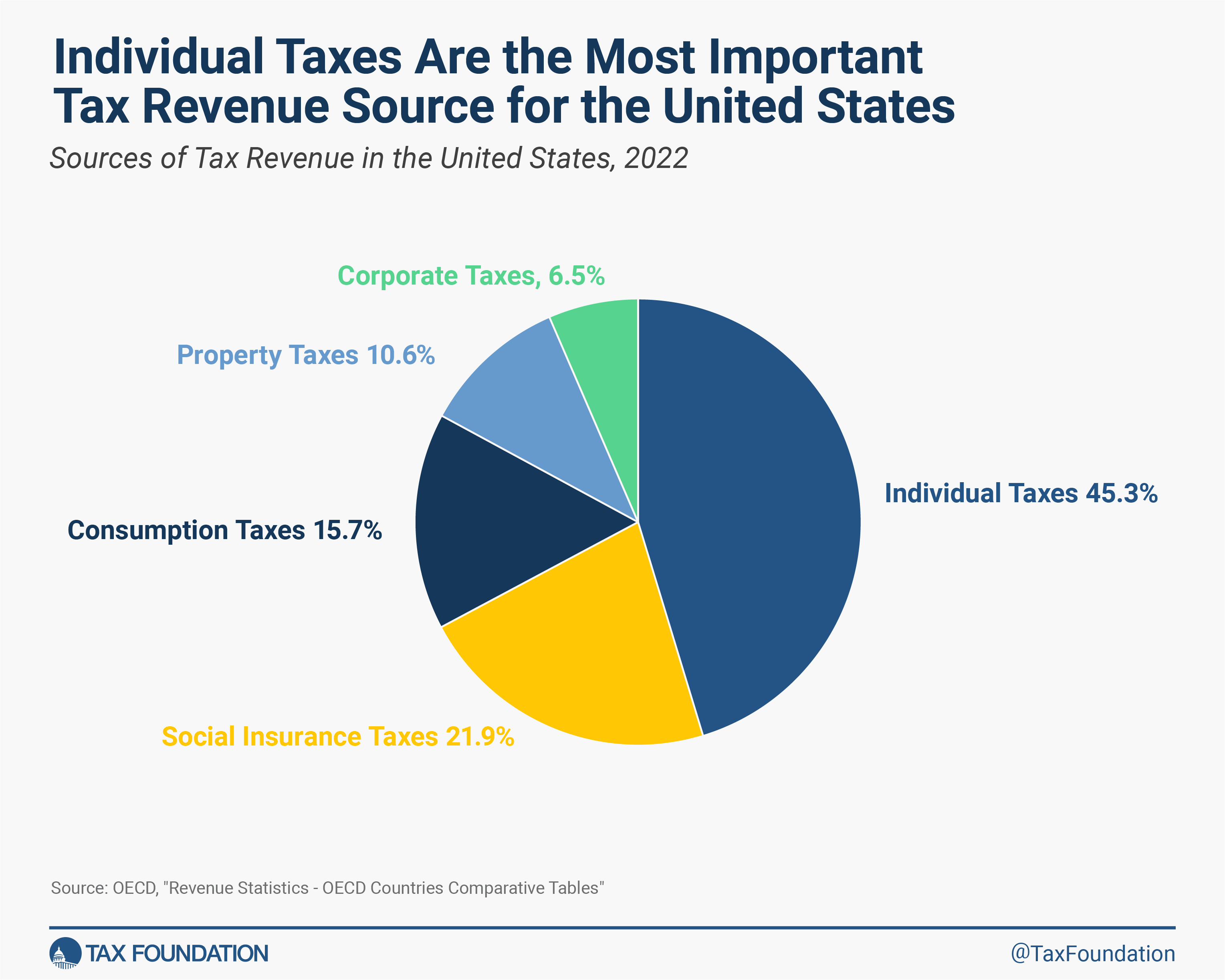

Tax Implications: Multiple income streams complicate your taxes. Consult a tax professional for guidance.

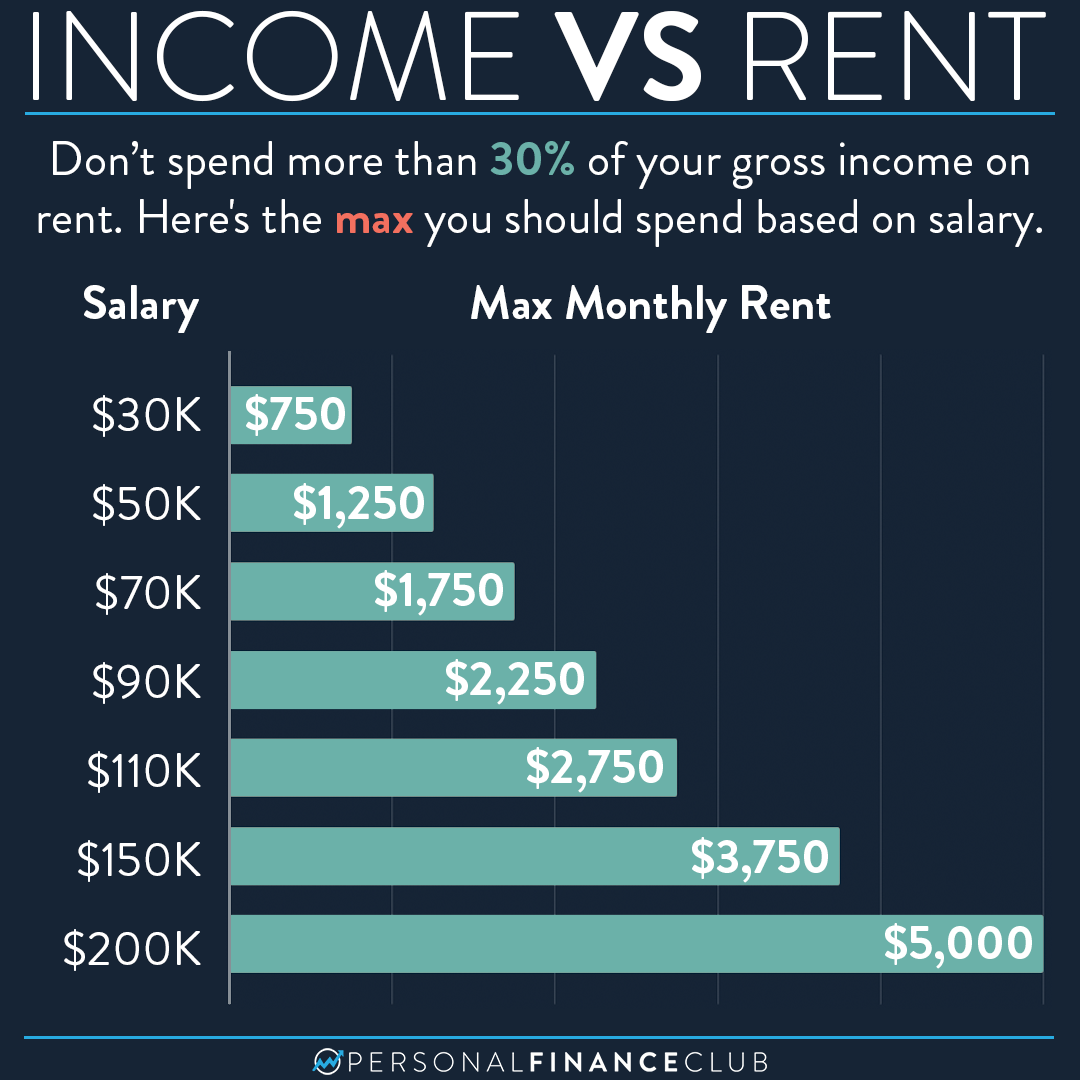

Cash Flow Management: Track your income and expenses meticulously. Utilize budgeting tools to stay on top of your finances.

Legal Considerations: Ensure your side hustles comply with all applicable laws and regulations.

Take Action Now

Evaluate your current financial situation. Identify potential income opportunities based on your skills and interests.

Start small. Begin with one additional income stream and gradually expand as you gain experience and confidence.

Consult a financial advisor to create a personalized diversification strategy. The time to act is now: secure your financial future by embracing multiple income streams.

![How Many Sources Of Income Should I Have [FREE] The pie graph shows sources of income for people ages 65 and](https://media.brainly.com/image/rs:fill/w:1920/q:75/plain/https://us-static.z-dn.net/files/d1d/f3310191a900cddbeb39658dbf2899fa.png)