How Many Streams Of Income Should You Have

In today's volatile economic landscape, the concept of relying on a single income stream is increasingly viewed as a precarious position. Many are now exploring the diversification of their financial portfolios through multiple revenue sources. But the question remains: how many streams of income is the right number?

The "magic number" isn't a one-size-fits-all answer. Instead, the ideal number of income streams depends heavily on individual circumstances, risk tolerance, and financial goals. Experts emphasize that quality and sustainability are paramount to quantity, with careful planning being the cornerstone of a successful multi-income strategy.

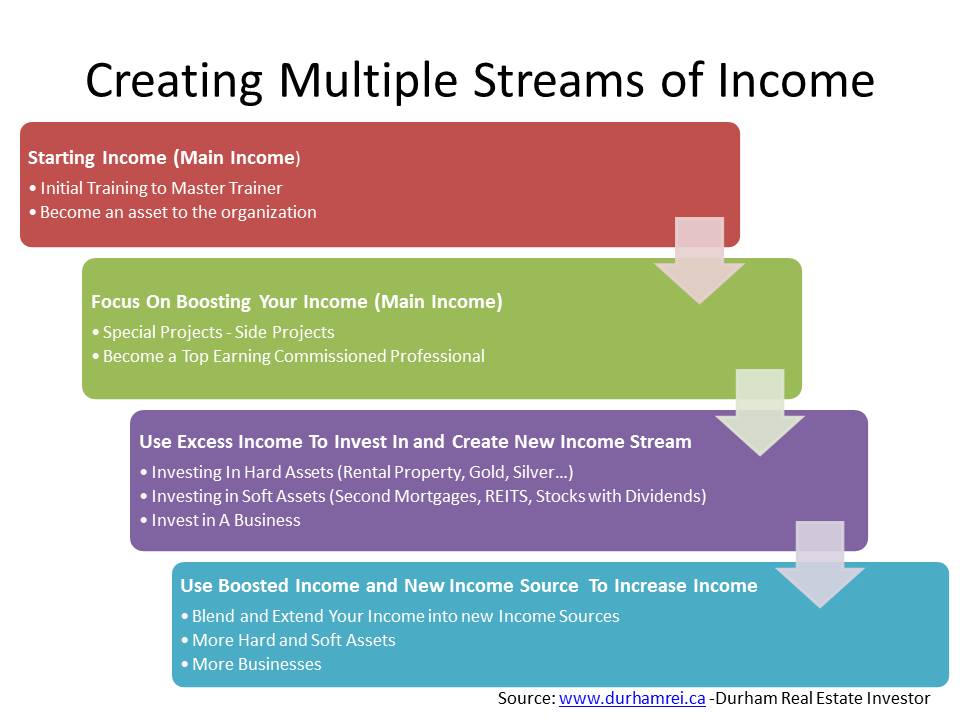

Financial advisors suggest starting with a careful assessment of one's current financial situation. This includes evaluating existing income, expenses, debts, and savings. Understanding these foundational elements is crucial before venturing into new income-generating activities.

Factors Influencing Income Stream Count

Several factors play a significant role in determining the optimal number of income streams. Risk tolerance is a key consideration. Those comfortable with higher risk might explore more speculative ventures, while those seeking stability may prefer lower-risk options.

Available time and resources also significantly impact the feasibility of managing multiple income streams. Juggling a full-time job with several side hustles can be demanding. Burnout is a real concern, and sustainable work-life balance should be prioritized.

Financial goals further influence the decision. Is the objective to supplement existing income, achieve financial independence, or build wealth? The answer dictates the types of income streams pursued and their associated time commitments.

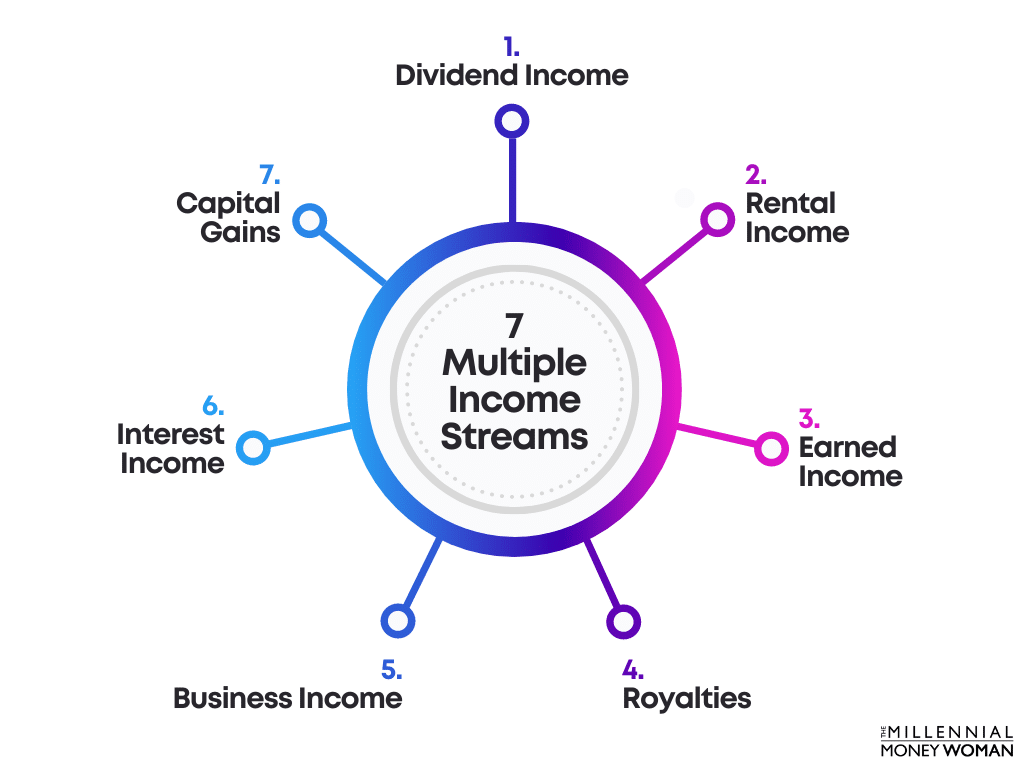

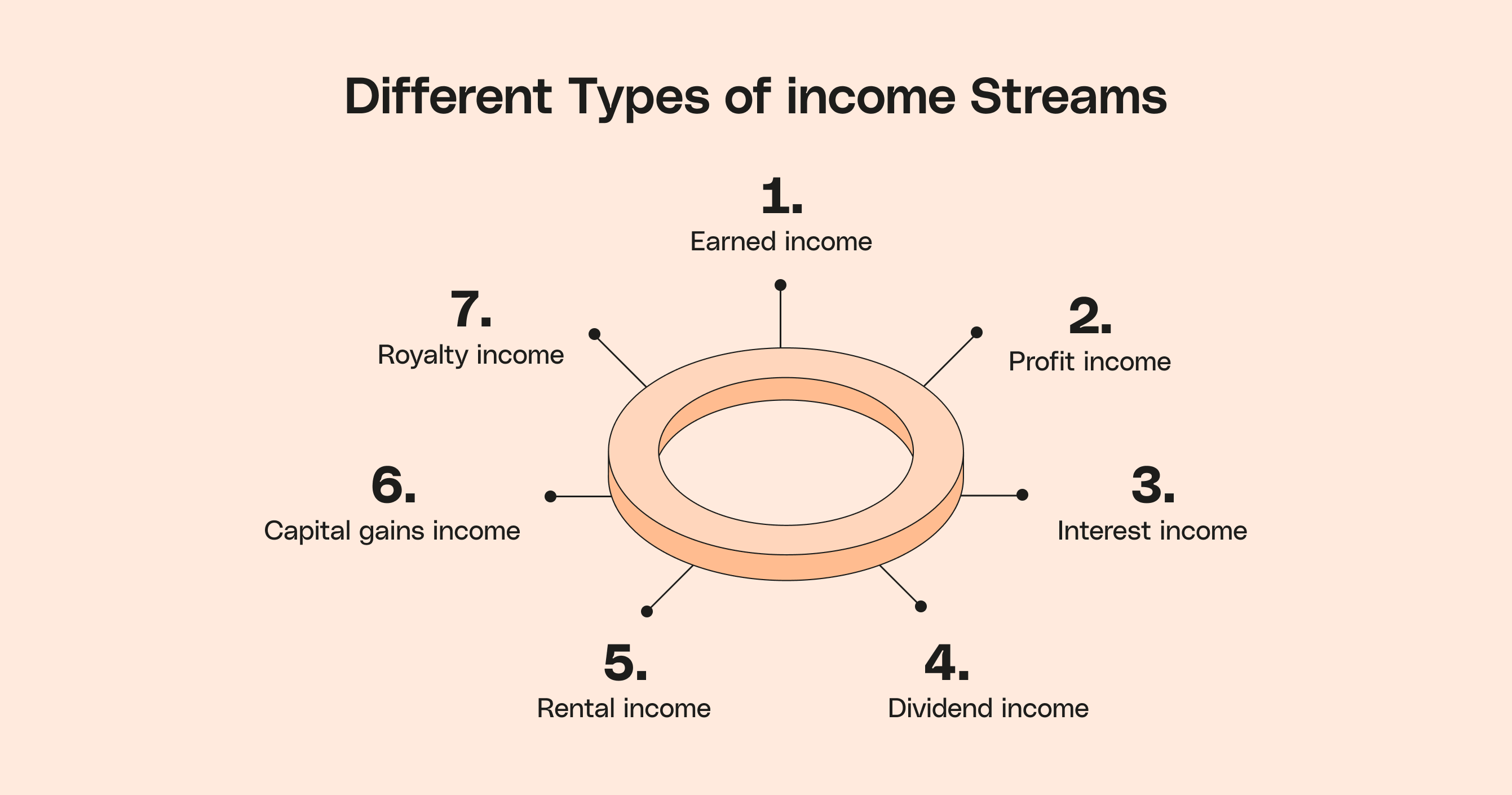

Common Income Stream Options

The landscape of potential income streams is diverse, ranging from traditional employment to entrepreneurial pursuits. Freelancing, for example, has become increasingly popular, offering flexibility and the potential to leverage specific skills.

Investment income, derived from sources such as stocks, bonds, and real estate, offers passive earning potential. However, this avenue requires careful research and a solid understanding of investment principles.

Creating and selling digital products, such as online courses or e-books, presents another viable option for generating income. Affiliate marketing, where commissions are earned by promoting other companies' products, also presents a low-barrier entry point.

Expert Opinions and Data

According to a survey by Bankrate, a significant portion of Americans are actively pursuing multiple income streams. The survey revealed that a substantial number of individuals hold a side hustle in addition to their primary job.

"The key is to diversify intelligently and build a safety net, not to spread yourself so thin that you compromise the quality of your primary income source," explains Jane Smith, a certified financial planner at Acme Financial Advisors.

The U.S. Bureau of Labor Statistics (BLS) offers data on employment and self-employment trends, providing insights into the growing prevalence of gig work and entrepreneurial activities. These figures illustrate the changing nature of work and the increasing acceptance of multiple income streams.

Potential Impact and Considerations

Diversifying income streams can provide a buffer against job loss or economic downturns. It can also accelerate progress toward financial goals, such as paying off debt or saving for retirement.

However, managing multiple income streams requires discipline and organization. Effective time management and meticulous record-keeping are essential for avoiding financial mismanagement.

Tax implications should also be carefully considered. Consulting with a tax professional is recommended to ensure compliance and optimize tax strategies.

Ultimately, the optimal number of income streams is a personal decision. It depends on a careful evaluation of individual circumstances, risk tolerance, and financial goals. By prioritizing quality, sustainability, and informed decision-making, individuals can successfully navigate the world of multiple income streams and build a more secure financial future.