How Much Capital To Start A Business

The entrepreneurial dream, once a beacon of hope and self-determination, often clashes with the cold reality of capital requirements. Launching a successful business isn't just about passion and a solid business plan; it demands a strategic financial foundation. From bootstrapping startups to venture-backed enterprises, understanding the costs involved is the first, and perhaps most crucial, step towards realizing that dream.

Estimating the necessary capital to launch a business is a multifaceted challenge. It's not simply about adding up expenses. The required amount hinges on factors such as industry, business model, location, and growth strategy. The absence of adequate initial capital can doom even the most promising ventures, hindering growth, impacting operations, and ultimately, leading to failure.

Estimating Your Startup Costs

Several reputable sources provide guidance on estimating startup costs. The Small Business Administration (SBA) offers resources and tools to help entrepreneurs develop business plans and project financial needs. Similarly, organizations like SCORE, a non-profit offering free business mentoring, can help refine financial projections.

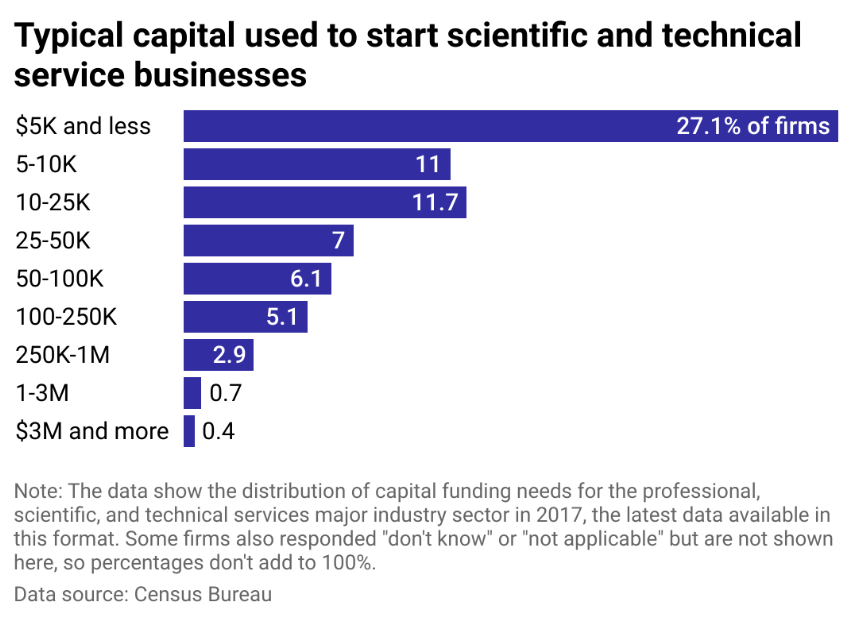

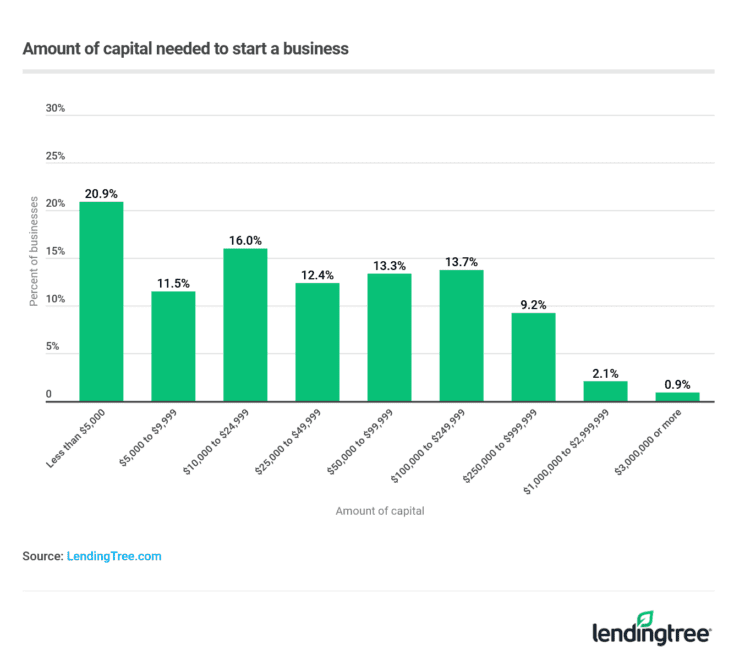

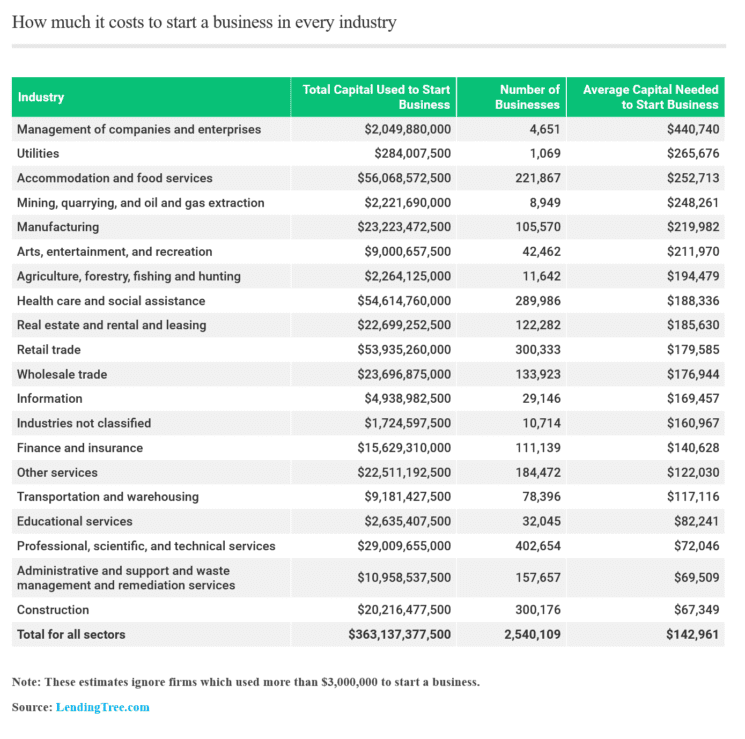

According to data compiled from numerous sources, including industry reports and crowdfunding platforms, the average startup costs can vary significantly. A lean, home-based service business might require as little as a few thousand dollars to cover initial marketing, software, and legal fees. A manufacturing operation or a brick-and-mortar retail store, however, could easily require hundreds of thousands or even millions.

Factors Influencing Capital Needs

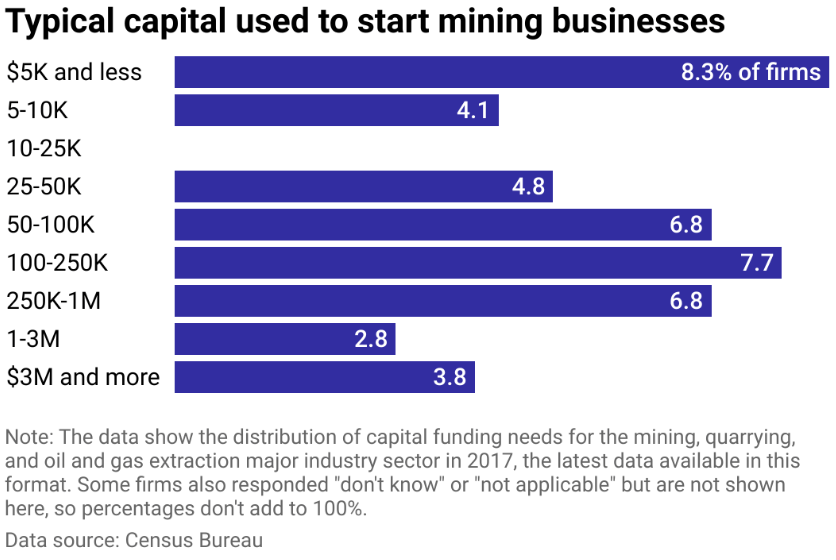

Industry choice is a primary determinant of startup costs. Tech startups often have significant upfront investments in research and development. Restaurants and retail businesses have expenses related to real estate, equipment, and inventory.

Business model also matters. A purely online business may have lower overhead costs than a physical store. However, it might require a larger investment in digital marketing and website development.

Location plays a key role, with costs fluctuating based on factors like rent, labor, and taxes. Real estate in major metropolitan areas tends to be more expensive, driving up initial costs.

Sources of Funding

Entrepreneurs can tap into various funding sources. Bootstrapping, or self-funding, is a common approach, often involving using personal savings or borrowing from friends and family. This approach minimizes debt and maintains control.

Small business loans from banks and credit unions remain a popular option. However, these loans often require a solid business plan, strong credit history, and collateral.

Angel investors and venture capitalists are potential sources for high-growth startups. Venture capital firms provide substantial funding in exchange for equity in the company. This is usually reserved for ventures with high growth potential.

Crowdfunding platforms like Kickstarter and Indiegogo allow entrepreneurs to raise capital from a large number of individuals. This can be a great way to test market demand and build a community around a product or service.

The Importance of Contingency Planning

Underestimating startup costs is a common mistake. It's crucial to include a contingency fund in the initial budget to cover unexpected expenses or delays. Aim to allocate 10-20% of the total budget as a buffer.

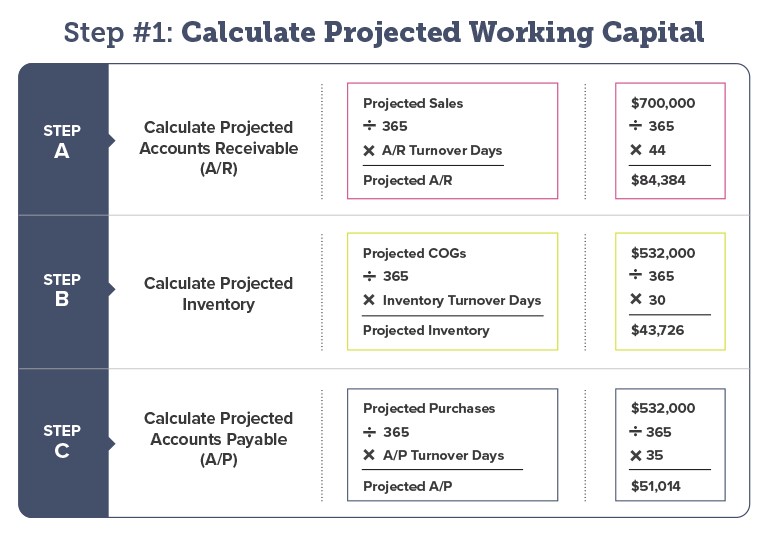

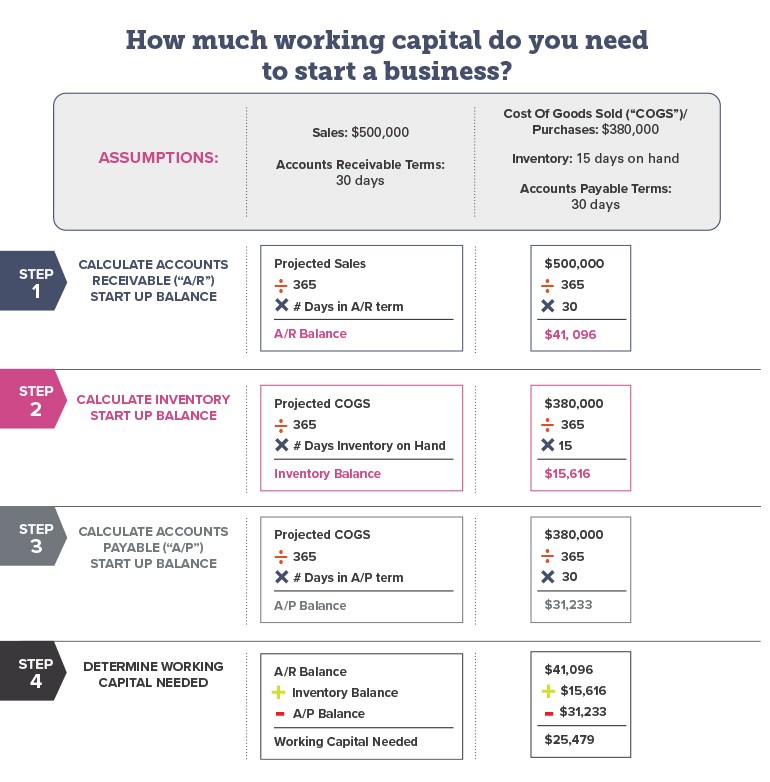

Cash flow management is crucial, especially in the early stages. Accurately forecasting revenues and expenses can prevent cash shortages and keep the business afloat.

Looking Ahead

The landscape of startup funding is constantly evolving. The rise of online lending platforms and alternative financing options is providing entrepreneurs with more choices. Innovations in technology are also driving down some startup costs.

Careful planning and realistic financial projections are more crucial than ever. By understanding the true costs of launching a business and exploring available funding options, entrepreneurs can increase their chances of success.

Starting a business is a challenging but rewarding endeavor. A solid financial foundation is key to navigating the hurdles and achieving long-term sustainability. Success requires careful planning, strategic decision-making, and a realistic assessment of financial needs.