How Much Do Brokers Charge To Sell Shares

Breaking: Confusion reigns as investors grapple with varying broker fees for share sales. Understanding these charges is now critical to maximizing returns and avoiding unexpected costs.

Navigating the stock market requires understanding the fees involved, particularly when selling shares. These charges, levied by brokers, can significantly impact your profit margin. Here’s a breakdown of what you need to know.

Understanding Brokerage Fees: A Crucial Overview

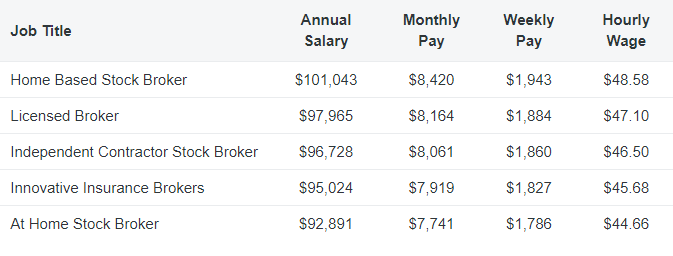

Brokerage fees are the charges levied by brokers for executing trades on behalf of their clients. These fees vary widely depending on the type of broker, the trading volume, and the services offered.

The landscape has shifted dramatically in recent years. The emergence of discount brokers has pressured traditional firms to lower their costs.

The Rise of Commission-Free Trading

Several brokers, including Robinhood and Webull, have popularized commission-free trading. This means they don't charge a direct fee for buying or selling stocks.

However, "commission-free" doesn't always mean "fee-free." These brokers may generate revenue through other means. These include payment for order flow, margin lending, and premium subscription services.

Traditional Brokers and Their Fee Structures

Traditional brokers, such as Fidelity, Charles Schwab, and TD Ameritrade (now part of Schwab), also offer commission-free trading for stocks and ETFs.

However, they often charge fees for other services. These services might be options contracts, broker-assisted trades, or wire transfers.

Hidden Costs: What to Watch Out For

Even with commission-free brokers, hidden costs can arise. Regulatory fees, like those charged by the SEC and FINRA, are often passed on to the customer.

These fees, while small, can add up over time, especially for frequent traders. Inactivity fees may also apply if your account remains dormant for a certain period.

Fee Comparison: Major Brokers

Here's a snapshot of brokerage fee structures at major firms (as of late 2024):

Robinhood & Webull: Commission-free for stocks, ETFs, and options (small regulatory fees apply).

Fidelity & Charles Schwab: Commission-free for stocks and ETFs. Options contracts have a per-contract fee (e.g., $0.65 per contract).

Interactive Brokers: Offers both fixed and tiered pricing models, with costs depending on trading volume and account type.

Broker-assisted trades, where a broker manually executes the trade for you, typically incur higher fees across most platforms.

Key Considerations Before Selling

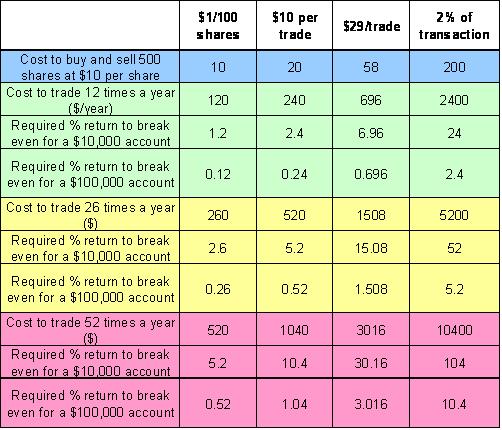

Before selling your shares, carefully review your broker's fee schedule. Consider the frequency and volume of your trades.

Evaluate whether you need access to research, educational resources, or personalized advice. Premium services usually come at a cost.

Be aware of potential transfer fees if you decide to move your assets to a different brokerage. Compare the total cost of trading, including commissions, fees, and other charges.

Staying Informed: What's Next

The brokerage fee landscape is constantly evolving. Brokers adjust their fee structures to stay competitive.

Investors must stay informed by regularly reviewing their broker's terms and conditions. Pay attention to any notifications about changes to fees or services.

Consult with a financial advisor to determine the best brokerage account for your individual needs and investment goals. This can help avoid hidden costs and maximize returns.

![How Much Do Brokers Charge To Sell Shares How Do Realtors Get Paid? - [Agent Commissions Explained]](https://greatcoloradohomes.com/photos/shares/2020-blogs/How-Do-Realtors-Get-Paid-Breakdown.jpg)